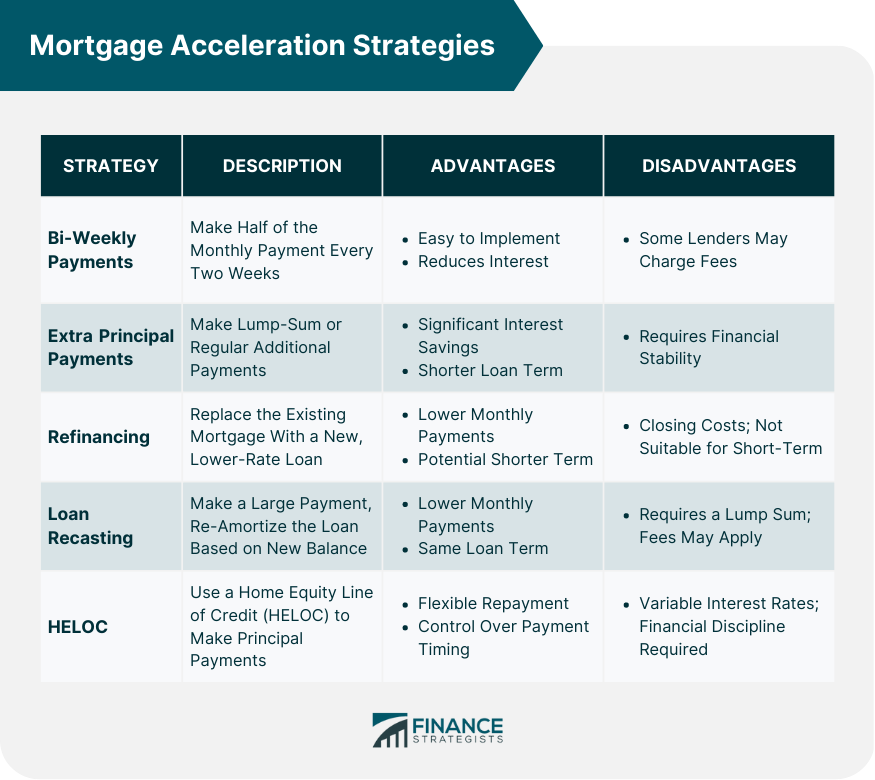

Mortgage acceleration refers to a strategy used to pay off a mortgage loan faster than the term specified in the loan agreement. This strategy typically involves making extra payments towards the principal balance of the mortgage, which reduces the amount of interest that accrues over time and can significantly shorten the life of the loan. Under this strategy, homeowners make half of their monthly mortgage payment every two weeks instead of making a full payment once a month. This results in 26 half-payments per year, equivalent to 13 full monthly payments. This extra payment goes directly toward the principal balance, reducing the interest paid over the life of the loan. Bi-weekly payments can be an easy and relatively painless way to accelerate mortgage repayment. However, some lenders may not offer this option, or they might charge a fee for processing bi-weekly payments. Homeowners should check with their lender before implementing this strategy. One way to accelerate mortgage repayment is by making occasional lump-sum payments directly toward the principal balance. These payments can be made with bonuses, tax refunds, or other windfalls. Another approach is to consistently make extra payments along with the regular monthly mortgage payments. Even a small additional amount can make a significant difference over the life of the loan. Making extra principal payments can result in substantial interest savings and a shorter loan term. However, homeowners should ensure they have enough financial stability and emergency savings before committing to this strategy. Refinancing involves replacing an existing mortgage with a new one, often at a lower interest rate. A lower interest rate can lead to a reduced monthly payment, allowing homeowners to allocate the savings toward additional principal payments. Homeowners can also refinance their mortgage for a shorter term, such as converting a 30-year mortgage to a 15-year mortgage. This may result in higher monthly payments, but the loan will be paid off much faster, saving on interest payments. Refinancing can be an effective mortgage acceleration strategy if interest rates have dropped since the original mortgage was obtained. However, refinancing comes with closing costs and may not be worthwhile if the homeowner plans to move in the near future. Loan recasting involves making a large lump-sum payment toward the principal balance and then having the lender re-amortize the loan based on the new balance. This results in lower monthly payments while maintaining the original loan term. Loan recasting can provide immediate relief in monthly payments while still accelerating mortgage repayment. However, not all lenders offer this option, and there may be a fee associated with recasting. Additionally, homeowners should have a significant lump sum available to make the initial payment. A home equity line of credit (HELOC) is a revolving line of credit that uses the borrower's home as collateral. Homeowners can use a HELOC to make additional principal payments on their mortgage and then repay the HELOC over time, effectively accelerating the mortgage repayment process. Using a HELOC for mortgage acceleration can be a flexible option, as homeowners can control the timing and amount of additional principal payments. However, HELOCs come with variable interest rates and may not be the best choice for those who struggle with financial discipline or are uncomfortable with the risk of rising interest rates. Homeowners should consider their overall financial goals when selecting a mortgage acceleration strategy. It is essential to balance mortgage acceleration with other priorities, such as saving for retirement, building an emergency fund, or paying off high-interest debt. Understanding the terms and conditions of the mortgage, such as prepayment penalties or restrictions, is crucial when choosing an acceleration strategy. Some lenders may charge fees or penalties for early repayment, negating the benefits of mortgage acceleration. If a mortgage has prepayment penalties, homeowners should carefully weigh the benefits of acceleration against the potential costs of these penalties. Mortgage interest is often tax-deductible, so accelerating mortgage payments may reduce the tax benefits associated with mortgage interest. Homeowners should consult a tax professional to understand the implications of their chosen strategy. Homeowners should evaluate their financial resources and stability before committing to a mortgage acceleration strategy. Ensuring that there is an adequate emergency fund and the ability to manage additional financial obligations is essential. One of the main advantages of accelerating a mortgage is the potential to save thousands of dollars in interest payments. By paying off the principal balance faster, less interest accrues over the life of the loan. Accelerating mortgage payments can help homeowners pay off their mortgage in a shorter period, freeing up funds for other financial goals, such as investing, saving for retirement, or funding college education. Mortgage acceleration leads to a faster increase in home equity, which can provide homeowners with more financial security and flexibility. This equity can be leveraged for various purposes, such as home improvements or funding major life events. Paying off a mortgage ahead of schedule provides homeowners with increased financial flexibility. With the mortgage paid off, homeowners can redirect their funds toward other financial goals or enjoy a reduced cost of living. Creating a detailed budget and financial plan is the first step in implementing a mortgage acceleration strategy. This will help homeowners identify areas where they can allocate extra funds toward their mortgage. It is crucial to communicate with the lender when implementing a mortgage acceleration strategy. Homeowners should notify their lenders of their plans and ensure that any additional payments are applied correctly to the principal balance. Regularly monitoring mortgage repayment progress can help homeowners stay on track and make adjustments as needed. This may involve tracking principal payments, reviewing loan statements, or using online mortgage calculators. Homeowners should be prepared to adjust their mortgage acceleration strategy as their financial situation changes. This may involve increasing or decreasing additional payments, refinancing, or exploring alternative strategies. Implementing a mortgage acceleration strategy can have numerous benefits, including interest savings, shortened loan terms, increased home equity, and financial flexibility. Bi-weekly payments, extra principal payments, refinancing, loan recasting, and using a home equity line of credit are all effective strategies to consider. However, homeowners should carefully evaluate their personal financial goals, mortgage terms and conditions, loan prepayment penalties, tax implications, and available resources before choosing a strategy. Additionally, creating a budget and financial plan, communicating with the lender, monitoring progress, and adjusting the strategy as needed are all important steps in successfully implementing a mortgage acceleration strategy. With careful consideration and planning, homeowners can accelerate their mortgage repayment and achieve greater financial security and flexibility.Definition of Mortgage Acceleration

Mortgage Acceleration Strategies

Bi-Weekly Payments

How It Works

Advantages and Disadvantages

Extra Principal Payments

Lump-Sum Payments

Regular Additional Payments

Advantages and Disadvantages

Refinancing

Lower Interest Rates

Shorter Loan Term

Advantages and Disadvantages

Loan Recasting

How It Works

Advantages and Disadvantages

Using a Home Equity Line of Credit (HELOC)

How It Works

Advantages and Disadvantages

Factors to Consider When Choosing a Strategy

Personal Financial Goals

Mortgage Terms and Conditions

Loan Prepayment Penalties

Tax Implications

Available Resources

Benefits of Mortgage Acceleration

Interest Savings

Shortened Loan Term

Increased Home Equity

Financial Flexibility

Implementing a Mortgage Acceleration Strategy

Budgeting and Planning

Communicating with the Lender

Monitoring Progress

Adjusting Strategy as Needed

Conclusion

Mortgage Acceleration Strategies FAQs

Mortgage acceleration strategies can help homeowners save on interest payments, shorten the loan term, increase home equity, and provide greater financial flexibility.

Common mortgage acceleration strategies include making bi-weekly payments, extra principal payments (lump-sum or regular additional payments), refinancing, loan recasting, and using a home equity line of credit (HELOC).

When selecting a mortgage acceleration strategy, consider your personal financial goals, the terms and conditions of your mortgage, loan prepayment penalties, tax implications, and available financial resources.

Yes, you can combine various mortgage acceleration strategies to optimize your mortgage repayment plan. However, it's essential to balance your financial priorities and ensure that you have adequate emergency funds and resources.

To monitor your progress, regularly review your loan statements, track principal payments, and use online mortgage calculators. Be prepared to adjust your mortgage acceleration strategy as your financial situation changes, and communicate with your lender to ensure proper application of additional payments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.