Exchange-traded notes (ETNs) are financial instruments that provide investors with exposure to a variety of asset classes, including commodities, currencies, equities, and fixed income. These debt securities are traded on major stock exchanges and offer a unique way for investors to gain access to niche markets and hard-to-reach assets. Commodity ETNs allow investors to gain exposure to various commodities without having to hold the physical asset. They track the performance of a commodity index, offering a convenient way to invest in assets such as gold, silver, oil, and agricultural products. Currency ETNs provide investors with exposure to foreign currencies, allowing them to speculate on currency movements or hedge against currency risks. These ETNs typically track the performance of a specific currency pair, such as the EUR/USD or USD/JPY. Equity-linked ETNs offer exposure to a specific index, sector, or market segment, allowing investors to gain targeted exposure to specific areas of the stock market. They track the performance of an underlying index, such as the S&P 500 or NASDAQ Composite. Fixed-income ETNs provide investors with exposure to various bond markets, including government bonds, corporate bonds, and municipal bonds. They allow investors to gain access to fixed-income assets without having to purchase individual bonds directly. Volatility ETNs offer exposure to market volatility, allowing investors to speculate on market fluctuations or hedge against potential downturns. These ETNs typically track the performance of a volatility index, such as the CBOE Volatility Index (VIX). Leveraged ETNs offer investors the opportunity to magnify their returns by using leverage, while inverse ETNs allow investors to profit from a decline in the value of an underlying index. These ETNs can be used for speculative purposes or as a hedge against market movements. To invest in ETNs, investors must first open a brokerage account with a firm that offers access to these financial instruments. Many online brokers provide this service, making it easy for investors to get started. Investors should research and evaluate potential ETN investments, considering factors such as the underlying index or asset, the ETN's performance history, fees, and credit risk. Financial news, analyst reports, and other resources can help inform this decision-making process. Once an investor has selected an ETN, they can place a trade through their brokerage account. Investors should monitor their ETN positions regularly and adjust their holdings as needed to maintain a diversified and balanced portfolio. Investors should periodically review the performance of their ETN investments to ensure they are meeting their financial objectives. This may involve comparing the performance of the ETN to its underlying index or benchmark, as well as assessing its overall impact on the investor's portfolio. Regulatory bodies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play a crucial role in overseeing the ETN market, ensuring transparency, and protecting investors. Recent regulatory changes have impacted the ETN market, with some issuers discontinuing or restructuring their ETN offerings in response to new rules and guidelines. Investors should stay informed of these changes to understand their potential impact on their ETN investments. The future of the ETN market may be shaped by ongoing regulatory changes, technological advancements, and shifts in investor demand. Potential challenges include increased competition from other investment vehicles, evolving investor preferences, and the need for ongoing innovation to meet the changing needs of the market. Advancements in financial technology, such as blockchain and artificial intelligence, could potentially transform the ETN market by enhancing transparency, reducing costs, and improving accessibility for investors. ETNs offer tax benefits for investors, as they are typically subject to long-term capital gains tax rates, rather than the higher short-term rates that apply to other financial instruments. ETNs generally provide accurate tracking of their underlying indices, as they are structured as unsecured debt obligations of the issuer. This means that the performance of an ETN is directly linked to the performance of its underlying index. ETNs offer investors access to a wide range of niche markets and hard-to-reach asset classes, including commodities, currencies, and fixed-income assets. This allows investors to diversify their portfolios and gain exposure to assets that may not be easily accessible through other investment vehicles. ETNs typically have lower fees than mutual funds, as they do not require active management by a fund manager. This can result in significant cost savings for investors over the long term. ETNs are traded on major stock exchanges, providing investors with the flexibility to buy and sell their investments throughout the trading day. This liquidity allows investors to quickly adjust their positions in response to changing market conditions. As ETNs are unsecured debt obligations of the issuer, investors are exposed to the credit risk of the issuer. If the issuer were to default on its obligations, investors could lose some or all of their investment. ETNs are subject to market risk, as their value depends on the performance of the underlying index or asset. Market fluctuations can result in losses for investors if the value of the ETN declines. While ETNs are generally considered to be liquid investments, some ETNs may experience lower trading volumes and wider bid-ask spreads. This can make it more difficult for investors to buy or sell their ETN positions at their desired price. The regulatory environment for ETNs is subject to change, which can impact the performance and liquidity of these investment vehicles. Changes in regulations may result in increased costs, restrictions, or even the delisting of certain ETNs. Although ETNs can offer tax benefits, they also come with tax complexities that investors should be aware of. The tax treatment of ETNs can vary depending on the type of underlying asset, the investor's tax bracket, and other factors. Exchange-traded notes (ETNs) offer a unique way for investors to gain exposure to a wide range of asset classes, providing opportunities for diversification and access to niche markets. While ETNs have several advantages, such as tax benefits, tracking accuracy, and lower fees compared to mutual funds, they also come with risks like credit risk, market risk, and regulatory risk. Investors should carefully consider these factors when incorporating ETNs into their portfolios, conducting thorough research and monitoring their investments to ensure they align with their financial objectives. By staying informed of regulatory changes and market developments, investors can make the most of the opportunities that ETNs offer while managing the associated risks.Definition of Exchange-Traded Notes (ETNs)

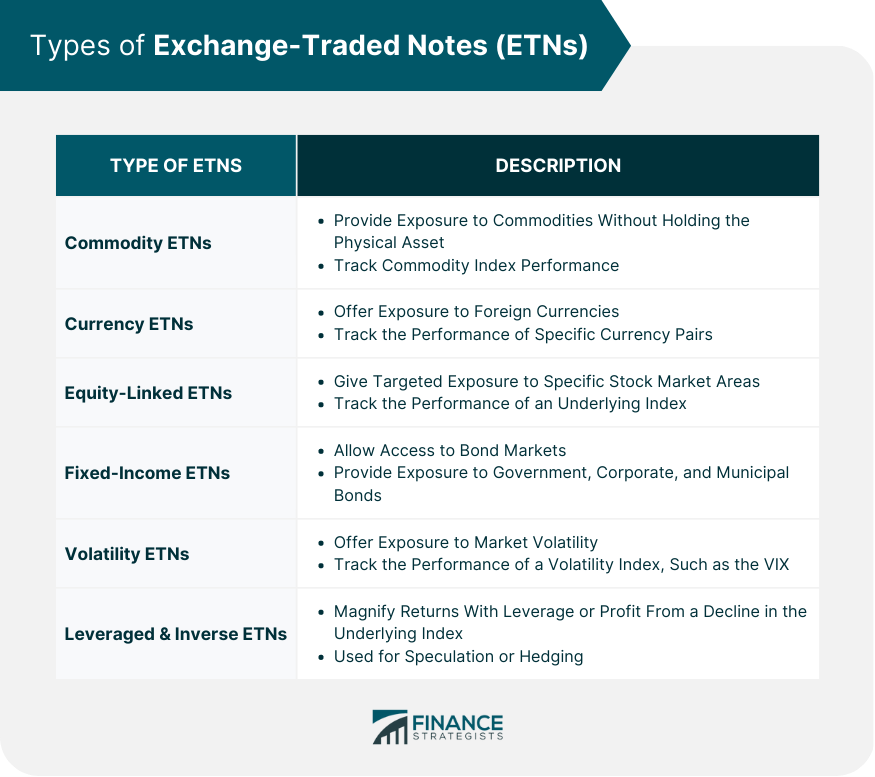

Types of ETNs

Commodity ETNs

Currency ETNs

Equity-Linked ETNs

Fixed-Income ETNs

Volatility ETNs

Leveraged and Inverse ETNs

How to Invest in ETNs

Opening a Brokerage Account

Researching and Selecting ETNs

Trading and Managing ETN Investments

Monitoring and Assessing Performance

Regulatory Environment and Future Prospects

Regulatory Bodies and Their Roles

Recent Regulatory Changes

Potential Future Developments and Challenges

Impact of Technology and Innovation on ETNs

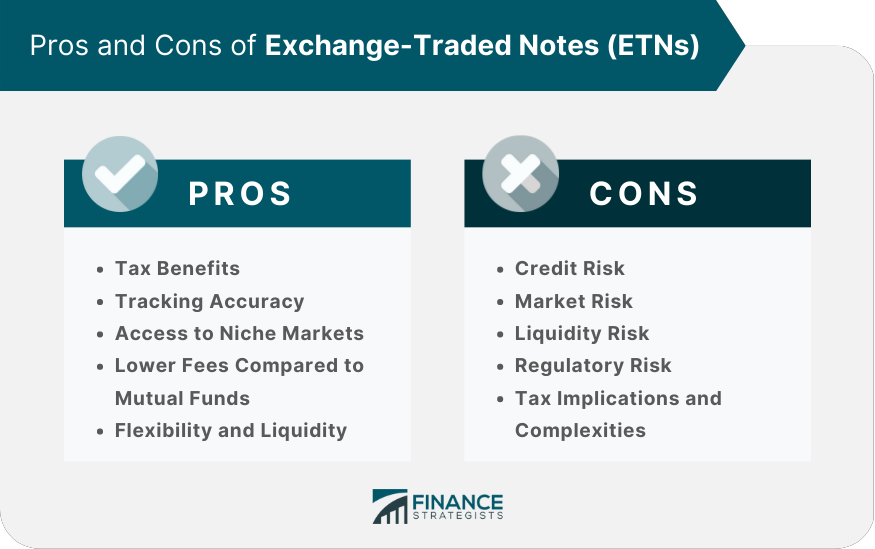

Pros of Investing in ETNs

Tax Benefits

Tracking Accuracy

Access to Niche Markets and Hard-To-Reach Asset Classes

Lower Fees Compared to Mutual Funds

Flexibility and Liquidity

Cons of Investing in ETNs

Credit Risk

Market Risk

Liquidity Risk

Regulatory Risk

Tax Implications and Complexities

Conclusion

Exchange-Traded Notes (ETNs) FAQs

Exchange-traded notes (ETNs) are debt securities that provide investors with exposure to various asset classes, including commodities, currencies, equities, and fixed income. They are unsecured debt obligations of the issuer and are traded on major stock exchanges. ETNs differ from ETFs in that ETFs are investment funds that hold a basket of underlying assets, while ETNs are debt instruments linked to the performance of an underlying index or asset.

Some advantages of investing in ETNs include tax benefits, tracking accuracy, access to niche markets and hard-to-reach asset classes, lower fees compared to mutual funds, and flexibility and liquidity due to being traded on major stock exchanges.

The main risks associated with investing in ETNs are credit risk (as ETNs are unsecured debt obligations of the issuer), market risk (due to fluctuations in the value of the underlying index or asset), liquidity risk (potential lower trading volumes and wider bid-ask spreads), regulatory risk (changes in regulations affecting ETN performance and liquidity), and tax implications and complexities.

To invest in ETNs, investors need to open a brokerage account with a firm that offers access to these financial instruments. They should research and evaluate potential ETN investments, considering factors such as the underlying index or asset, the ETN's performance history, fees, and credit risk. Once they have selected an ETN, they can place a trade through their brokerage account and monitor their ETN positions regularly.

Popular ETN providers include Barclays iPath ETNs, Credit Suisse X-Links ETNs, UBS ETRACS ETNs, Invesco ETNs, and J.P. Morgan ETNs. These providers offer a wide range of ETNs that track various asset classes and market segments, providing investors with diverse investment options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.