Tax constraints refer to the various legal and economic factors that limit a taxpayer's ability to minimize their tax liability. These factors can include tax laws, constitutional provisions, judicial precedents, tax base, tax rate, and tax elasticity. Understanding tax constraints is critical for individuals and businesses to make informed decisions about their tax planning and compliance strategies. Failure to consider tax constraints can lead to unintended tax consequences, including penalties and interest charges, and can adversely impact a taxpayer's financial well-being. Legal constraints refer to the various tax laws, constitutional provisions, and judicial precedents that limit a taxpayer's ability to minimize their tax liability. Tax laws are the primary source of legal constraints, and they can vary significantly across jurisdictions. Constitutional provisions, such as the commerce clause in the U.S. Constitution, can also impact a taxpayer's tax liability. Judicial precedents, such as tax court rulings, can establish legal constraints that must be considered when planning and filing taxes. Economic constraints refer to the various economic factors that limit a taxpayer's ability to minimize their tax liability. The tax base, tax rate, and tax elasticity are the primary economic constraints. The tax base refers to the types of income or transactions that are subject to tax. The tax rate refers to the percentage of the tax base that is subject to tax. Tax elasticity refers to the responsiveness of taxpayers to changes in tax rates. Tax constraints can significantly impact the cost of compliance for businesses. Compliance with tax laws and regulations can be a time-consuming and expensive process, requiring significant resources to maintain accurate records and file timely tax returns. Failure to comply with tax laws can lead to penalties and interest charges, negatively impacting a company's bottom line. Tax constraints can also impact investment decisions for businesses. The tax implications of a potential investment can significantly impact the overall return on investment. Understanding tax constraints, such as tax laws and tax incentives, is critical for businesses to make informed investment decisions. Tax constraints can also impact the structure of a business. Choosing the appropriate business structure can have significant tax implications, impacting a company's overall tax liability. Businesses must consider tax constraints, such as the tax rate and tax base, when choosing a business structure. Personal income tax is a tax that individuals pay on their income earned through various sources, such as salaries, wages, tips, and investment earnings. Tax constraints on personal income can impact an individual's finances in several ways, such as reducing the disposable income available for savings or investment, limiting their purchasing power, and affecting their overall financial planning. Personal income tax constraints may vary based on an individual's income level, marital status, and other factors. It is essential to understand the tax laws and regulations related to personal income tax to minimize the tax burden and maximize the available tax benefits. Estate and gift taxes are taxes imposed on the transfer of property, either during an individual's lifetime or after their death. These taxes can significantly impact an individual's estate planning, especially for high-net-worth individuals. The tax rate and threshold for estate and gift taxes may vary based on the jurisdiction and the size of the estate or gift. Estate and gift tax constraints may affect an individual's ability to transfer their wealth to their heirs or charitable organizations. Therefore, it is essential to have a clear understanding of estate and gift tax laws and regulations and develop an effective estate planning strategy to minimize tax liabilities. Property taxes are taxes imposed on the value of real estate, including land and buildings. Property tax constraints may vary based on the jurisdiction, the assessed value of the property, and the property's use. Property tax constraints can impact an individual's finances in several ways, such as increasing the cost of homeownership, reducing property values, and affecting rental income for investment properties. Property tax constraints can be managed by understanding the local tax laws and regulations and developing a property tax management strategy, such as appealing tax assessments or using tax incentives and exemptions. Tax planning is a critical strategy for managing tax constraints. By proactively planning for tax liabilities and considering tax constraints, businesses can minimize their tax liability and avoid unintended tax consequences. Effective tax planning requires a thorough understanding of tax laws and regulations, as well as an understanding of the business's operations and financial objectives. Compliance management is another critical strategy for managing tax constraints. Effective compliance management requires establishing processes and controls to ensure timely and accurate tax reporting and payment. Compliance management also requires staying up-to-date on changes in tax laws and regulations to ensure ongoing compliance. Tax credits and incentives can be effective strategies for managing tax constraints. Tax credits and incentives can reduce a business's tax liability and provide opportunities for reinvestment in the business. To effectively leverage tax credits and incentives, businesses must have a thorough understanding of the available credits and incentives and the eligibility requirements. Tax constraints are legal and economic factors that impact a taxpayer's ability to minimize their tax liability. The understanding of tax constraints is important for making informed tax planning and compliance strategies. The legal and economic constraints, including tax laws, constitutional provisions, judicial precedents, tax base, tax rate, and tax elasticity can significantly impact the cost of compliance, investment decisions, and business structure. Strategies for managing tax constraints include tax planning, compliance management, and leveraging tax credits and incentives. By staying up-to-date on changes in tax constraints and developing effective tax management strategies, individuals and businesses can minimize their tax liability and avoid unintended tax consequences.What Are Tax Constraints?

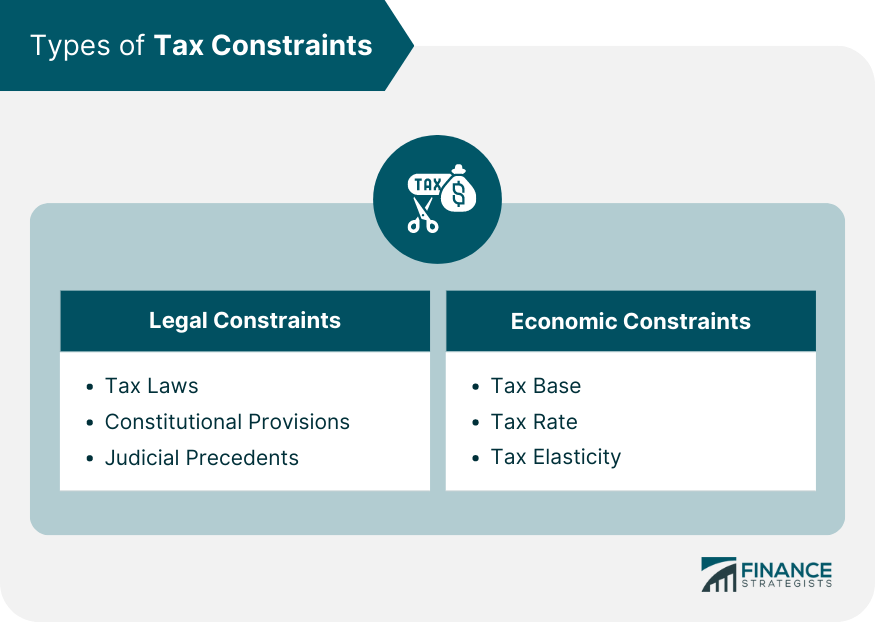

Types of Tax Constraints

Legal Constraints

Economic Constraints

Impact of Tax Constraints on Business Operations

Cost of Compliance

Investment Decisions

Business Structure

Impact of Tax Constraints on Personal Finances

Personal Income Tax Constraints

Estate and Gift Tax Constraints

Property Tax Constraints

Strategies for Managing Tax Constraints

Tax Planning

Compliance Management

Tax Credits and Incentives

Final Thoughts

Tax Constraints FAQs

Tax constraints are legal and economic limitations on the ability of governments to impose taxes, which can affect businesses and individuals.

The two main types of tax constraints are legal constraints, which include tax laws and constitutional provisions, and economic constraints, which include tax base, tax rate, and tax elasticity.

Tax constraints can impact businesses in various ways, such as increasing the cost of compliance, influencing investment decisions, and affecting business structure.

Businesses can manage tax constraints by implementing tax planning, compliance management, and taking advantage of tax credits and incentives.

Businesses can stay up-to-date on tax constraints by regularly reviewing tax laws and regulations, consulting with tax professionals, and monitoring changes in the tax landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.