Fannie Mae's declining bonus income refers to a specific policy within Fannie Mae's mortgage lending guidelines that focuses on the pattern of a borrower's bonus income over time. If there is a noticeable decline in this bonus income, it could influence a borrower's eligibility for a mortgage loan. The purpose of scrutinizing declining bonus income is to assess the stability and reliability of a borrower's total income. Bonus income often forms a part of the borrower's total earnings, and a consistent reduction could indicate potential issues with employment stability or financial health. By examining this trend, Fannie Mae and lenders can make informed decisions about loan qualifications, ensuring responsible lending practices that align with broader financial stability goals. This policy emphasizes fairness and transparency in the lending process, protecting both lenders and borrowers. Declining bonus income is a significant challenge for borrowers seeking mortgage loans under Fannie Mae's guidelines. Bonus income often forms a part of a borrower's total income, and a consistent pattern of decline can raise concerns for lenders. Understanding this pattern is vital, as it affects loan eligibility and the borrower's capacity to repay. The issue arises when there is a noticeable downward trend in bonus income over several years. Lenders must scrutinize this trend, as it can indicate potential instability in the borrower's financial situation. It could be a result of changes within the borrower's company, the industry, or broader economic conditions. Fannie Mae's policies require close attention to these patterns to ensure the borrower's financial soundness. Fannie Mae has specific rules about declining bonus income, providing clear guidelines for how lenders should handle this situation. If a borrower's bonus income shows a decrease over recent years, the lender must exercise caution. In some cases, they may exclude the bonus income from the qualification altogether. These guidelines are in place to protect both the lender and the borrower. A consistent decline in bonus income may signal an underlying issue with the borrower's employment stability or financial health. By adhering to Fannie Mae's guidelines, lenders can reduce the risk of default, promoting responsible lending practices. The effect of declining bonus income on loan qualification can be significant. If bonus income is a large part of the borrower's total income, then excluding it due to a declining trend can lead to a lower qualification amount or even disqualification from a specific loan product. There may be exceptions and workarounds, such as providing additional documentation or seeking alternative loan products. However, this often requires more effort and documentation from the borrower, potentially leading to delays or higher costs. Fluctuations in bonus income over time are not uncommon and often reflect broader economic trends. Economic expansion might see a rise in bonus payouts, while economic downturns could lead to reductions. Industry-specific factors can also play a role, with certain sectors experiencing more significant changes in bonus income. Understanding these fluctuations requires an in-depth analysis of both macroeconomic conditions and individual employment scenarios. Lenders must be cognizant of these trends and how they may impact a borrower's bonus income. Changes in Fannie Mae's policies over time reflect adjustments to economic trends and conditions. When the economy is strong and bonus incomes are rising, the guidelines may become more flexible. Conversely, during economic downturns, the policies may tighten to reflect increased risk. Fannie Mae's guidelines aim to ensure that mortgage lending remains responsible and sustainable. Aligning with broader economic trends helps Fannie Mae to adapt to changing conditions, maintaining a balance between accessibility to loans and risk management. Fannie Mae's policy on declining bonus income aligns with federal regulations to ensure legal compliance. The guidelines are designed to promote responsible lending and protect consumer interests in accordance with federal laws. Lenders must adhere to these guidelines, as failure to comply could result in legal penalties. The alignment of Fannie Mae's policies with federal regulations ensures a consistent approach across the industry, promoting fair lending practices. There may be legal challenges from borrowers affected by Fannie Mae's policy on declining bonus income. If a borrower feels that they have been unfairly denied a loan or given unfavorable terms, they may seek legal recourse. This emphasizes the need for clear communication between lenders and borrowers and careful adherence to guidelines. Understanding and correctly applying Fannie Mae's policy can mitigate potential legal issues, supporting a transparent and fair lending process. Strategies to manage declining bonus income include thorough analysis and clear communication with borrowers. Lenders must train their loan officers to recognize patterns of declining bonus income and understand Fannie Mae's guidelines. Providing tools to accurately assess and document declining bonus income will aid in the decision-making process. Transparent communication with borrowers about the impact of declining bonus income and potential alternatives ensures a fair and informed lending process. Education about the impact of declining bonus income is essential for borrowers. Understanding how it can affect loan qualification helps borrowers to plan and make informed decisions. If faced with this situation, seeking professional guidance and exploring alternative loan products may provide solutions. Borrowers should be proactive in discussing bonus income with lenders and provide all necessary documentation to support their applications. Collaboration between lenders and borrowers can ease the process, allowing for a more favorable outcome. Fannie Mae's policy on declining bonus income serves as a vital measure in the mortgage lending process, emphasizing a balanced approach that protects both lenders and borrowers. It reflects an understanding of economic fluctuations and industry trends while aligning with federal regulations. The policy requires lenders to carefully evaluate and document declining bonus income, which can significantly impact loan qualifications. Meanwhile, it necessitates transparency and collaboration between borrowers and lenders. By following these guidelines, lenders foster responsible lending practices that resonate with broader financial stability goals, and borrowers are equipped to make informed decisions. Overall, this policy symbolizes an essential aspect of the mortgage lending landscape, intricately connecting financial scrutiny, legal compliance, and consumer protection.Fannie Mae Declining Bonus Income Overview

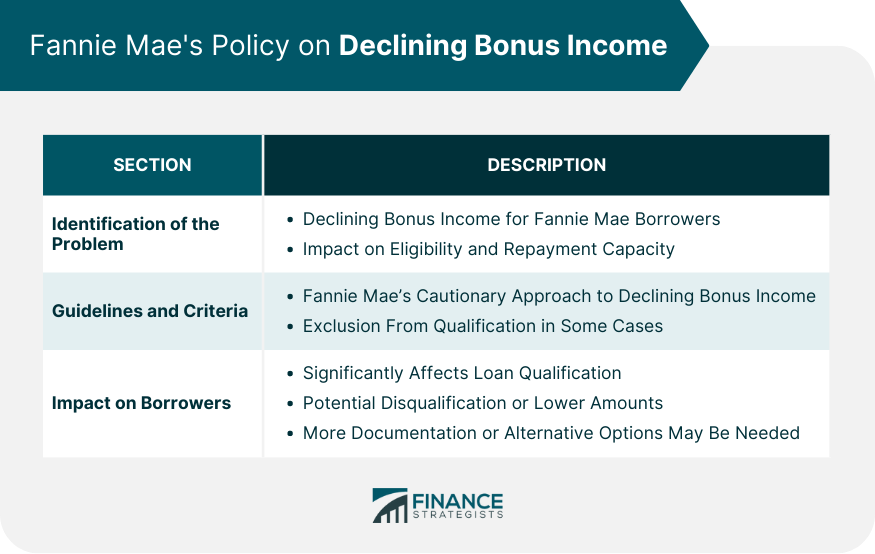

Fannie Mae's Policy on Declining Bonus Income

Identification of the Problem

Guidelines and Criteria

Impact on Borrowers

Fannie Mae Historical Context of Declining Bonus Income

Trends in Bonus Income

Fannie Mae's Response to Economic Conditions

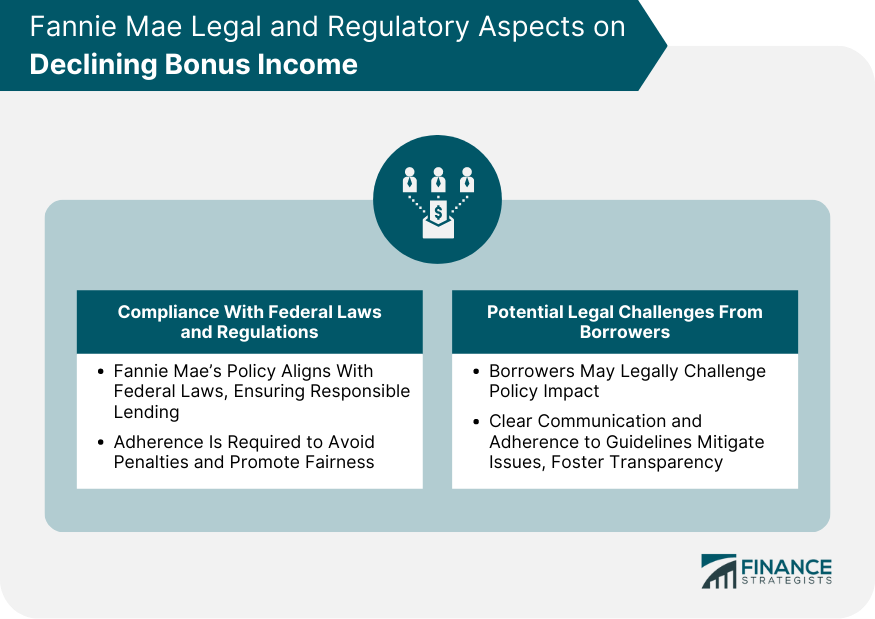

Fannie Mae Legal and Regulatory Aspects on Declining Bonus Income

Compliance With Federal Laws and Regulations

Potential Legal Challenges From Borrowers

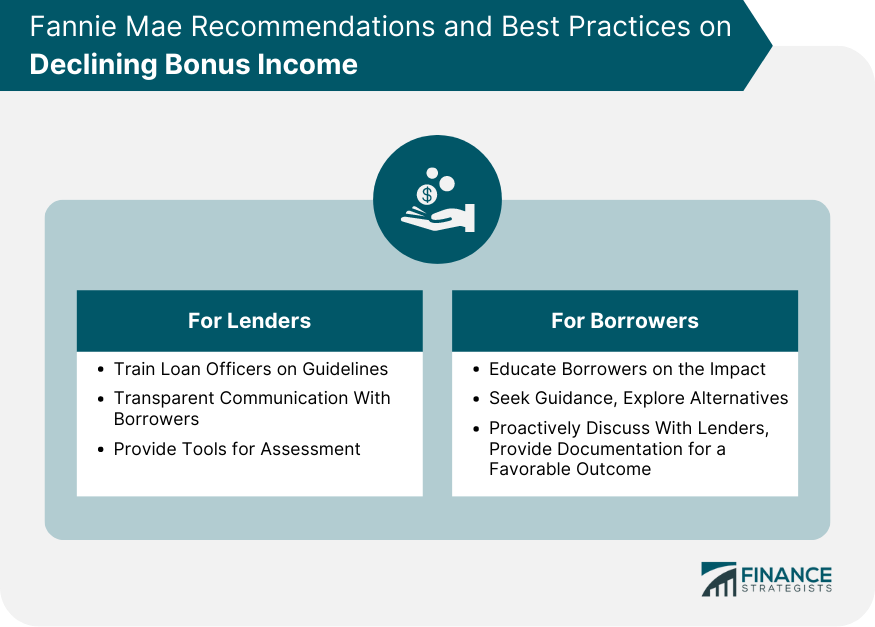

Fannie Mae Recommendations and Best Practices on Declining Bonus Income

For Lenders

For Borrowers

Bottom Line

Fannie Mae Declining Bonus Income FAQs

Fannie Mae's policy requires lenders to scrutinize any noticeable downward trend in a borrower's bonus income over several years. If there's a consistent decline, lenders may exclude the bonus income from loan qualification. This policy is vital to ensure financial soundness, reduce the risk of default, and promote responsible lending practices.

Declining bonus income can have a significant impact on loan eligibility. If bonus income forms a considerable part of the borrower's total income, excluding it can lead to a lower qualification amount or even disqualification. However, exceptions and workarounds might be available with additional documentation.

Lenders should implement strategies that include thorough analysis, clear communication with borrowers, and adherence to Fannie Mae's guidelines. They must also provide training and tools to loan officers to recognize and document declining bonus income patterns accurately, ensuring fair and informed lending practices.

Fannie Mae's policy on declining bonus income aligns with federal laws to promote responsible lending and protect consumer interests. Failure to comply with these guidelines could lead to legal penalties, emphasizing the importance of consistency across the industry and alignment with federal regulations.

Borrowers should understand the impact of declining bonus income on loan qualification and be proactive in discussing it with lenders. They may need to provide additional documentation or explore alternative loan products. Education and collaboration with lenders are key to navigating this situation successfully.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.