Excess aggregate contributions refer to contributions made to an employee's account in a 401(k) plan that exceed the allowable limits for certain types of contributions, specifically matching and after-tax contributions, under the Internal Revenue Code (IRC). They typically occur when a 401(k) plan fails the Actual Contribution Percentage (ACP) test, which is one of the nondiscrimination tests that 401(k) plans must perform annually. If a 401(k) plan fails the ACP test, the plan must take corrective action to bring the plan into compliance. One common corrective action is distributing the excess aggregate contributions and any associated earnings to the affected HCEs. These distributions must generally be made within 12 months after the end of the plan year in which the excess contributions occurred. It's important to note that excess aggregate contributions are taxable to the affected employees in the year in which they are distributed. Additionally, if the excess aggregate contributions are not corrected promptly, the plan may face penalties and potentially lose its tax-qualified status. Employee contributions play a significant role in retirement plans and include two primary types: Employees make these pre-tax contributions to retirement plans, such as 401(k) and 403(b) plans, directly from their paychecks. Employees can also make after-tax contributions to retirement plans, such as Roth 401(k) contributions, which grow tax-free. Employers often contribute to employees' retirement plans through: Employers match employee contributions up to a certain percentage of the employee's salary. Employers may contribute a percentage of company profits to employees' retirement plans, regardless of employee contributions. Several factors can impact aggregate contributions, including employee demographics, industry-specific considerations, and economic conditions. Excess Aggregate Contributions occur when employees and employers contribute more than the allowed annual limits to retirement plans. These limits are set by the Internal Revenue Service (IRS) and are updated periodically: The individual limit is the maximum amount an employee can contribute to their retirement plan each year. The combined limit is the maximum amount an employee and their employer can contribute to the employee's retirement plan each year. An HCE is an employee who earns significantly more than the average employee, as defined by the IRS. The IRS sets income thresholds to determine which employees qualify as HCEs. Retirement plans must undergo annual Actual Deferral Percentage (ADP) and ACP tests to ensure that they comply with federal regulations and that contributions from HCEs are proportionate to those of non-HCEs. These tests help prevent discrimination favoring HCEs and ensure that all employees have equitable access to retirement plan benefits. The ADP and ACP tests compare the average contribution percentages for HCEs and non-HCEs. Plans that fail these tests must take corrective actions to maintain their tax-qualified status. Excess Aggregate Contributions can have negative implications for both employees and employers. Employees may face additional taxes on excess contributions, which are not tax-deductible. Excess contributions must be distributed to affected employees, which could result in additional taxes or penalties. Employers may face penalties for failing to correct excess contributions in a timely manner. Managing excess contributions can be time-consuming and require additional resources for employers. To effectively address Excess Aggregate Contributions, employers can consider the following strategies: Employers can bypass ADP and ACP testing requirements by adopting a safe harbor 401(k) plan, provided they meet specific contribution and vesting requirements. Implementing automatic enrollment and escalation features can help increase participation and deferral rates among non-HCEs, potentially reducing the likelihood of excess contributions. Employers should educate employees about the importance of diversifying their savings strategies and considering alternative options, such as IRAs and taxable investment accounts. Informing employees about annual contribution limits and potential tax implications can help them make informed decisions and avoid excess contributions. Employers should perform regular testing and analysis to identify potential excess aggregate contributions and take corrective actions as needed. Hiring a third-party administrator can help employers manage retirement plans more efficiently, ensuring compliance with regulations and monitoring for excess contributions. Excess Aggregate Contributions play a significant role in the financial landscape, and understanding their components, consequences, and management strategies is essential for both employers and employees. Retirement plans comprise contributions from employees, through salary deferrals and after-tax contributions, as well as from employers, via matching and profit-sharing contributions. Identifying excess contributions involves understanding annual limits, HCE status, and ADP and ACP tests. Excess contributions can lead to negative tax implications and administrative burdens for both employees and employers. Employers can effectively manage these contributions by implementing plan design modifications, educating employees about savings strategies and limits, and engaging in regular monitoring and compliance efforts. By staying informed and adapting to evolving regulations, organizations can ensure compliance and provide equitable retirement benefits to all employees.What Are Excess Aggregate Contributions?

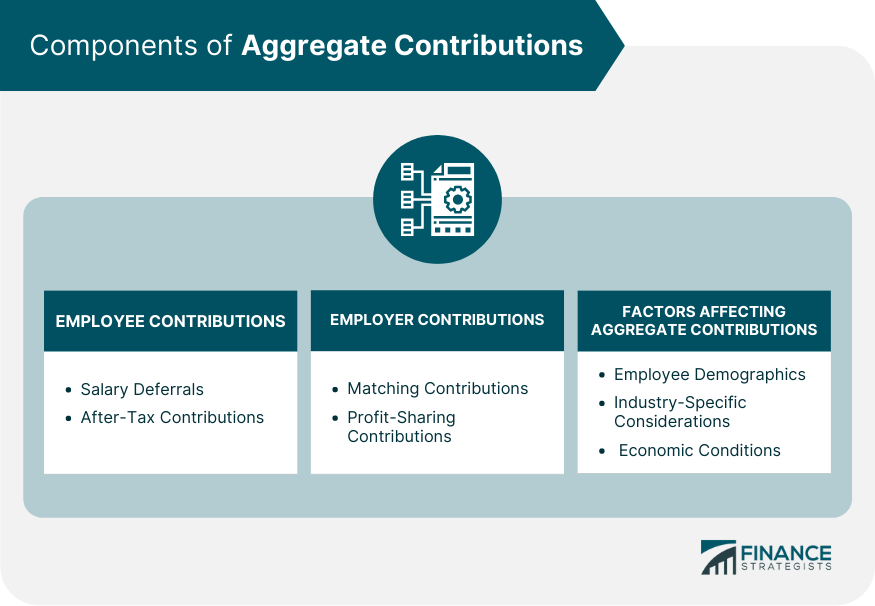

Components of Aggregate Contributions

Employee Contributions

Salary Deferrals

After-Tax Contributions

Employer Contributions

Matching Contributions

Profit-Sharing Contributions

Factors Affecting Aggregate Contributions

Identifying Excess Aggregate Contributions

Annual Contribution Limits

Individual Limits

Combined Limits for Employee and Employer Contributions

Highly Compensated Employee (HCE) Status

Definition

Income Thresholds

Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) Tests

Purpose

Test Methodology

Compliance Requirements

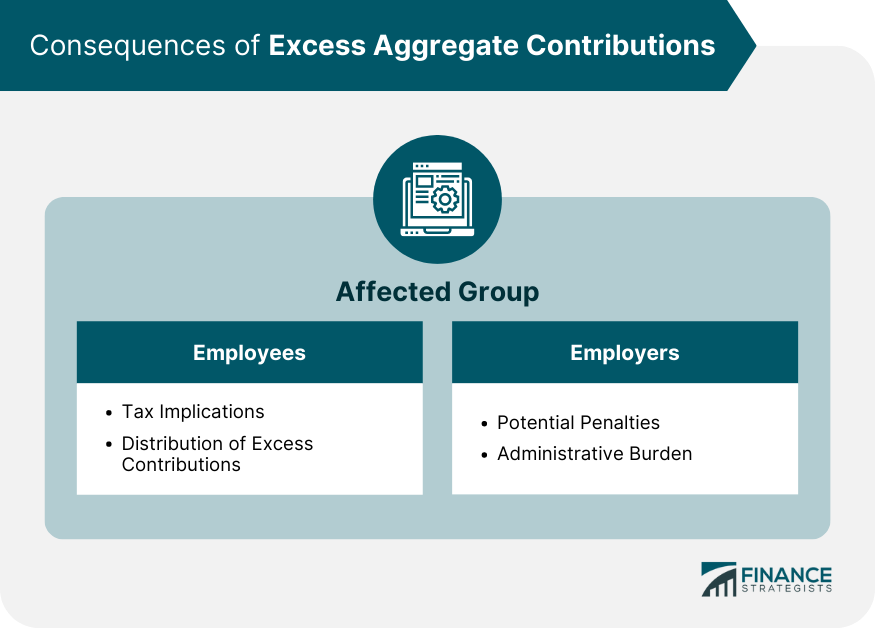

Consequences of Excess Aggregate Contributions

Impact on Employees

Tax Implications

Distribution of Excess Contributions

Impact on Employers

Potential Penalties

Administrative Burden

Strategies for Managing Excess Aggregate Contributions

Plan Design Modifications

Safe Harbor 401(k) Plans

Automatic Enrollment and Escalation Features

Employee Education and Communication

Importance of Diversifying Savings Strategies

Awareness of Contribution Limits and Potential Tax Implications

Monitoring and Compliance

Regular Testing and Analysis

Engaging Third-Party Administrators

Conclusion

Excess Aggregate Contributions FAQs

Excess aggregate contributions refer to the amount contributed to a retirement plan that exceeds the annual limits set by the Internal Revenue Service (IRS).

You can determine if you have made excess aggregate contributions by reviewing your annual contribution statement and comparing your contributions to the IRS limits.

You may be subject to additional taxes and penalties if you make excess aggregate contributions to your retirement plan. To avoid penalties, you must withdraw the excess contributions and any related earnings before the tax filing deadline.

Yes, excess aggregate contributions can be corrected by withdrawing the excess contributions and any related earnings before the tax filing deadline. You can also contact your plan administrator for assistance in correcting excess contributions.

To avoid making excess aggregate contributions, it's important to understand the annual contribution limits set by the IRS and monitor your contributions throughout the year. You can also work with a financial advisor or plan administrator to ensure you contribute within the limits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.