Up-Front Mortgage Insurance (UFMI) is a type of insurance that protects lenders against borrower default on mortgage loans. It is typically required for certain types of mortgage loans, such as those insured by the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA). UFMI is different from Private Mortgage Insurance (PMI), which is typically required for conventional mortgage loans with a down payment of less than 20%. The primary purpose of UFMI is to protect lenders against the risk of borrower default on mortgage loans. UFMI ensures that lenders receive compensation in the event that a borrower is unable to repay their mortgage loan, helping to mitigate the financial losses that lenders would otherwise incur. This insurance enables lenders to offer mortgage loans to a broader range of borrowers, including those who may not meet traditional underwriting criteria or who have limited financial resources. UFMI plays a critical role in the housing market by enabling lenders to offer mortgage loans to a broader range of borrowers. Without UFMI, many borrowers would be unable to secure mortgage loans, resulting in a decrease in housing demand and a potential downturn in the housing market. Additionally, UFMI helps to stabilize the housing market by reducing the risk of foreclosure and providing lenders with a degree of financial protection, enabling them to continue lending even during economic downturns. UFMI is typically paid upfront by borrowers as a one-time fee, although it may also be included in the mortgage loan amount. The cost of UFMI varies depending on factors such as the loan amount, the loan term, and the loan-to-value ratio (LTV) of the mortgage. The higher the LTV, the higher the UFMI cost, as the risk of borrower default is greater for mortgages with higher LTV ratios. The UFMI fee may be financed into the mortgage loan, resulting in higher monthly mortgage payments for borrowers. Alternatively, borrowers may choose to pay the UFMI fee upfront in a lump sum, reducing the amount of the mortgage loan and resulting in lower monthly mortgage payments. The FHA is one of the largest issuers of UFMI policies in the United States. FHA UFMI guidelines require borrowers to pay an upfront UFMI fee of 1.75% of the loan amount, which can be financed into the mortgage loan. Additionally, borrowers must pay an annual UFMI premium, which is based on the loan amount and the LTV ratio. The annual UFMI premium is typically divided into monthly payments and added to the borrower's monthly mortgage payment. FHA UFMI guidelines also require borrowers to meet certain credit and income requirements, and they limit the maximum loan amount based on the borrower's location and the property's value. FHA UFMI guidelines may be more flexible than conventional mortgage guidelines, making it easier for borrowers with limited financial resources to qualify for a mortgage loan. UFMI guidelines may vary for mortgage loans that are not insured by the FHA or the VA. Conventional mortgage lenders may require borrowers to pay a higher upfront UFMI fee, depending on the loan-to-value ratio and other factors. Additionally, some lenders may require borrowers to pay a monthly UFMI premium in addition to the upfront UFMI fee. Lenders are responsible for ensuring that borrowers meet the UFMI guidelines for the mortgage loan. Lenders must verify the borrower's income, credit, and other financial information to ensure that they meet the UFMI eligibility requirements. Additionally, lenders are responsible for disclosing the UFMI fees and premiums to borrowers and providing them with an accurate estimate of the total cost of the mortgage loan. One of the primary advantages of UFMI is that it can reduce the monthly mortgage payments for borrowers. By paying an upfront UFMI fee, borrowers may be able to secure a lower interest rate or reduce the amount of the mortgage loan, resulting in lower monthly mortgage payments. This can make homeownership more affordable and accessible for borrowers who may not have the financial resources to make a large down payment. Another advantage of UFMI is that it can make it easier for borrowers to qualify for a mortgage loan. By reducing the lender's risk of borrower default, UFMI enables lenders to offer mortgage loans to a broader range of borrowers, including those with lower credit scores or limited financial resources. This can help to increase homeownership rates and promote economic growth. The primary advantage of UFMI is that it protects lenders from borrower default on mortgage loans. If a borrower is unable to repay their mortgage loan, the lender can file a claim with the UFMI provider and receive compensation for the loss. This helps to reduce the financial risk for lenders, enabling them to continue lending and supporting economic growth. One of the primary disadvantages of UFMI is the higher upfront costs associated with the insurance. The UFMI fee can be a significant expense for borrowers, particularly for those with limited financial resources. Additionally, the UFMI fee may be financed into the mortgage loan, resulting in higher monthly mortgage payments over the life of the loan. Another disadvantage of UFMI is that it may be non-cancellable in some cases. For example, UFMI policies issued by the FHA are typically non-cancellable for the life of the loan. This means that borrowers must continue paying the UFMI premium for the entire term of the loan, even if the loan-to-value ratio falls below 78%. This can result in higher overall mortgage costs for borrowers. UFMI can also limit a borrower's ability to build equity in their home until the UFMI is paid off. Because the UFMI fee is typically included in the mortgage loan amount, borrowers may owe more on their mortgage than the actual value of the home. This can limit their ability to sell or refinance the property until the UFMI is paid off, potentially delaying their plans for homeownership. UFMI and PMI are both types of mortgage insurance that protect lenders against borrower default. However, there are some key differences between the two types of insurance. UFMI is typically required for certain government-backed mortgage loans, such as FHA and VA loans, while PMI is typically required for conventional mortgage loans with a down payment of less than 20%. The pros and cons of UFMI vs. PMI depend on a variety of factors, including the borrower's financial situation and the type of mortgage loan they are seeking. UFMI may be a better option for borrowers who have limited financial resources and need a lower down payment option, while PMI may be a better option for borrowers who have a larger down payment and higher credit scores. Additionally, UFMI may be more expensive than PMI in some cases, while PMI may be non-cancellable under certain conditions. The guidelines for UFMI and PMI vary depending on the type of mortgage loan and the lender's requirements. However, both types of insurance typically require borrowers to pay an upfront fee or a monthly premium to protect the lender against borrower default. The cost of the insurance may vary depending on factors such as the loan-to-value ratio, the loan amount, and the borrower's credit score. Up-Front Mortgage Insurance (UFMI) is a type of insurance that protects lenders against borrower default on mortgage loans. It is typically required for certain types of mortgage loans, such as those insured by the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA). UFMI is typically paid upfront by borrowers as a one-time fee, although it may also be included in the mortgage loan amount. The cost of UFMI varies depending on factors such as the loan amount, the loan term, and the loan-to-value ratio (LTV) of the mortgage. UFMI can offer several advantages, including lower monthly mortgage payments, easier qualification for a mortgage loan, and protection for lenders against borrower default. However, it also has several disadvantages, including higher upfront costs, non-cancellation in some cases, and no equity buildup until the UFMI is paid off. Overall, UFMI plays a critical role in the housing market by enabling lenders to offer mortgage loans to a broader range of borrowers and protecting them against financial losses in the event of borrower default. By carefully evaluating the advantages and disadvantages of UFMI and comparing it to other types of mortgage insurance, borrowers can make an informed decision about the best type of mortgage loan for their needs and financial situation.What Is Up-Front Mortgage Insurance (UFMI)?

Importance of UFMI in the Housing Market

How Up-Front Mortgage Insurance (UFMI) Works

UFMI Guidelines

Federal Housing Administration (FHA) UFMI Guidelines

UFMI Guidelines for Other Mortgage Loan Types

Lender's Responsibility in UFMI

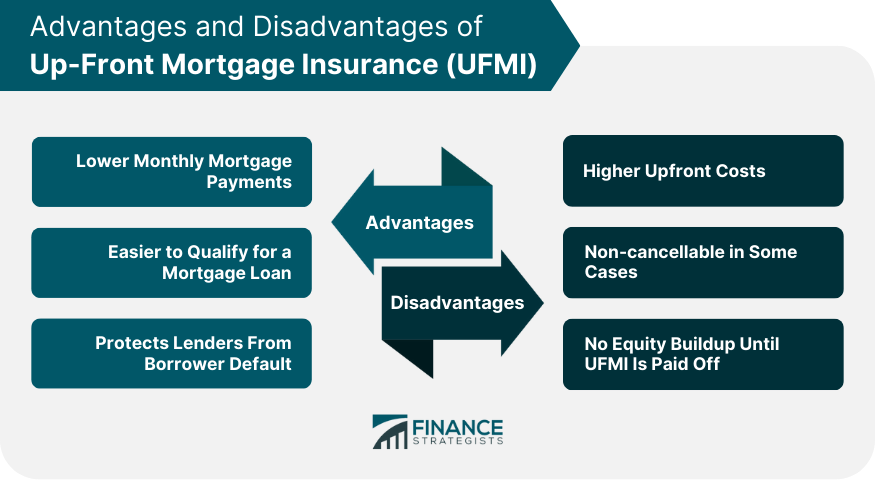

Advantages of UFMI

Lower Monthly Mortgage Payments

Easier to Qualify for a Mortgage Loan

Protects Lenders From Borrower Default

Disadvantages of UFMI

Higher Upfront Costs

Non-cancellable in Some Cases

No Equity Buildup Until UFMI Is Paid Off

UFMI vs Private Mortgage Insurance (PMI)

Difference Between UFMI and PMI

Pros and Cons of UFMI vs PMI

Comparison of UFMI and PMI Guidelines

Bottom Line

Up-Front Mortgage Insurance (UFMI) FAQs

UFMI is an insurance premium paid by the borrower at closing to protect the lender in case of default on the mortgage loan.

UFMI is a one-time upfront payment made at the time of closing, while MMI is a recurring monthly payment made along with your mortgage payment.

UFMI can help lower your monthly mortgage payments, make it easier to qualify for a mortgage loan, and protect lenders from borrower default.

UFMI has higher upfront costs, may not be cancellable in some cases, and prevents equity buildup until it is paid off.

The UFMI amount is calculated as a percentage of your loan amount and depends on the type of loan and your credit score. Your lender can provide specific details.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.