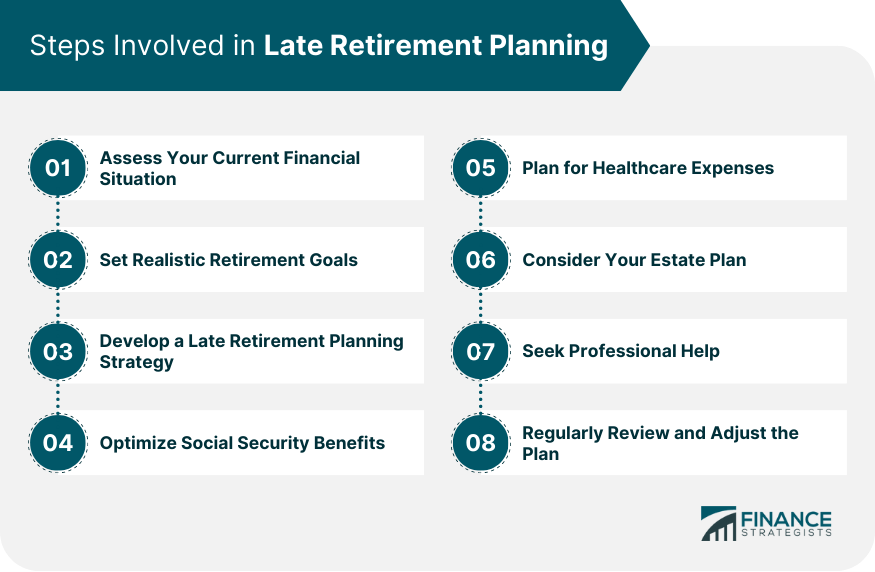

Late retirement planning refers to creating and implementing a retirement strategy later in life, often when an individual needs to prepare for retirement during their earlier years adequately. This process involves assessing one's current financial situation, setting realistic retirement goals, and developing tailored strategies to catch up on savings and investments to achieve a secure and comfortable retirement. Late retirement planning may present unique challenges due to the limited time available to accumulate sufficient retirement savings. However, individuals can still work towards a successful retirement with focused efforts, disciplined savings, and strategic financial management. Begin by creating a detailed list of your assets (e.g., savings accounts, investments, real estate) and liabilities (e.g., mortgage, credit card debt, student loans). This will provide you with a clear understanding of your current financial standing. Subtract your total liabilities from your total assets to calculate your net worth. This figure will serve as a starting point for your retirement planning and can help identify areas for improvement. Identify all sources of income, including salary, rental income, and investments. This will help you determine how much money is available for saving and investing toward retirement. Create a detailed budget, listing all expenses, including housing, food, transportation, insurance, and discretionary spending. This will help you identify areas where you can cut back and allocate more funds toward retirement savings. Analyze your net worth, income, and expenses to determine whether you're on track to meet your retirement goals. If you find shortfalls, identify opportunities for improvement, such as increasing savings, reducing expenses, or seeking additional income sources. Choose a target retirement age based on factors such as health, career satisfaction, and financial stability. Keep in mind that working longer can increase your retirement savings and Social Security benefits. Project your future living expenses, considering factors such as inflation and changes in lifestyle. Estimate retirement healthcare costs, including Medicare coverage, supplemental insurance, and out-of-pocket expenses. Factor in expenses related to travel, hobbies, and other leisure activities you plan to pursue during retirement. Define your desired retirement lifestyle, considering factors such as housing, location, and social activities. This will help you determine the amount of savings needed to support your desired lifestyle. Calculate the total amount of savings required to fund your retirement based on your projected expenses and desired lifestyle. Adjust your goals as needed based on your current financial situation. Focus on reducing high-interest debt, such as credit card balances, to free up funds for retirement savings and minimize interest expenses. Take advantage of employer-sponsored retirement plans by contributing the maximum amount allowed. Ensure you receive any available employer match, as this is essentially free money for your retirement. Maximize contributions to individual retirement accounts (IRAs), which offer tax advantages and allow your investments to grow tax-deferred or tax-free. Individuals age 50 and older can make catch-up contributions to retirement accounts, which allow for higher contribution limits and accelerated savings. Invest in real estate to diversify your investment portfolio and generate passive income through rental properties. Annuities can provide a guaranteed income stream during retirement, offering additional financial security. Invest in taxable brokerage accounts to access a wider range of investment options and potentially generate additional income. As you near retirement, consider adjusting your investment portfolio to reduce risk and preserve capital. This may involve shifting assets to more conservative investments, such as bonds or dividend-paying stocks. Establish an emergency fund to cover unexpected expenses like medical bills or home repairs. This will help protect your retirement savings and provide a financial safety net. Learn how Social Security benefits are calculated, considering your lifetime earnings, age at retirement, and claiming strategy. Evaluate the pros and cons of claiming Social Security benefits at different ages to determine the optimal time to receive payments. Explore various strategies to maximize Social Security benefits, such as delaying claims, coordinating spousal benefits, or utilizing survivor benefits. If you are married, coordinate with your spouse to maximize combined Social Security benefits and optimize retirement income. Project future healthcare expenses, taking into account factors such as inflation, medical advancements, and potential changes in Medicare coverage. Learn about Medicare coverage, eligibility requirements, and enrollment periods to ensure you receive the appropriate healthcare benefits during retirement. Consider purchasing supplemental insurance policies, such as Medigap or Medicare Advantage plans, to cover healthcare expenses not covered by Medicare. Evaluate the need for long-term care insurance, which can help cover the costs of nursing homes, assisted living facilities, or in-home care. Create a will or trust to ensure your assets are distributed according to your wishes upon your death, and to minimize potential tax liabilities for your heirs. Designate beneficiaries for your financial accounts, such as retirement plans and life insurance policies, to ensure a smooth transfer of assets upon your death. Select trusted individuals to serve as your power of attorney and healthcare proxy, granting them the authority to make financial and medical decisions on your behalf if you become incapacitated. Assess your life insurance needs to ensure your dependents are adequately protected in the event of your death. Determine when it's appropriate to seek professional advice, such as when you need assistance with complex financial planning strategies or require specialized expertise. Research and interview potential financial planners or advisors to find a professional who aligns with your goals, values, and financial situation. Be aware of the fees and costs associated with financial advice, and weigh the potential benefits against the expense. Work with other professionals, such as tax advisors and attorneys, to ensure a comprehensive approach to your late retirement planning strategy. Periodically assess your progress towards your retirement goals and adjust as necessary to stay on track. Update your retirement plan as your life circumstances change, such as career advancements, family dynamics, or health issues. Keep current on tax laws and regulations impacting your retirement planning strategy and adjust accordingly. Remain disciplined in your savings and investment strategies, and maintain a long-term focus to help ensure a successful and secure retirement. Late retirement planning involves creating a retirement strategy later in life to secure a comfortable and financially stable retirement. It begins with assessing your current financial situation, including assets, liabilities, net worth, income sources, expenses, and identifying areas for improvement. Developing a late retirement planning strategy entails prioritizing debt reduction, maximizing contributions to retirement accounts, considering alternative investment vehicles, adjusting investment risk tolerance, creating an emergency fund, and optimizing Social Security benefits. Healthcare expenses and estate planning considerations, such as drafting a will or trust, naming beneficiaries, and reviewing life insurance needs, are other important factors to consider. Regularly reviewing and adjusting the plan based on progress, life events, changes in tax laws and regulations, and maintaining discipline and focus on long-term objectives are essential for successful late retirement planning. Late retirement planning may present challenges due to limited time for saving, but with focused efforts, disciplined savings, and strategic financial management, individuals can work towards achieving a secure and comfortable retirement. What Is Late Retirement Planning?

Assessing Your Current Financial Situation

Listing All Assets and Liabilities

Estimating Net Worth

Evaluating Income Sources

Understanding Expenses and Budgeting

Identifying Shortfalls and Opportunities for Improvement

Setting Realistic Retirement Goals

Determining Retirement Age

Estimating Retirement Expenses

Basic Living Expenses

Healthcare Costs

Travel and Leisure Activities

Establishing Desired Retirement Lifestyle

Calculating Required Retirement Savings

Developing a Late Retirement Planning Strategy

Prioritizing Debt Reduction

Maximizing Contributions to Retirement Accounts

401(k) or 403(b)

Traditional and Roth IRA

Catch-Up Contributions for Older Individuals

Considering Alternative Investment Vehicles

Real Estate

Annuities

Taxable Brokerage Accounts

Adjusting Investment Risk Tolerance

Creating an Emergency Fund

Optimizing Social Security Benefits

Understanding How Benefits Are Calculated

Determining Optimal Claiming Age

Strategies to Maximize Benefits

Coordinating With Spousal Benefits

Planning for Healthcare Expenses

Estimating Future Healthcare Costs

Understanding Medicare Benefits

Evaluating Supplemental Insurance Options

Considering Long-Term Care Insurance

Estate Planning Considerations

Drafting a Will or Trust

Naming Beneficiaries for Financial Accounts

Establishing Power of Attorney and Healthcare Proxy

Reviewing Life Insurance Needs

Seeking Professional Help

Identifying When to Consult a Financial Planner

Finding a Qualified Financial Planner or Advisor

Understanding the Cost of Financial Advice

Collaborating With Other Professionals

Regularly Reviewing and Adjusting the Plan

Evaluating Progress Towards Retirement Goals

Adjusting Strategy Based on Life Events and Changes

Staying Informed on Tax Laws and Regulations

Maintaining Discipline and Focus on Long-Term Objectives

Conclusion

Late Retirement Planning FAQs

Late retirement planning refers to the process of preparing for retirement when an individual has already passed the optimal age to begin saving for retirement.

Late retirement planning can result in a smaller retirement fund, a reduced standard of living, and a lack of financial security in retirement.

Late Retirement Planning offers several advantages, including higher monthly Social Security benefits, increased retirement savings, continued access to employer-sponsored benefits, and potential improvements in overall financial security during retirement.

When engaging in Late Retirement Planning, it is important to consider personal financial circumstances, overall health, job opportunities, and the presence of other retirement income sources to determine the feasibility and benefits of delaying retirement.

A financial advisor can assist with identifying retirement goals, creating a personalized retirement plan, recommending investment strategies to maximize savings, and providing ongoing guidance and support to stay on track.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.