501(c)(3) corporations are nonprofit entities that have been granted tax-exempt status by the Internal Revenue Service (IRS). Their name is derived from the section of the U.S. tax code that dictates their operations, section 501(c)(3). The Internal Revenue Code, Section 501(c)(3) serves as the legal backbone for these organizations. It details the regulations and expectations that 501(c)(3) organizations must adhere to maintain their tax-exempt status. The organizations falling under this category are generally those dedicated to religious, charitable, educational, literary, or scientific purposes. These organizations are expected to operate solely for the benefit of the public, meaning their work should consistently and positively impact society. Organizations must serve one or more of the following: religious, charitable, scientific, testing for public safety, literary, and educational purposes, fostering national or international sports competition, or prevention of cruelty to animals or children. This broad interpretation of charitable purpose allows a wide array of nonprofits to benefit from the advantages that 501(c)(3) status confers. But regardless of the variety, the ultimate goal is the same: to promote and enhance public welfare. As the name suggests, non-profit organizations exist not to profit individuals or stakeholders but to serve the public good. This non-profit nature is crucial for eligibility for 501(c)(3) status. These organizations are prohibited from distributing profits to individuals who control the organization, such as board members or trustees. However, this does not mean that they cannot generate surplus revenues. Surplus revenues must be reinvested back into the organization to support its charitable purpose rather than being distributed to the organization’s members, officers, or directors. Organizations seeking 501(c)(3) status must be structured as a corporation, community chest, fund, or foundation. A simple association or informal group does not qualify for this status. The IRS requires a formal structure to ensure accountability and compliance with tax regulations. The governing documents of the organization, such as the articles of incorporation and bylaws, must clearly state the organization’s exempt purpose and contain specific language restricting the organization’s activities to its stated purpose. Being a tax-exempt organization, a 501(c)(3) corporation does not pay federal income taxes on its corporate income. This allows such organizations to devote more of their resources to their mission, thereby amplifying their impact. Moreover, state and local tax exemptions often come along with federal tax exemptions. This may include exemption from sales taxes on purchases made by the organization and property taxes on real estate and other property owned by the organization. Contributions made to 501(c)(3) organizations are tax-deductible for donors, making them attractive recipients for donors looking for tax benefits. These tax incentives can encourage more generous giving, thereby enabling nonprofits to raise more funds for their charitable purposes. Donors can deduct such contributions because the funds are used to support activities that benefit society. This structure effectively allows the government to subsidize charitable activities through the tax code. Many foundations and government agencies only provide grants to 501(c)(3) organizations. Access to these funding sources can be a major advantage for 501(c)(3) corporations, as grants can provide significant funding to support their programs and operations. 501(c)(3) status signifies to grant-making institutions that the organization has met the IRS's rigorous standards for charitable purpose and accountability. This can instill confidence in funders that their resources will be used responsibly and for the intended purpose. The IRS endorsement implicit in 501(c)(3) status can lend an organization credibility in the eyes of the public. This can lead to increased donations, volunteer participation, and general community support. Moreover, 501(c)(3) status requires organizations to be transparent about their finances, which can further enhance public trust. By demonstrating that they are accountable and committed to their mission, these organizations can attract more resources to support their work. A fundamental restriction is on certain types of activities. For example, they are strictly prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office. 501(c)(3) organizations cannot operate for the benefit of private interests, such as the organization's founder, the founder's family, shareholders of the organization, or persons controlled, directly or indirectly, by such private interests. A 501(c)(3) organization’s activities should not serve the private interests of any individual or entity more than insubstantially. This principle, known as the doctrine of private benefit, is closely related to the requirement that a 501(c)(3) organization serve a public rather than a private purpose. Inurement refers to the prohibition against using income or assets of a tax-exempt organization to unduly benefit individuals who have some close relationship with the organization and are in a position to exercise significant influence over its activities. If a 501(c)(3) organization engages in excessive inurement, the IRS can revoke its tax-exempt status and impose excise taxes on those who benefit. While some lobbying activities are allowed, they must remain an insubstantial part of the organization’s overall activities. Section 501(c)(3) organizations are prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for public office. The IRS considers a variety of factors to determine whether an organization’s lobbying activity is substantial, including the time devoted (by both compensated and volunteer workers) and the expenditures devoted by the organization to the activity. Violation of these rules can result in denial or revocation of tax-exempt status and the imposition of certain excise taxes. Nonprofits must file an annual information return (Form 990, 990-EZ, or 990-N), which details their financial activities. This information is public and can be accessed by anyone, ensuring transparency and accountability. 501(c)(3) organizations are also subject to additional compliance requirements, such as maintaining proper records, reporting changes to the IRS, and compliance with employment tax laws. This requires filing articles of incorporation with the appropriate state agency, usually the Secretary of State's office. The articles must include specific language required by the IRS, including a statement of the organization’s exempt purpose. After incorporation, the organization must apply for an Employer Identification Number (EIN) from the IRS, even if it does not have employees. Then, the organization can apply for 501(c)(3) status using IRS Form 1023 or 1023-EZ. A well-structured organization is more likely to fulfill its mission effectively and maintain the trust of donors and the public. Key components of a 501(c)(3) corporation's structure include a board of directors, officers, and possibly staff and volunteers. The board is legally responsible for the governance of the organization, while officers (such as the president or executive director) manage day-to-day operations. All individuals involved in the organization should understand their roles and responsibilities to ensure the organization complies with laws and operates effectively. This group is legally responsible for governance, ensuring that the organization stays true to its mission and purpose. The board makes key decisions, oversees management, and helps to guide the organization's strategic direction. Typically, a 501(c)(3) corporation's board of directors is composed of volunteers who bring a diverse set of skills and perspectives. Board members should have a strong commitment to the organization's mission and be willing to devote the necessary time and resources to fulfill their responsibilities effectively. Bylaws and governance policies provide the framework for a 501(c)(3) corporation's operations. The bylaws are a legally binding document that outlines how the organization will be governed and managed. They typically cover topics like the function and size of the board, how and when board meetings will be held, and how board members are elected. Governance policies can include conflict of interest policies, document retention policies, and whistleblower policies. These policies help ensure the organization operates ethically and transparently and can protect the organization's tax-exempt status. Fundraising is crucial for nonprofits because it provides the financial resources they need to carry out their mission. Effective fundraising strategies can involve a combination of individual donations, corporate sponsorships, grants, and fundraising events. Nonprofits must be mindful of the laws and regulations governing fundraising. This includes complying with charitable solicitation laws in the states where they raise funds and providing appropriate acknowledgment to donors for their contributions. Donor relations and stewardship play a significant role in a 501(c)(3) corporation's sustainability and growth. Donor relations involve cultivating relationships with current and potential donors, while stewardship involves ensuring that donated resources are used efficiently and effectively. Effective stewardship can help to build trust with donors and encourage repeat and larger donations. It also involves regular communication with donors about the organization's activities and impact, demonstrating how their donations are making a difference. Many nonprofits rely on grants from foundations, corporations, and government agencies to fund their programs and operations. Successful grant writing involves researching potential funders, writing compelling proposals that align with the funder's interests and guidelines, and managing the grant process, including reporting on how funds are used. By diversifying their revenue sources, nonprofits can reduce their dependence on any single funding source and increase their financial stability. Revenue diversification can involve developing earned income strategies, such as selling products or services or renting out space. It can also involve cultivating a broad base of donors, seeking grants from a variety of sources, and organizing a mix of fundraising events. A well-planned budget is a fundamental tool for any 501(c)(3) corporation. It provides a forecast of revenues and expenses, enabling the organization to plan for the future. Financial planning goes hand in hand with budgeting. It helps the organization to allocate its resources efficiently, plan for financial stability, and achieve its mission and objectives. They involve recording and organizing all the financial transactions of the organization, such as donations received, bills paid, and payroll expenses. Good bookkeeping practices ensure that financial data is accurate, up-to-date, and ready for review at any time. This information is critical for the board, management, and funders to understand the financial position of the organization and make informed decisions. Nonprofits are required to produce financial statements, such as a statement of financial position (similar to a balance sheet), a statement of activities (similar to an income statement), and a statement of cash flows. These statements provide important information about the organization's assets, liabilities, revenues, and expenses. The organization must also file an annual information return (Form 990) with the IRS, which provides detailed financial data and is available to the public. An audit is a systematic review of an organization's financial statements by an independent auditor. The auditor verifies the accuracy of the financial statements and ensures that the organization is following appropriate accounting practices. While not all nonprofits are required to have an independent audit, many choose to do so voluntarily. An audit can provide reassurance to the board, management, funders, and the public that the organization is managing its finances responsibly. 501(c)(3) corporations are nonprofit organizations granted tax-exempt status by the IRS, operating with the mission of benefiting religious, charitable, educational, literary, or scientific purposes. The advantages of being a 501(c)(3) corporation are significant. They include tax-exempt status, allowing organizations to allocate more resources to their mission. Additionally, the ability to receive tax-deductible charitable contributions attracts donors and encourages generous giving. Access to grants and funding opportunities provides crucial financial support for programs and operations. 501(c)(3) corporations also face restrictions to maintain their tax-exempt status. These include limitations on prohibited activities, avoiding private benefit and inurement, adhering to restrictions on lobbying and political activities. To ensure effective governance, 501(c)(3) corporations must establish a well-structured organizational framework with a board of directors and clear bylaws and governance policies. 501(c)(3) corporations hold a unique position in society, combining the advantages of tax-exempt status with the responsibility of upholding their mission and complying with regulatory requirements.What Are 501(c)(3) Corporations?

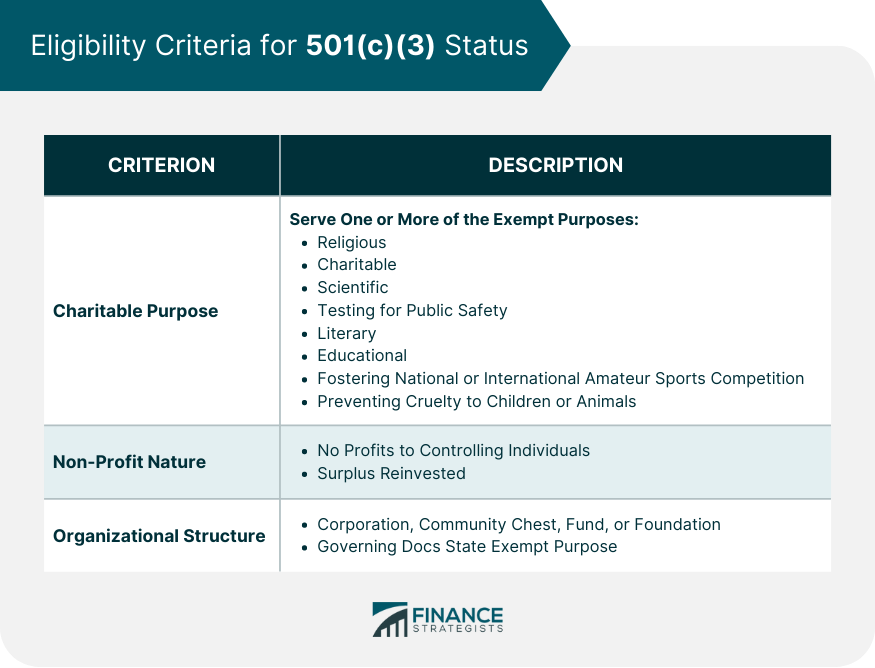

Eligibility Criteria for 501(c)(3) Status

Charitable Purpose

Non-Profit Nature

Organizational Structure

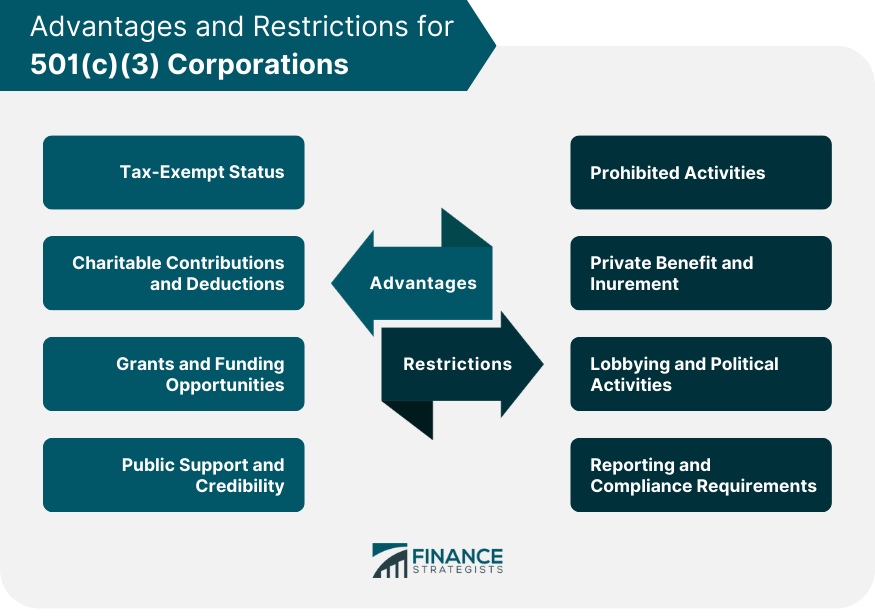

Advantages of 501(c)(3) Corporations

Tax-Exempt Status

Charitable Contributions and Deductions

Grants and Funding Opportunities

Public Support and Credibility

Restrictions for 501(c)(3) Corporations

Prohibited Activities

Private Benefit and Inurement

Lobbying and Political Activities

Reporting and Compliance Requirements

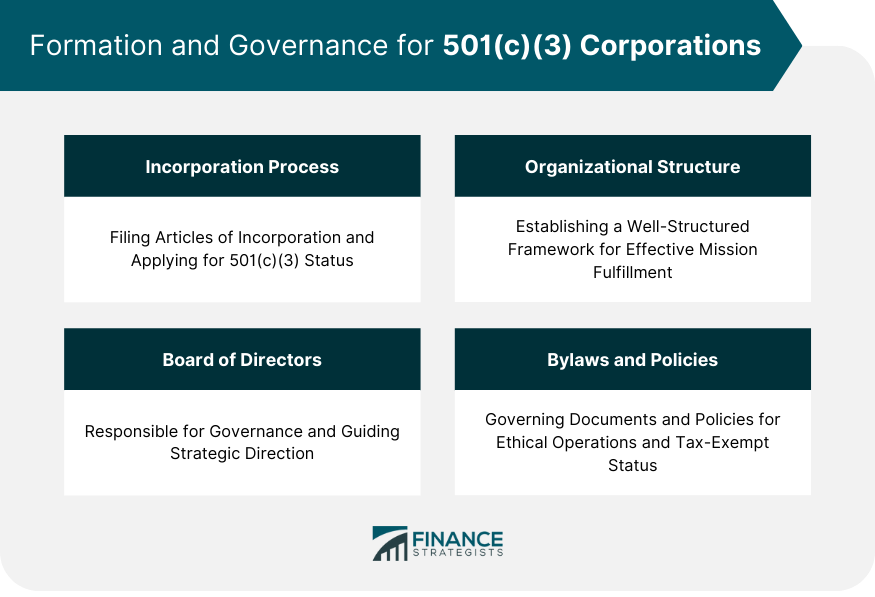

Formation and Governance

Incorporation Process

Organizational Structure

Board of Directors

Bylaws and Governance Policies

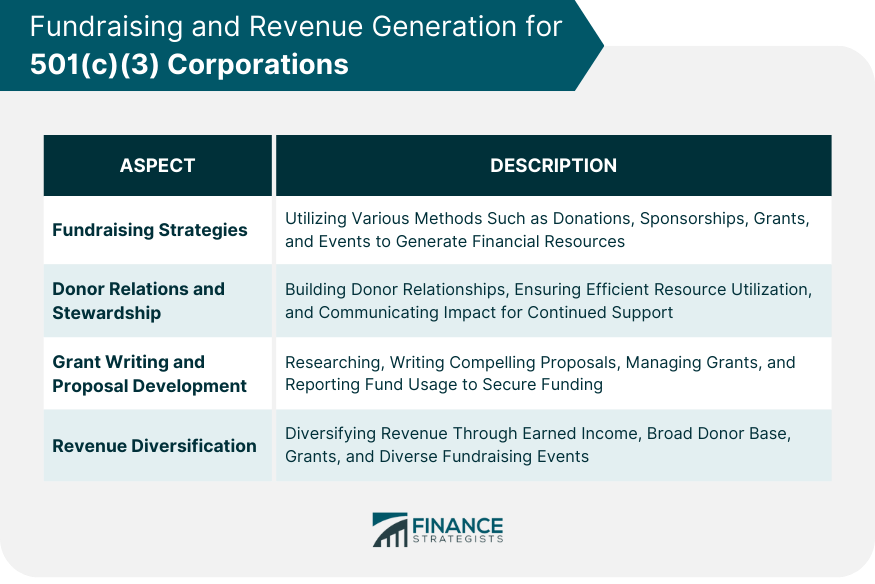

Fundraising and Revenue Generation

Fundraising Strategies

Donor Relations and Stewardship

Grant Writing and Proposal Development

Revenue Diversification

Financial Management and Accountability

Budgeting and Financial Planning

Accounting and Bookkeeping

Financial Statements and Reporting

Independent Audits

Conclusion

501(c)(3) Corporation FAQs

A 501(c)(3) corporation is a nonprofit organization that has been granted tax-exempt status by the IRS because it operates for religious, charitable, scientific, literary, or educational purposes.

The benefits include tax-exempt status, the ability to accept tax-deductible donations, access to grant funding, and increased public support and credibility.

These organizations cannot engage in political campaign activity, must limit their lobbying activities, cannot operate for the benefit of private interests, and must comply with specific reporting and compliance requirements.

A 501(c)(3) corporation is established by filing articles of incorporation with the appropriate state agency and applying for tax-exempt status with the IRS using Form 1023 or 1023-EZ.

Responsibilities include meeting ongoing compliance requirements, fulfilling IRS reporting and filing obligations, conducting exempt purpose activities, and maintaining proper record-keeping and document retention.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.