The Projected Benefit Obligation (PBO) represents a crucial financial metric, especially for companies that offer pension plans to their employees. PBO, in simple terms, is an actuarial measurement that calculates the present value of future pension liabilities. It provides an estimate of the amount a company would need at the present time to cover future pension commitments. The PBO assumes a pivotal role in financial planning as it offers an understanding of the company's future financial responsibilities. It aids corporations in planning their capital allocation and helps maintain a balance between current operational needs and future pension obligations. Furthermore, it allows investors and stakeholders to assess a company's long-term financial health, especially when comparing PBO with the assets held in the pension plan. Actuarial measurements are statistical calculations used to evaluate financial risks and uncertainties, typically involving future events or conditions. In the context of PBO, actuaries use data like employee lifespan, retirement age, compensation, and interest rates to predict the company's future pension liabilities. Pension liabilities refer to the obligations a company has to its employees in terms of pension payments. These payments are usually determined by factors such as the employee's salary, years of service, and the terms of the pension plan. Pension liabilities can be a significant part of a company's financial obligations, especially for large companies with a substantial workforce. Underfunded pension plans occur when the total value of the plan's assets is less than the PBO. This situation indicates that the company lacks sufficient resources to meet its future pension obligations, posing potential risks to both the company and its employees. Actuaries play a crucial role in the calculation of PBO. Using their knowledge of statistics, finance, and business, actuaries predict the company's future pension obligations. This prediction is based on several factors, including the number of employees, their average age, the average number of years until retirement, expected salary increases, and expected return on pension plan assets. The PBO calculation considers several factors, including current employee salaries, expected salary increases, employee turnover rate, retirement age, life expectancy, and the expected return on plan assets. It also factors in specific features of the pension plan, such as early retirement provisions or cost-of-living adjustments. The PBO is adjusted to reflect anticipated future compensation increases. Actuaries use historical data and trends to estimate future salary increases and incorporate these projections into the PBO calculation. This process ensures that the PBO remains a realistic estimate of the company's future pension liabilities. A fundamental assumption behind the PBO calculation is that the pension plan will continue indefinitely. This assumption means that the company expects to continue operating and providing pensions for its employees for the foreseeable future. This ongoing nature assumption is critical as the discontinuation of the pension plan could significantly alter the PBO. Another key assumption is the projection of future salaries and compensation. Actuaries assume that salaries will increase over time, reflecting inflation, promotions, and cost-of-living adjustments. These projections help ensure that the PBO provides an accurate representation of future pension liabilities. Finally, the PBO calculation also considers the impact of inflation and interest rates. Inflation affects the purchasing power of future pension payments, which is factored into the calculation of PBO. Similarly, the discount rate, often based on current interest rates, is used to calculate the present value of future obligations. Both these factors play a pivotal role in determining the accuracy of the PBO. Despite its importance, PBO calculation isn't without its critics. The primary criticism is that it relies heavily on assumptions such as future salary increases, employee turnover, retirement age, and life expectancy, which may not always prove accurate. Changes in these factors can lead to significant differences between the projected and actual pension obligations. PBO calculations also assume that the company and its pension plan will continue indefinitely. However, changing business environments, economic downturns, or company-specific issues can disrupt this assumption. If a company were to go bankrupt, for instance, it might not be able to fulfill its pension obligations, leading to a discrepancy between the PBO and the actual payments made. Projected Benefit Obligation (PBO) is a crucial financial concept, providing an estimate of a company's current obligations to cover future pension liabilities. It involves key concepts such as actuarial measurements, pension liabilities, and the notion of underfunded pension plans. PBO calculation, guided by numerous assumptions like ongoing pension plans, future salary hikes, and impacts of inflation and interest rates, plays a pivotal role in pension plan assessment. The importance of understanding PBO cannot be overstated, especially for companies and employees planning for retirement. It's a critical component of financial planning, helping companies balance their current operational needs with future pension obligations and assisting employees in understanding their retirement benefits. In the face of increasing complexity in retirement planning, it is advisable to seek professional retirement planning services. They can provide expert guidance on understanding PBO and other key financial metrics, helping you navigate the complexities of pension plans and secure a financially stable retirement.What Is Projected Benefit Obligation (PBO)?

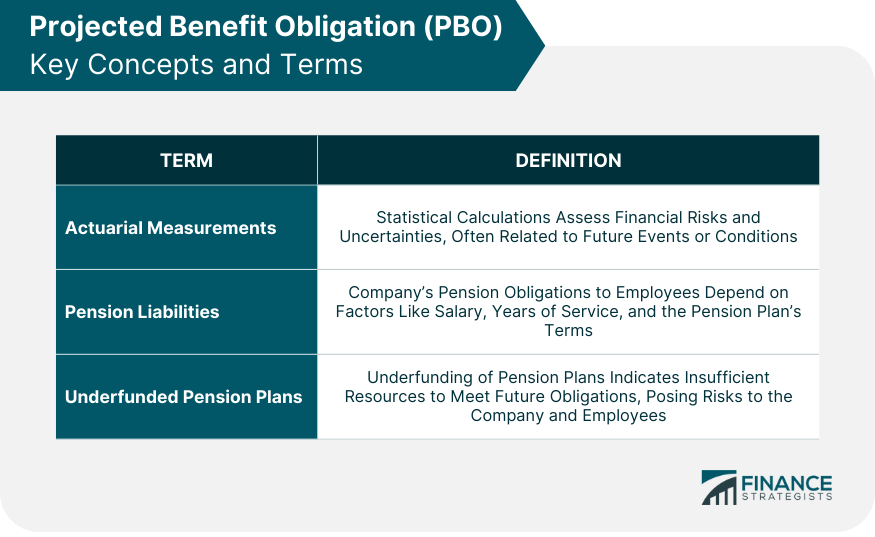

Key Concepts and Terms

Actuarial Measurements

Pension Liabilities

Underfunded Pension Plans

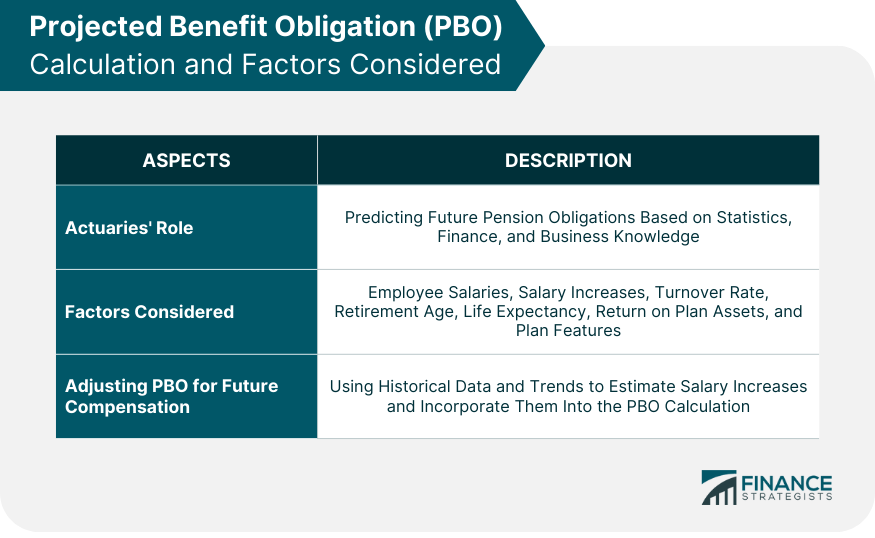

Calculation of PBO

Role of Actuaries in PBO Calculation

Factors Considered in PBO Calculation

Process of Adjusting PBO for Future Compensation

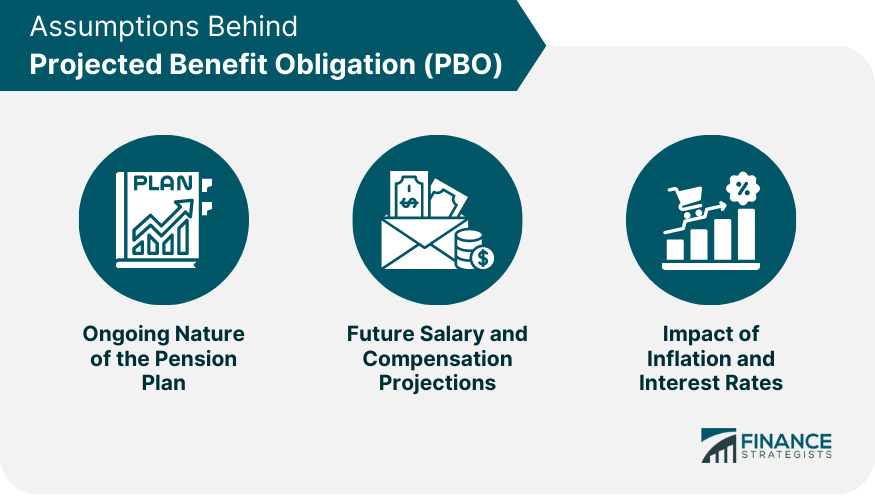

Assumptions Behind PBO

Ongoing Nature of the Pension Plan

Future Salary and Compensation Projections

Impact of Inflation and Interest Rates

Criticisms and Limitations of PBO

Potential Drawbacks and Inaccuracies in PBO Calculation

Impact of Changing Business Environments on PBO

Final Thoughts

Projected Benefit Obligation FAQs

A Projected Benefit Obligation (PBO) is an actuarial measurement that estimates the current amount a company needs to cover future pension liabilities. It's an essential tool for understanding a company's future financial responsibilities related to employee pension plans.

PBO is calculated by actuaries using several factors, including current employee salaries, expected salary increases, employee turnover rates, retirement age, life expectancy, and expected return on plan assets. It's then adjusted to account for expected future compensation increases.

The calculation of PBO assumes that the pension plan will continue indefinitely and that salaries will increase over time due to inflation, promotions, and cost-of-living adjustments. It also considers the impact of inflation and interest rates on future pension payments.

The PBO plays a crucial role in assessing the status of a pension plan. By comparing the PBO with the assets held in the pension plan, companies can determine if their pension plans are fully funded, underfunded, or overfunded. This assessment helps companies plan for their future financial obligations and ensures employees' retirement benefits are secure.

Changes in business environments can significantly impact the PBO. For instance, if a company goes bankrupt, it might not be able to fulfill its pension obligations, causing a discrepancy between the PBO and the actual payments made. Moreover, changing labor market trends and economic conditions can alter assumptions used in PBO calculation, affecting its accuracy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.