The term 'Dual Income, No Kids' or 'DINK' is a descriptor for couples who have decided to live a child-free lifestyle, focusing on their careers and themselves rather than raising a family. With changing societal norms and financial necessities, DINKs have become a growing demographic pattern. They represent a lifestyle choice that carries significant economic implications, reflecting a variety of social and economic trends. Cultural and societal changes over time have shaped the rise of DINK households. The concept of DINKs has evolved with changes in societal values, increased emphasis on higher education and careers, and changing economic conditions. In particular, a shift towards gender equality and increased participation of women in the workforce has contributed significantly to the DINK phenomenon. DINK households often have higher incomes than their single-income counterparts due to the combined earning power of both partners. However, this does not mean DINK households are free from income disparity. The gender pay gap persists, even in dual-income households, leading to variations in income contributions between partners. DINK couples typically have greater financial flexibility, resulting in different spending habits compared to families with children. They often invest in travel, hobbies, luxury goods, and experiences that enhance their quality of life. Similarly, their investment habits lean more towards high-risk, high-reward assets, given their comparatively higher disposable income and financial resilience. DINK households often enjoy tax advantages compared to single-income households with the same overall income. However, they also must navigate unique challenges in tax planning. They can use strategies like income splitting to reduce their overall tax liability. Without the financial responsibilities of raising children, DINK couples often have more resources to devote to retirement planning. However, without children to rely on for support in old age, planning for a secure retirement becomes even more critical. Despite the financial advantages, DINK households face specific economic challenges. Economic downturns can hit DINK households harder if both partners work in sectors affected by the downturn. Additionally, the cost of living and maintaining a certain lifestyle can also pose a challenge. There are societal pressures and prejudices that DINK couples often face. These pressures can range from the expectation of having children to balancing work and personal life. For some, there is a perceived lack of work-life balance due to the focus on careers. On the other hand, DINK households enjoy increased financial freedom and stability. This freedom often translates into opportunities for personal development, pursuing hobbies, and career advancement. DINK couples are often able to take on more professional risks, which can potentially lead to higher financial rewards. Navigating the financial landscape as a DINK household requires a nuanced approach that takes into consideration the unique opportunities and challenges this lifestyle presents. Financial planning is paramount for DINK households. With a potentially larger disposable income, it is crucial to have a structured plan to manage resources effectively. A well-crafted financial plan provides a roadmap for achieving financial goals, ensuring financial stability, and allowing the household to maintain or improve its lifestyle. A significant aspect of financial planning for DINK households is diversification. This not only includes diversifying investments across different asset classes such as stocks, bonds, real estate, and mutual funds but also diversifying income sources. Examples include side gigs, rental income, or starting a small business. Diversification helps reduce financial risk and enhance wealth creation. As a DINK household, it's essential to prioritize savings and retirement planning. Without children to potentially provide support in old age, laying a solid foundation for retirement is crucial. This could mean maximizing contributions to retirement accounts, investing in a diversified retirement portfolio, or exploring other retirement-saving options. Lastly, DINK households should ensure they have a robust contingency plan. This involves having adequate insurance coverage and building an emergency fund that can cover at least 3-6 months of living expenses. Insurance policies, such as health, life, and disability insurance, provide a safety net against unforeseen incidents, while an emergency fund offers a financial cushion during unexpected circumstances such as job loss or major home repairs. The number of DINK households is likely to increase in the future due to changing societal norms and economic conditions. This increase may be influenced by policy changes, such as tax laws, social security benefits, and employment regulations. As the economic landscape continues to change, it will undoubtedly impact the financial planning strategies of DINK households. The Dual Income, No Kids (DINK) lifestyle represents a growing demographic with distinctive financial traits and potential challenges. These households typically benefit from combined incomes, allowing for diversified spending, saving, and investment habits. They also have unique tax implications and retirement planning necessities. However, challenges persist, such as vulnerability to economic downturns, high living costs, and societal pressures related to childlessness. To effectively navigate these challenges and capitalize on their opportunities, DINK households must implement strategic financial planning, which includes income and investment diversification, robust retirement planning, and solid contingency measures like insurance and emergency funds. As societal norms and economic conditions evolve, the prevalence of DINK households is expected to rise, which might be influenced by future policy changes. Thus, understanding and adapting to the financial dynamics of this lifestyle is crucial for their sustained financial success.Definition of Dual Income, No Kids (DINK)

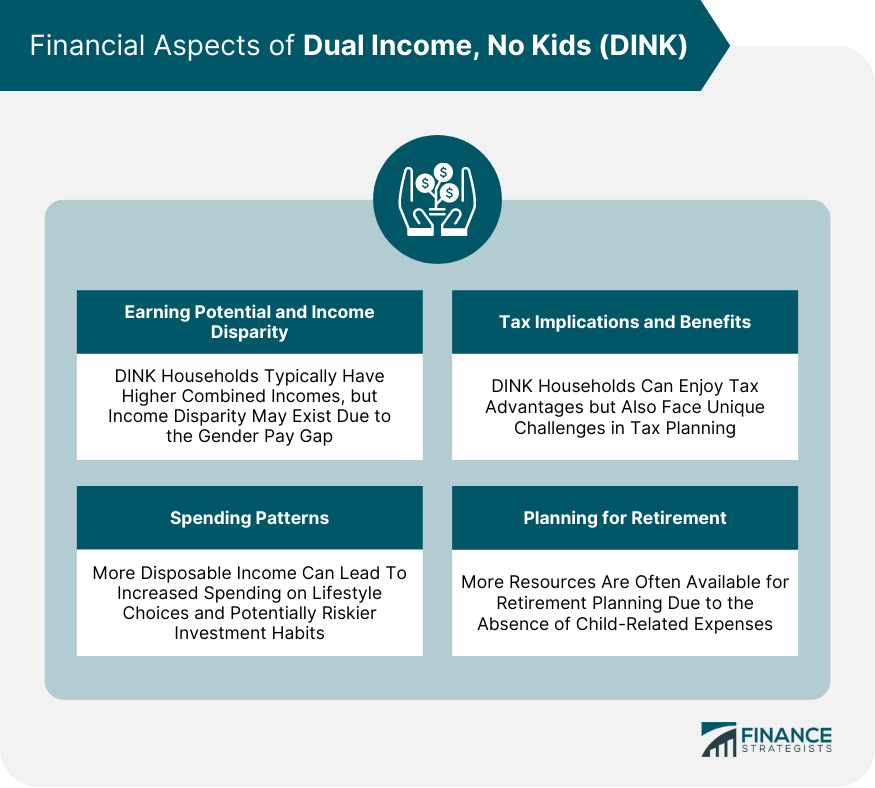

Financial Aspects of DINK

Earning Potential and Income Disparity

Spending Patterns

Tax Implications and Benefits

Planning for Retirement

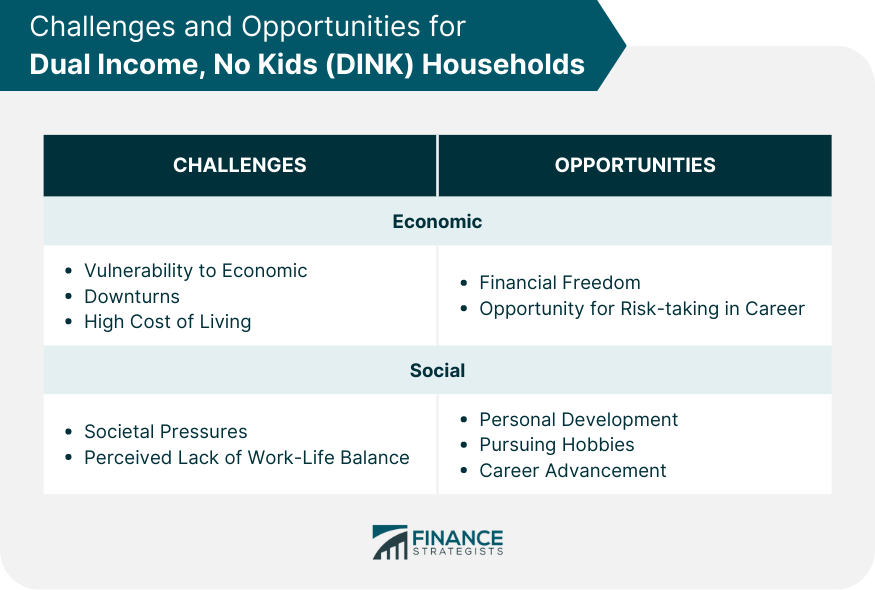

Challenges and Opportunities for DINK Households

Economic Challenges

Social Challenges

Opportunities

Strategies for Financial Planning for DINK Households

Importance of Financial Planning

Diversification of Income Sources and Investments

Savings and Retirement Planning

Contingency Planning: Insurance, Emergency Funds, Etc.

Future Trends for DINK Households

Final Thoughts

Dual Income, No Kids (DINK) FAQs

Dual Income, No Kids (DINK) refers to couples who have chosen not to have children and both partners are earning an income. This choice could be due to personal preferences, professional commitments, or other reasons.

DINK households often have higher disposable incomes due to dual earnings and no child-related expenses. This allows for more flexibility in spending, saving, and investing. DINK couples also tend to have more resources for retirement planning.

While DINK households enjoy certain financial advantages, they also face specific challenges. Economic downturns can impact them severely if both partners work in affected sectors. They may also face societal pressures due to their choice of not having children, and maintaining a certain lifestyle can be costly.

DINK households should focus on diversifying income sources and investments to reduce risk and increase wealth. They should have a robust retirement plan, especially because they may not have children to rely on in old age. Additionally, DINK couples should ensure they have insurance and emergency funds for unexpected situations.

The number of DINK households is likely to increase due to changing societal norms and economic conditions. Policy changes, such as modifications to tax laws and employment regulations, may also impact the financial landscape for DINK households.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.