A Financial Advisor Bio serves as a critical tool for establishing a professional image, demonstrating expertise, and building trust with potential clients. It should succinctly detail your qualifications, such as education, certifications, and years in the industry. Highlight your specialties, like retirement planning or wealth management, to appeal to your target demographic. Personal values and your unique financial philosophy are vital to helping clients understand your approach. Include personal anecdotes to add relatability, making you more than just a financial professional. Don't forget to mention any awards, recognitions, or positive testimonials to boost credibility. Lastly, a compelling can encourage prospective clients to reach out to you. Regularly review and update your bio to keep it relevant and accurate. A well-crafted bio can leave a lasting impression, potentially converting a reader into a client. One of the first steps in crafting a successful bio is defining your expertise and values. This includes your skills, knowledge, and the financial services you provide. Are you a specialist in retirement planning, or do you focus on wealth management for high-net-worth individuals? Do you emphasize conservative investment strategies or do you take an aggressive approach? Answering these questions can help you establish your unique value proposition. Your bio should clearly highlight your experience in the financial industry. This includes both your years of experience and your specific areas of expertise. For example, if you specialize in retirement planning, your bio should highlight your experience in this area. Your bio should also highlight your skills and knowledge. This can include specific financial planning strategies, knowledge of tax laws, or proficiency in financial software. It's essential to remember that the goal of your bio is not just to list your skills and experience but to demonstrate how these skills and experience can benefit your clients. Nothing builds trust and credibility quite like testimonials and achievements. If you've received positive feedback from clients or won awards for your work, your bio is the perfect place to highlight these accomplishments. These testimonials and achievements not only demonstrate your success as a financial advisor but also provide potential clients with a sense of confidence in your abilities. Your name and professional title are the first things potential clients will see, so it's crucial to clearly state these at the beginning of your bio. If you hold any professional designations or certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), be sure to include these in your title. These designations not only demonstrate your expertise but also provide potential clients with a sense of trust in your credentials. Your experience and skills are a key part of your bio, so it's important to detail these aspects clearly and succinctly. Be sure to highlight the types of financial services you offer and your specific areas of expertise. For example, you might mention that you specialize in retirement planning, wealth management, or estate planning. Your educational background is another critical component of your bio. Be sure to include any degrees you hold, especially if they're in fields related to financial planning, such as finance, economics, or business. You should also mention any relevant certifications or ongoing education, as these demonstrate your commitment to staying current in your field. Every financial advisor has a unique approach to financial planning, and your bio is the perfect place to share this philosophy. Whether you're a conservative investor who focuses on long-term growth or a more aggressive advisor who takes calculated risks, your philosophy should align with the needs and goals of your potential clients. Sharing your financial philosophy can also help potential clients understand what it might be like to work with you. It can give them an idea of your decision-making process, your approach to risk management, and your overall financial planning strategy. While your bio should be professional, it shouldn't be impersonal. Sharing personal anecdotes or hobbies can make your bio more relatable and engaging. Maybe you're a passionate traveler who has visited every continent, or perhaps you're an avid runner who competes in marathons. These personal details not only make your bio more interesting but can also provide conversation starters when you meet with potential clients. A strong bio should always end with a call to action. This could be an invitation to schedule a consultation, a link to your contact information, or a prompt to download a free resource. The goal is to encourage potential clients to take the next step and get in touch with you. Lastly, remember to review and update your bio regularly. Your experience, skills, and credentials will evolve over time, so it's important that your bio reflects these changes. A bio that is accurate, up-to-date, and engaging will make the best impression on potential clients. A Financial Advisor Bio, more than just a list of qualifications, is a dynamic tool for establishing rapport and building trust with potential clients. It must clearly communicate your expertise, experiences, and unique financial philosophy while highlighting personal elements for relatability. Achievements and testimonials amplify your credibility, and the inclusion of designations in your title enhances clients' confidence. A strong call to action prompts prospective clients to engage with you further. Regular reviews ensure the bio's relevancy, reflecting your evolving skills and credentials. Well-balanced between professional and personal, your bio serves as a solid first impression, fostering a meaningful connection with clients and leading to successful partnerships. Financial Advisor Bio Overview

Key Components of a Successful Financial Advisor Bio

Defining Your Expertise and Values

Highlighting Your Experience and Skills

Testimonials and Achievements

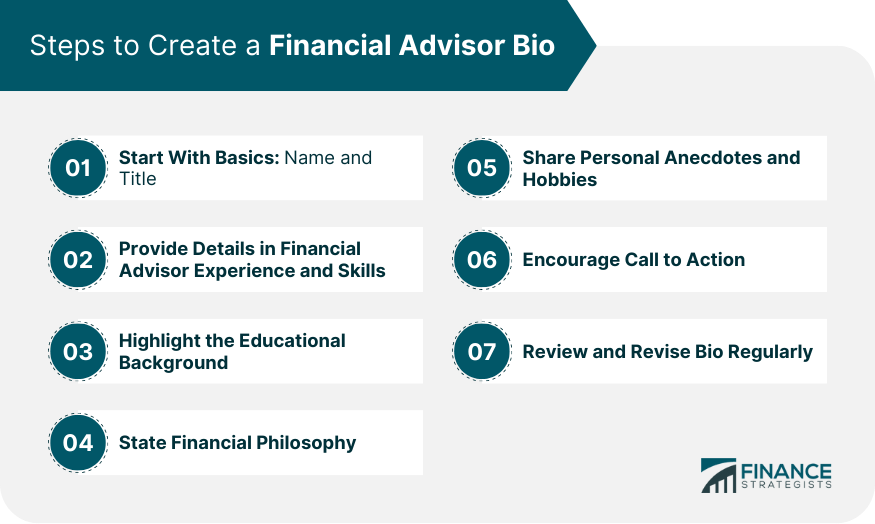

Steps to Create a Financial Advisor Bio

Start With Basics: Name and Title

Detail Your Financial Advisor Experience and Skills

Highlight Your Educational Background

State Your Financial Philosophy

Share Personal Anecdotes and Hobbies

Encourage Call to Action

Review and Revise Bio Regularly

Conclusion

Financial Advisor Bio FAQs

A Financial Advisor Bio should include your name, title, and any relevant designations or certifications. It should also highlight your experience in the financial industry, specific areas of expertise, educational background, and financial philosophy. Personal anecdotes and hobbies can also be included to make the bio more relatable.

It's important to review and update your Financial Advisor Bio regularly. As your experience, skills, and credentials evolve over time, your bio should reflect these changes. An accurate and up-to-date bio makes the best impression on potential clients.

Making your Financial Advisor Bio more engaging can involve sharing personal anecdotes or hobbies, incorporating testimonials and achievements, and clearly stating your unique financial philosophy. Remember, while your bio should be professional, it shouldn't be impersonal.

A Call to Action in a Financial Advisor Bio encourages potential clients to take the next step, whether that's scheduling a consultation, contacting you for more information, or downloading a free resource. It's a key element in converting readers into leads or clients.

Demonstrating expertise in your Financial Advisor Bio can be done by detailing your experience in the financial industry, your specific areas of expertise, and your educational background. Don't forget to include any relevant certifications or ongoing education. Testimonials and achievements can also help to demonstrate your expertise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.