Financial advisors have traditionally been the go-to professionals for individuals looking to manage their wealth, plan for retirement, or navigate complex financial waters. They offer expert advice, personalized strategies, and the peace of mind that comes from having a knowledgeable partner in financial decision-making. However, as technology advances and individual financial literacy grows, there has been a rising interest in alternatives to these traditional advisors. Many individuals are seeking more accessible or affordable options or simply wish to take a more hands-on approach to managing their money. For some, the alternatives offer a more cost-effective way to get investment advice. For others, it's about having more control and flexibility in their financial decisions. From automated platforms to peer-to-peer advice, the alternatives cater to a broad audience with varied financial aspirations and appetites for involvement in managing their assets. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. These platforms typically collect information about a client’s financial situation and goals through an online survey and then use the data to offer advice and/or automatically invest client assets. One of the main draws of robo-advisors is their cost efficiency. Traditional financial advisors often charge a percentage of assets under management, which can add up over time. In contrast, robo-advisors usually charge lower fees, making them an attractive option for those looking to minimize costs. These platforms allow individuals to handpick their investments, making all the decisions themselves. With the proliferation of online brokerage platforms and mobile trading apps, anyone can now be their own portfolio manager. While the allure of self-directed investment is strong, especially for those well-versed in the financial markets, there are inherent risks. Without the guidance of a financial advisor, it's easy to make impulsive decisions based on market noise or emotions. Moreover, managing one's own investments requires time, effort, and continuous learning. The plethora of tools and resources available can aid in the process, but they can't replace the years of expertise and insight a seasoned advisor brings. Beyond investing, managing finances encompasses budgeting, planning for future expenses, and setting and tracking financial goals. This is where financial planning software and apps come into play. These digital tools allow individuals to get a holistic view of their finances, from tracking daily expenses to forecasting future savings. These platforms often come equipped with features that allow users to link multiple accounts, set up budgets, and monitor their progress towards financial milestones. While incredibly valuable, it's essential to understand the distinction between these tools and actual financial advice. These platforms provide data-driven insights and automation, but they typically don't offer personalized advice tailored to an individual's unique circumstances. Peer-to-peer financial communities are platforms where individuals share advice, insights, and personal experiences related to money management. These communities can be found on dedicated forums, social media groups, and even in-app ecosystems. There's undeniable value in collective wisdom. Hearing from peers who've been in similar financial situations can provide unique insights and solutions. However, one should approach advice from these platforms with caution. While shared experiences can be valuable, they are no substitute for expert advice, and there's always the risk of misinformation or misunderstanding in such communities. Hybrid models combine the efficiency and accessibility of robo-advisors with the personalized touch of human financial advisors. The beauty of hybrid models lies in their flexibility. They cater to a wider audience by offering a more personalized touch when required while still harnessing the cost-efficiency of automated systems. For many, this strikes the right balance between technology and human connection, ensuring they're not missing out on any aspect of financial planning and advice. Financial literacy is a cornerstone of sound money management. Recognizing this, many organizations, both online and offline, offer workshops and seminars dedicated to various financial topics. These sessions range from basic budgeting and investing principles to more complex subjects like tax planning and estate management. However, while workshops provide foundational knowledge, they might not offer the ongoing support and advice that comes with a dedicated financial advisor. It's crucial to view them as a supplement to financial education rather than a replacement for expert guidance. Financial books and literature offer in-depth insights into money management, investment strategies, and the principles of economics. From classic texts to contemporary bestsellers, there's a wealth of knowledge waiting to be unlocked. Books can provide foundational knowledge and inspire readers to view their finances from different perspectives. However, just like with educational workshops, it's essential to remember that books offer static information. The financial landscape is ever-changing, and while the principles might remain consistent, strategies and recommendations may evolve. As such, relying solely on literature for financial guidance might not be ideal for everyone. With so many new ways to handle money popping up, you might wonder if you still need an old-school financial advisor. But there are times when having an expert by your side can really make a difference. Complex Financial Situations: Handling intricate tax planning, estate management, and other advanced financial scenarios can be challenging without expert guidance. Significant Life Changes: Major life events such as marriage, childbirth, divorce, or the loss of a loved one can have profound financial implications that benefit from a seasoned advisor's perspective. Tailored Financial Planning: Generic financial strategies might not cater to unique individual circumstances. A traditional financial advisor can create a customized plan aligned with personal aspirations and needs. Personalized, Face-to-Face Interaction: The human connection and trust built through in-person interactions can be invaluable. Some discussions or concerns are best-addressed face-to-face. Deep Understanding of Client's Life Goals: Beyond just financial metrics, understanding an individual's life goals, aspirations, and fears allows for holistic financial planning. Risk Management: Navigating the volatile financial markets and making decisions on risk tolerance and investment strategies often benefit from an advisor's expertise. Continuous Monitoring and Adjustments: Financial plans aren't static; they need constant adjustments based on market conditions, life changes, or shifts in financial goals. A traditional advisor can provide this ongoing support. Regulatory and Compliance Guidance: The financial world is laden with regulations. An advisor ensures that financial decisions adhere to current laws and regulations. Emotional Buffer: During turbulent market times, a financial advisor serves as a buffer, providing grounded advice and preventing impulsive decisions driven by emotions. Access to Exclusive Opportunities: Traditional advisors might have access to specific investment opportunities or financial products not readily available to the general public. Traditional financial advisors have long been a trusted source of expertise, offering tailored strategies and peace of mind. While alternative options have gained prominence, they present a spectrum of advantages and challenges. Robo-advisors streamline financial planning with cost-efficient algorithms, appealing to those seeking accessibility and affordability. Self-directed platforms empower investors to manage their portfolios. Financial planning tools and apps provide holistic insights, bridging budgeting and forecasting, but they lack personalized advice. Peer-to-peer communities harness collective wisdom but may lack accuracy. Hybrid models combine technology's efficiency with human insight, catering to diverse preferences. Educational workshops, literature, and self-learning contribute foundational knowledge, though they lack continuous support. However, in intricate tax planning, significant life changes, personalized planning, risk management, compliance, emotional stability, and accessing exclusive opportunities, the value of a traditional advisor remains unparalleled.Role of Financial Advisors

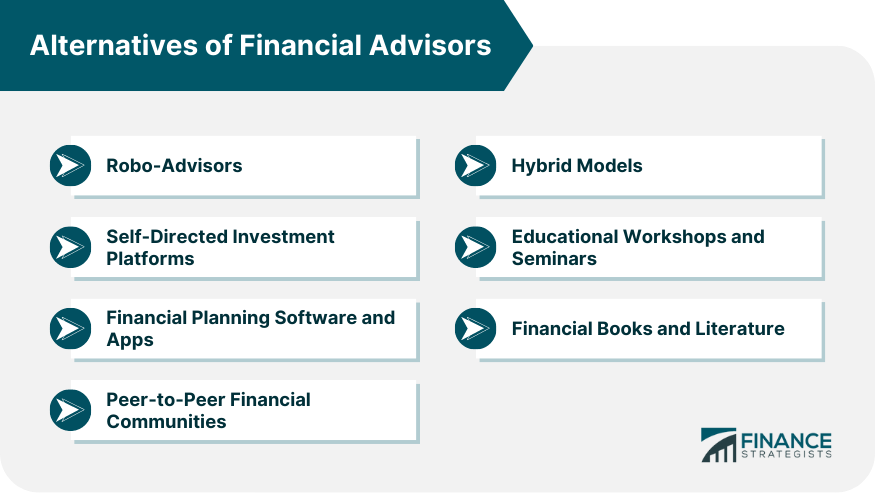

Alternatives of Financial Advisors

Robo-Advisors

Self-Directed Investment Platforms

Financial Planning Software and Apps

Peer-to-Peer Financial Communities

Hybrid Models

Educational Workshops and Seminars

Financial Books and Literature

When Might a Traditional Financial Advisor Still Be Necessary?

Conclusion

Alternatives of Financial Advisors FAQs

The alternatives to traditional financial advisors include robo-advisors, self-directed investment platforms, financial planning software and apps, peer-to-peer financial communities, and hybrid models.

Robo-advisors are automated platforms that offer algorithm-driven financial planning with minimal human involvement. They usually charge lower fees compared to traditional advisors and are suitable for cost-conscious individuals.

Self-directed investment platforms allow individuals to manage their portfolios directly. While empowering, they require careful consideration and time investment, as decisions are made without personalized advice.

Financial planning software and apps provide tools to manage budgets, track expenses, and set goals. However, they lack the personalized advice that a financial advisor offers, making them suitable for those seeking data-driven insights rather than tailored guidance.

Hybrid models combine the efficiency of robo-advisors with the personal touch of human advisors. They strike a balance between technology and human interaction, providing algorithmic insights along with the ability to consult a human advisor for more complex financial queries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.