A lottery annuity is a method of receiving winnings from a lottery jackpot. When a player wins a lottery, they are typically given two options on how to receive their winnings: as a lump sum or an annuity. Choosing the annuity option means the lottery winner receives their prize money in a series of payments over time rather than all at once. The specifics can vary, but typically, an initial payment is made immediately after the win, followed by annual payments for a set number of years. Annuity payments are generally fixed and guaranteed, providing a steady and predictable income stream for the winner over the payout period. The lottery organization or an associated insurance company manages the investment of the winnings to generate this revenue stream. When a lottery winner opts for an annuity, the lottery organization typically invests the bulk of the winnings into various safe, interest-generating securities, such as government bonds. This investment is designed to guarantee the winner's annual payouts over the chosen annuity term, often spanning 20 to 30 years. An initial payment is usually made immediately, followed by subsequent yearly payments until the full amount is disbursed. The specific duration and frequency of payments can vary based on the lottery organization's rules and the winner's preferences. However, annuity payments are generally made annually and spread over a fixed period. For instance, some lottery organizations stipulate a 30-year payout period, where the winner will receive 30 payments over 29 years, with the first payment made immediately after the win. Often, an insurance company manages the annuity on behalf of the lottery organization. This company is responsible for investing the lump-sum amount to generate the required returns that will meet the yearly payout amounts. The insurance company guarantees the payments, providing security to the winner that they will receive their promised funds. This arrangement also reduces the administrative burden on the lottery organization, as the insurance company handles the ongoing payment management. The annuity payments are usually consistent from year to year, offering predictability for the winner's financial planning. However, some lotteries offer graduated annuities, where payments increase annually, often by a percentage defined in the lottery rules. The type of annuity available may affect a winner's decision on whether to opt for an annuity or a lump sum. Choosing a lottery annuity creates a consistent income stream over an extended period. This reliable, long-term income provides winners with the financial stability they might not otherwise have, especially if they have few other substantial income sources. The ability to rely on this money for the next few decades can reduce stress and provide peace of mind, allowing winners to plan their future without the anxiety of depleting their resources too quickly. When you opt for an annuity, the tax is paid incrementally on each annual payout rather than in one lump sum. This approach can reduce the overall tax burden, as the yearly income may fall into a lower tax bracket compared to the lump sum, which could push the winner into the highest tax bracket immediately. Annuity payments, by virtue of their frequency and smaller amounts, provide a more tax-efficient way of receiving lottery winnings. Winning the lottery is a life-changing event, and having access to a large amount of money all at once can lead to impulsive decisions and overspending. By opting for an annuity, winners are protected from the temptation to spend recklessly or make poor investments. The annual payments act as a built-in budgeting tool, limiting the amount available to spend each year and reducing the risk of squandering the winnings. Receiving yearly payments can help winners manage their finances more effectively. It simplifies budgeting, as winners know the exact amount they will receive each year, and allows them to plan major expenses accordingly. This structure provides an opportunity to plan for long-term financial goals and major life events, such as buying a house, funding children's education, or planning for retirement. In some cases, the total payout received through an annuity can exceed the amount that would have been received as a lump sum. This difference is primarily due to tax advantages. When winners choose a lump sum, they receive only a portion of the total jackpot, with the rest being taken out for taxes. With an annuity, however, winners can end up receiving closer to the full amount of the jackpot over the lifetime of the annuity, due to the incremental tax payments. Over the years, the purchasing power of money decreases due to inflation. Given that annuity payments remain fixed, their real value—what they can actually buy—erodes over time. Therefore, the final payment of the annuity might have significantly less purchasing power than the first payment, effectively reducing the wealth of the lottery winner in real terms. When a winner chooses a lottery annuity, they do not get immediate access to their entire winnings. This could prove problematic if the winner has urgent, large-scale financial needs that require more than the annual annuity payments. Furthermore, life circumstances can change rapidly, and a need for funds could arise unexpectedly, at which point the staggered nature of annuity payments might feel restrictive. With a large lump sum, winners could invest in opportunities with higher returns than those provided by the conservative, low-risk investments typically associated with annuities. These could include real estate, stocks, or starting a business. However, these potential opportunities require financial acumen and a willingness to accept a higher level of risk. Though exceedingly rare, there is a risk that the insurance company or financial institution managing the annuity could go bankrupt, potentially affecting the payout of future annuity installments. While there are state guaranty associations that protect annuity holders in such cases, the coverage limits may not cover the entire amount of a substantial lottery win. The payment of lottery annuities is spread out over many years, often decades. If the lottery winner passes away before the end of the payout schedule, they might not fully benefit from their winnings. While some arrangements allow for the remaining payments to be made to the winner's estate or beneficiaries, this isn't always the case. It's essential for potential winners to understand the specifics of their lottery's annuity terms before making their decision. When a lottery annuity holder passes away before the entirety of their payouts have been distributed, the financial implications can be multifaceted. The remaining annuity installments don't simply vanish; instead, they typically become integrated into the deceased's estate. This means they are subject to the rules of estate distribution and succession. The direction of these payouts is then guided by the stipulations of the decedent's will if one has been established. If the deceased did not have a will in place, the distribution of the remaining annuity payments is governed by the intestacy laws of their state of residence. This process can sometimes lead to unexpected outcomes, and may not reflect the deceased's personal preferences for distribution, highlighting the importance of having a well-structured will in place. Inheriting annuity payments may initially seem like a windfall for the heirs and beneficiaries of the deceased lottery winner, but this event can also present significant challenges. One of the most immediate impacts is the potential tax implications. As inheritors of these annuity payments, heirs and beneficiaries could face a considerable tax burden. The annuity payments, much like any other form of income, are taxable. Inheritors need to understand these potential tax obligations to adequately prepare and avoid any unexpected financial strain. In addition, there is the process of probate to consider. Probate is the legal procedure for validating a will and distributing an estate under court supervision. It can be a complex and time-consuming process, often taking months or even years to fully resolve. Navigating this process while also handling the emotional impact of a loved one's passing can be particularly challenging. The legal landscape surrounding the distribution of remaining annuity payments after a lottery winner's death can be challenging to navigate. The complexity is amplified by factors such as the size of the estate, the presence (or lack) of a legally valid will, and the specific legal requirements of the decedent's state of residence. For instance, some states have estate or inheritance taxes that could significantly impact the total amount beneficiaries receive. Also, the specific terms of the annuity could potentially pose issues, especially if it contains clauses that complicate or restrict the transfer to heirs. It is strongly advisable for lottery winners to engage the services of an experienced estate planning attorney. Such a professional can provide valuable guidance to ensure the lottery winner's intentions are accurately represented in their estate plans, and potential legal or financial obstacles are effectively managed. One direct alternative to the lottery annuity is choosing the lump sum payment option. It provides immediate access to all the lottery winnings at once. It can be particularly useful for those with pressing financial needs, such as paying off existing debts or investing in significant opportunities like a business venture or real estate. Nonetheless, this option also comes with its own set of challenges. The lump sum is typically a reduced amount due to tax implications, and having a large amount of money all at once can lead to impulsive spending or poor investment choices without careful planning and discipline. While a lottery annuity is one form of structured payout, several other types of annuities can serve as alternative investment vehicles. For instance, fixed annuities provide a guaranteed fixed return over a specified period, regardless of market conditions, thus providing stability and predictability. Variable annuities, on the other hand, allow for potentially higher returns by investing in market securities. However, they also carry higher risk as the returns depend on the performance of the chosen investments. Another type is indexed annuities, where returns are tied to a specific market index, offering a blend of risk and potential returns. Each of these alternatives offers unique advantages and disadvantages, so understanding their characteristics is crucial before making a choice. For lottery winners who are knowledgeable about financial markets and comfortable with risk, investing a lump sum payout can be a profitable alternative to a lottery annuity. This approach requires a deep understanding of investment principles and a well-thought-out strategy. Options might include investing in the stock market, real estate, bonds, mutual funds, or even starting a business. A diversified portfolio can help balance risk and return, and potentially provide a higher overall return in the long run compared to the annuity payments. However, this approach requires not only financial acumen but also the emotional discipline to handle potential market downturns and investment losses. A lottery annuity offers winners the option of receiving their jackpot money through a series of payments over time. Opting for a lottery annuity provides several advantages, including a guaranteed income stream and reduced tax burden. It promotes financial stability, protects against overspending, and enables long-term financial planning. In some cases, the total payout through an annuity can exceed the amount received as a lump sum. However, drawbacks include inflation risk, limited immediate access to funds, missed investment opportunities, the possibility of default by the managing institution, and longevity risk if the winner passes away before the full payout. Estate planning aspects add complexity, as the distribution of remaining annuity payments after the winner's death depends on estate laws and the presence of a valid will. Heirs and beneficiaries may face tax implications and navigate the probate process. Alternative options to a lottery annuity include choosing the lump sum payment option or exploring different types of annuities. Investing the lump sum requires financial expertise and discipline. Ultimately, the decision between a lottery annuity and other options depends on individual circumstances, financial goals, and risk tolerance, with careful consideration and professional guidance being crucial.What Is a Lottery Annuity?

How a Lottery Annuity Works

Basic Mechanics

Duration and Frequency of Payments

Role of the Insurance Company

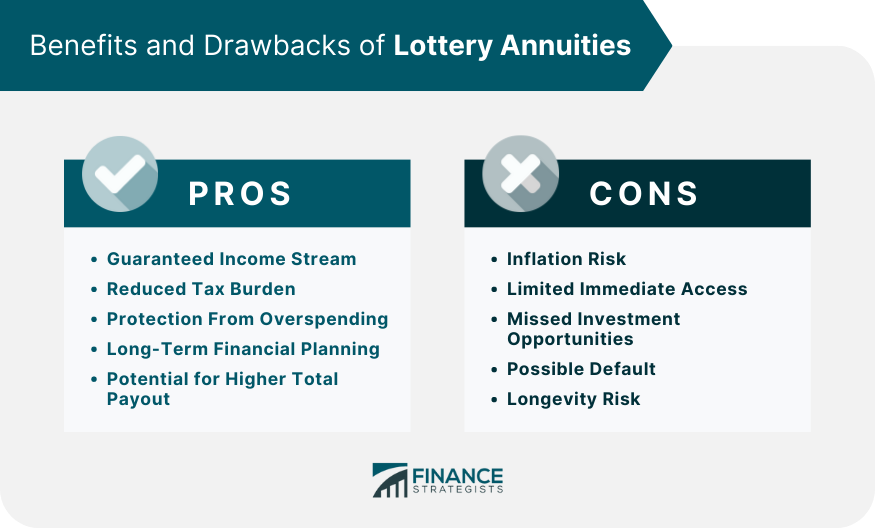

Benefits of Lottery Annuities

Guaranteed Income Stream

Reduced Tax Burden

Protection From Overspending

Long-Term Financial Planning

Potential for Higher Total Payout

Drawbacks of Lottery Annuities

Inflation Risk

Limited Immediate Access

Missed Investment Opportunities

Possible Default

Longevity Risk

Estate Planning Aspects of a Lottery Annuity

Succession of Annuity Payments

Consequences for Heirs and Beneficiaries

Legal Factors and Potential Obstacles

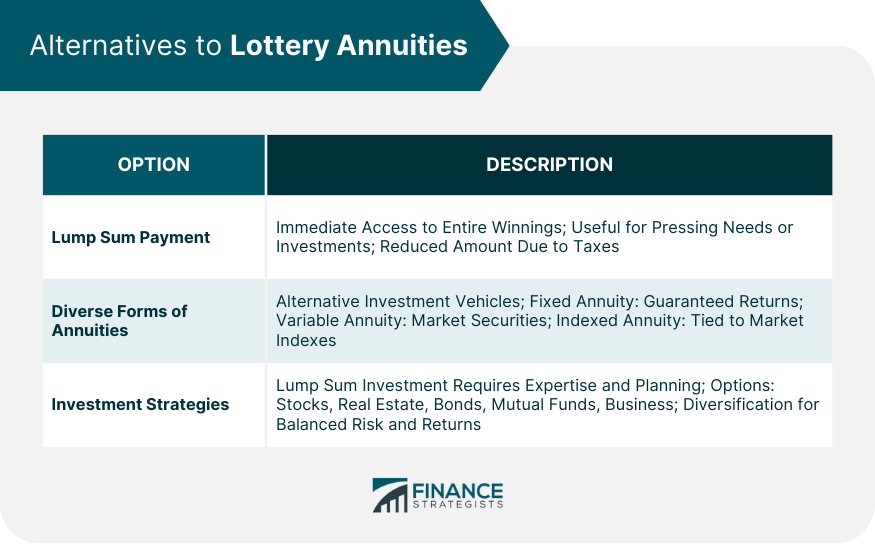

Alternatives to Lottery Annuities

Lump Sum Payment Option

Diverse Forms of Annuities

Investment Strategies for Lottery Winnings

Final Thoughts

Lottery Annuity FAQs

A lottery annuity is a method of receiving lottery winnings through a series of payments over time, rather than as a lump sum.

The lottery organization or an associated insurance company invests the winnings to generate a steady income stream to fund the annuity payments.

Annuity payments are generally fixed, providing a predictable income stream over the payout period. However, some lotteries offer graduated annuities with annual payment increases.

Opting for a lottery annuity provides a guaranteed income stream, reduces the tax burden, protects against overspending, and promotes long-term financial planning.

Yes, potential drawbacks include inflation risk, limited immediate access to funds, missed investment opportunities, the possibility of default by the managing institution, and longevity risk if the winner passes away before the full payout.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.