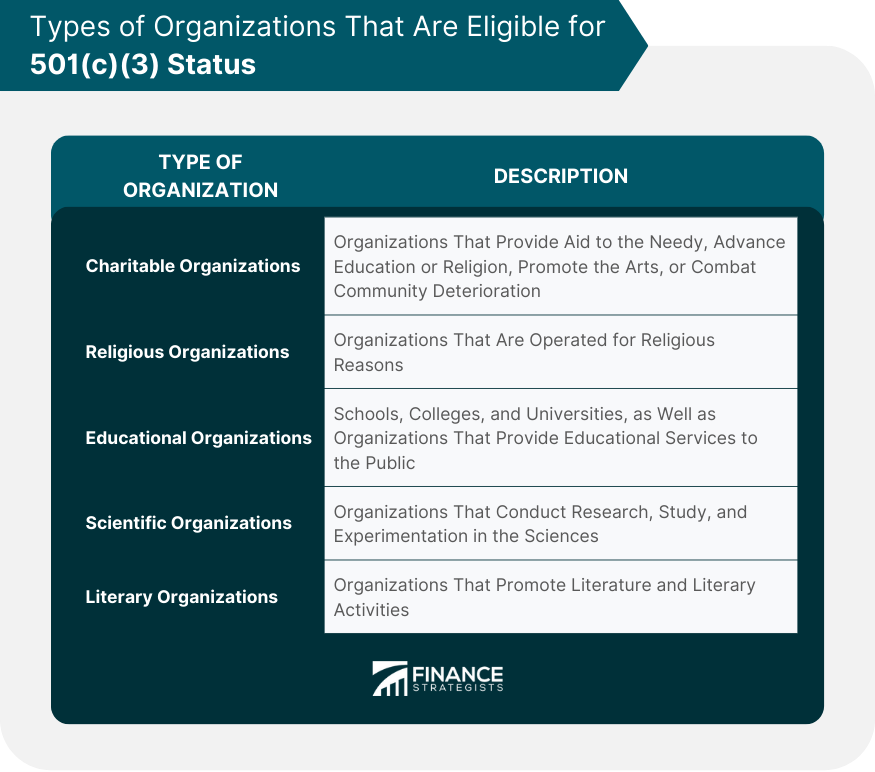

501(c)(3) nonprofit status is an important designation for organizations that are dedicated to charitable purposes. The designation grants organizations certain tax exemptions and benefits, as well as the ability to receive tax-deductible contributions from donors. However, the process of obtaining 501(c)(3) status can be complex and time-consuming. The process of obtaining 501(c)(3) status can be complex and time-consuming. Organizations seeking 501(c)(3) status must complete and file either Form 1023 or Form 1023-EZ with the IRS. Form 1023 is a longer and more comprehensive application that requires extensive information about the organization's structure, activities, and governance. Form 1023-EZ, on the other hand, is a streamlined application that is available to smaller organizations with less than $50,000 in gross receipts and assets. Both forms require organizations to provide detailed information about their mission, activities, and governance structure. Specifically, organizations must provide information about their board of directors, officers, and key employees, as well as their organizational structure, fundraising activities, and finances. Supporting documents, such as articles of incorporation and bylaws, must also be included with the application. The application process can be lengthy and may take several months to complete. Organizations should be prepared to devote significant time and resources to the application process and should seek professional assistance if necessary. An organization must be organized and operated exclusively for charitable, religious, educational, scientific, or literary purposes. Additionally, the organization must not engage in activities that are prohibited by the IRS, such as political campaigning or lobbying, and must not benefit any individual or private shareholder. There are several types of organizations that are eligible for 501(c)(3) status, including charitable organizations, religious organizations, educational organizations, scientific organizations, and literary organizations. Charitable organizations include those that provide aid to the needy, advance education or religion, promote the arts, or combat community deterioration. Religious organizations must have religious purposes and be organized and operated for religious reasons. Educational organizations include schools, colleges, and universities, as well as organizations that provide educational services to the public. Scientific organizations conduct research, study, and experimentation in the sciences, and literary organizations promote literature and literary activities. In addition to the above requirements, organizations seeking 501(c)(3) status must meet certain restrictions on activities and income. Specifically, organizations must not engage in any activities that are deemed illegal or contrary to public policy, and must not operate for the primary purpose of generating profit. Additionally, 501(c)(3) organizations are restricted in the amount of unrelated business income they can generate. Any income generated from activities unrelated to the organization's tax-exempt purpose may be subject to Unrelated Business Income Tax (UBIT). The most important requirement for 501(c)(3) status, however, is the charitable purpose requirement. Organizations seeking 501(c)(3) status must have a charitable purpose that is beneficial to the public, rather than a private interest. This requirement is critical, as it ensures that organizations seeking tax-exempt status are genuinely focused on public benefit. 501(c)(3) organizations are eligible for several tax exemptions and benefits. The most significant of these is an exemption from federal income tax. Once an organization has been granted 501(c)(3) status, it is generally exempt from paying federal income tax on its income, including donations, grants, and other sources of revenue. Additionally, 501(c)(3) organizations may be eligible for state and local tax exemptions, including property tax and sales tax exemptions. Another significant benefit of 501(c)(3) status is the ability to receive tax-deductible contributions from donors. Donors who contribute to 501(c)(3) organizations are generally able to deduct their contributions from their federal income taxes. This can be a powerful incentive for donors and can help organizations to raise significant amounts of money. However, with these tax exemptions and benefits come certain obligations. 501(c)(3) organizations must file annual returns with the IRS, known as Form 990, which provides detailed information about their activities and finances. These returns are available to the public and can be used to evaluate the organization's performance and financial health. Additionally, 501(c)(3) organizations must comply with certain rules regarding their lobbying and political activities. Specifically, they may not engage in partisan political campaigning and must limit their lobbying activities to a certain percentage of their total activities and expenditures. Maintaining 501(c)(3) status requires ongoing compliance with IRS regulations and rules. Specifically, organizations must maintain accurate and complete records of their activities and finances and must ensure that their activities remain consistent with their tax-exempt purposes. Organizations must also comply with restrictions on lobbying and political activities and must avoid engaging in any activities or transactions that could jeopardize their tax-exempt status. If an organization fails to comply with these requirements, its tax-exempt status may be revoked. In some cases, an organization may be able to have its status reinstated if it can demonstrate that it has corrected the issues that led to its revocation. However, reinstatement can be a complex and time-consuming process, and it is generally best to avoid losing tax-exempt status in the first place. 501(c)(3) nonprofit status is an important designation for organizations that are dedicated to charitable purposes. It provides tax exemptions and benefits, as well as the ability to receive tax-deductible contributions from donors. However, obtaining and maintaining 501(c)(3) status can be complex and time-consuming. Organizations seeking 501(c)(3) status should be prepared to devote significant time and resources to the application process and should seek professional assistance if necessary. Additionally, organizations must comply with IRS regulations and rules to maintain their tax-exempt status. With careful attention to these requirements, 501(c)(3) organizations can continue to make a significant impact in their communities and beyond.What Is a 501(c)(3) Nonprofit Status?

How Do You Get a 501(c)(3) Nonprofit Status?

Eligibility Criteria for 501(c)(3) Status

501(c)(3) Tax Exemptions and Obligations

Maintaining 501(c)(3) Status

Conclusion

How Do You Get a 501(c)(3) Nonprofit Status? FAQs

501(c)(3) organizations are nonprofit organizations that are exempt from federal income tax and are eligible to receive tax-deductible contributions. 501(c)(4) organizations, on the other hand, are social welfare organizations that are also exempt from federal income tax but are not eligible to receive tax-deductible contributions. Additionally, 501(c)(4) organizations are allowed to engage in political campaigning and lobbying activities, while 501(c)(3) organizations are restricted in these activities.

The processing time for 501(c)(3) applications can vary, but it typically takes several months to receive a determination from the IRS. Larger organizations or those with more complex activities may take longer to process. It is important to carefully review the application and ensure that all required information and supporting documents are included to avoid unnecessary delays.

Yes, but there are restrictions on the number of lobbying activities that a 501(c)(3) organization can engage in. Specifically, lobbying activities cannot be a substantial part of the organization's activities or expenditures. 501(c)(3) organizations must also file a form 990 with the IRS, which includes information on their lobbying activities.

Yes, 501(c)(3) organizations can receive grants from the government, but the grants must be used for charitable purposes. Additionally, the organization must comply with any requirements or restrictions associated with the grant.

No, only nonprofit organizations can apply for 501(c)(3) status. For-profit businesses may be eligible for other types of tax exemptions or designations, depending on their activities and purpose.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.