501(c)(3) is a designation given to public charitable organizations in the United States. Charities that receive this designation are exempt from paying some federal taxes, and they are eligible to receive tax-deductible donations. In order to qualify for 501(c)(3) status, an organization must have certain characteristics, including being organized and operated exclusively for religious, educational, scientific, literary, or charitable purposes with no private benefit involved. The organization must also be non-profit and not engage in any activity that violates public policy. Organizations recognized as 501(c)(3)s can apply for federal grants, apply for loans from banks without having to pay taxes on the funds received, and will generally be exempt from paying taxes on the money it earns through investments or donations. Donations made to 501(c)(3) organizations are typically tax deductible for the donor if the donation is used for the intended purpose of helping others. When setting up a new charity organization, it is important to understand the requirements for 501(c)(3) status before applying so that all eligibility criteria can be met. Once approved by the IRS, organizations must maintain their status by following all state and federal regulations pertaining to nonprofit organizations. A 501(c)(3) is a designation given to public charitable organizations in the United States. This designation provides certain tax benefits that can help organizations fulfill their charitable goals. First, an organization must apply for and be approved by the Internal Revenue Service (IRS) as a 501(c)(3). This involves submitting an application to the IRS with all of the necessary paperwork, including proof that the organization meets all of the criteria. The organization must also provide documentation showing that it operates exclusively for religious, educational, scientific, literary, or charitable purposes with no private benefit involved. Once approved, the organization can begin accepting donations and other forms of financial support from donors who may be eligible to receive a tax deduction for their contribution. In order for an organization to maintain its 501(c)(3) status, it must be operated in accordance with all applicable state and federal regulations pertaining to nonprofit organizations. Organizations must also ensure that their finances are thoroughly accounted for so that any donations received are used solely for their intended purposes. Additionally, they must keep detailed records of all activities related to fundraising or other public interactions so they can report accurate information on required government filings each year. By taking advantage of the tax benefits associated with 501(c)(3) status, charities can better achieve their mission and serve those in need without having to worry about paying taxes on donations or other income earned through investment activities. It is important for new organizations to understand these requirements before applying so they can ensure eligibility standards are met and stay compliant with all necessary regulations throughout their operation. In order to qualify for 501(c)(3) status, an organization must have certain characteristics. This designation is reserved for public charity organizations in the United States that are non-profit and meet the following criteria: Organized and operated exclusively for religious, educational, scientific, literary, or charitable purposes with no private benefit involved Must not engage in any activity that violates public policy Must be exempt from federal income tax under Section 501(a) of the IRS Code and allowed to receive tax-deductible donations from individuals and corporations It is important to note that any organization seeking 501(c)(3) status must be able to prove that it meets all of the criteria listed above. In addition to these basic requirements, organizations must also provide proof of legal existence as either a corporation, unincorporated association, or trust, have articles of incorporation on file with their state, and have detailed information about its purpose and activities available. Furthermore, they must have operational procedures in place, keep detailed financial records, maintain adequate insurance coverage, and apply for recognition by filing Form 1023 with the IRS. By obtaining 501(c)(3) status, charities can take advantage of certain tax benefits as well as eligibility to receive government grants and loans from banks without paying taxes on them. It is essential for potential applicants to understand all the eligibility requirements before submitting their application so they can ensure they meet all necessary standards. Organizations seeking 501(c)(3) status must understand the restrictions that accompany it. This designation provides certain tax benefits and other advantages, but they come with a few limitations as well. First, organizations are restricted in the extent to which they can engage in lobbying activities. Although this type of activity is generally allowed, it is limited and cannot constitute a “substantial part” of an organization’s efforts. Additionally, any political activity must adhere to strict guidelines in order to stay within IRS regulations. In addition, organizations with 501(c)(3) status cannot distribute profits or dividends to its members or directors, nor can they provide a private benefit for any individuals associated with the charity. This means that no one person should receive any special benefits from the organization, such as excessive salaries or bonuses. Furthermore, fundraising activities should be carefully conducted in accordance with all applicable federal and state laws. By understanding these restrictions and requirements, charities can ensure compliance so they avoid jeopardizing their 501(c)(3) status and its accompanying benefits. It is important for new applicants to research all relevant regulations before submitting their application so they can ensure all necessary criteria are met along the way. Obtaining 501(c)(3) status can be a complex and lengthy process, however, the rewards that come with such recognition can be well worth the effort. The following steps provide an overview of how to apply for this type of certification: One of the first steps in applying for 501(c)(3) status is to obtain and submit documents such as articles of incorporation, bylaws, and state certificates of registration or formation. Organizations must also make sure they meet all criteria in order to be eligible for 501(c)(3) status. This includes being organized and operated exclusively for charitable purposes with no private benefit involved; not engaging in any activity that violates public policy; and being exempt from federal income tax under Section 501(a) of the IRS Code. Charities must document their work and ensure they have written policies in place regarding activities such as fundraising, donations, board meetings, financial management, record keeping, etc. Once all other eligibility requirements have been met, organizations can then file Form 1023 with the IRS in order to request recognition as a public charity organization under Section 501(c)(3). By following these steps carefully and providing detailed documentation throughout the process, charities can increase their chances of achieving successful 501(c)(3) status so they can enjoy the associated benefits. For any organization, obtaining 501(c)(3) status can bring a number of advantages. However, there are some potential drawbacks that should also be considered before making the decision to pursue this designation. Some of the advantages are the following: Tax Exemption – Organizations with 501(c)(3) status often enjoy tax exemptions on their donations, contributions, and other income sources. Additionally, they may qualify for reduced rates on shipping services or other related services. Public Support– Charities with 501(c)(3) status often receive more public support since individuals are able to donate to them as a tax-deductible contribution and have confidence in their charitable mission and purpose. Increased Credibility – Organizations with this designation often garner more recognition from the public as well as other organizations who view them as legitimate entities that are dedicated to serving the community. On the other hand, there are also several drawbacks, including: Lobbying Restrictions – Although lobbying activities may be allowed under certain circumstances, charities with 501(c)(3) status must ensure they adhere to strict guidelines or risk losing their designation. Financial & Record Keeping Requirements – Organizations must adhere to strict financial management policies and document all transactions in order to remain compliant with IRS regulations as well as maintain their non-profit status. Private Benefit Restrictions – These organizations cannot distribute profits or dividends to its members or directors, nor can they provide any sort of private benefit for those associated with the charity. This makes it difficult to fundraise effectively and operate at maximum efficiency if resources are limited. Overall, while obtaining 501(c)(3) certification comes with a few restrictions, many organizations find the benefits far outweigh the disadvantages in terms of increased public support and enhanced credibility, which could result in greater donations over time for their cause or mission. Obtaining 501(c)(3) status can bring a lot of benefits and recognition to an organization, but it can also come with some restrictions and requirements that should be taken into consideration. In order to apply for 501(c)(3) status, make sure to obtain all the necessary documents and that all criteria are met. Once the operational procedures have been established, organizations may file Form 1023. With the right planning and dedication to following all related guidelines, charities can enjoy the associated rewards of increased donations and enhanced public support.How 501(c)(3) Works

Eligibility Requirements of 501(c)(3)

Restrictions of 501(c)(3)

Steps in Applying for 501(c)(3)

Obtain Organizational Documents

Ensure All Criteria Are Met

Establish Operational Procedures

Request Recognition by Filing Form 1023

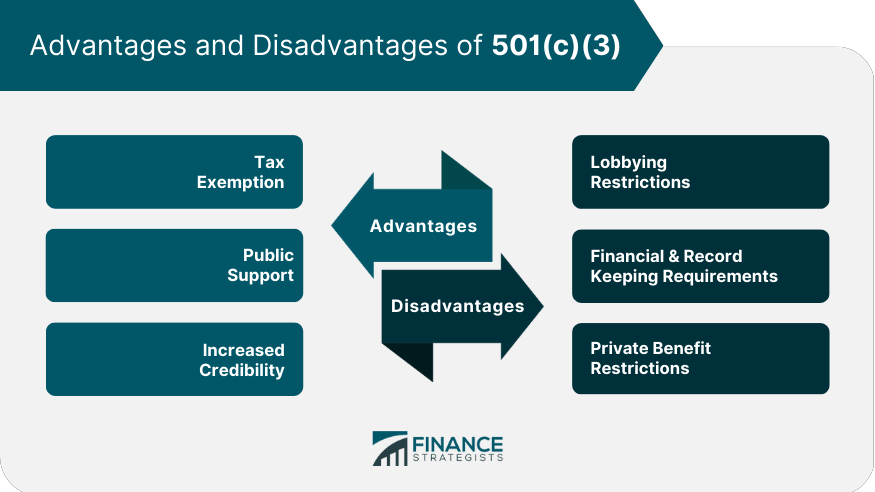

Advantages and Disadvantages of 501(c)(3)

Conclusion

How to Apply for 501(c)(3) FAQs

501(c)(3) status is a designation given to nonprofit organizations and charitable trusts by the Internal Revenue Service (IRS), recognizing them as exempt from federal income tax.

Organizations that are organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes may qualify for 501(c)(3) status.

To apply for 501(c)(3) status, you must file Form 1023 (Application for Recognition of Exemption Under Section 501(c)(3) of The Internal Revenue Code). This form should be accompanied by any necessary attachments and required documents like your Articles of Incorporation, Bylaws, etc.

The IRS typically takes 2-6 months to process applications after they are received, depending on their workload at the time of submission. A decision will be issued within this timeframe.

You must wait until your organizations application is approved before you can legally solicit donations, as donations made prior to being officially recognized as a non-profit organization cannot be considered tax-deductible contributions by the IRS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.