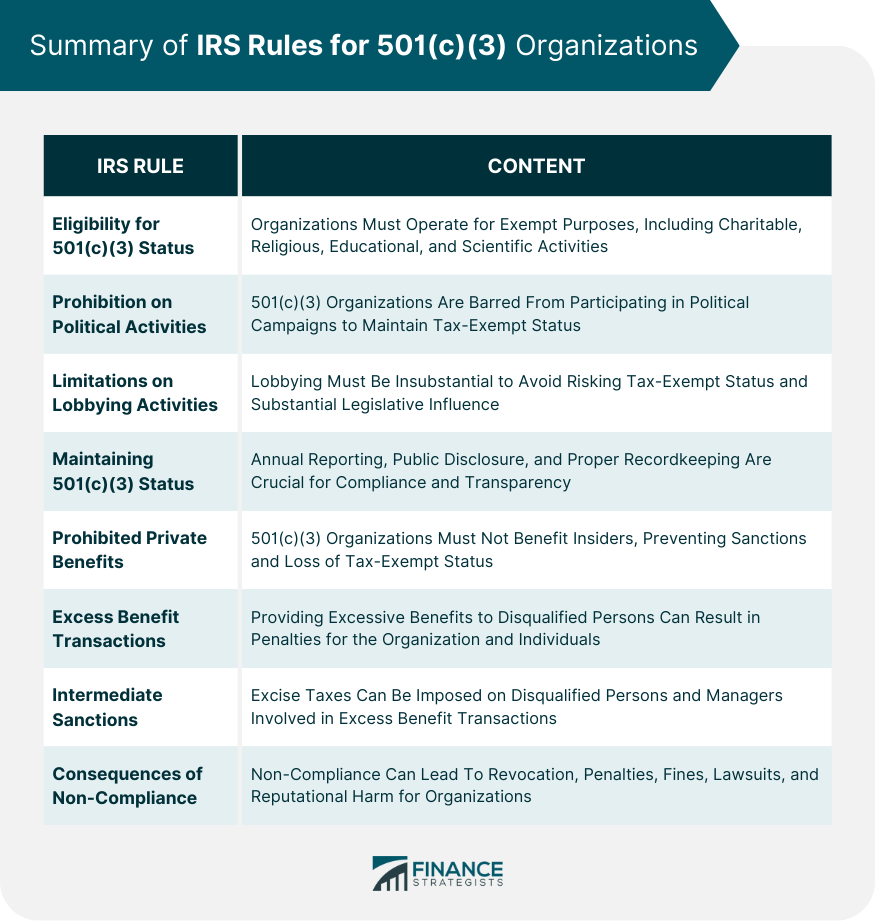

The Internal Revenue Service (IRS) rules for 501(c)(3) organizations refer to the set of regulations and guidelines that govern the operations of tax-exempt entities, often known as charitable organizations. These regulations are codified under section 501(c)(3) of the Internal Revenue Code and include requirements for obtaining and maintaining tax-exempt status. 501(c)(3) organizations include a wide array of entities such as charitable, religious, educational, scientific, and literary organizations, as well as those focused on testing for public safety. Additionally, they include fostering national or international amateur sports competition, and preventing cruelty to children or animals. The IRS rules for 501(c)(3) organizations cover several aspects, including the criteria for achieving tax-exempt status, the application process, ongoing compliance requirements, and consequences for non-compliance. The rules outline specific eligibility criteria, such as the need to operate for a specific exempt purpose, and restrictions on political and lobbying activities. Additionally, these rules also stipulate annual reporting requirements, public disclosure obligations, and restrictions on benefits to insiders or private individuals, among others. Compliance with these rules is essential for 501(c)(3) organizations to maintain their tax-exempt status. The IRS has a laundry list of rules for the operation of 501(c)(3)s, but some of the most important are: Must be run as a nonprofit At least one third of income must come from public donations (for public charities) Must not engage in lobbying or political activity To be eligible for 501(c)(3) status, organizations must be established and operated for one or more exempt purposes as outlined by the IRS. These include charitable, religious, educational, scientific, literary, fostering national or international amateur sports competition, and preventing cruelty to children or animals. The term "charitable" is used in its generally accepted legal sense and includes relief of the poor, the distressed, or the underprivileged, advancement of religion or education. These also include the lessening of neighborhood tensions, eliminating prejudice and discrimination; and defending human and civil rights. A fundamental requirement for 501(c)(3) organizations is the prohibition on political campaign activities. These organizations are barred from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office. Violating this prohibition may result in denial or revocation of tax-exempt status and the imposition of certain excise taxes. While 501(c)(3) organizations are allowed to engage in some lobbying activities or advocate for legislative changes, these activities must be an insubstantial part of their overall activities. If a substantial part of an organization's activities involves attempting to influence legislation, the organization may risk losing its tax-exempt status. Most 501(c)(3) organizations are required to file an annual information return or notice with the IRS. The form to be filed typically depends on the organization's gross receipts and assets. Filing the appropriate form in a timely and accurate manner is essential to maintain tax-exempt status. The IRS rules also stipulate that 501(c)(3) organizations must make their approved application for recognition of exemption, their annual returns for the past three years, and any supporting documents available for public inspection. This requirement ensures transparency and accountability in the organization's operations. Maintaining proper books and records is vital for 501(c)(3) organizations. These records must be available for inspection by the IRS, and they must demonstrate the organization's compliance with tax rules and its progress in achieving its mission. Adequate records can also assist in preparing accurate financial statements and annual returns. Under IRS rules, 501(c)(3) organizations are prohibited from allowing their income or assets to benefit insiders. Insiders refer to persons who have a personal or private interest in the activities of the organization, such as officers, directors, or key employees. Excessive benefits to insiders can result in sanctions and loss of tax-exempt status. Excess benefit transactions occur when an economic benefit provided by the organization to a disqualified person exceeds the value of the consideration received by the organization. Disqualified persons include those with substantial influence over the organization, such as founders, board members, and family members of such individuals. Penalties for excess benefit transactions can be severe, affecting both the organization and the disqualified person. The IRS can impose intermediate sanctions, which are excise taxes, on disqualified persons who benefit from excess benefit transactions, and organization managers who approve such transactions. These sanctions provide a measure of accountability without revoking the organization's tax-exempt status. Non-compliance with IRS rules can lead to severe consequences for 501(c)(3) organizations, including the revocation of tax-exempt status. This revocation could mean the organization becomes liable for federal income tax and may have to pay a tax on the net income of the business. In addition to revocation, organizations may face penalties and fines for non-compliance. Penalties can be levied for failure to file returns or provide public disclosures, engage in prohibited activities, or for excess benefit transactions, among others. Besides financial penalties, non-compliance can lead to legal consequences. For instance, if an organization loses its tax-exempt status, it could face lawsuits from donors who contributed on a tax-exempt basis. The organization's reputation may also suffer, affecting future fundraising and membership efforts. The IRS rules for 501(c)(3) organizations cover various aspects, including eligibility criteria, application processes, ongoing compliance requirements, and potential consequences of non-compliance. To achieve and maintain tax-exempt status, organizations must operate for exempt purposes, such as charitable, religious, educational, or scientific activities. They must refrain from engaging in political campaign activities and limit lobbying activities. Compliance entails meeting annual reporting requirements, disclosing information to the public, and maintaining proper records. Non-compliance can result in revocation of tax-exempt status, imposing federal income tax liabilities, and subjecting organizations to penalties and fines. Moreover, legal consequences, such as lawsuits and reputational damage, may arise. It is vital for 501(c)(3) organizations to adhere to the IRS rules to fulfill their mission effectively.What Are IRS Rules for 501(c)(3) Organizations?

What Do the IRS Rules for 501(c)(3) Cover?

501(c)(3) IRS Rules Made Easy

Eligibility for 501(c)(3) Status

Requirements for Charitable Purposes

Prohibition on Political Activities

Limitations on Lobbying Activities

Maintaining 501(c)(3) Status

Annual Reporting Requirements

Public Disclosure Obligations

Recordkeeping and Documentation

Compliance With IRS Rules

Prohibited Private Benefits

Excess Benefit Transactions

Intermediate Sanctions

Consequences of Non-Compliance

Revocation of Tax-Exempt Status

Penalties and Fines

Potential Legal Consequences

Conclusion

IRS Rules for 501(c)(3) FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

The biggest requirement for maintaining 501(c)(3) status is to always be run and perate as a nonprofit and to not engage in political lobying or activity.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) is the internal revenue code (IRC) section for organizations with tax exempt status. 501(c)(3) falls under internal revenue code 501(c).

To apply for 501(c)(3) status, an organization must submit Form 1023 or the shorter Form 1024. Additionally, an application fee of $850 must be paid by the organization.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.