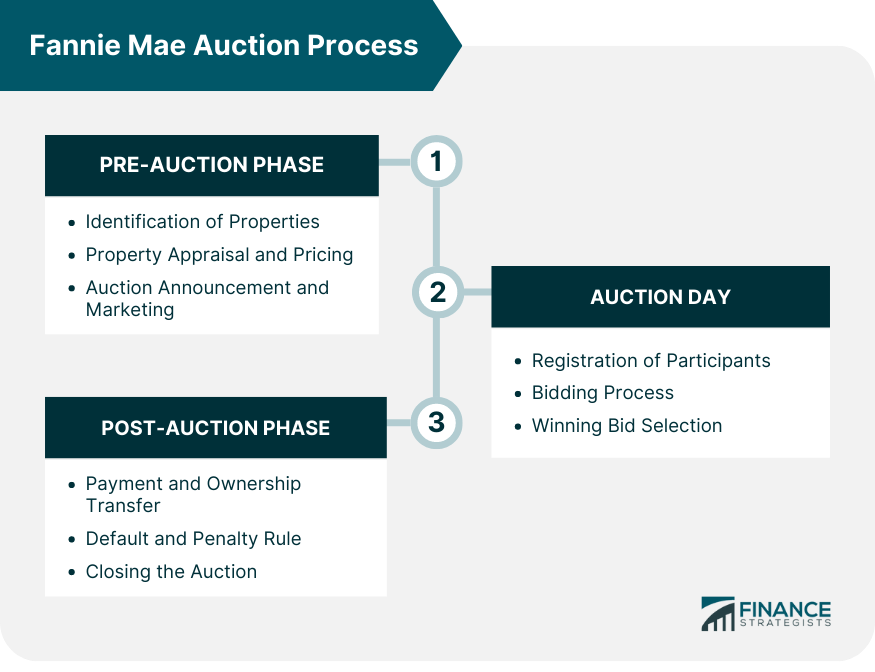

Fannie Mae's auction process involves the sale of real estate-owned (REO) properties—homes that have been foreclosed upon and are now owned by the agency. These auctions aim to mitigate losses by recovering as much of the outstanding loan balance as possible while also expediting the removal of these properties from Fannie Mae's balance sheet. The participants in Fannie Mae's auctions include individual buyers, real estate investors, and institutions. All participants are required to comply with auction policies and requirements. This includes proving that they have the financial means to purchase the property. Fannie Mae typically holds these auctions regularly, depending on the volume of foreclosed properties it currently holds. The auctions can be regional or national, depending on the properties on offer, and they can involve a few homes or several hundred at a time. The first step in Fannie Mae's auction process involves identifying which properties will be auctioned. This includes REO properties that have gone through the foreclosure process and are now fully under Fannie Mae's control. These homes are typically ones where the mortgage was backed by Fannie Mae, and the borrower, defaulted on the loan. Before a property can be auctioned, it must be appraised to determine its market value. This appraisal considers factors like the home's condition, location, and local market trends. Fannie Mae sets a reserve price, which is the minimum amount it will accept for the property at auction. Once the properties have been selected and priced, Fannie Mae announces the auction. It utilizes various channels to advertise these auctions, including its website, real estate sites, local newspapers, and direct mail. On the day of the auction, participants must register and provide proof of their ability to pay, usually in the form of a cashier's check or certified funds. There might be some eligibility requirements to participate in the auction. During the auction, participants place bids on the properties they're interested in. Bidding can be competitive, particularly for properties in desirable locations. The auctioneer oversees the process to ensure it runs smoothly and fairly. The property is awarded to the highest bidder above the reserve price. If no bids meet the reserve price, Fannie Mae has the right to remove the property from the auction or negotiate a sale with the highest bidder. After the auction, the winning bidder makes the payment, and Fannie Mae transfers ownership of the property. The time frame for this process can vary, but it usually occurs shortly after the auction. If the winning bidder defaults on the payment, they may forfeit their deposit, and the property may be offered to the next highest bidder or re-auctioned. Fannie Mae has strict rules about defaults to discourage non-serious bidders. After all payments have been received and property ownership has been transferred, the auction is officially closed. Fannie Mae will then prepare for future auctions. In some cases, Fannie Mae holds bulk auctions, selling large numbers of properties in a single transaction, often to institutional investors. These bulk auctions are usually aimed at quickly reducing the number of REO properties on Fannie Mae's books. Fannie Mae also conducts online auctions, allowing bidders from around the country (or even the world) to participate. These online auctions follow similar rules to live auctions but are conducted on a designated website over a specific time period. Live auctions are held in person and provide participants with the opportunity to inspect the properties before bidding. These auctions are often conducted by a professional auctioneer and follow a set schedule. By selling REO properties, Fannie Mae helps to stabilize neighborhoods and housing markets. These auctions can contribute to reducing the number of vacant homes in an area and can provide opportunities for homeownership to individuals who might otherwise be priced out of the market. Auctions help manage foreclosure rates by offering a platform to dispose of foreclosed properties quickly and efficiently. This can help to maintain the health of the overall housing market and minimize the impact of foreclosures on local property values. Through these auctions, Fannie Mae can also contribute to community development. Buyers often improve and occupy the properties they purchase, leading to neighborhood revitalization. In some cases, Fannie Mae offers special programs or incentives to encourage buyers to invest in hard-hit communities. There have been criticisms of Fannie Mae's auction process, particularly concerning transparency and fairness. Some critics argue that the auctions favor large institutional buyers over individuals or that the bidding process is not transparent enough. There are also concerns about the impact on homeowners and renters. When properties are bought in bulk by investors, this can lead to increased rents or the displacement of existing tenants. Fannie Mae has faced legal and regulatory challenges related to its handling of foreclosed properties. Some of these challenges include accusations of inadequate maintenance of REO properties or discriminatory practices in the management and sale of these homes. Fannie Mae's auction process plays a pivotal role in the housing market by selling REO properties swiftly and effectively. This not only helps in mitigating financial losses but also supports community revitalization by offering homeownership opportunities to individuals. The process encompasses the identification and pricing of properties, auction announcement, bidding, and finally, payment and ownership transfer. Despite its significance, the process has faced criticisms for favoring institutional buyers and potential adverse effects on homeowners and renters. Fannie Mae has made strides to address these issues and improve auction procedures through innovations like online and bulk auctions. Nonetheless, ensuring a fair, transparent, and inclusive auction process that balances the interests of all stakeholders continues to be a pressing concern. Moving forward, Fannie Mae is likely to continue refining its auction process in response to these challenges, contributing to a more equitable housing market.Fannie Mae Auction Process: Overview

Fannie Mae Pre-auction Phase

Identification of Properties for Auction

Property Appraisal and Pricing

Auction Announcement and Marketing

Fannie Mae Auction Day

Registration of Participants

Bidding Process

Winning Bid Selection

Fannie Mae Post-auction Phase

Payment and Ownership Transfer

Default and Penalty Rules

Closing the Auction

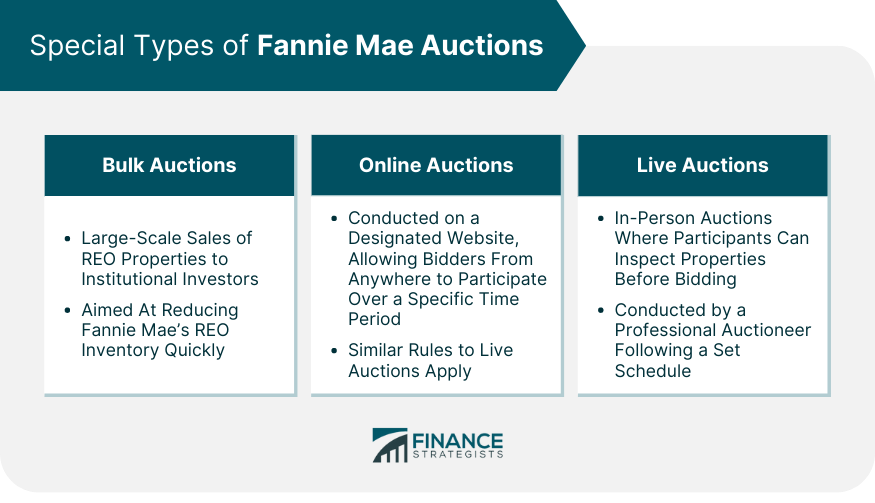

Special Types of Fannie Mae Auctions

Bulk Auctions

Online Auctions

Live Auctions

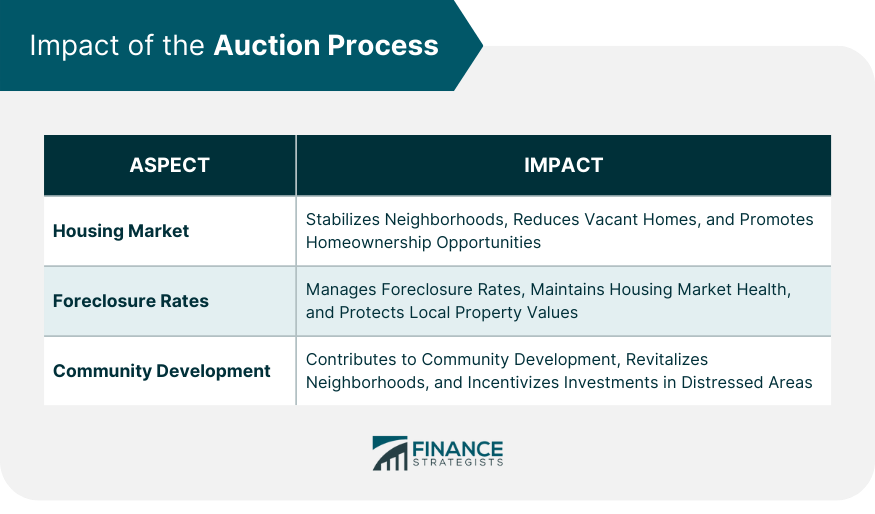

Impact of Fannie Mae Auction Process

Housing Market

Foreclosure Rates

Community Development

Controversies and Criticisms of Fannie Mae Auctions

Issues of Transparency and Fairness

Impact on Homeowners and Renters

Legal and Regulatory Challenges

Bottom Line

Fannie Mae Auction Process FAQs

The primary purpose of Fannie Mae's auction process is to sell real estate-owned (REO) properties—homes that have been foreclosed upon and are now owned by Fannie Mae. These auctions aim to mitigate losses by recovering as much of the outstanding loan balance as possible while also expediting the removal of these properties from Fannie Mae's balance sheet.

Both individual buyers and institutional investors can participate in Fannie Mae's auctions. All participants must comply with auction policies and requirements, including providing proof of their ability to pay for the property.

Before a property can be auctioned, it must be appraised to determine its market value. This appraisal considers the home's condition, location, and local market trends. Fannie Mae sets a reserve price, which is the minimum amount it will accept for the property at auction.

If the winning bidder defaults on the payment, they may forfeit their deposit, and the property may be offered to the next highest bidder or re-auctioned. Fannie Mae has strict rules about defaults to discourage non-serious bidders.

Some critics argue that Fannie Mae's auctions lack transparency and fairness, often favoring large institutional buyers over individuals. There are also concerns about the impact on homeowners and renters, particularly when properties are bought in bulk by investors. Moreover, Fannie Mae has faced legal and regulatory challenges related to its handling of foreclosed properties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.