A dark pool is a private exchange where buyers and sellers can trade securities, usually stocks or bonds, anonymously, without disclosing their identity or the details of the transactions. Dark pools are also called "dark liquidity" pools because they allow investors to buy or sell large blocks of securities without affecting the market price. Dark pools are typically used by institutional investors, such as mutual funds, hedge funds, and pension funds, who trade in large volumes and seek to minimize market impact. They play a critical role in wealth management because they enable institutional investors to trade large blocks of securities without disrupting the market. This is particularly important for investors who manage large portfolios and need to execute trades in a manner that does not affect the price of the securities they are buying or selling. By using dark pools, investors can avoid tipping their hand to other market participants and reduce the risk of adverse price movements. Dark pools work by matching buyers and sellers of securities privately, without revealing the identity of the parties or the details of the trade to the broader market. When an investor wants to buy or sell securities, they submit an order to the dark pool, specifying the quantity and the price they are willing to pay or receive. The dark pool matches the orders and executes the trade at the agreed-upon price. The settlement of the trade takes place outside the public market, usually through a clearinghouse or a custodian. Dark pools can be accessed through electronic trading platforms or directly through brokers who have access to the pool. The platforms or brokers charge fees for using the dark pool, which can vary depending on the size of the order, the frequency of the trades, and the liquidity of the securities being traded. A lit dark pool is a private exchange where buyers and sellers can trade securities anonymously, but the details of the transactions are made available to the public. Lit dark pools are regulated by securities laws and are required to report their trading activity to the relevant authorities. They are typically used by institutional investors who need to trade large blocks of securities but also want to ensure transparency and price discovery. A dark lit pool is a private exchange where the details of the transactions are not available to the public, but the pool is still regulated by securities laws and required to report trading activity to the relevant authorities. Dark lit pools are typically used by institutional investors who need to trade large blocks of securities and want to minimize market impact and maximize anonymity. One of the primary benefits of dark pools is that they reduce market impact, meaning that the execution of a large trade does not significantly affect the price of the security being traded. By matching buyers and sellers privately and executing the trade outside the public market, dark pools prevent other market participants from reacting to the trade and driving up or down the price. Dark pools provide increased anonymity for investors, which can be particularly beneficial for large institutional investors who do not want to reveal their trading strategies or tip their hand to other market participants. By trading anonymously, investors can avoid being targeted by high-frequency traders or other investors who may seek to exploit their trading activity. Dark pools provide access to liquidity for investors who need to trade large blocks of securities that may not be available on the public market. By matching buyers and sellers privately, dark pools can provide access to liquidity that may not be visible to the broader market. Dark pools can also offer lower transaction costs for investors because they allow investors to trade anonymously and avoid market impact, which can reduce the bid-ask spread and other transaction costs associated with trading on the public market. Additionally, some dark pools charge lower fees than traditional exchanges, which can further reduce transaction costs for investors. One of the main criticisms of dark pools is their lack of transparency. Since the details of the trades are not available to the public, it can be challenging to assess the impact of dark pool trading on the broader market. Additionally, some critics argue that the lack of transparency can create opportunities for insider trading or other forms of market manipulation. Another criticism of dark pools is the potential for insider trading or other forms of market manipulation. Since the details of the trades are not available to the public, it can be challenging to detect and prevent illegal trading activity in dark pools. Additionally, some investors may use dark pools to gain an unfair advantage over other market participants, such as by front-running trades or manipulating the price of securities. Dark pools can also reduce price discovery, meaning that the true market price of a security may not be accurately reflected in the dark pool. This can be particularly problematic for securities that are less liquid or less actively traded, as the prices in the dark pool may not accurately reflect the supply and demand for the security in the broader market. Dark pool liquidity-seeking strategies are designed to minimize market impact and reduce transaction costs by seeking out liquidity in the dark pool. These strategies typically involve using algorithms to find the most efficient way to execute a trade while minimizing the impact on the market. Dark pool pricing strategies are designed to take advantage of price discrepancies between the dark pool and the public market. These strategies typically involve buying securities in the dark pool at a lower price than the public market and then selling them on the public market at a higher price, profiting from the difference. Dark pool informational strategies are designed to take advantage of the information asymmetry that exists in the dark pool. These strategies typically involve using insider information or other non-public information to trade in the dark pool, gaining an unfair advantage over other market participants. Dark pools are regulated by the Securities and Exchange Commission (SEC) in the United States. The SEC requires dark pools to register as alternative trading systems (ATSs) and comply with a range of regulations designed to protect investors and ensure market integrity. The Financial Industry Regulatory Authority (FINRA) also regulates dark pools in the United States. FINRA is responsible for monitoring dark pool activity and ensuring compliance with securities laws and regulations. FINRA has the authority to investigate and discipline firms that engage in illegal or unethical trading activity in dark pools. A Dark Pool is a private electronic trading platform where buyers and sellers can execute trades without displaying their orders to the public. Dark Pools offer a more private and less volatile trading environment, as orders are matched anonymously and executed outside of public exchanges. Dark pools offer institutional investors a range of benefits, including reduced market impact, increased anonymity, access to liquidity, and lower transaction costs. However, dark pools also have drawbacks, including a lack of transparency, potential for insider trading, and reduced price discovery. Investors considering using dark pools should carefully evaluate the benefits and drawbacks and consider the specific trading strategies that are most appropriate for their investment objectives and risk tolerance. Additionally, investors should be aware of the regulatory framework governing dark pools and ensure compliance with all relevant securities laws and regulations.Definition of Dark Pools

How Dark Pools Work

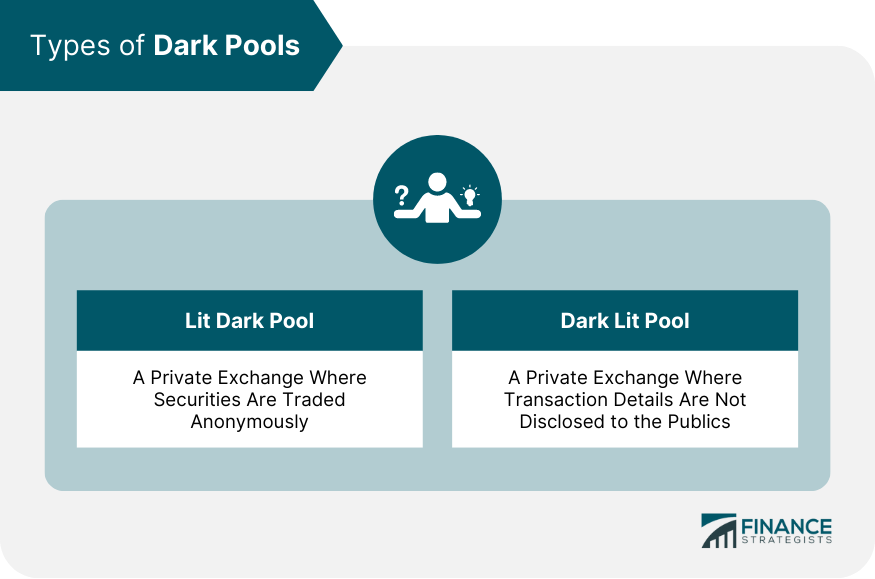

Types of Dark Pools

Lit Dark Pool

Dark Lit Pool

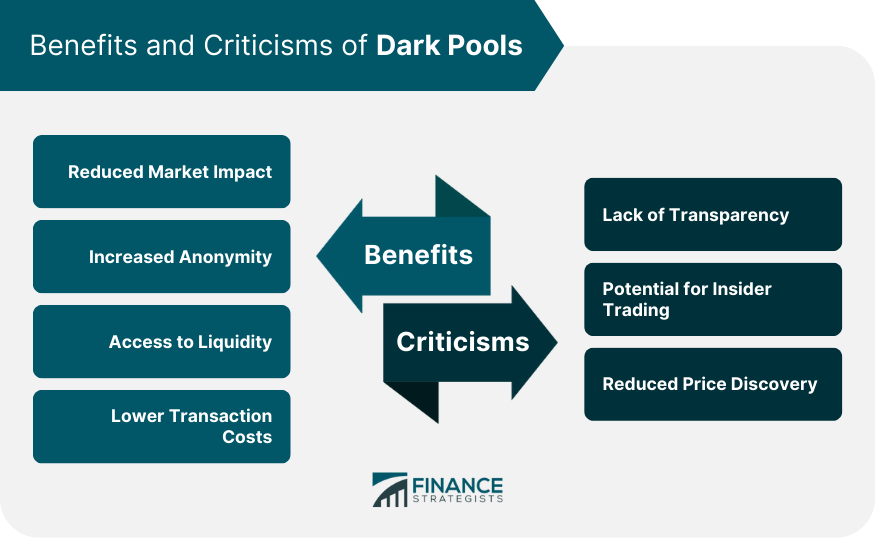

Benefits of Dark Pools

Reduced Market Impact

Increased Anonymity

Access to Liquidity

Lower Transaction Costs

Criticisms of Dark Pools

Lack of Transparency

Potential for Insider Trading

Reduced Price Discovery

Trading Strategies in Dark Pools

Dark Pool Liquidity Seeking Strategies

Dark Pool Pricing Strategies

Dark Pool Informational Strategies

Regulation of Dark Pools

SEC Regulations

FINRA Regulations

Bottom Line

Dark Pool FAQs

A Dark Pool is a private electronic trading platform where buyers and sellers can execute trades without displaying their orders to the public.

Dark Pools work by matching buyers and sellers anonymously and executing trades outside of public exchanges. They offer a more private and less volatile trading environment.

Dark Pools offer benefits such as improved execution quality, reduced market impact costs, and enhanced privacy and reduced information leakage.

Yes, Dark Pools are subject to regulatory oversight and must comply with rules set by regulatory bodies such as the Securities and Exchange Commission (SEC).

Some criticisms of Dark Pools include a lack of transparency, potential for market manipulation, and negative impact on price discovery in public markets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.