Single-purpose reverse mortgages are a specific type of loan that allows homeowners to access their home equity for a predetermined purpose. These loans can be beneficial for seniors on a limited income who need to pay for specific expenses such as property taxes or home repairs. To qualify for a single-purpose reverse mortgage, the borrower must meet certain requirements: Age and Homeowner Status: The borrower must be at least 62 years old and own their home. Primary Residence: The home must be the borrower's primary residence. Property Standards: The property must meet certain standards set by the lender, such as being well-maintained and meeting local building codes. Unlike other types of reverse mortgages, a single-purpose reverse mortgage can only be used for a specific purpose approved by the lender. Common examples of approved purposes include home repairs, property taxes, or insurance payments. Interest rates for single-purpose reverse mortgages can be either fixed or variable. Generally, these rates are lower than those of other reverse mortgage types, such as Home Equity Conversion Mortgages (HECMs) or proprietary reverse mortgages. Single-purpose reverse mortgages typically offer two disbursement options: Lump-Sum Payment: The borrower receives the entire loan amount in one payment. Scheduled Payments: The borrower receives the loan proceeds in a series of scheduled payments over a specified period. Single-purpose reverse mortgages typically have lower origination fees and closing costs compared to other reverse mortgage types. As previously mentioned, interest rates for single-purpose reverse mortgages are generally lower than those of other reverse mortgage types. Since the loan proceeds can only be used for a specific purpose, there is a reduced risk of borrowers misusing the funds. Single-purpose reverse mortgages can provide much-needed financial assistance for low-income seniors who may not qualify for other types of reverse mortgages. The main drawback of single-purpose reverse mortgages is the limited use of funds. Borrowers may only use the proceeds for the specific purpose approved by the lender. Single-purpose reverse mortgages are not widely available. Government agencies or nonprofit organizations often offer them and may have geographic restrictions. The loan proceeds may not be sufficient to cover all homeowner expenses, such as ongoing maintenance, property taxes, or insurance premiums. Receiving a single-purpose reverse mortgage could affect the borrower's eligibility for certain government benefits, such as Medicaid or Supplemental Security Income (SSI). To apply for a single-purpose reverse mortgage, borrowers must first find a lender. This can be a government agency or a nonprofit organization. Applicants will need to provide various documents, such as proof of age, proof of homeownership, and information about their home and its value. An appraisal and inspection may be required to determine the value of the home and ensure it meets the lender's property standards. Before obtaining a single-purpose reverse mortgage, borrowers must undergo financial counseling to ensure they fully understand the terms and conditions of the loan. Repayment of a single-purpose reverse mortgage becomes due when one of the following events occurs: Borrower's Death: The loan becomes due upon the borrower's death, and the heirs must repay it. Home Sale or Transfer: The loan must be repaid if the borrower sells or transfers the property. Permanent Move or Extended Absence: The loan becomes due if the borrower permanently moves out of the home or is absent for an extended period (usually 12 months or more). When repayment is triggered, there are several options available: Heirs: The borrower's heirs can repay the loan using personal funds or by refinancing the property. Home Sale Proceeds: The loan can be repaid using the proceeds from the sale of the home. There are certain tax considerations for single-purpose reverse mortgages: Tax-Free Loan Proceeds: The funds received from a single-purpose reverse mortgage are not considered taxable income. Property Tax and Insurance Responsibilities: Borrowers are still responsible for paying property taxes and maintaining homeowner's insurance during the life of the loan. For those who may not qualify for a single-purpose reverse mortgage or need more flexibility in using their home equity, there are several alternatives: HECMs are federally insured reverse mortgages that allow borrowers to use the loan proceeds for any purpose. Proprietary reverse mortgages are privately backed loans that may offer higher loan amounts and more flexible use of proceeds than single-purpose reverse mortgages. Home equity loans and lines of credit allow homeowners to borrow against their home's equity with more flexibility in how the funds can be used, but they require monthly payments and may have higher interest rates. Various government and nonprofit assistance programs are available to help seniors cover expenses such as home repairs, property taxes, and insurance premiums. Single-purpose reverse mortgages are a unique financial product tailored to senior homeowners with specific financial needs. They offer several advantages, such as lower costs and interest rates, reduced risk of misuse, and financial assistance for low-income seniors. However, they also have some drawbacks, including limited use of funds, limited availability, and potential impact on government benefits. Potential borrowers need to understand the application process, repayment and tax considerations, and alternative options available, such as HECMs, proprietary reverse mortgages, home equity loans, and government assistance programs. By carefully assessing their financial needs, consulting with a financial counselor, and weighing the pros and cons of single-purpose reverse mortgages, senior homeowners can make an informed decision that best suits their individual circumstances.What Are Single-Purpose Reverse Mortgages?

How Single-Purpose Reverse Mortgages Work

Basic Requirements

Loan Proceeds Usage

Interest Rates

Loan Disbursement Options

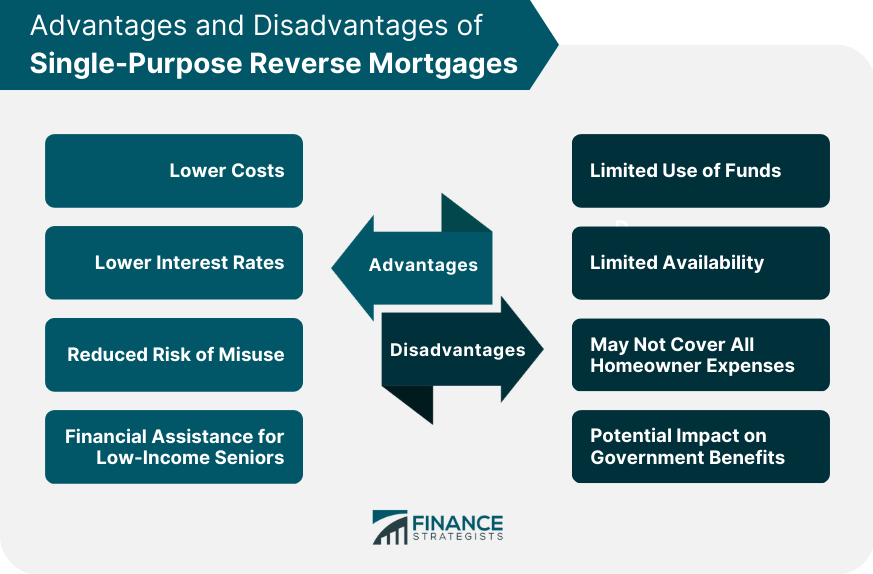

Advantages of Single-Purpose Reverse Mortgages

Lower Costs

Lower Interest Rates

Reduced Risk of Misuse

Financial Assistance for Low-Income Seniors

Disadvantages of Single-Purpose Reverse Mortgages

Limited Use of Funds

Limited Availability

May Not Cover All Homeowner Expenses

Potential Impact on Government Benefits

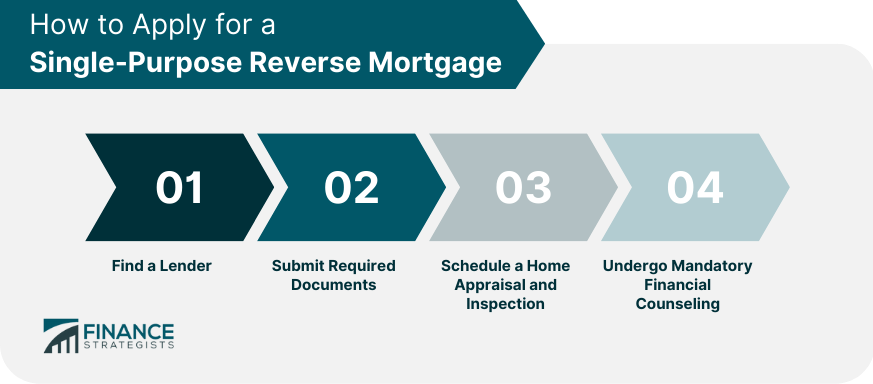

Application Process of Single-Purpose Reverse Mortgages

Find a Lender

Submit Required Documents

Schedule a Home Appraisal and Inspection

Undergo Mandatory Financial Counseling

Repayment and Tax Considerations of Single-Purpose Reverse Mortgages

Repayment Triggers

Repayment Options

Tax Implications

Alternatives to Single-Purpose Reverse Mortgages

Home Equity Conversion Mortgages (HECMs)

Proprietary Reverse Mortgages

Home Equity Loans and Lines of Credit

Government and Nonprofit Assistance Programs

Conclusion

Single-Purpose Reverse Mortgages FAQs

A single-purpose reverse mortgage is a type of loan that allows homeowners to access the equity in their homes for a specific purpose, such as paying property taxes or making home repairs.

Unlike other types of reverse mortgages, which can be used for any purpose, single-purpose reverse mortgages are restricted to a specific purpose, such as paying property taxes or making home repairs.

Eligibility for a single-purpose reverse mortgage varies by lender, but typically, they are available to low-income seniors who own their homes and have limited income and assets.

The benefits of a single-purpose reverse mortgage include access to cash to pay for specific expenses, lower costs and fees compared to other types of reverse mortgages, and the ability to remain in your home.

To apply for a single-purpose reverse mortgage, you should contact your local housing agency or nonprofit organization that offers these types of loans. They can provide information on eligibility requirements and the application process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.