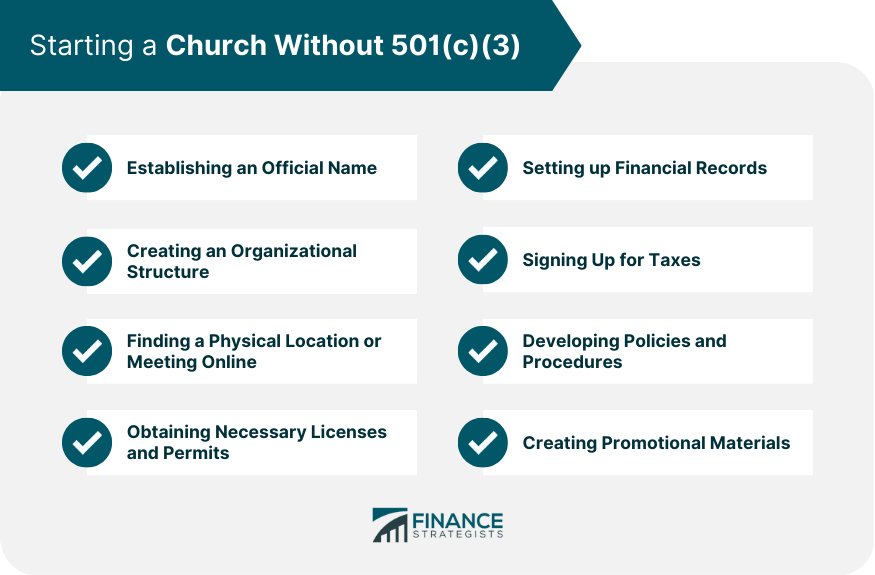

The IRS considers most religious institutions, particularly churches, 501(c)(3)s automatically, with no need to apply. If you feel that your particular church may not be automatically eligible, you may still apply formally. The IRS offers an application, Form 1023, on their website. A church without 501(c)(3) is an entity that does not have tax-exempt status from the Internal Revenue Service (IRS). This means that, unlike churches with 501(c)(3) status, donations to a church without 501(c)(3) are not tax-deductible and may be subject to federal income taxes. It also means that the church is no longer eligible for certain grants and gifts due to its lack of recognition by the IRS as an exempt organization. Despite these drawbacks of being without 501(c)(3), many churches choose not to pursue this status in order to remain independent of government interference and retain control of their affairs. For some denominations, avoiding 501(c)(3) status is simply part of their identity—such as those belonging to the “house church” movement (which typically rejects incorporation). In addition, since 501(c)(3) requires organizations to submit detailed financial information every year, being free from this requirement may be beneficial to smaller churches with limited or no financial reporting capabilities. That said, there are costs associated with this independence; having fewer resources often makes it harder for a church without 501(c)(3) status to acquire land or other property needed for their operations. While having non-profit status can seem appealing on paper, small congregations need to carefully consider what it means for them—both financially and otherwise—before making any decisions. Churches without such designation are just as capable of reaching and helping individuals within their communities; they will just have fewer options when it comes to fundraising activities or recognizing large donations made by members via tax deductions benefits. Churches without 501(c)(3) status are held to the same standards and regulations as churches with 501(c)(3) status. This means that churches without 501(c)(3) must still meet all of their local, state, and federal legal requirements related to taxes, insurance, licensing, permits, and more. The difference is that donations made to these churches cannot be deducted from one's income taxes as they would be if given to an organization with 501(c)(3) status. In addition, since the church lacks non-profit status, it will not be eligible for certain grants or gifts due to its lack of recognition by the IRS as an exempt organization. Despite these drawbacks of being without 501(c)(3), many churches choose this option in order to remain independent of government interference and retain control of their affairs. It also allows them to avoid having to submit detailed financial information each year, which can be beneficial for smaller organizations with limited financial reporting capabilities. For those seeking an alternative way of operating a church without having to worry about filing forms or dealing with extra paperwork, being without 501(c)(3) may offer a viable solution. For others, however, it may be worth considering obtaining non-profit status in order to gain access to tax deductions and other benefits available for those registered under section 501(c). In order to be considered a church, there are certain legal requirements that must be met. These requirements are determined by the Internal Revenue Service (IRS) and may vary from state to state. Generally, the following criteria must be satisfied: The organization must have one or more members, with a group leader designated for worship activities. The organization must have an established creed or statement of faith, which outlines its core beliefs and teachings. The organization must have regularly scheduled worship services, meetings, or other related activities such as religious education classes. The organization must not operate primarily for the purpose of making money. The organization’s primary purpose should be religious in nature, not social or recreational. It is important to note that churches are eligible for tax exemption status under section 501(c)(3) of the IRS code, but this is not required in order to be recognized as a church by the government. Furthermore, churches without 501(c)(3) status are still bound by most of the same laws and regulations as those with non-profit status, so they should familiarize themselves with their local laws before making any decisions regarding their operations. Establishing a church without tax-exempt status requires taking a few steps. First, you need to decide on an official name and determine what type of church it is (denomination, non-denominational, etc.). Second, create bylaws or articles of incorporation for the organizational structure. Third, find a physical location for worship services and meetings or start meeting online. Fourth, obtain any applicable licenses or permits related to the area you are operating in (business license, zoning permits, etc.). Fifth, set up financial records to track donations and expenses. Sixth, sign up for taxes such as quarterly estimated taxes so that you meet federal requirements. And lastly, develop policies and procedures related to church governance and membership rules as this is not regulated by the government if there is no 501(c)(3) status. Additionally, create promotional materials such as a website or social media page to spread awareness about your new church. For many churches, filing for tax-exempt status under section 501(c)(3) of the IRS code can have numerous advantages. Depending on your church’s size and scope, these advantages may include: Being exempt from federal, state, and local income taxes. Access to grants and donations from foundations, corporations, or other sources that are generally exclusively available to non-profit organizations. Donors to a 501(c)(3) organization can receive a deduction on their taxes when they make contributions. Increased credibility among members, donors, and the general public due to the association with nonprofit organizations. Lower insurance premiums based on a lower risk associated with federally approved non-profits. Filing for 501(c)(3) tax-exempt status is not a requirement for being recognized as a church by the government, but it can provide certain benefits that may be advantageous in some situations. It is important to consider all aspects of filing before making any decisions about whether or not it is right for your particular organization. While filing for 501(c)(3) tax-exempt status is not a requirement for being considered a church, it can provide many advantages and benefits that may be beneficial for your organization. It is important to consider all aspects of the process before making any decisions in order to ensure that it is the right choice for your church’s particular needs. Ultimately, the decision of whether or not to pursue this option is purely up to each individual church, but with proper research and knowledge, it can be a great way to increase credibility among members, donors, and the public at large.Starting a Church Without 501(c)(3) Overview

What Is a Church Without 501(c)(3)?

How a Church Without 501(c)(3) Works

Legal Requirements to Be Considered a Church

Steps in Starting a Church Without 501(c)(3)

Advantages of Filing for 501(c)(3) Tax-Exempt Status

Final Thoughts

How to Start a Church Without 501(c)(3) FAQs

Yes, you can start a church without filing for tax exemption. All churches are recognized by the IRS as exempt from taxation regardless of their tax-exempt status.

To get your church officially recognized and established, you will need to have your state recognize it as an official religious organization, register it with the government, create bylaws and/or other governing documents, and open a bank account in the name of your church.

If you do not file for 501(c)(3), you will still be considered a valid church in the eyes of the IRS; however, donations will not be tax deductible and your organization may miss out on certain grants or funding opportunities that are only available to non-profits with federal tax-exemption status.

Yes, the IRS can revoke an organizations 501(c)(3) status if they fail to comply with regulations or do not submit annual information returns.

Yes, there are some grant programs available that do not require non-profit statuses such as those offered by private foundations or corporations. It is important to research all options thoroughly before you begin applying for grants, as some may have additional requirements or restrictions in place that need to be met in order to qualify.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.