Fannie Mae and FHA loans are two types of mortgages designed to help individuals achieve homeownership, yet they cater to different borrower needs. Fannie Mae, or the Federal National Mortgage Association, is a government-sponsored entity that buys and securitizes mortgages to ensure a steady supply of money for home loans. Their offerings often cater to borrowers with good credit and stable income. FHA loans, backed by the Federal Housing Administration, are designed to make homeownership more accessible to individuals with lower credit scores and smaller down payments. They provide an extra layer of protection to lenders in case of default, often resulting in more lenient qualification requirements for borrowers. While both loan types can help you purchase a home, the right choice depends on individual circumstances, financial health, and homeownership goals. Both Fannie Mae and FHA loans have eligibility requirements, but they differ in nature. FHA loans have more lenient credit score requirements, and their down payments can be as low as 3.5% for borrowers with a credit score of 580 or higher. On the other hand, Fannie Mae loans generally require a higher credit score, but they offer more flexible options, especially with their HomeReady program designed for low-to-moderate income borrowers. Fannie Mae and FHA loans also vary significantly in their loan limits. Fannie Mae loans tend to have higher loan limits, making them suitable for borrowers looking to buy in more expensive markets. In contrast, FHA loan limits are set annually by the Department of Housing and Urban Development and tend to be lower, typically favoring those looking to purchase moderately priced or first-time homes. Mortgage insurance plays a distinct role in both Fannie Mae and FHA loans. For Fannie Mae, borrowers who can't afford a 20% down payment must pay for Private Mortgage Insurance (PMI). This insurance can be removed once the borrower achieves 20% equity in their home. FHA loans, in contrast, require both an upfront mortgage insurance premium and an annual premium, which is typically included in monthly payments. This insurance remains for the life of the loan unless you put down 10% or more, in which case it can be removed after 11 years. Interest rates can also vary between Fannie Mae and FHA loans. While both offer competitive rates, FHA loans often provide lower interest rates to borrowers, particularly those with less-than-perfect credit. This lower rate is possible because of the government guarantee, which reduces the risk for lenders. Fannie Mae’s rates, while competitive, may be higher due to factors such as loan type, borrower credit score, and down payment amount. Lastly, the down payment requirements for these loans can differ considerably. FHA loans are well-known for their low down payment requirement, as low as 3.5% for borrowers with credit scores of 580 or more. Fannie Mae, while often requiring a higher down payment, does offer programs such as the HomeReady loan, which allows for down payments as low as 3% for eligible borrowers. Fannie Mae loans don't require perfect credit scores, enabling a larger group of borrowers to qualify. While good credit enhances the chances of approval, borrowers with less-than-perfect credit scores aren't necessarily disqualified. Compared to other loan types, Fannie Mae loans generally offer lower mortgage rates. Lower rates translate into reduced monthly payments, enabling borrowers to save a significant amount over the life of the loan. Fannie Mae loans are preferred by those purchasing homes in high-cost areas due to their higher loan limits. Higher loan limits allow borrowers to finance a more expensive home without resorting to more costly jumbo loans. Fannie Mae offers a wide range of mortgage options catering to different needs. Whether you're a first-time homebuyer, an investor, or looking for a low down payment loan, Fannie Mae's diverse portfolio ensures there's a suitable option for you. Fannie Mae loans have specific criteria about the types of properties you can purchase. This might limit your options, especially if you're considering unique or non-traditional homes. While Fannie Mae does offer some low down payment options, certain loans require a higher down payment. This could potentially be a barrier for borrowers with limited funds for upfront costs. Fannie Mae's underwriting guidelines can be quite stringent. The approval process might be more complicated and longer than with other types of loans, which might delay the homebuying process. If you can't afford a 20% down payment, you'll need to pay for PMI. This additional cost increases the overall expense of your loan until you reach 20% equity in your home. FHA loans are known for their accessibility. They require lower minimum credit scores compared to most conventional loans, making homeownership possible for a wider audience. FHA loans are favored by many due to their low down payment requirement, usually just 3.5% for those with a credit score of 580 or higher. This makes it easier for potential homebuyers to make the initial investment. If you've previously faced financial hardships like bankruptcy or foreclosure, FHA loans provide a path to homeownership by being more forgiving, given you've established a satisfactory credit history since. If you decide to sell, the buyer can assume your FHA loan. This can be a valuable selling point, especially in a rising interest rate environment. FHA loans have lower loan limits compared to Fannie Mae loans. This could limit your buying power, especially in high-cost areas. FHA loans require an upfront mortgage insurance premium and an annual premium. These extra costs can make the loan more expensive over time, even if the initial rate is appealing. FHA offers fewer loan product options compared to Fannie Mae. This might limit your choices, especially if you have specific needs that are not addressed by FHA's loan offerings. To qualify for an FHA loan, the property must meet certain health and safety standards. This may limit your options or require the seller to make improvements before the sale can proceed. As you weigh your options between Fannie Mae and FHA loans, one of the first things to consider is your credit score. FHA loans have more lenient credit score requirements, making them an attractive choice for those with lower scores. Conversely, if your credit score is in good shape, a Fannie Mae loan may be a better option as it could provide a lower interest rate. Another critical factor is the resources you have for a down payment. FHA loans offer lower down payment requirements, which could be a deciding factor for first-time homebuyers or those with limited savings. On the other hand, while Fannie Mae loans often require a higher down payment, their flexible options might still make them an attractive choice for certain borrowers. First-time homebuyers have unique needs and should consider their circumstances carefully. FHA loans have historically been a popular choice for first-time homebuyers due to their more lenient requirements and lower down payments. However, Fannie Mae's HomeReady program offers attractive options to first-time buyers with low-to-moderate incomes. Both Fannie Mae and FHA loans offer distinct advantages and cater to different borrower needs. FHA loans, with their low down payment and more lenient credit requirements, provide an excellent path to homeownership for those with lower credit scores or limited funds. Meanwhile, Fannie Mae loans offer attractive interest rates, higher loan limits, and flexible credit requirements, making them a suitable choice for those with stable income and good credit. The choice between the two largely depends on individual circumstances, such as credit score, down payment resources, and the specific needs of the borrower. Remember, it's always advisable to consider various loan options, consult with professionals, and analyze personal financial health before making a decision. In the end, both loan types aim to facilitate homeownership and contribute positively to individual financial growth and the overall housing market.Fannie Mae vs FHA Loan: Overview

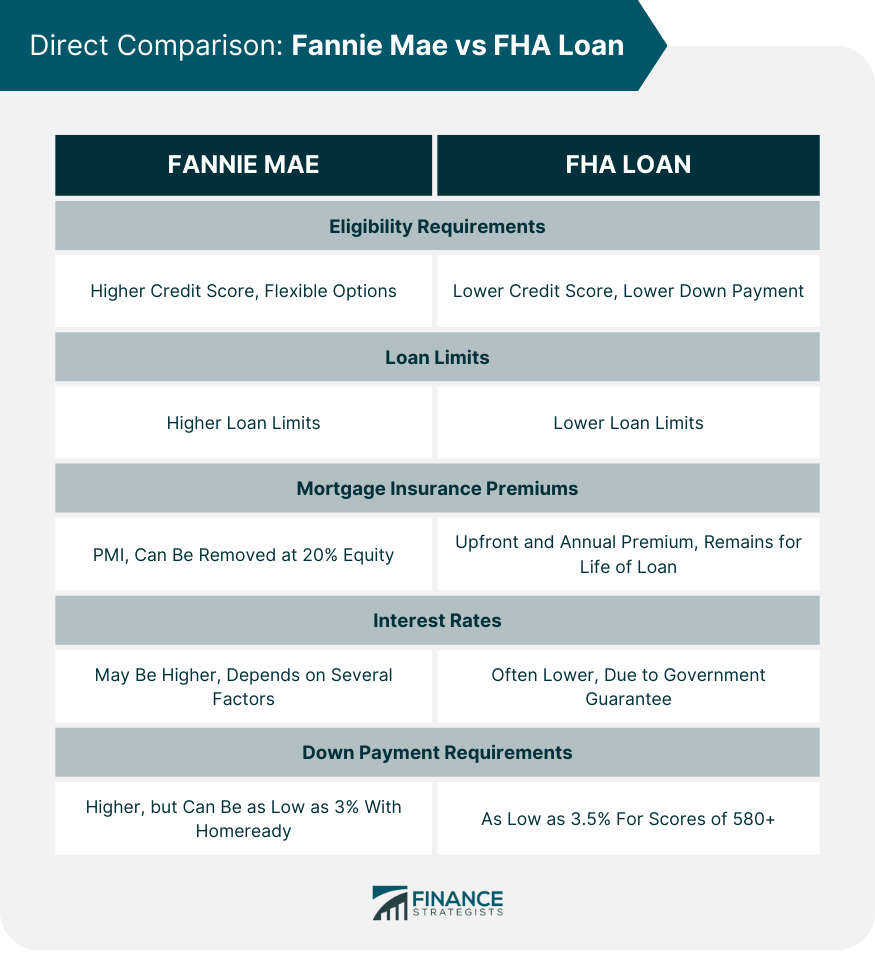

Direct Comparison: Fannie Mae vs FHA Loan

Eligibility Requirements

Loan Limits

Mortgage Insurance Premiums

Interest Rates

Down Payment Requirements

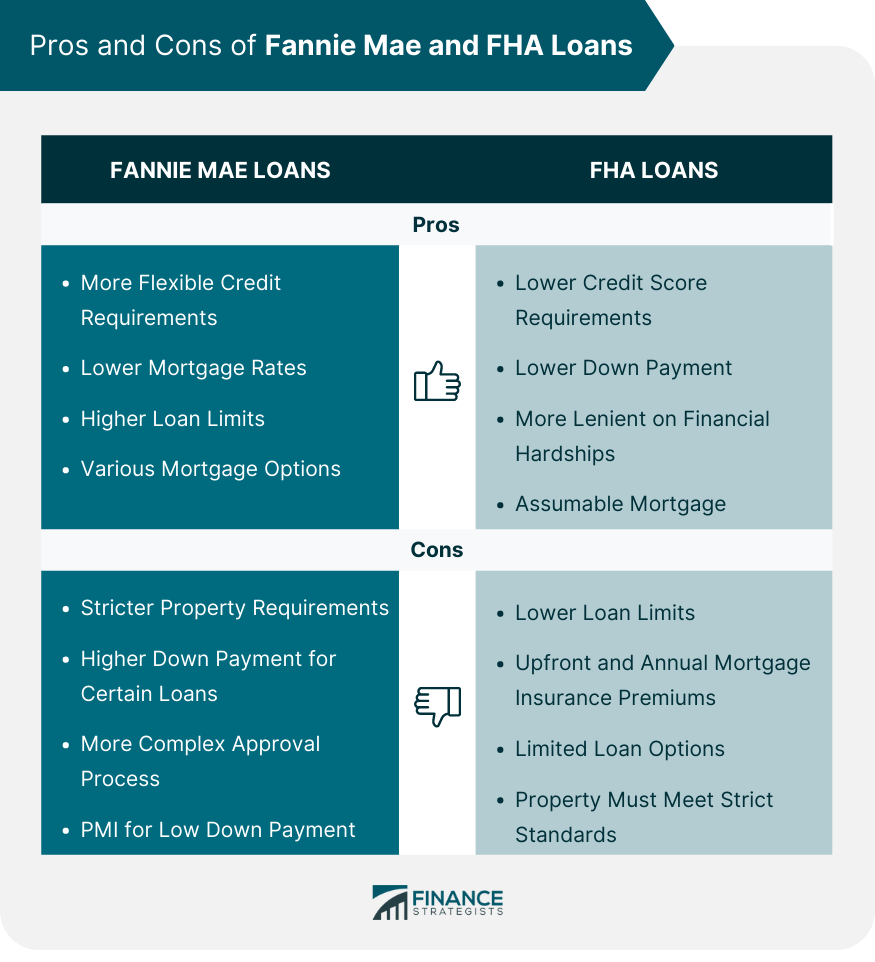

Pros and Cons of Fannie Mae Loans

Benefits of Choosing Fannie Mae Loans

More Flexible Credit Requirements

Lower Mortgage Rates

Higher Loan Limits

Various Mortgage Options

Drawbacks of Fannie Mae Loans

Stricter Property Requirements

Higher Down Payment for Certain Loans

More Complex Approval Process

Private Mortgage Insurance (PMI) for Low Down Payment

Pros and Cons of FHA Loans

Benefits of Choosing FHA Loans

Lower Credit Score Requirements

Lower Down Payment

More Lenient on Financial Hardships

Assumable Mortgage

Drawbacks of FHA Loans

Lower Loan Limits

Upfront and Annual Mortgage Insurance Premiums

Limited Loan Options

Property Must Meet Strict Standards

Practical Considerations When Choosing Between Fannie Mae and FHA Loans

Credit Score Requirements

Down Payment Resources

Considerations for First-Time Home Buyers

Bottom Line

Fannie Mae vs FHA Loan FAQs

Fannie Mae loans offer flexible credit requirements, lower mortgage rates, higher loan limits, and a variety of mortgage options.

FHA loans come with lower loan limits, upfront and annual mortgage insurance premiums, limited loan options, and strict property standards.

FHA loans are more forgiving with lower credit scores, while Fannie Mae loans require a better credit score but can offer lower interest rates.

FHA loans have lower down payment and credit score requirements, making them accessible for first-time buyers. Fannie Mae's HomeReady program is also tailored for low-to-moderate income first-time homebuyers.

FHA loans require as low as a 3.5% down payment, while Fannie Mae loans can require a higher down payment, but some programs allow down payments as low as 3%.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.