A Primary Earnings per Share of a company is a measurement of its profitability, calculated by dividing its net earnings by the total number of outstanding shares of its common stock. Primary EPS provides key insights into a company’s financial health and performance. This parameter tells a story of a company's profits - the plotline every investor is keen to follow. This powerful indicator offers investors a clear-cut approach to assessing a company’s profitability. It is like the pulse of the company – an immediate snapshot of its financial health. It excludes any potential dilution from convertible securities, stock options, warrants, or other instruments that can convert into common shares. It focuses solely on the earnings attributable to common shareholders. Primary EPS works by quantifying the portion of a company's profit allocated to each share of common stock. The premise is straightforward: take the net income, subtract the dividends on preferred stock, and divide by the number of outstanding shares. The result is the EPS - a clear, per-share profitability indicator that investors can readily grasp and compare. Behind the figures, it embodies the interplay of company performance, market expectations, and investment decisions. For instance, an increase in EPS can boost investors' confidence and trigger buying action, pushing the share price up. Hence, EPS works not just as a passive indicator but also as a dynamic influencer in the financial markets. These two factors directly contribute to the bottom line, hence impacting the EPS. A company with a consistent record of increasing revenue and sales is likely to exhibit a growing EPS. This points to a financially robust company, making it attractive to investors. However, the influence of revenue and sales on EPS is not always linear. A surge in sales does not necessarily lead to an increase in EPS, especially if it is accompanied by rising costs. Therefore, it's crucial for investors to take a holistic view, understanding the context and the underlying factors that drive both sales growth and EPS. A company that effectively controls its costs can increase its net income and consequently, its EPS. It's a delicate balancing act, a dance between reducing costs and maintaining product or service quality. However, the implications of cost management on EPS are not always straightforward. Cost-cutting measures can boost EPS in the short term, but they may hamper growth and innovation in the long run. Hence, it's essential for investors to delve deeper and understand the nuances of a company's cost management strategy and its potential effects on EPS. The interplay between debt and equity, the mix of long-term and short-term liabilities, and the cost of capital - these factors influence the net income and the number of outstanding shares, which directly affect the EPS. While judicious use of debt can enhance EPS by increasing net income (through tax advantages associated with debt financing), excessive debt can erode investor confidence, increase financial risk, and potentially diminish EPS. Therefore, understanding a company's capital structure and financing decisions is pivotal to interpreting its EPS accurately. Changes in tax laws can alter a company’s after-tax income, which directly impacts the EPS. Additionally, government policies and regulations can affect a company's operations, thereby influencing its profitability and, in turn, the EPS. However, these influences can be double-edged. While a tax cut or favorable policy can boost EPS, increased taxation or regulatory burdens can put downward pressure on it. Therefore, investors need to stay abreast of the changing tax and regulatory landscape and understand its implications for EPS. In the globalized business environment, currency exchange rates have become a pivotal factor affecting EPS, especially for multinational companies. Currency fluctuations can impact both the revenue and costs of a company operating in different countries, thereby influencing the EPS. For example, a depreciating home currency can inflate overseas revenue when converted back, thereby boosting EPS. On the flip side, a strong home currency can erode foreign earnings and depress EPS. Hence, understanding the dynamics of currency exchange rates is essential for investors analyzing EPS. By quantifying the profits per share of common stock, it offers a clear, readily comprehensible view of a company's earning power. Primary EPS is more than just a figure; it's a narrative of a company's profitability, relayed in the simplest terms. Yet, as the saying goes, 'not everything that glitters is gold.' A high EPS does not always equate to sound financial health. It may reflect a one-time gain or even the outcome of certain accounting practices. Therefore, while EPS stands as a crucial measure of profitability, it warrants a thorough analysis and understanding. Primary EPS emerges as a valuable compass guiding investors. It serves as a comparison tool, enabling investors to gauge the relative profitability of different companies or the same company over different periods. By standardizing profits on a per-share basis, EPS cuts through the complexities, offering a simple, clear benchmark for comparison. However, it's worth noting that the value of EPS as a comparison tool is contingent on the companies being compared being similar in terms of industry, size, and capital structure. A high EPS of a large, established company may not hold the same weight as that of a small, growth-oriented firm. Therefore, while EPS can facilitate comparisons, its interpretation should be contextual. A rise in EPS can bolster investor confidence, potentially leading to an increase in stock prices. Conversely, a drop in EPS can be a signal of financial troubles, causing the stock price to fall. However, the relationship between EPS and stock prices isn't always straightforward. Market sentiment, economic conditions, and other factors can also sway stock prices. Thus, while EPS can influence stock prices, it's merely one of the many factors at play in the complex dynamics of stock market valuation. Companies with a high EPS typically have more profits available for distribution as dividends, leading to higher dividend payments. This can make the company’s shares more attractive to income-oriented investors. However, a high EPS does not guarantee high dividends. The company's dividend policy, financial needs, and future investment plans also influence dividend payments. Therefore, while EPS can indicate a potential for dividends, it's not the sole determinant of a company's dividend payouts. EPS captures a snapshot of a company's profitability for a given period, typically a quarter or a year. It emphasizes immediate results, often overlooking the long-term prospects and growth potential of the company. However, business is more than just a series of quarterly earnings. Sustainable growth, strategic investments, and long-term initiatives may depress EPS in the short run but can pay off in the long run. Therefore, while EPS is a valuable measure of short-term profitability, it's critical to complement it with a long-term perspective. The use of different accounting methods can significantly alter net income and, consequently, the EPS. Additionally, management may resort to "earnings management" to paint a rosy picture of the company's financial health. For instance, a company may time the recognition of revenue or expenses to inflate its EPS. Such manipulations can create an illusion of high profitability, misleading investors. Therefore, while analyzing EPS, it's essential to be wary of its vulnerability to accounting practices and scrutinize the underlying financial statements. It captures the net income per share but doesn't distinguish between earnings from core operations and those from one-time events or non-operational sources. For example, a company might report a high EPS due to a one-time gain from the sale of assets, which does not necessarily indicate a strong operational performance. While EPS can provide a quick snapshot of profitability, it may not always reflect the sustainability or quality of earnings. Items such as gains or losses from investments or extraordinary items are typically excluded from the calculation of EPS. This exclusion can lead to an over or underestimation of a company's true earning power. For instance, a company might report a high EPS by excluding a substantial one-time loss, thus painting an overly positive picture of its financial health. Therefore, while analyzing EPS, it's crucial to consider non-operating items that could significantly impact a company's profitability. Trailing EPS refers to the EPS calculated using the net income of the last four quarters. It provides a rear-view mirror perspective, showing how a company has performed in the recent past. Trailing EPS, with its reliance on actual numbers, offers a reality check of a company's profitability. However, the past is not always indicative of the future. While trailing EPS provides a clear picture of historical performance, it might not reflect the company's future earnings potential. It's vital to consider future prospects and growth estimates alongside trailing EPS. Forward EPS, also known as estimated EPS, projects future earnings per share based on analysts' forecasts. It provides a glimpse into the future, signaling the expected profitability of the company. Forward EPS is widely used by investors to make investment decisions, given its forward-looking nature. Yet, the crystal ball of forward EPS is not always accurate. These estimates rely on a multitude of assumptions and forecasts, which may or may not pan out. Hence, while forward EPS can guide investment decisions, it should be considered along with other indicators and market trends. Adjusted EPS takes the concept of EPS a step further by excluding one-time items and non-operational elements from earnings. This provides a more accurate reflection of a company's operational performance. Adjusted EPS offers a clear lens, stripping away the noise and distortions to reveal the core earnings power. However, the calculation of adjusted EPS leaves room for discretion, and different companies might use different adjustments. Therefore, while adjusted EPS provides a purer view of operational profitability, it's essential to understand the specific adjustments made and interpret it with caution. Primary Earnings per Share is a crucial metric that provides insights into a company's profitability and acts as a comparison tool for investors. It quantifies the earnings allocated to each outstanding share of common stock. EPS impacts stock prices, valuation, and dividend payments, influencing investment decisions. However, EPS has limitations. It focuses on short-term performance, overlooking long-term prospects. It is vulnerable to accounting practices and manipulation. Primary EPS does not reflect earnings quality and excludes non-operating income and expenses. Investors should complement EPS analysis with a long-term perspective, consider accounting practices, assess earnings sustainability, and account for non-operating items. Variations like trailing, forward, and adjusted EPS offer additional insights but require careful interpretation.What Is Primary Earnings per Share (EPS)?

How Does a Primary Earning per Share Work

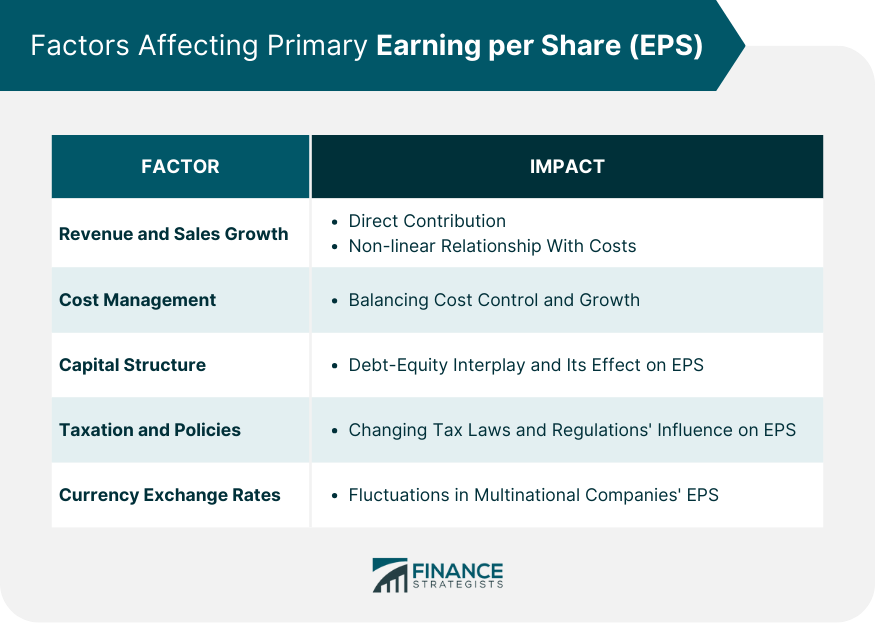

Factors Affecting Primary Earning per Share

Revenue and Sales Growth

Cost Management and Efficiency

Capital Structure and Financing Decisions

Taxation and Government Policies

Currency Exchange Rates

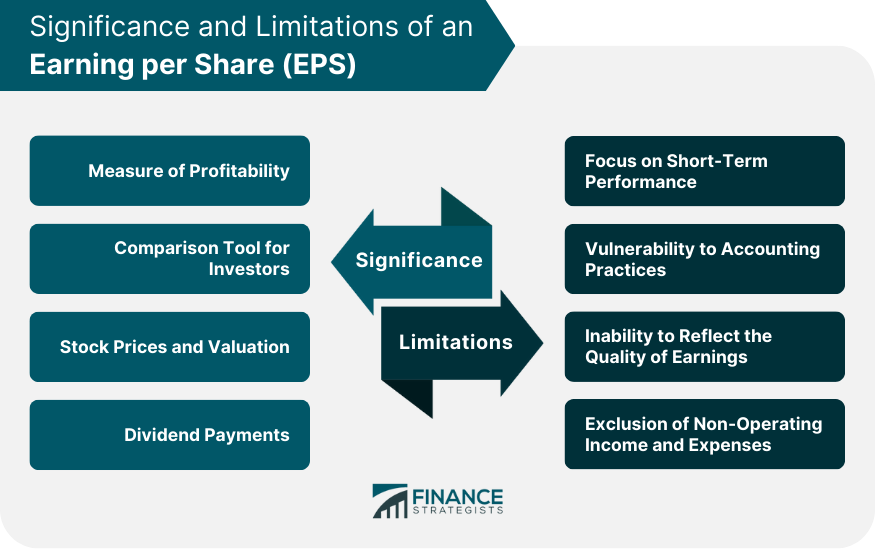

Significance of Primary Earning per Share

Measure of Profitability

Comparison Tool for Investors

Stock Prices and Valuation

Dividend Payments

Limitations of Primary Earning per Share

Focus on Short-Term Performance

Vulnerability to Accounting Practices

Inability to Reflect the Quality of Earnings

Exclusion of Non-operating Income and Expenses

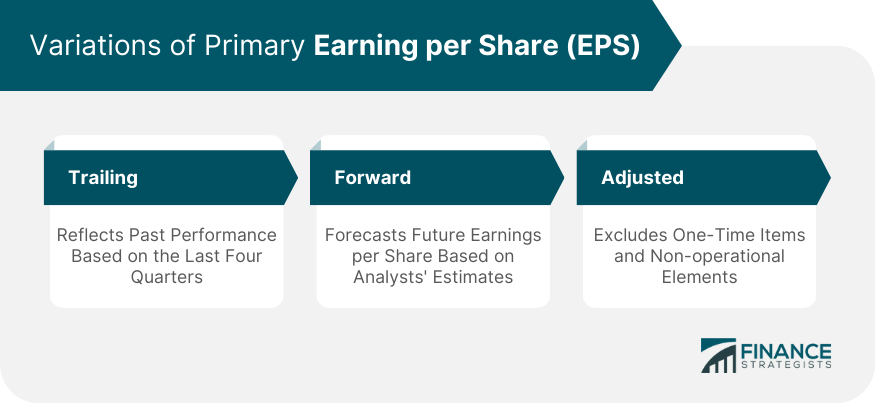

Variations of Primary Earning per Share

Trailing

Forward

Adjusted

Conclusion

Primary Earning per Share (EPS) FAQs

EPS, or Earnings per Share, is a measure of a company's profitability, calculated by dividing its net income by the number of outstanding shares. It's an important indicator for investors as it offers insights into a company's financial health and performance.

EPS is calculated by subtracting dividends on preferred stock from net income, then dividing the result by the number of outstanding shares of common stock.

Several factors can affect EPS, including revenue and sales growth, cost management, capital structure and financing decisions, taxation and government policies, and currency exchange rates.

The different types of EPS include trailing EPS (based on past earnings), forward EPS (based on future earnings estimates), and adjusted EPS (which excludes one-time and non-operational items).

EPS has several limitations, including its focus on short-term performance, vulnerability to accounting practices, inability to reflect the quality of earnings and exclusion of non-operating income and expenses. It's crucial to view EPS as part of a broader analytical toolkit rather than a standalone indicator of financial performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.