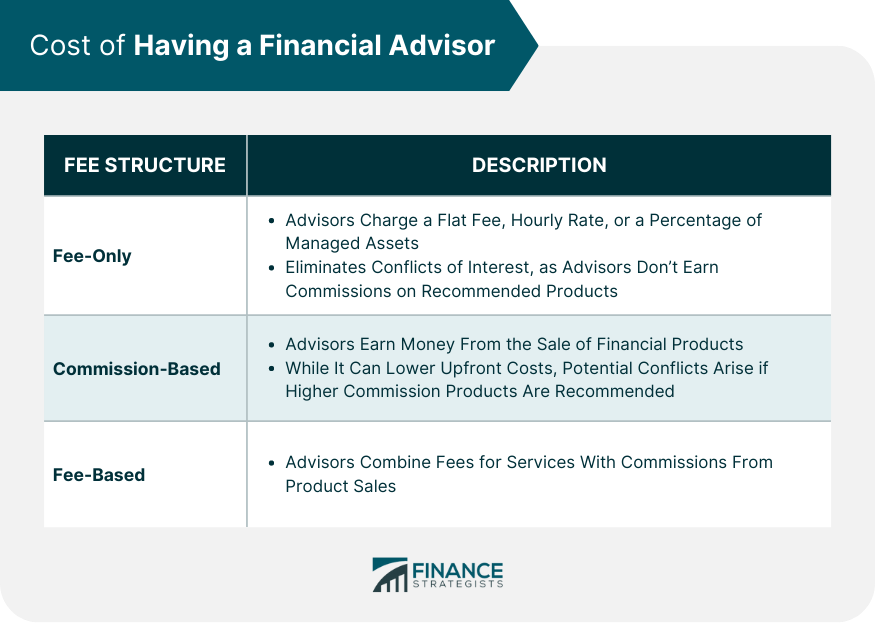

A financial advisor is a professional who offers expert guidance on managing personal finances, investments, and financial planning. They analyze a client's financial situation, goals, and risk tolerance to create customized strategies, offering insights on retirement planning, investment options, tax strategies, and more to help clients achieve their financial objectives. One of the most prominent benefits of having a financial advisor is access to expert advice and guidance. Financial advisors have extensive knowledge of financial markets, investment products, tax laws, and other financial-related topics. This expertise allows them to guide their clients toward financially sound decisions. They can explain complex financial concepts and provide clarity, which helps clients understand their financial situation and make informed decisions. Managing your own finances, especially if you have a diverse investment portfolio, can be time-consuming. Researching investment opportunities, monitoring market trends, and staying updated with changes in financial regulations and tax laws require a significant investment of time and energy. A financial advisor, equipped with expertise and tools, can efficiently handle these tasks. They can keep track of market trends, manage your investment portfolio, and plan for your financial future while you focus on other important aspects of your life. Financial mistakes can be costly and detrimental to one's financial health. Unfortunately, without adequate knowledge and experience, one can easily fall into these pitfalls. Common financial mistakes include inadequate diversification, poor timing of investments, failure to plan for taxes, and ignoring inflation when planning for retirement. A financial advisor can help prevent these mistakes. With their expert knowledge and experience, they can guide you to diversify your portfolio, time your investments wisely, plan effectively for taxes, and consider inflation in your retirement planning. They can also advise against risky or unwise investments that you might be tempted to pursue without professional guidance. Financial advisors often have access to a wide range of investment opportunities that may not be available to the general public. These may include certain mutual funds, hedge funds, and other investment products. By leveraging their industry contacts and resources, they can help their clients diversify their investment portfolios and potentially achieve higher returns. Moreover, financial advisors can tailor investment strategies to suit their client's unique needs and goals. Whether you want to save for your child's education, buy a house, or plan for retirement, a financial advisor can help you choose the right investments for your specific goals. Financial advisors play a crucial role in enhancing financial security. They guide their clients in setting realistic financial goals, planning and saving for retirement, building an emergency fund, and securing the right insurance policies. This comprehensive approach ensures that clients are well-prepared for financial uncertainties or emergencies. Financial advisors also help manage investment risks. They do this by diversifying their client's investment portfolios across different asset classes and ensuring they are not overly exposed to a single asset or market. This risk management strategy can protect clients from major financial losses in case of adverse market movements. Managing finances can often be stressful, especially if you're dealing with debt, planning for retirement, or navigating through tough economic times. A financial advisor can help alleviate this stress by taking charge of your financial management. With their expert knowledge and professional approach, they can help you develop a solid financial plan, guide you toward achieving your financial goals, and give you the confidence to handle financial uncertainties. Knowing that a professional is managing your finances can provide peace of mind and reduce stress related to financial decision-making. Check the qualifications of potential financial advisors to ensure they have the necessary skills and knowledge. Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) are reputable credentials in the field. Additionally, look for an advisor with ample experience in handling finances similar to yours. Financial advisors can be compensated in several ways, including commission-based, fee-only, and fee-based. It's important to understand how an advisor is compensated to ensure transparency and determine if their fee structure aligns with your financial situation. A financial advisor with a fiduciary duty is obligated to act in the best interest of their clients. This means they must provide advice and recommend financial products that best serve your financial goals rather than the products that would earn them the highest commissions. Some financial advisors specialize in certain areas, such as retirement planning, wealth management for high-net-worth individuals, or financial planning for small businesses. Choose a financial advisor whose expertise aligns with your specific financial needs and goals. Having a good personal rapport with your financial advisor is essential. Since you'll be entrusting your financial future to this person, it's important that you feel comfortable discussing your finances with them. Look for an advisor who is approachable, understanding, and good at communicating. The cost of a financial advisor is often based on their fee structure. Some common types include: Fee-only advisors charge a flat fee, hourly rate, or a percentage of the assets they manage. This model is straightforward and avoids potential conflicts of interest since the advisor doesn't earn a commission on the products they recommend. Commission-based advisors earn money from the financial products they sell. While this can lower upfront costs, it might pose a conflict of interest if the advisor recommends products that earn them a higher commission. Fee-based advisors combine both methods. They charge a fee for their services and also earn commissions on the products they sell. It's essential to understand both aspects of their compensation. Several factors can affect the cost of a financial advisor. These include the complexity of your financial situation, the type of services you need, and the advisor's level of experience and expertise. While cost is an important consideration, it's equally important to assess the value a financial advisor brings. The right advisor can provide expert advice, save you time, prevent costly mistakes, and potentially increase your overall wealth. In many cases, these benefits can outweigh the cost of the advisor. Navigating the financial landscape can be complex and time-consuming, and this is where a financial advisor can prove invaluable. With their expert knowledge and industry experience, financial advisors provide guidance on various aspects of financial planning, including investment, retirement, tax, and estate planning. They can help avoid common financial mistakes, provide access to a broad range of investment opportunities, and enhance financial security. Moreover, they alleviate the stress associated with managing finances, giving clients peace of mind. When selecting a financial advisor, it's important to consider their qualifications, fee structure, fiduciary responsibility, area of specialization, and rapport. While there is a cost associated with engaging a financial advisor, the value they provide can often outweigh the expense. They not only save time but can also enhance your overall financial health, making the cost a worthwhile investment in your financial future.Financial Advisor Overview

Benefits of Having a Financial Advisor

Expert Advice and Guidance

Time-Saving Assistance

Avoidance of Common Financial Mistakes

Access to Better Investment Opportunities

Enhanced Financial Security

Reduced Financial Stress

How to Select the Right Financial Advisor

Check Qualifications and Experience

Understand Their Fee Structure

Verify Fiduciary Duty

Review Specialization

Establish Personal Rapport

Cost of Having a Financial Advisor

Fee-Only

Commission-Based

Fee-Based

Factors Affecting the Cost

Conclusion

Benefits of Having a Financial Advisor FAQs

Some key benefits of having a financial advisor include access to expert financial advice, saving time in managing personal finances, avoiding common financial mistakes, getting access to a broader range of investment opportunities, and achieving enhanced financial security. They can also help reduce the stress associated with financial planning and decision-making.

A financial advisor, with their knowledge and experience, can guide you to diversify your portfolio, time your investments wisely, plan effectively for taxes, and consider inflation in your retirement planning. They can also advise against risky or unwise investments that you might be tempted to pursue without professional guidance.

Yes, financial advisors often have access to a wider range of investment opportunities that may not be readily available to individual investors. They can use their industry contacts and resources to help their clients diversify their portfolios and potentially achieve higher returns.

Financial advisors help in setting realistic financial goals, planning and saving for retirement, building an emergency fund, and securing the right insurance policies. They also manage investment risks by diversifying your investment portfolio across different asset classes. All these contribute to enhancing your financial security.

Yes, while engaging a financial advisor comes at a cost, the benefits such as expert advice, time-saving, access to better investment opportunities, and enhanced financial security often outweigh the expense. A good financial advisor can help grow your wealth over time, further justifying the cost.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.