Reverse mortgage payout options refer to the ways in which borrowers can receive funds from a reverse mortgage, including lump sum, line of credit, monthly payments, or a combination of these options. It's important to carefully consider which payout option best suits your financial needs and goals. A reverse mortgage is a financial product that allows homeowners aged 62 and older to convert a portion of their home equity into cash. This type of mortgage is designed to help retirees supplement their retirement income, cover unexpected expenses, or make home improvements. To be eligible for a reverse mortgage, the homeowner must meet specific criteria, including owning the home outright or having a low remaining mortgage balance. A lump-sum payment involves receiving the entire loan amount upfront. This option is available only for fixed-rate reverse mortgages and is typically used for immediate, large expenses or debt consolidation. Pros of a lump-sum payment include quick access to funds and the ability to pay off high-interest debts. Cons include the potential for higher fees, interest costs, and the risk of depleting home equity too quickly. A lump-sum payment may be suitable for homeowners with significant immediate financial needs or wanting to pay off high-interest debt. A tenure payment provides equal monthly payments for as long as the borrower lives in the home. This option offers a stable, predictable income source for retirees. Pros of a tenure payment include a guaranteed income stream and the ability to budget more effectively. Cons include the inability to access additional funds beyond the monthly payment and the potential for unused home equity if the borrower vacates the home or passes away. Tenure payments are ideal for homeowners seeking a consistent monthly income to cover living expenses throughout their retirement. A term payment provides equal monthly payments for a fixed period chosen by the borrower. This option allows for tailored income based on specific financial needs and goals. Pros of a term payment include a predictable income stream and the ability to choose the payment duration. Cons include the potential for financial instability if the borrower outlives the term and the risk of unused home equity if the borrower vacates the home or passes away during the term. Term payments may be suitable for homeowners who need supplemental income for a specific period, such as paying off a mortgage or covering college tuition for a family member. A line of credit allows borrowers to access funds up to a predetermined limit as needed. The available credit grows over time, providing flexibility and control over loan disbursements. Pros of a line of credit include flexibility, control over loan disbursements, and the potential for growth in available credit. Cons include variable interest rates and the risk of mismanaging funds. A line of credit is ideal for homeowners who want to access funds on an as-needed basis, such as for emergency expenses or home improvements. A modified tenure payment combines the features of a tenure payment and a line of credit, providing monthly payments and access to a line of credit as needed. Pros of a modified tenure payment include a guaranteed monthly income, access to additional funds through a line of credit, and flexibility in managing financial needs. Cons include the potential for mismanaging funds and the complexity of managing two financial products simultaneously. Modified tenure payments are suitable for homeowners who want the security of a consistent monthly income while maintaining access to additional funds for unexpected expenses or investments. A modified term payment combines the features of a term payment and a line of credit, providing monthly payments for a fixed period and access to a line of credit as needed. Pros of a modified term payment include a predictable income stream for a fixed period, access to additional funds through a line of credit, and flexibility in managing financial needs. Cons include the potential for financial instability if the borrower outlives the term and the risk of mismanaging funds. Modified term payments may be ideal for homeowners who need a stable income for a specific period while maintaining access to additional funds for unexpected expenses or investments. Selecting the right payout option is crucial for maximizing the benefits of a reverse mortgage. Different payout options suit different financial situations and needs, making it essential to understand each option and weigh the pros and cons before making a decision. When comparing reverse mortgage payout options, homeowners should consider their financial needs and goals, lifestyle preferences, tax implications, and the potential impact on government benefits. To compare reverse mortgage payout options, homeowners can use reverse mortgage calculators, consult with financial advisors, and explore government and non-profit resources for guidance. Reverse mortgages are subject to consumer protection regulations designed to ensure borrowers are informed about the terms and conditions of their loans and safeguard against predatory lending practices. Borrowers are responsible for maintaining their property, paying property taxes and homeowners insurance, and complying with the terms of the reverse mortgage agreement. Lenders are required to provide clear and accurate information about reverse mortgage products, assess borrowers' ability to meet their obligations and adhere to regulatory guidelines for loan origination and servicing. A common misconception is that a reverse mortgage results in the loss of homeownership or property rights. In reality, borrowers retain ownership and can continue living in the home as long as they meet their obligations under the reverse mortgage agreement. Some people worry that a reverse mortgage will leave their heirs with significant debt. However, the non-recourse feature of reverse mortgages ensures that heirs are not responsible for more than the home's current market value. There often needs to be more clarity about the repayment terms of a reverse mortgage. Repayment is generally required when the borrower passes away, sells the home, or moves out permanently. Some homeowners are concerned about the fees and costs associated with reverse mortgages, such as origination fees, mortgage insurance premiums, and closing costs. These fees can be financed into the loan, reducing the out-of-pocket expenses for the borrower. Reverse mortgage payout options offer various ways for homeowners to access home equity and address financial needs during retirement. Careful evaluation of each option, consideration of individual circumstances, and consultation with professional advisors are crucial to making well-informed decisions. By understanding legal and regulatory aspects and addressing common misconceptions, homeowners can confidently choose a payout option that aligns with their financial goals and secures their financial future in retirement.Definition of Reverse Mortgage Payout Options

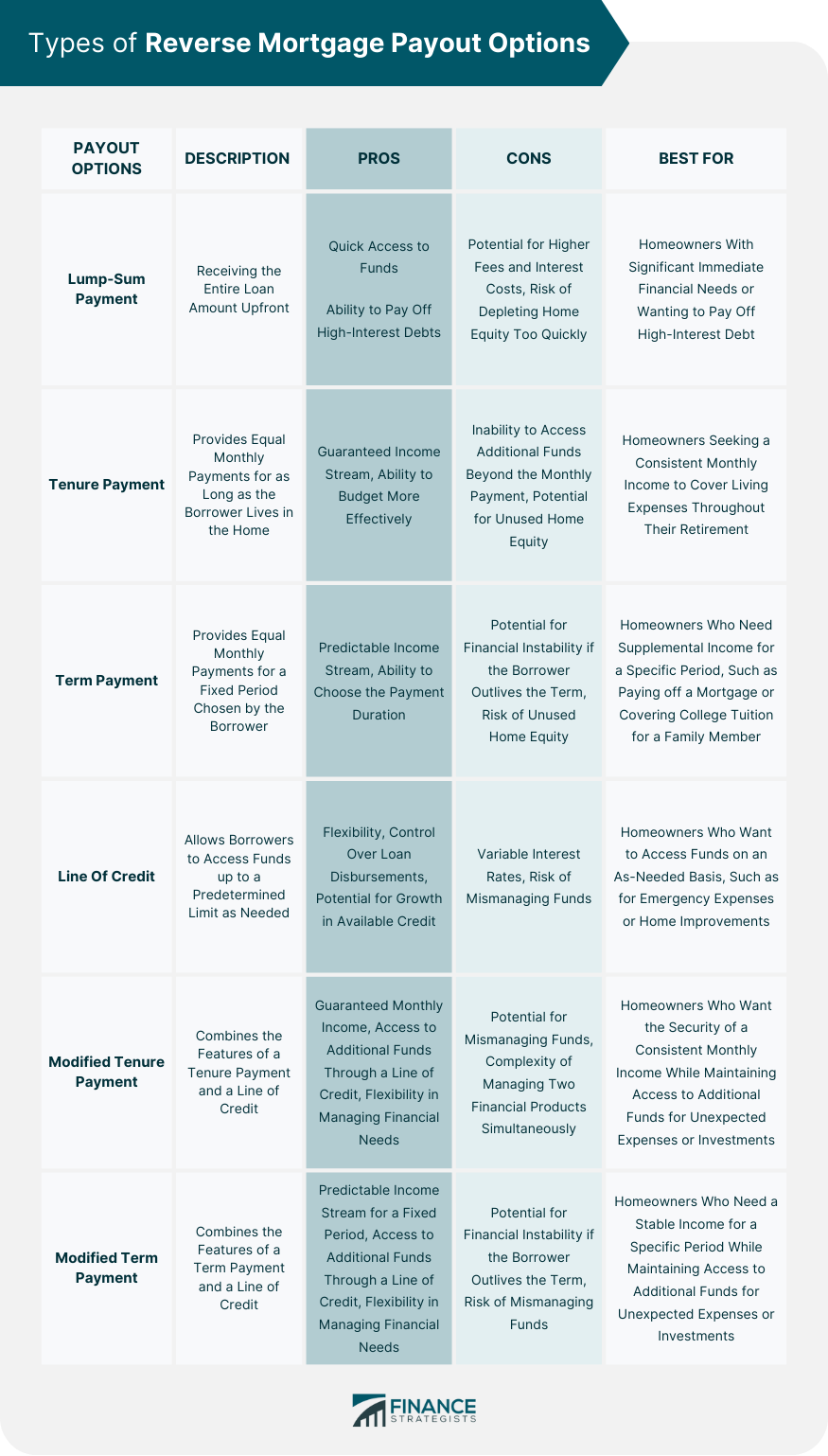

Types of Reverse Mortgage Payout Options

Lump-Sum Payment

Description and Features

Pros and Cons

Suitable Scenarios for Choosing This Option

Tenure Payment

Description and Features

Pros and Cons

Suitable Scenarios for Choosing This Option

Term Payment

Description and Features

Pros and Cons

Suitable Scenarios for Choosing This Option

Line of Credit

Description and Features

Pros and Cons

Suitable Scenarios for Choosing This Option

Modified Tenure Payment

Description and Features

Pros and Cons

Suitable Scenarios for Choosing This Option

Modified Term Payment

Description and Features

Pros and Cons

Suitable Scenarios for Choosing This Option

Choosing the Right Reverse Mortgage Payout Option

Factors to Consider When Comparing Options

Tools and Resources for Comparing Options

Legal and Regulatory Aspects of Reverse Mortgages

Consumer Protection Regulations

Borrower's Obligations and Responsibilities

Lender's Obligations and Responsibilities

Common Misconceptions and Concerns about Reverse Mortgages

Homeownership and Property Rights

Impact on Heirs and Estate Planning

Repayment Terms and Conditions

Fees and Costs Associated With Reverse Mortgages

Conclusion

Reverse Mortgage Payout Options FAQs

The payout options for a reverse mortgage typically include a lump sum, line of credit, monthly payments, or a combination of these options.

Yes, you can change your reverse mortgage payout option if you have not received the funds. It's best to speak with your lender to explore your options.

Yes, your payout option can affect the amount of interest you owe on a reverse mortgage. Generally, taking a lump sum payout will result in higher interest charges than a line of credit or monthly payments.

Your best payout option will depend on your financial needs and goals. It's important to speak with a financial advisor and carefully consider your options before making a decision.

No, there are generally no restrictions on how you can use the funds from a reverse mortgage payout. You can use the money for any purpose you choose, including paying off debt, covering living expenses, or making home improvements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.