Equity crowdfunding is a method of raising capital for startups and small businesses by offering equity shares to the general public. Through this approach, investors can acquire ownership in a company in exchange for their financial contributions. Equity crowdfunding allows investors to benefit from the potential growth and success of the company. While both equity and traditional crowdfunding rely on the collective financial support of individuals, the primary difference lies in the benefits received by investors. In traditional crowdfunding, backers are typically offered non-monetary rewards, such as products or experiences. In equity crowdfunding, however, investors receive ownership stakes in the company and stand to benefit from its growth and future success. Equity crowdfunding has emerged as a crucial funding avenue for startups, bridging the gap between traditional venture capital and other financing methods. This approach democratizes investment opportunities, allowing a wider range of investors to participate in the startup ecosystem and contribute to economic growth. Equity crowdfunding is regulated by various laws and guidelines to protect investors and ensure fair practices: The JOBS Act, signed into law in 2012, enables small businesses to raise capital through equity crowdfunding. The act includes provisions such as investor limitations, disclosure requirements, and funding caps to protect both investors and businesses. The FCA regulates equity crowdfunding in the UK by setting guidelines for platform operations, investor protections, and financial promotions. Platforms must obtain authorization from the FCA to operate and adhere to strict due diligence and disclosure requirements. As equity crowdfunding gains global traction, countries worldwide are establishing regulatory frameworks to govern this emerging sector. These regulations vary by jurisdiction, with some countries adopting more lenient policies to foster innovation and others imposing stricter guidelines to protect investors. Regulations often include provisions to limit investor exposure and ensure that only suitable investors participate in equity crowdfunding. These provisions may include income, net worth, and investment caps. Investors are typically required to acknowledge the risks involved and may need to complete investor education materials. To participate in equity crowdfunding, startups must meet specific eligibility criteria, such as company size, annual revenue, and funding limits. They must also comply with ongoing reporting and disclosure requirements to maintain transparency and investor confidence. Several platforms facilitate equity crowdfunding by connecting startups with investors. Some of the most popular platforms include SeedInvest, Crowdcube, CircleUp, and StartEngine. SeedInvest is a leading equity crowdfunding platform in the United States, offering investment opportunities in vetted startups across various industries. Based in the UK, Crowdcube is a prominent platform that has facilitated over £1 billion in investments, supporting more than 1,000 startups since its inception. CircleUp is an equity crowdfunding platform focusing on consumer goods and retail companies, leveraging data and technology to identify promising investment opportunities. StartEngine is a US-based platform that has helped hundreds of startups raise capital, offering investors a diverse range of investment opportunities across industries. Equity crowdfunding platforms offer various features to support startups and investors, such as campaign management tools, investor communication channels, and due diligence processes. Platform fees may include setup costs, success fees, and ongoing maintenance fees. These fees vary depending on the platform and the scope of services provided. To protect investors and maintain platform credibility, equity crowdfunding platforms typically conduct thorough due diligence on the startups seeking funding. The vetting process may involve reviewing financial statements, assessing the management team, evaluating the business model, and verifying legal compliance. Only startups that meet the platform's stringent criteria are allowed to launch campaigns. Equity crowdfunding provides startups with an alternative funding source, allowing them to bypass traditional financing methods such as bank loans and venture capital. This approach can help startups access the capital they need to grow and scale their businesses. Investing in equity crowdfunding campaigns allows investors to diversify their portfolios by allocating funds to high-growth potential startups. This diversification can mitigate risk and potentially lead to higher returns. Equity crowdfunding democratizes investment opportunities by enabling a broader range of individuals to participate in the startup ecosystem. This accessibility fosters innovation and contributes to economic growth. Equity crowdfunding platforms facilitate communication between startups and investors, promoting a more engaged and informed investor base. This ongoing dialogue helps startups receive valuable feedback and insights, while investors stay updated on company progress. By providing startups with much-needed capital, equity crowdfunding can contribute to job creation and stimulate economic growth. Successful startups can generate employment opportunities and drive innovation across various industries. Investing in startups through equity crowdfunding carries inherent risks, such as startup failure rates, illiquidity, and dilution. Investors should be aware of these risks and make informed decisions when allocating funds to equity crowdfunding campaigns. A significant portion of startups fail within the first few years, which can result in a total loss of investment. Investors must recognize this risk when investing in early-stage companies. Equity crowdfunding investments are typically illiquid, meaning investors may not be able to easily sell their shares. Exit strategies, such as IPOs or acquisitions, can be uncertain and may take several years to materialize, if at all. Future funding rounds may dilute an investor's ownership percentage, potentially affecting the value of their investment. Investors should consider the potential for dilution when evaluating investment opportunities. Startups and investors must comply with various regulations governing equity crowdfunding to avoid legal repercussions. Failure to adhere to these requirements can result in fines, penalties, or even the suspension of crowdfunding campaigns. Platform-related risks include platform viability and sustainability, as well as data security and privacy concerns. Investors should evaluate the credibility and stability of the platform before participating in equity crowdfunding campaigns. A compelling pitch is essential to attract investors and secure funding. Startups should focus on showcasing their unique value proposition, target market, competitive advantages, and growth potential. Startups should set realistic valuations and funding targets to ensure a successful campaign. Overvaluing the company or setting unreachable funding goals can deter potential investors. Having a strong team and advisory board can boost investor confidence in the startup's ability to execute its business plan and achieve growth objectives. Investors should conduct thorough research on the startups they are considering investing in, evaluating factors such as the management team, business model, market potential, and financial projections. This research helps investors make informed decisions and mitigates the risks associated with equity crowdfunding investments. To minimize risk, investors should diversify their portfolios by investing in multiple startups across different industries and stages of development. This diversification strategy can potentially lead to higher returns and reduce the impact of individual startup failures. Investors should actively engage with the startups they invest in by attending shareholder meetings, providing feedback, and staying informed about company progress. Active engagement can help investors better understand the businesses they invest in and make more informed decisions regarding their investments. As equity crowdfunding continues to grow, new trends and innovations are expected to emerge. These may include the integration of blockchain technology, the rise of industry-specific platforms, and the development of secondary markets for trading equity crowdfunding shares. As the equity crowdfunding sector evolves, regulatory frameworks may be updated to address new challenges and ensure continued investor protection. Investors and startups should stay informed about regulatory changes and adapt their strategies accordingly. Equity crowdfunding is likely to become increasingly integrated with other funding methods, such as venture capital and peer-to-peer lending. Additionally, the convergence of financial technologies, like digital currencies and mobile payments, may further streamline the equity crowdfunding process and expand access to capital. As equity crowdfunding gains traction worldwide, startups and investors must navigate the challenges of international regulations and cross-border investments. However, the global expansion of equity crowdfunding also presents opportunities for startups to access a broader investor base and for investors to diversify their portfolios with international investments.What is Equity Crowdfunding?

Legal and Regulatory Framework of Equity Crowdfunding

Legislation and Guidelines

The JOBS Act (USA)

FCA Regulations (UK)

International Regulations

Investor Requirements and Limitations

Startup Eligibility for Equity Crowdfunding

Platforms and Services for Equity Crowdfunding

Overview of Popular Platforms

SeedInvest

Crowdcube

CircleUp

StartEngine

Platform Features and Fees

Due Diligence and Vetting Process

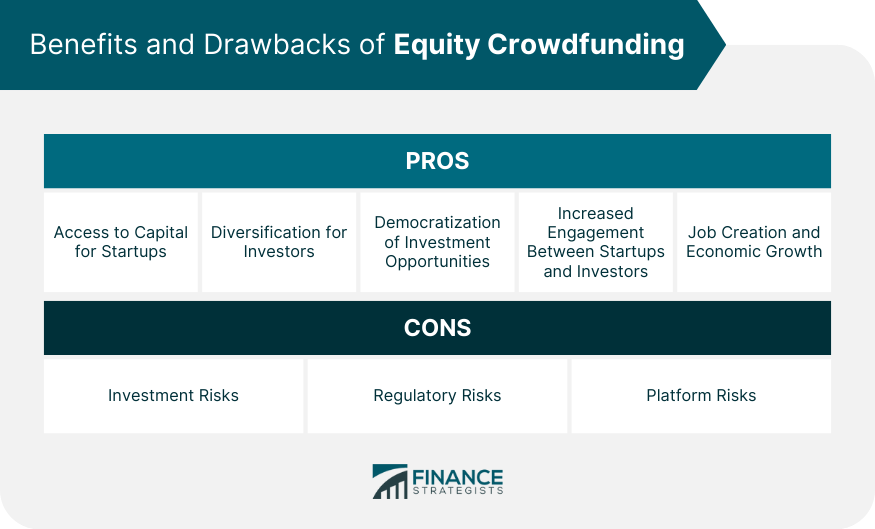

Benefits of Equity Crowdfunding

Access to Capital for Startups

Diversification for Investors

Democratization of Investment Opportunities

Increased Engagement Between Startups and Investors

Job Creation and Economic Growth

Risks and Challenges

Investment Risks

Startup Failure Rates

Illiquidity and Exit Strategies

Dilution

Regulatory Risks

Platform Risks

Best Practices for Startups and Investors

For Startups

Creating a Compelling Pitch

Setting Realistic Valuations and Funding Targets

Building a Strong Team and Advisory Board

For Investors

Conducting Thorough Research

Diversifying Investments

Actively Engaging With Startups

Final Thoughts

Emerging Trends and Innovations

Potential Regulatory Changes

Integration With Other Funding Methods and Financial Technologies

Challenges and Opportunities for Global Expansion

Equity Crowdfunding FAQs

Equity crowdfunding is a type of crowdfunding that allows individuals to invest in a company or project in exchange for equity, such as shares of stock.

Equity crowdfunding typically involves a company or project seeking to raise capital through a crowdfunding platform. Investors can then contribute funds to the campaign in exchange for equity in the company or project.

Equity crowdfunding provides several benefits for both investors and companies or projects. For investors, equity crowdfunding allows them to invest in early-stage companies and potentially receive significant returns on their investment. For companies or projects, equity crowdfunding can provide a source of funding that may be difficult to obtain through traditional financing methods.

As with any investment, equity crowdfunding carries risks. Investors may lose some or all of their investment if the company or project fails, and there may be a lack of liquidity for the shares. Companies or projects may also face risks such as dilution of ownership and regulatory compliance issues.

Some popular equity crowdfunding platforms include SeedInvest, Crowdcube, CircleUp, and StartEngine. Each platform has its own specific requirements and offerings, so it is important to research and compare options before investing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.