Animal rescue organizations, so long as they are non-political and run solely for charitable purposes, qualify for 501(c)(3) status under the IRC code. Being a 501(c)(3) means that they qualify for tax exempt status. However, being a 501(c) defines taxability, not reputability; make sure to do appropriate research if you are looking to adopt. A 501(c)(3) animal rescue refers to a charitable entity dedicated to the welfare and safety of animals. Recognized by the Internal Revenue Service (IRS), these entities are granted tax-exempt status under the 501(c)(3) section of the United States Internal Revenue Code. Their purpose is intrinsically tied to the promotion of animal welfare, ranging from the rescue and rehabilitation of abused or neglected animals to advocacy work for animal rights. Moreover, a 501(c)(3) animal rescue doesn't merely operate in a vacuum. It leverages a network of volunteers, foster homes, local veterinarians, and donors to fulfill its mission. Some specialize in particular species or breeds, while others accept all sorts of animals in need. The primary consideration for acquiring 501(c)(3) status is an explicit commitment to animal welfare and rescue. The organization must clearly articulate this in its mission and demonstrate it in action. It can range from rescuing abandoned or abused animals, providing necessary veterinary care, rehabilitation, spaying/neutering, to facilitating successful adoptions into loving homes. A 501(c)(3) animal rescue isn't a profit-oriented venture but a vehicle for compassionate service. It's not uncommon for these entities to collaborate with other community organizations or government agencies to respond to cases of animal neglect, hoarding, or abuse, emphasizing the necessity for such organizations within society. As the very nature of a non-profit implies, a 501(c)(3) animal rescue must operate for the public benefit. This means the organization's activities should serve a broad segment of the community, such as improving community health through spay/neuter programs to control animal population or educating the public about responsible pet ownership. Animal rescues frequently contribute to public safety by helping control stray animal populations and addressing situations of animal neglect or abuse. Their work often extends beyond animal welfare, intersecting with social issues and contributing to broader community wellbeing. Community engagement is a crucial aspect of 501(c)(3) status. An animal rescue organization must actively seek to involve the public in its activities, whether through volunteer opportunities, educational programs, or outreach events. This active participation helps raise awareness about the organization's mission and promotes a culture of compassion and respect for animal life. Animal rescue organizations often lean heavily on their communities for support. They host events to raise funds, mobilize volunteers for rescue missions and care activities, and work closely with local businesses for sponsorships or partnerships. This engagement creates a sense of shared responsibility and collective action towards animal welfare. 501(c)(3) animal rescue organizations enjoy several benefits, one of the most significant being tax-exempt status. This means that these organizations are exempt from paying federal income tax on funds received in support of their charitable mission. Not only does this preserve more resources for the organization's core work, but it also offers tax benefits to donors. Donors to 501(c)(3) organizations can deduct their contributions from their taxable income, encouraging more generous giving. This unique advantage facilitates the flow of resources and support to the organization, directly contributing to their rescue and advocacy efforts. Another key advantage of the 501(c)(3) status is access to a wider range of funding opportunities. Many grant-making bodies and foundations specifically target registered non-profit organizations for their programs. This can open up significant sources of funding, which may not be accessible to organizations without this status. These grant opportunities can make a huge difference in an animal rescue organization's capacity to serve. Whether it's funding for a new animal shelter, a spay/neuter program, or an educational initiative, this increased access to resources can significantly enhance an organization's reach and impact. Having a 501(c)(3) status also bolsters an organization's credibility and fosters public trust. It signals that the organization operates transparently, is regulated by the IRS, and uses its funds for public benefit. This enhanced reputation can make it easier to attract donors, volunteers, and partners to the organization's cause. Moreover, the rigorous reporting and compliance requirements associated with the 501(c)(3) status ensure that these organizations maintain high standards of financial and operational integrity. This visibility fosters trust, which is critical to sustaining long-term support and community engagement. A healthy mix of revenue sources is vital to the sustainability of 501(c)(3) animal rescue organizations. Traditional fundraising events, individual donations, corporate sponsorships, grants, and in-kind donations are common revenue streams. Some organizations also generate income through adoption fees, although these typically cover only a fraction of the costs associated with rescue and care. Moreover, many organizations tap into the power of digital platforms to reach a broader donor base. Online giving campaigns, social media fundraisers, and crowdfunding can be effective tools for raising funds. It's essential, however, for organizations to be transparent about the use of these funds to maintain donor trust and engagement. Effective budgeting and financial management are crucial to the success of any non-profit organization. These aspects are even more critical for 501(c)(3) animal rescue organizations, given the unpredictable nature of rescue work. Unforeseen rescue missions, medical emergencies, and changing needs of animals in care can result in significant and unexpected expenses. Having a robust financial management system helps ensure resources are used efficiently, and the organization's operations are sustainable. Regular budget reviews, financial reporting, and strategic planning should be integral components of the organization's operations. This not only promotes financial stability but also reinforces accountability and transparency. Maintaining 501(c)(3) status requires strict adherence to reporting and compliance standards set by the IRS. Organizations are required to file annual information returns detailing their income, expenses, and activities. Failure to meet these reporting requirements can result in penalties and potentially jeopardize the organization's tax-exempt status. Compliance also extends to the use of funds. Money raised must be used for the organization's stated charitable purpose. Regular audits can ensure that funds are being used appropriately and provide an opportunity to identify and address any potential issues. Compliance isn't merely a legal obligation; it's a commitment to donors, volunteers, and the community that the organization operates responsibly and in service of its mission. Individual giving campaigns remain a staple for many 501(c)(3) animal rescue organizations. These can range from annual giving drives, monthly donor programs, to targeted fundraising for specific needs such as a medical fund or shelter expansion. By connecting donors directly with the impact of their gifts, organizations can foster deeper engagement and encourage more substantial giving. Creative storytelling is at the heart of successful giving campaigns. By sharing compelling stories of rescue, recovery, and adoption, organizations can touch hearts and open wallets. A mix of traditional and digital communication channels can help reach different segments of donors, maximizing the campaign's reach and impact. Corporate partnerships and sponsorships can bring additional resources and visibility to animal rescue organizations. Companies can offer financial support, in-kind donations, or even encourage employee volunteerism. These partnerships can be mutually beneficial, aligning the company with a charitable cause, enhancing their corporate image, while providing vital support to the rescue organization. Understanding a company's corporate social responsibility objectives and tailoring a partnership proposal to align with these can enhance the chances of securing a partnership. Such relationships can offer a sustainable source of support and open doors to new networks and opportunities. Finally, grant writing and foundation funding can provide significant financial support to 501(c)(3) animal rescue organizations. Grants from foundations, government agencies, and even corporations can fund specific projects, ongoing operations, or capacity-building efforts. However, grant writing is a skill that requires careful research, clear writing, and strategic alignment with the grantmaker's priorities. Many organizations choose to invest in professional grant writing support to increase their chances of success. While the process can be time-consuming and competitive, securing a grant can provide substantial resources, enabling the organization to expand its services and deepen its impact. Animal rescue organization is a non-profit entity dedicated to promoting animal welfare and rescue. These organizations operate under the tax-exempt status granted by the Internal Revenue Service (IRS) under section 501(c)(3). By fulfilling the requirements for tax-exempt status, animal rescue organizations can enjoy several benefits. Firstly, they are exempt from federal income tax, allowing them to allocate more resources towards their charitable mission. Additionally, being a 501(c)(3) organization enhances their credibility and fosters public trust, attracting donors, volunteers, and partners. Diversifying revenue sources, effective budgeting, and financial management, as well as maintaining compliance with reporting standards, are crucial aspects to ensure the organization's long-term success. 501(c)(3) Animal Rescue Definition

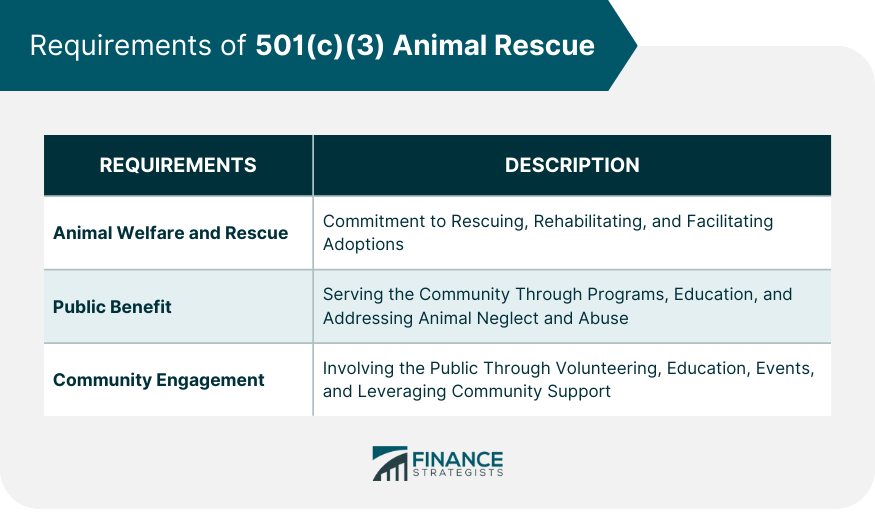

Requirements of 501(c)(3) Animal Rescue

Focus on Animal Welfare and Rescue

Public Benefit

Community Engagement

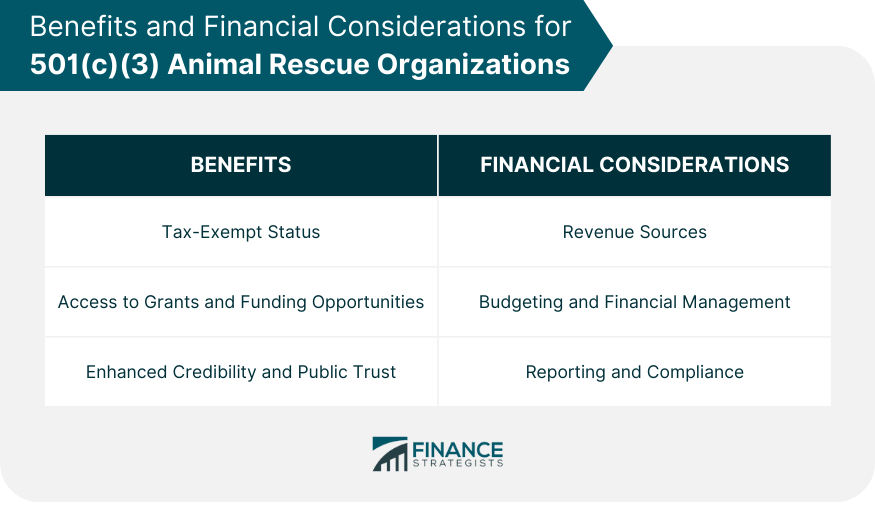

Benefits of 501(c)(3) Status for Animal Rescue Organizations

Tax-Exempt Status

Access to Grants and Funding Opportunities

Enhanced Credibility and Public Trust

Financial Considerations for 501(c)(3) Animal Rescue Organizations

Revenue Sources

Budgeting and Financial Management

Reporting and Compliance

Fundraising Strategies for 501(c)(3) Animal Rescue Organizations

Individual Giving Campaigns

Corporate Partnerships and Sponsorships

Grant Writing and Foundation Funding

Final Thoughts

501(c)(3) Animal Rescue FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

Animal rescue organizations, so long as they are non-political and run solely for charitable purposes, qualify for 501(c)(3) status under the IRC code. Being a 501(c)(3) means that they qualify for tax exempt status.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) organizations are typically focused on rescuing cats, dogs, and other companion animals. However, some organizations may have the resources to provide rescue services for other types of animals as well.

To apply for 501(c)(3) tax-exempt status, you will need to complete IRS Form 1023 and submit it to the IRS along with a $600 application fee.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.