The term "Original Face" is used in the mortgage broker context to denote the initial principal balance or total loan amount that is provided to a borrower. It's an integral part of the loan contract, signifying the financial obligation that the borrower has committed to repay. This loan amount is calculated based on several factors, such as the borrower's income, creditworthiness, and the loan-to-value ratio. It forms the foundation on which other loan elements, such as the interest rate, term, and amortization schedule, are structured. Understanding the original face is fundamental in analyzing and managing financial instruments within the context of investment portfolios, debt management, and financial planning. Original Face serves more than just defining the initial loan amount. It is the cornerstone of loan agreement, helping to establish the specifics of the repayment schedule, including the principal and interest payments. Moreover, the Original Face directly influences the borrower's financial commitment, shaping the amount they would be expected to repay over the term of the loan. Understanding the Original Face is crucial for both borrowers and lenders in creating an effective and manageable loan agreement. In the loan documentation and underwriting process, the Original Face plays a pivotal role. It is one of the first elements determined in the underwriting process, which sets the stage for other terms of the loan. Furthermore, the Original Face forms part of the official loan documentation, which legally binds the borrower to repay the loan amount. It also provides a reference point for loan modifications, if any, during the life of the loan. Hence, it's crucial for the Original Face to be accurately stated and documented. The loan amount represents the largest component of the Original Face. This is the sum of money borrowed, which will eventually need to be repaid along with the accrued interest. The loan amount is generally determined based on the borrower's financial needs and their ability to repay the loan. Factors such as the borrower's income, existing debt, and credit score play a significant role in determining this amount. The interest rate is another key element of the Original Face. It represents the cost of borrowing money and is usually expressed as a percentage of the loan amount. Interest rates are determined by various factors including the borrower's creditworthiness, the type of loan, and market conditions. The interest rate directly impacts the amount of interest payments over the life of the loan and thus, forms an integral part of the Original Face. The term of the loan, or the duration over which the loan is to be repaid, is another critical part of the Original Face. The term can vary widely, from a few years to as long as 30 years in the case of some home loans. The length of the loan term affects the amount of the monthly payments and the total amount of interest paid over the life of the loan. Thus, the loan term has a substantial impact on the Original Face. The amortization schedule, which sets out the timeline for the principal and interest payments, is another fundamental element of the Original Face. This schedule provides a complete breakdown of each payment over the loan's term, indicating how much of each payment is allocated towards the principal and the interest. This schedule helps borrowers understand how their loan balance will decrease over time and when the loan will be completely repaid. Therefore, it's an important component of the Original Face that influences the overall cost of the loan. Apart from the aforementioned elements, other loan terms such as fees, penalties, and optional features like balloon payments or adjustable rates, also contribute to the Original Face. These terms can influence the cost of borrowing and the borrower's repayment obligations. Thus, they form an integral part of the Original Face and should be clearly defined and understood by the borrower before entering into a loan agreement. The Original Face is of paramount importance in maintaining accuracy and consistency throughout loan documentation. This is the amount that the borrower agrees to repay and forms the basis for the calculation of the interest and the establishment of the amortization schedule. It is imperative that this amount is correctly stated in all relevant documentation to prevent any potential disputes or misunderstandings later in the life of the loan. Moreover, consistency in the Original Face is crucial when comparing multiple loan offers or when modifying loan terms. Original Face plays a critical role in the evaluation and comparison of loan offers. Different loans can have varying Original Faces, and comparing these amounts can help borrowers understand the different financial commitments associated with each loan. Further, the Original Face can also influence other loan terms, such as interest rates and repayment schedules. Therefore, a clear understanding of the Original Face is essential when comparing and selecting the most suitable loan offer. Any changes to the Original Face during the loan processing have significant implications. A change could occur due to revised loan terms, borrower's changed financial circumstances, or alterations in the lending market conditions. Such changes can affect the loan repayment schedule and the total cost of the loan for the borrower. Thus, understanding the implications of changes to the Original Face is crucial for both the lender and the borrower to ensure transparency and fairness in the loan agreement. The borrower's creditworthiness is a primary factor that influences the Original Face. Lenders assess a borrower's creditworthiness to determine the risk involved in lending money. Factors such as credit score, repayment history, current income, and existing debt are taken into consideration. Borrowers with higher creditworthiness may be able to borrow larger amounts, impacting the Original Face. The loan-to-value (LTV) ratio is another critical factor influencing the Original Face. This ratio represents the amount of the loan compared to the value of the property that is being financed. Lenders use this ratio to assess the risk of the loan. A higher LTV ratio might signify a riskier loan and could potentially lower the amount a lender is willing to offer, thus affecting the Original Face. In a high-interest-rate environment, the cost of borrowing increases, which could potentially lower the loan amount a borrower is able to afford, thereby reducing the Original Face. Conversely, in a low-interest-rate environment, the cost of borrowing decreases, which could allow borrowers to afford a larger loan amount, thus increasing the Original Face. The type of loan program and the specific product options selected by the borrower also influence the Original Face. Different loan programs, such as fixed-rate or adjustable-rate mortgages, have different terms and conditions which can impact the loan amount. For example, some loan programs may allow for a larger loan amount but come with higher interest rates or more restrictive repayment terms. Thus, the selection of the loan program and product can directly impact the Original Face. The Original Face provides a clear and concise representation of the borrower's financial obligation under the loan agreement. It helps to eliminate ambiguity and ensure that borrowers fully understand their repayment obligations. This transparency aids borrowers in making informed decisions about their loan options. Understanding the Original Face facilitates the borrower's financial planning. By providing a clear understanding of the total loan amount and how it will be repaid over time, the Original Face allows borrowers to plan their finances effectively. It helps borrowers to determine how the loan repayment will fit into their broader financial situation, aiding in budgeting and long-term financial planning. As such, the Original Face plays a vital role in facilitating sound financial planning and management. The Original Face enhances a borrower's ability to assess loan affordability. It clearly delineates the amount that the borrower will be obligated to repay, allowing them to assess whether the loan is within their means. Moreover, as the Original Face influences the repayment schedule, it assists borrowers in understanding their ongoing repayment obligations. Hence, it plays a crucial role in helping borrowers assess whether a particular loan is affordable given their financial circumstances. The Original Face serves as a crucial tool for borrower protection and facilitates informed decision-making. By clearly stating the loan amount and influencing key loan terms, the Original Face ensures that borrowers are fully informed of their obligations. This information empowers borrowers to compare different loan offers and make informed decisions about which loan best suits their needs and circumstances. Thus, the Original Face plays a crucial role in protecting borrowers and fostering informed decision-making. In the context of regulatory compliance, the Original Face plays a significant role. Mortgage brokers are required to adhere to consumer protection laws and regulations, which mandate transparency and accuracy in loan terms. The Original Face, being a crucial part of the loan agreement, must be correctly stated and presented to ensure compliance. It forms the basis for calculating interest and repayment schedules, making it critical for regulatory compliance. As per regulations, lenders are required to provide certain disclosures to borrowers. These disclosures typically include the Original Face, along with other key loan terms such as the interest rate and repayment schedule. These disclosures ensure that borrowers are fully informed of their obligations and can make informed decisions. Thus, the Original Face plays a vital role in the regulatory framework surrounding mortgage lending. Mortgage brokers have a responsibility to ensure the accuracy of the Original Face. Any errors or inaccuracies could lead to regulatory non-compliance and potential disputes. Mortgage brokers need to ensure that the Original Face is correctly calculated, accurately documented, and clearly communicated to the borrower. This responsibility underscores the significant role the Original Face plays in mortgage brokerage operations. The term "original face" in finance refers to the initial principal amount assigned to a financial instrument or security at the time of issuance. It serves as a fundamental benchmark for measuring the value and performance of the instrument over time. The original face value is essential in calculating interest payments, amortization schedules, and evaluating potential gains or losses. Key elements of the original face include the principal amount, the interest rate, and the term or maturity period. Understanding and accurately determining the original face is crucial in analyzing and managing financial instruments within investment portfolios, debt management, and financial planning. Various factors such as market conditions, creditworthiness, and economic factors can affect the original face value. The benefits of considering the original face value include providing a baseline for assessing returns, facilitating risk management, and enabling effective decision-making in the realm of finance.What Is Original Face?

Purpose of Original Face

Role of Original Face in Loan Documentation and Underwriting Process

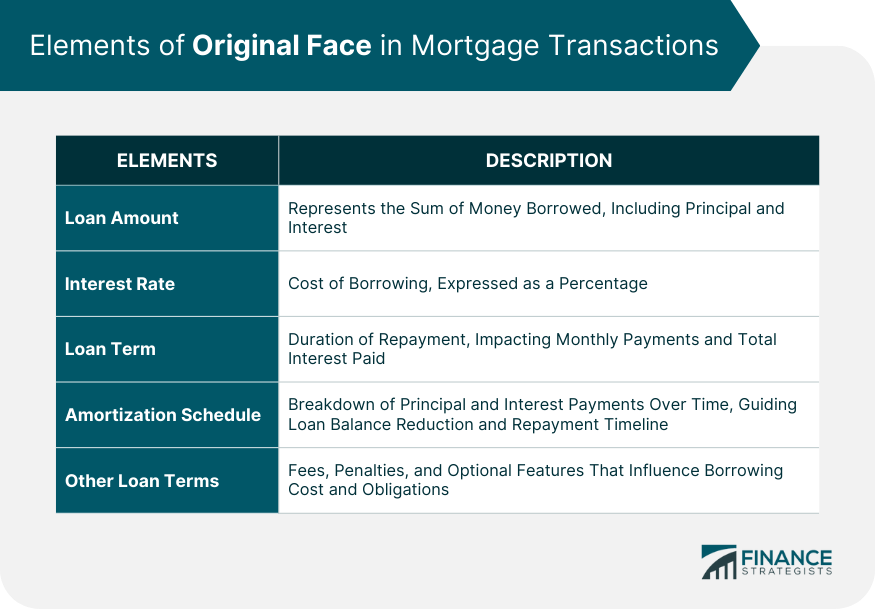

Key Elements of Original Face

Loan Amount

Interest Rate

Term of the Loan

Amortization Schedule

Other Relevant Loan Terms

Importance of Original Face in Mortgage Brokerage

Ensuring Accuracy and Consistency in Loan Documentation

Facilitating Proper Evaluation and Comparison of Loan Offers

Implications of Changes to Original Face During Loan Processing

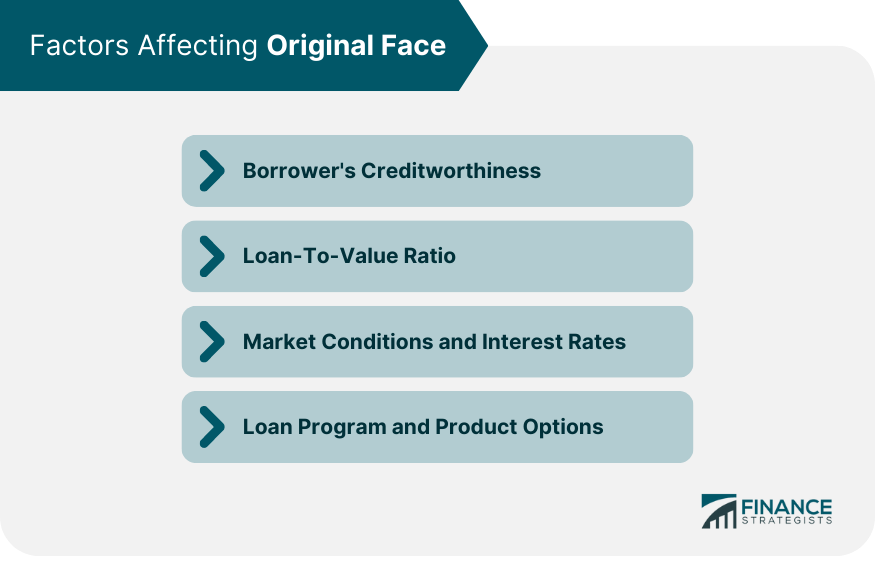

Factors Affecting Original Face

Borrower's Creditworthiness

Loan-To-Value Ratio

Market Conditions and Interest Rates

Loan Program and Product Options

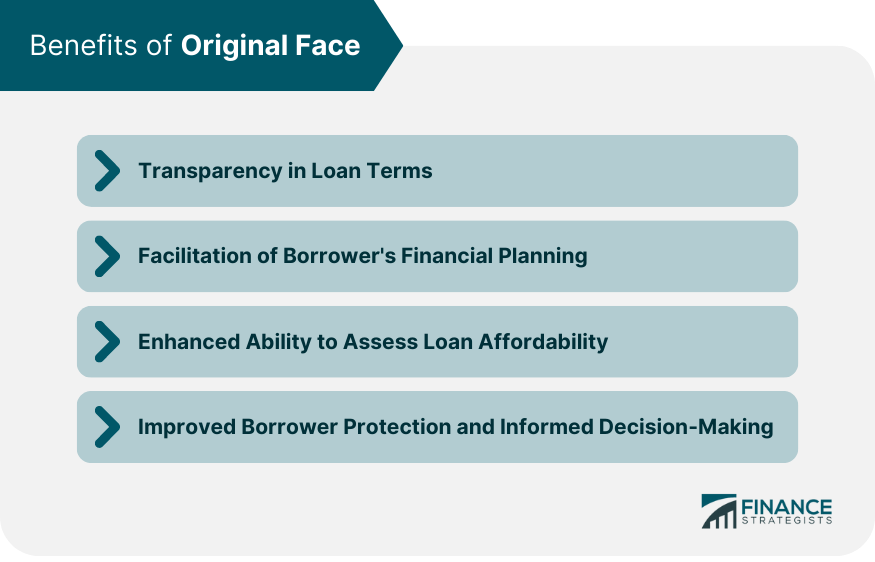

Benefits of Original Face

Transparency in Loan Terms

Facilitation of Borrower's Financial Planning

Enhanced Ability to Assess Loan Affordability

Improved Borrower Protection and Informed Decision-Making

Regulatory Considerations

Compliance With Consumer Protection Laws and Regulations

Disclosures Related to Original Face

Responsibilities of Mortgage Brokers in Maintaining Original Face Accuracy

Conclusion

Original Face FAQs

Original Face refers to the initial principal balance or the total loan amount provided to a borrower in a mortgage agreement. It is the base figure upon which other loan elements, such as the interest rate and repayment schedule, are structured.

The Original Face directly impacts your loan repayment as it determines the total amount you are obligated to repay. The Original Face, coupled with the interest rate, influences the repayment schedule and the amount of each repayment installment.

Generally, the Original Face of a loan does not change after the loan agreement is signed. However, changes may occur if loan terms are modified due to refinancing or loan restructuring.

Typically, a higher Original Face means higher monthly payments, assuming the interest rate and loan term remain the same. However, the exact monthly payment will also depend on other factors, such as the loan term and the structure of the loan.

The Original Face is crucial in mortgage brokerage as it ensures transparency and consistency in loan documentation, facilitates the proper evaluation and comparison of loan offers, and has significant implications if changes occur during loan processing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.