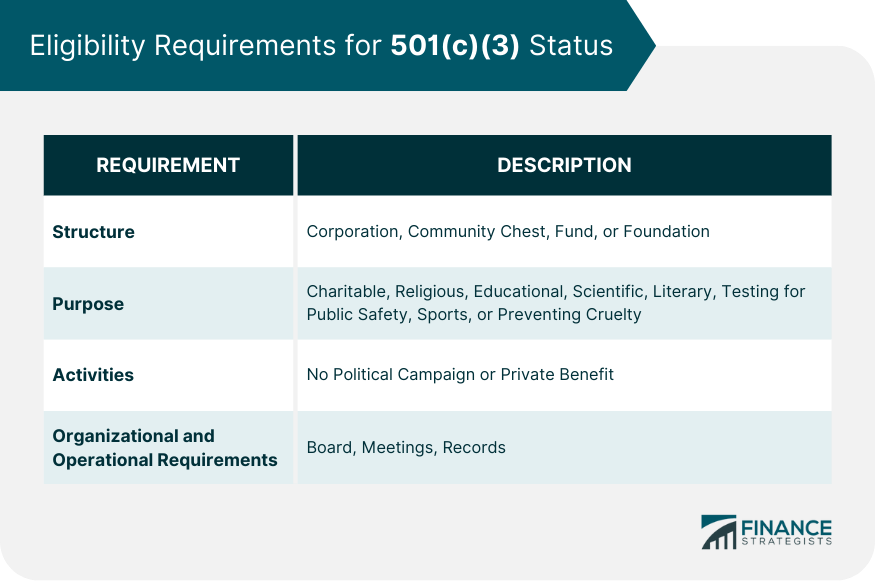

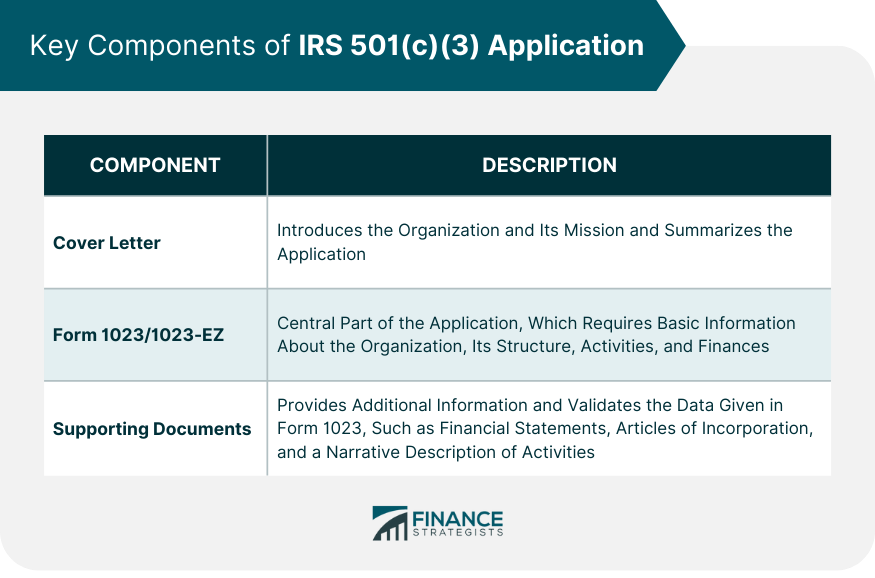

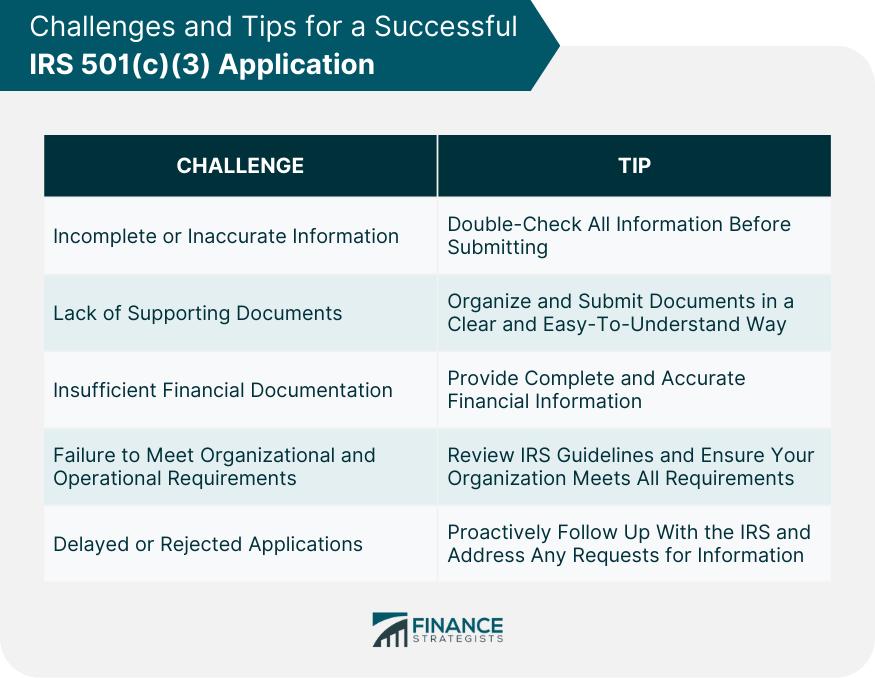

The IRS 501(c)(3) application, officially known as Form 1023, is the document that organizations submit to the Internal Revenue Service (IRS) to obtain recognition as a tax-exempt entity under Section 501(c)(3) of the Internal Revenue Code. The application is comprehensive, requiring detailed information about the organization's structure, purpose, governance, and financials. 501(c)(3) status is a legal designation applied to non-profit organizations in the United States, and it grants them exemption from federal income tax. Organizations that qualify under this status include those with religious, charitable, scientific, literary, or educational purposes. Attaining 501(c)(3) status is crucial for many non-profit organizations. It not only exempts the organization from federal income tax but also enables donors to make tax-deductible contributions. It may also make the organization eligible for certain grants and other types of funding. Furthermore, the status adds credibility to the organization, enhancing its reputation among donors, volunteers, and the community it serves. To qualify for 501(c)(3) status, an organization must be structured as a corporation, community chest, fund, or foundation; individual entrepreneurs and partnerships are not eligible. Additionally, the organization must have a stated purpose that aligns with the categories specified in the Internal Revenue Code, and it must refrain from engaging in specific activities, such as political campaigning. Earnings must not benefit any private shareholder or individual. The organization must also meet specific organizational and operational requirements to demonstrate that it is indeed functioning for its declared exempt purposes. The key components of an IRS 501(c)(3) application include the submission of a cover letter, Form 1023/1023-EZ, and supporting documents such as financial statements, articles of incorporation, and a narrative description of activities. These components play a crucial role in demonstrating an organization's eligibility and compliance with the requirements for obtaining 501(c)(3) status. A cover letter serves as an introduction to the organization and its mission. It provides a summary of the application and should clearly state the request for 501(c)(3) status. Form 1023, or its simpler version, Form 1023-EZ, is the central part of the application. This section requires basic information about the organization, such as its name, mailing address, and Employer Identification Number (EIN). Here, the applicant must indicate the structure of the organization (corporation, trust, association, etc.) and provide proof of its legal existence. In this part, the organization describes its past, current, and planned activities in detail. This section seeks information about the compensation of officers, directors, and trustees, along with other financial data. The IRS charges a user fee for processing the application, which must be paid when filing Form 1023. The application must be signed and dated by an authorized individual attesting to the accuracy of the information provided. The application also requires various supporting documents to provide additional information and validate the data given in Form 1023. Financial statements provide a clear picture of the organization's financial health and operations. The Articles of Incorporation establish the existence of the organization and include information like the organization's name, purpose, and more. The bylaws outline the organization's internal rules and procedures for governance. A Conflict of Interest policy is necessary to ensure that the organization's management acts in the best interest of the organization. A narrative description offers a detailed account of the organization's activities, demonstrating its mission in action. Samples of fundraising materials can help the IRS understand the organization's fundraising strategies and practices. Budget documents and financial projections provide insight into the organization's financial planning. Information about the organization's board members, including their roles, responsibilities, and qualifications, is required. The EIN is the unique nine-digit number assigned by the IRS to identify the organization for tax purposes. The application submission process for an IRS 501(c)(3) application involves completing all required forms and submitting them to the IRS for review. It is important to ensure that the application is complete and accurate to avoid delays or rejections. During the review process, the IRS may request additional information or clarification on certain aspects of the application. If the application meets all the requirements and is approved, the IRS will issue a determination letter officially recognizing the organization's 501(c)(3) status. This letter serves as proof of the organization's tax-exempt status and allows it to receive tax-deductible donations and enjoy other benefits associated with nonprofit status. The most common issue with 501(c)(3) applications is incomplete or inaccurate information. The IRS requires precise, detailed information about the organization's activities, financials, and governance. Failure to provide necessary supporting documents can also delay the application process. These documents validate the information provided in the application and offer a more comprehensive view of the organization. Organizations must provide robust financial information, including past financial statements and future financial projections. Inadequate financial information can result in an application being delayed or rejected. Organizations must meet specific organizational and operational requirements to qualify for 501(c)(3) status. If the IRS determines that these requirements are not met, it can deny the application. Even with a complete application, processing times can be lengthy. If the IRS finds issues with the application, it can be delayed even further or, in some cases, rejected. Reading and understanding the instructions and guidelines provided by the IRS can ensure that you accurately complete each section of the application. Given the complexity of the application process, it can be beneficial to seek help from a professional, such as an attorney or CPA, who is familiar with the 501(c)(3) application process. To avoid unnecessary delays or denials, ensure that all information provided in the application is accurate and complete. Double-check all sections before submission. Keep all supporting documents organized and submit them in a manner that makes it easy for the IRS to understand and review your application. Don't just wait after you've submitted your application. Proactively follow up with the IRS to track the status of your application and address any additional requests for information. The IRS 501(c)(3) application, or Form 1023, is a critical process for non-profit organizations seeking recognition of tax-exempt status. This status brings numerous benefits, including tax exemption, eligibility for grants, and enhanced credibility. The application comprises several parts, including a cover letter, Form 1023 itself, and various supporting documents, each of which needs to be filled out accurately and completely. The IRS 501(c)(3) application is submitted for review, and the IRS may request additional information. Upon approval, a determination letter is issued recognizing the organization's 501(c)(3) status. Common challenges in the IRS 501(c)(3) application process include incomplete or inaccurate information, lack of supporting documents, insufficient financial documentation, and failure to meet organizational and operational requirements.What Is the IRS 501(c)(3) Application?

Eligibility Requirements for 501(c)(3) Status

Key Components of IRS 501(c)(3) Application

Cover Letter for a IRS 501(c)(3) Application

Form 1023/1023-EZ for a IRS 501(c)(3) Application

Part I: Identification of Applicant

Part II: Organizational Structure

Part III: Specific Activities and Operational Information

Part IV: Compensation and Financial Information

Part V: User Fee Information

Part VI: Signature and Closing

Supporting Documents for a IRS 501(c)(3) Application

Financial Statements

Articles of Incorporation

Bylaws

Conflict of Interest Policy

Narrative Description of Activities

Fundraising Materials

Budget and Financial Projections

Board of Directors Information

Employer Identification Number (EIN)

Application Submission Process

Common Challenges in the Application Process

Incomplete or Inaccurate Information

Lack of Supporting Documents

Insufficient Financial Documentation

Failure to Meet Organizational and Operational Requirements

Delayed or Rejected Applications

Tips for a Successful IRS 501(c)(3) Application

Thoroughly Review the Instructions and Guidelines

Seek Professional Assistance If Needed

Ensure Accuracy and Completeness of Information

Organize and Submit Supporting Documents Effectively

Follow Up on the Application Status

Conclusion

IRS 501(c)(3) Application FAQs

No, not every non-profit organization is eligible for 501(c)(3) status. To qualify, an organization must meet specific requirements, including having a charitable, religious, educational, scientific, or literary purpose and abstaining from certain activities, such as political campaigning.

Obtaining 501(c)(3) status provides several benefits, including exemption from federal income tax, eligibility for tax-deductible donations, access to certain grants and funding opportunities, and enhanced credibility and public trust.

Yes, an organization can apply for retroactive 501(c)(3) status by submitting a request for reinstatement along with the appropriate fees and documentation. However, it is advisable to apply for tax-exempt status as soon as possible to avoid any unnecessary complications or delays.

The processing time for a 501(c)(3) application can vary depending on various factors, such as the complexity of the organization's structure, the accuracy and completeness of the application, and the current workload of the IRS. Generally, it can take several months for the IRS to review and make a determination on an application.

Yes, it is common for organizations to seek professional assistance, such as from attorneys or certified public accountants (CPAs), in completing the 501(c)(3) application. Professionals who specialize in non-profit tax law can provide guidance, ensure accuracy, and increase the chances of a successful application outcome.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.