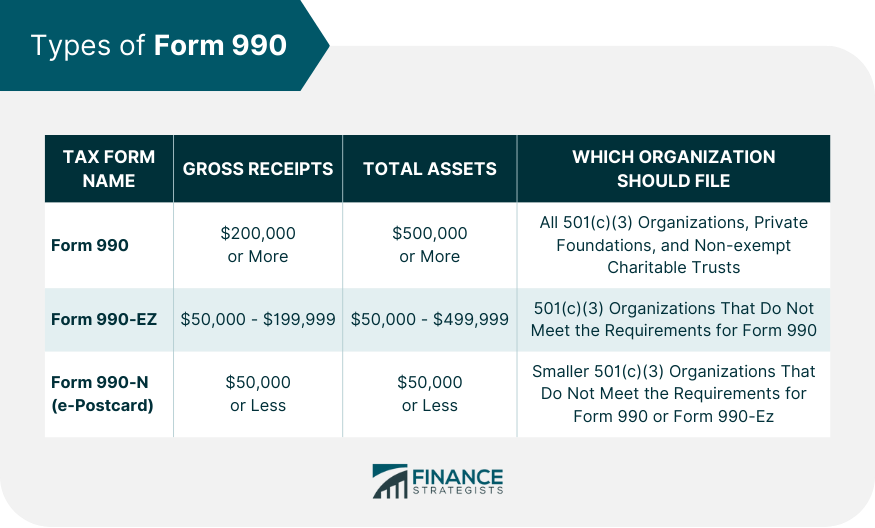

Non-profit organizations play a crucial role in society by providing various services that benefit the public.These organizations operate under a specific tax-exempt status granted by the Internal Revenue Service (IRS) known as the 501(c)(3) status. This status enables non-profit organizations to receive tax-deductible donations from individuals and corporations. However, with tax-exempt status comes certain tax compliance requirements, including the filing of annual tax forms. 501(c)(3) organizations are required to file various tax forms with the IRS, depending on the organization's size, revenue, and activities. The most commonly required tax forms include Form 990, Form 990-EZ, and Form 990-N. Each tax form serves a unique purpose and helps the IRS monitor the nonprofit's financial activity to ensure compliance with tax regulations. This is the most comprehensive tax form required by 501(c)(3) organizations. This form is used to report the organization's income, expenses, and other financial information. It is important to note that Form 990 is not only used for tax purposes but is also available to the public, which makes it a valuable resource for potential donors, researchers, and other stakeholders to evaluate the organization's financial health. Form 990 is required to be filed by any 501(c)(3) organization that has gross receipts of $200,000 or more, or total assets of $500,000 or more. Additionally, private foundations and non-exempt charitable trusts are required to file Form 990 regardless of their revenue or assets. There are three types of Form 990, including Form 990, Form 990-EZ and Form 990-N (e-postcard). Form 990 is the most comprehensive and is required to be filed by organizations with gross receipts of $200,000 or more or total assets of $500,000 or more. Form 990-EZ is a shorter version of Form 990 and is required to be filed by organizations with gross receipts between $50,000 and $199,999 or total assets between $50,000 and $499,999. Form 990-N is used for Tax-Exempt Organizations that are not required to File Form 990 or Form 990-EZ. Form 990 is due on the 15th day of the fifth month following the end of the organization's fiscal year. For example, if an organization's fiscal year ends on December 31st, Form 990 is due on May 15th of the following year. Failure to file Form 990 can result in penalties ranging from $20 to $105 per day, up to a maximum penalty of $54,500 or 5% of the organization's gross receipts, whichever is less. Form 990-EZ is a shorter version of Form 990 and is required to be filed by 501(c)(3) organizations that do not meet the requirements for filing Form 990. This form is designed for organizations with gross receipts between $50,000 and $199,999 or total assets between $50,000 and $499,999. The purpose of Form 990-EZ is to provide the IRS with basic financial information while reducing the reporting burden on smaller organizations. 501(c)(3) organizations with gross receipts between $50,000 and $199,999 or total assets between $50,000 and $499,999 are required to file Form 990-EZ. Form 990-EZ requires less information than Form 990, but it still requires some detailed financial information, including revenue and expense details, officer compensation, and other relevant financial details. Additionally, if the organization has any unrelated business income, it must be reported on Form 990-EZ. Form 990-EZ is also due on the 15th day of the fifth month following the end of the organization's fiscal year. Failure to file Form 990-EZ can result in penalties ranging from $20 to $100 per day, up to a maximum penalty of $10,000 or 5% of the organization's gross receipts, whichever is less. Form 990-N, also known as the Electronic Notice (e-Postcard) for Tax-Exempt Organizations, is a simplified version of Form 990 that must be filed electronically. This form is designed for smaller organizations that do not meet the requirements for filing Form 990 or Form 990-EZ. The purpose of Form 990-N is to provide basic information to the IRS and maintain the organization's tax-exempt status. 501(c)(3) organizations that have gross receipts of $50,000 or less are required to file Form 990-N. It is important to note that organizations that fail to file Form 990-N for three consecutive years will lose their tax-exempt status. Form 990-N requires minimal information, including the organization's name, address, Employer Identification Number (EIN), website address, and confirmation that the organization's gross receipts are $50,000 or less. Form 990-N is due on the 15th day of the fifth month following the end of the organization's fiscal year. Late filing of Form 990-N is not subject to a penalty, though organizations that miss three consecutive years of the required Forms 990, 990-EZ, or 990-N would automatically lose their tax-exempt status. In addition to Form 990, Form 990-EZ, and Form 990-N, there may be other tax forms that a 501(c)(3) organization is required to file depending on its activities. For example, if the organization has any unrelated business income, it may be required to file Form 990-T. Additionally, if the organization has any foreign investments, it may be required to file Form 5471 or Form 8865. It is important to consult with a professional specializing in tax services or the IRS to determine if any additional tax forms are required for your organization. Tax compliance is a critical aspect of running a 501(c)(3) organization. Failing to file the required tax forms or filing them incorrectly can result in penalties and could jeopardize the organization's tax-exempt status. By understanding the different tax forms required for 501(c)(3) organizations, you can ensure that your organization stays in compliance with tax regulations. It is essential to consult with either a tax professional or the IRS to determine which tax forms are required for your organization and to ensure that they are filed accurately and on time. Staying compliant with tax regulations will not only keep your organization in good standing with the IRS but will also provide transparency and accountability to potential donors, stakeholders, and the public.Tax Forms for 501(c)(3) Organizations: Understanding the Basics

Overview of Tax Forms for 501(c)(3) Organizations

Form 990

Who Needs to File Form 990?

Types of Form 990 and Which One to File

Deadlines and Penalties for Not Filing Form 990

Form 990-EZ

Who Needs to File Form 990-EZ?

Requirements and Limitations of Form 990-EZ

Deadlines and Penalties for Not Filing Form 990-EZ

Form 990-N

Who Needs to File Form 990-N?

Requirements and Limitations of Form 990-N

Deadlines and Penalties for Not Filing Form 990-N

Other Tax Forms

Conclusion

Tax Forms for 501(c)(3) Organizations FAQs

A 501(c)(3) organization is a non-profit organization that has been granted tax-exempt status by the IRS. This status allows the organization to receive tax-deductible donations from individuals and corporations.

Form 990 is a comprehensive tax form required for 501(c)(3) organizations with gross receipts of $200,000 or more or total assets of $500,000 or more. Form 990-EZ is a shorter version of Form 990 and is required for organizations with gross receipts between $50,000 and $199,999 or total assets between $50,000 and $499,999.

Failing to file the required tax forms or filing them incorrectly can result in penalties ranging from $20 to $100 per day, up to a maximum penalty of $10,000 or 5% of the organization's gross receipts, whichever is less. Additionally, failure to file Form 990-N for three consecutive years can result in the loss of the organization's tax-exempt status.

Yes, Form 990 is a public document and is available for anyone to access. This makes it a valuable resource for potential donors, researchers, and other stakeholders to evaluate the financial health of a 501(c)(3) organization.

Yes, depending on the organization's activities, there may be additional tax forms required. For example, if the organization has any unrelated business income, it may be required to file Form 990-T. Additionally, if the organization has any foreign investments, it may be required to file Form 5471 or Form 8865.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.