If you are looking to start or maintain a nonprofit organization, you may have heard about the concept of 501(c)(3) status. This designation is issued by the Internal Revenue Service (IRS) and provides certain benefits and protections for qualifying organizations. Obtaining 501(c)(3) status is a designation that reserves exemption from federal taxation under Section 501(c)(3) of the US tax code for nonprofit organizations organized and operated exclusively for certain specified charitable purposes. This status provides numerous benefits, including: Obtaining 501(c)(3) status is a designation that reserves exemption from federal taxation under Section 501(c)(3) of the US tax code for nonprofit organizations organized and operated exclusively for certain specified charitable purposes. This status provides numerous benefits, including allowing organizations to receive donations that are deductible on donors' income taxes. This signals to potential benefactors that their gift will be used responsibly and increases fundraising efficiency by featuring charities prominently in search results. There are two main types of organizations eligible for the 501(c)(3) classification: public charity and private foundations. A public charity generally has more diverse funding than a private foundation, as contributions are made from both individuals and corporations. These organizations fall into categories such as churches, hospitals, and schools; governmental units; volunteer fire companies; scientific research institutes; civic leagues; social welfare organizations, and others. Public charities typically serve the public in various ways - advocating change or providing services in areas such as youth development, arts and humanities, education, health care, animal services, and environmental protection. Private foundations receive most or all of their funds from a single source (like an individual's estate or the stock holdings of one family). These foundations have fewer rules to follow than public charities, but their activities must still center around charitable works, like helping disadvantaged people or promoting educational opportunities. Private foundations allow donors greater control over how their money is used, as they are not required to solicit funds from other sources or report about board meetings regularly. As such, private foundations tend to be more focused on specific areas rather than wide-ranging advocacy activities like those undertaken by public charities. Ultimately, obtaining 501(c)(3) status is essential for nonprofits seeking long-term financial stability while fulfilling their mission statements effectively. This allows them access to funding opportunities through both public grants and private donations, while providing assurance they will manage funds properly no matter what type of organization they may be. Obtaining 501(c)(3) status is a designation that reserves exemption from federal taxation under Section 501(c)(3) of the US tax code for nonprofit organizations organized and operated exclusively for certain specified charitable purposes. This status provides numerous benefits that are essential to the success of an organization, including financial advantages such as being exempt from federal taxes, and also eligibility for various grants available, both publicly and privately. One of the major benefits of owning a 501(c)(3) status is that it allows an organization to be exempt from federal taxes. This means that any income generated by their activities will not be subject to tax. However, some states may have different regulations when it comes to taxes, so one should keep this in mind while making decisions regarding operations. Another important benefit is that donations received by these organizations are considered gifts rather than taxable income, which encourages donors to provide more generous gifts with less financial burden. Moreover, having 501(c)(3) status signals the potential benefactor's assurance that their gift will directly contribute to its intended purpose, further making it easier to generate resources for development projects, services, and advocacy activities. Lastly, charitable organizations with the 501(c)(3) designation can receive funding opportunities through both public grants (from local state governments or governmental units) and private donations (from corporations and individuals). Consequently, having this status allows an organization's mission statement to make a clear impact on preserving public trust - securing both donor contributions and state grants alike. Overall, obtaining 501(c)(3) status is essential for nonprofits seeking long-term financial stability while fulfilling their mission statements effectively. Having 501(c)(3) status provides access to considerable resources made available through government grants and private donations, while ensuring funds are managed properly according to set standards. As beneficial as it can be for organizations to obtain 501(c)(3) status, there are also some drawbacks that could potentially diminish its benefits. 501(c)(3) organizations are limited in their ability to engage in certain activities, such as political campaigning, lobbying, and for-profit business operations. While some exceptions may exist when the activity serves to further the organization's mission statement, violating these regulations can lead to severe penalties, including revocation of tax-exempt status and hefty fines. This means that it is essential for nonprofits to research applicable rules before engaging in any activities that have even a remote connection to the promotion of a particular candidate or political party. As a condition of having 501(c)(3) status, organizations must make their financial information readily available to public scrutiny, which can be problematic when it comes to sensitive matters such as executive salaries. Additionally, since all donations made by benefactors are considered gifts, donors expect financial reports detailing how funds were allocated towards achieving stated objectives, and any discrepancies could damage public trust significantly. Lastly, while 501(c)(3) organizations can make payments to executives in line with industry standards, they must keep salaries well within those parameters, as any disproportionate private gain available would put their tax exemption in jeopardy. As such, it is important for Boards to take extra care when making decisions regarding compensation matters at all levels, ensuring that transactions remain clearly documented and valid under nonprofit regulations. Overall, while having 501(c)(3) status provides numerous financial advantages that are essential for sustainable growth and success, there are also several cons associated with it. Specifically, there are restrictions around political activities as well as considerable costs involved, both at the initial setup phase and afterward during follow up reporting requirements set forth by the IRS. Obtaining 501(c)(3) status is essential for organizations seeking tax-exempt status in the United States. This process can be a lengthy one and requires certain documents to be filed and fees paid. However, completing all steps properly ensures that your organization will enjoy the numerous financial benefits associated with this designation. Here are the necessary steps: Depending on the size of your organization, you may need to fill out either Form 1023 or Form 1023-EZ, which serve as applications for recognition of exemption from federal income taxation. This form must include detailed information about the organization, such as its history, mission statement, finances, sources of income, and more. Articles of Organization are legal documents that state the purpose for which the organization was created, how operations will be managed, who should receive assets upon dissolution, etc. These must be drafted by qualified attorneys and registered with applicable state authorities. All forms must include applicable filing fees depending on the size and type of organization applying for 501(c)(3) status. For example, filing Form 1023 comes at a $600 fee, whereas completing a smaller version only costs $275. It is important to check current rates before paying as they can change over time. Lastly, once all documents have been prepared and fees have been paid, they can then be filed with the Internal Revenue Service (IRS). After submitting materials, it can take anywhere from three months up to a year before notification of approval or denial is received, making it important to start the application process as soon as possible if aiming towards achieving this status within a reasonable timeline. Having 501(c)(3) status is an important designation for organizations seeking exemption from federal income tax. However, it is not a one-time approval and must be maintained through ongoing compliance with applicable regulations. Here are some of the key elements that organizations need to adhere to in order to remain qualified for this status: All information regarding operations, finances, and taxes must be reported annually via Form 990, which is due each year on the 15th day of the 5th month following the end of the organization's taxable year. Failing to file can lead to penalties as well as potential loss of exempt status, so it is important that all reports are filed regularly and in a timely fashion. Nonprofit corporations that have obtained 501(c)(3) status are required by law to refrain from lobbying activities or any endorsements of any specific political party or candidate. While exceptions exist allowing organizations to engage in certain voter education programs, promoting or opposing any particular legislation would result in severe financial penalties, including revocation of tax-exempt status. Organizations should maintain all records related to finances so that they can be subject to audit if necessary. This includes documenting donations received, expenditures made, revenue generated through fundraisers, etc. Meeting these requirements helps ensure that resources allocated towards achieving stated goals were indeed spent according to applicable rules and regulations, thus minimizing the risk of any discrepancies resulting in unwanted attention from IRS auditors. In summary, having a 501(c)(3) designation is essential for running effective nonprofit operations. It is crucial to note, however, that maintaining this status requires meeting various criteria, including filing annual reports, adhering to lobbying restrictions, as well as keeping up financial documents accurately. Following these guidelines will ensure that your organization can continue taking advantage of associated benefits without interruption. 501(c)(3) status is an important designation for organizations looking for tax-exempt status and access to certain charitable benefits. This designation has the purpose to help organizations improve their outreach and services, as well as increase public trust. While it offers many advantages like exemption from federal income taxes and potential eligibility for grant opportunities, there are also some drawbacks such as a complex application process and adherence to specific rules in order to maintain the status. Organizations considering applying should ensure that they understand all requirements prior to taking any action.501(c)(3) Status

Purpose of 501(c)(3) Status

Types of Organizations With 501(c)(3) Status

Public Charity

Private Foundation

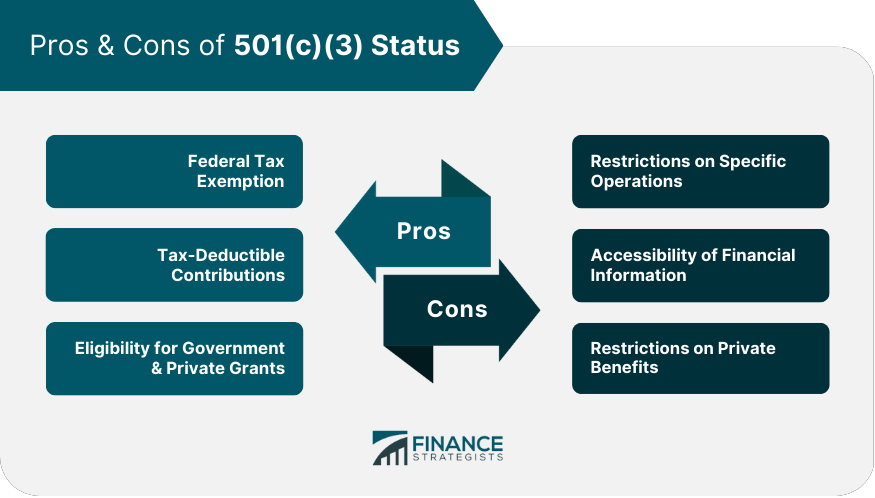

Pros of 501(c)(3) Status

Federal Tax Exemption

Tax-Deductible Contributions

Eligibility for Government & Private Grants

Cons of 501(c)(3) Status

Restrictions on Specific Operations

Accessibility of Financial Information

Restrictions on Private Benefits

How to Apply for 501(c)(3) Status

File Form 1023 or 1023-EZ

Prepare the Articles of Organization

Pay Filing Fee

Submit Documents to the IRS

Ongoing Compliance to Retain 501(c)(3) Status

File Annual Reports

Comply with Lobbying Restrictions

Maintain Financial Records

Final Thoughts

IRS 501(c)(3) Status Requirements FAQs

501(c)(3) status is an IRS designation assigned to organizations that are exempt from federal income taxation, which can be achieved through submitting an application and receiving approval from the IRS.

The purpose of 501(c)(3) status is to ensure that charities and certain other qualifying non-profit organizations are able to operate in the United States while enjoying certain tax benefits and increased public confidence.

Advantages include exemption from federal income taxes, eligibility for grant opportunities, access to tax-deductible donations, and potential recognition as a public charity by the IRS. Disadvantages include complex paperwork requirements, monitoring of lobbying activities, and restrictions on the political activities of employees and directors.

To apply for 501(c)(3) status, you must submit Form 1023 or Form 1023-EZ along with any required attachments such as Articles of Incorporation or bylaws to the IRS for approval, together with a filing fee.

Yes, if your organization does not meet its obligations under this designation, then it may be revoked or suspended by the IRS after due process has been followed in accordance with their requirements for compliance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.