An investment adviser is a professional who offers advice on securities to clients, manages investment portfolios, and provides financial planning services. Investment advisers may work with individuals, institutions, or businesses to help them make informed decisions regarding their investments. Investment advisers play a crucial role in the financial industry by helping clients achieve their financial goals through prudent and strategic investment decisions. They assist in portfolio management, asset allocation, and risk management, ensuring that their clients' investments are aligned with their financial objectives and risk tolerance. In the United States, investment advisers are regulated by the Securities and Exchange Commission (SEC) at the federal level and by state securities regulators at the state level. The regulatory framework aims to protect investors and maintain the integrity of the financial markets by establishing registration requirements, fiduciary duties, and ongoing compliance obligations for investment advisers. Advisers with AUM between $25 million and $100 million are required to register with the SEC if they do not qualify for state registration or are otherwise subject to federal regulation. To register as an investment adviser with the SEC, firms must file Form ADV, which serves as both the registration form and a comprehensive disclosure document. Form ADV consists of two parts – Part 1 provides information about the adviser's business, ownership, clients, and affiliations, while Part 2 includes detailed descriptions of the adviser's services, fees, investment strategies, and potential conflicts of interest. Investment advisers must register with the Investment Adviser Registration Depository (IARD), an electronic filing system operated by the Financial Industry Regulatory Authority (FINRA). This system facilitates the filing of Form ADV and other required documents and serves as a central repository of investment adviser information accessible by the public. Investment advisers are required to update their Form ADV annually or whenever there are material changes to their business or disclosure information. Additionally, advisers must promptly amend their registration if certain events occur, such as changes in ownership or disciplinary actions. State registration requirements may vary but typically include filing a state-specific form, paying a registration fee, and meeting certain examination or licensing requirements. Each state may have unique registration requirements, such as additional forms, fees, or examination prerequisites. Investment advisers should consult their state's securities regulator for specific guidance. In some cases, investment advisers may be required to register with both the SEC and one or more states. This can occur if an adviser has a place of business in a state where it is not registered or if it has more than five clients who are residents of that state. Certain advisers who exclusively manage private funds may be exempt from registration if they meet specific criteria, such as having AUM below $150 million. Advisers who exclusively manage venture capital funds may also be exempt from registration, although they may still be subject to certain reporting requirements. Non-U.S. investment advisers with no place of business in the United States and a limited number of U.S. clients may qualify for an exemption from registration. Advisers whose clients are all located within the same state as their place of business and who do not provide advice on securities listed on national exchanges may be exempt from federal registration, but may still be required to register at the state level. There are additional exceptions to registration, such as advisers who manage only insurance products or those who provide advice on U.S. government securities. Advisers should carefully review the applicable rules and regulations to determine if they qualify for an exemption or exception. Registered investment advisers are required to establish and maintain comprehensive compliance programs, which should be documented in a written compliance manual. The manual should cover all aspects of the adviser's business, including policies and procedures for preventing, detecting, and addressing potential violations of securities laws and regulations. Investment advisers must adopt and enforce a code of ethics that outlines the fiduciary duties owed to clients and establishes standards for personal trading by the firm's employees. The code should also address the prevention of insider trading and the protection of confidential client information. Advisers should establish written supervisory procedures to ensure that their employees comply with applicable laws, rules, and regulations. These procedures should include regular training, monitoring, and enforcement mechanisms to maintain a culture of compliance within the firm. Investment advisers must have a business continuity plan in place to address operational risks and ensure the ongoing servicing of client accounts in the event of a natural disaster, technological failure, or other significant disruption. Advisers should also consider succession planning to address the potential departure, disability, or death of key personnel. Investment advisers are subject to various recordkeeping requirements, which include maintaining books and records related to their business operations, client communications, advertising materials, and more. Advisers should ensure that their recordkeeping systems are comprehensive, accurate, and well-organized to facilitate regulatory examinations and compliance reviews. Investment advisers have a fiduciary duty to act in the best interests of their clients, which includes providing advice that is based on a thorough and reasonable analysis of relevant information and is consistent with the client's investment objectives and risk tolerance. Advisers must place the interests of their clients above their own and avoid conflicts of interest or, when such conflicts cannot be avoided, fully disclose them to clients in a clear and concise manner. Investment advisers should maintain a robust process for identifying, managing, and disclosing potential conflicts of interest, such as those related to compensation arrangements, affiliated transactions, or personal trading by employees. Advisers have an obligation to seek the best execution of client transactions, which means obtaining the most favorable terms for clients when trading securities, taking into account factors such as price, speed, and likelihood of execution. Investment advisers must provide clear, accurate, and timely communications to their clients, including periodic account statements, performance reports, and other disclosures required by securities laws and regulations. Investment advisers play a crucial role in the financial industry, offering advice on securities to clients, managing investment portfolios, and providing financial planning services. They are regulated by the Securities and Exchange Commission (SEC) at the federal level and by state securities regulators at the state level. Investment adviser registration requirements include filing Form ADV with the Investment Adviser Registration Depository (IARD) and meeting state-specific requirements, if applicable. Compliance programs and policies must be established, including a compliance manual, code of ethics, written supervisory procedures, business continuity and succession planning, and recordkeeping requirements. Investment advisers owe a fiduciary duty to act in the best interests of their clients, including the duties of care and loyalty. They must also disclose potential conflicts of interest, seek the best execution of client transactions, and provide clear and accurate communications and reporting to clients.Definition of Investment Adviser

Regulatory Framework

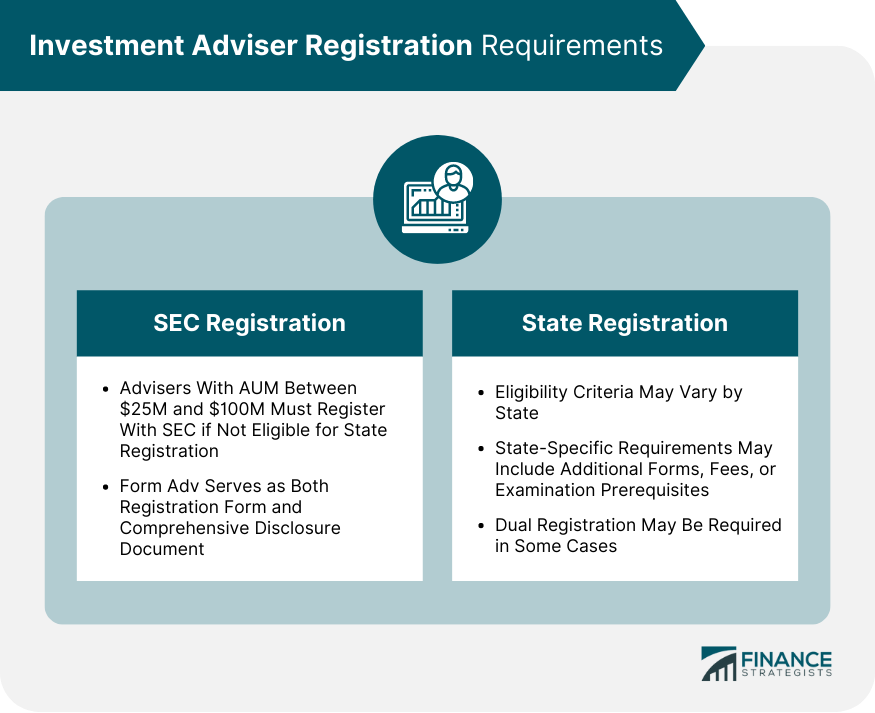

Investment Adviser Registration Requirements

SEC Registration

Eligibility Criteria

Form ADV Filing

State Registration

Eligibility Criteria

State-Specific Requirements

Dual Registration

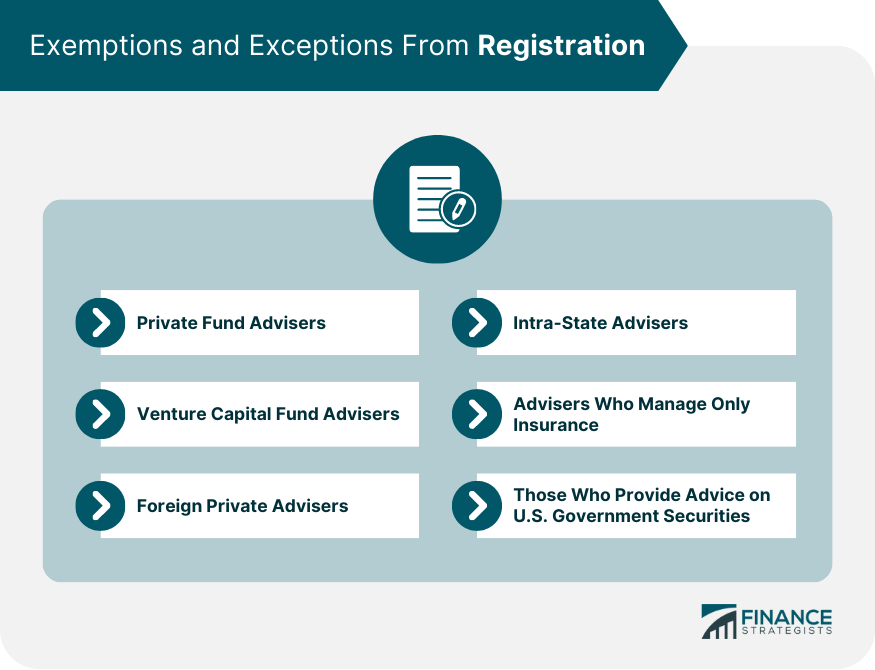

Exemptions and Exceptions From Registration

Private Fund Advisers

Venture Capital Fund Advisers

Foreign Private Advisers

Intra-State Advisers

Other Exceptions

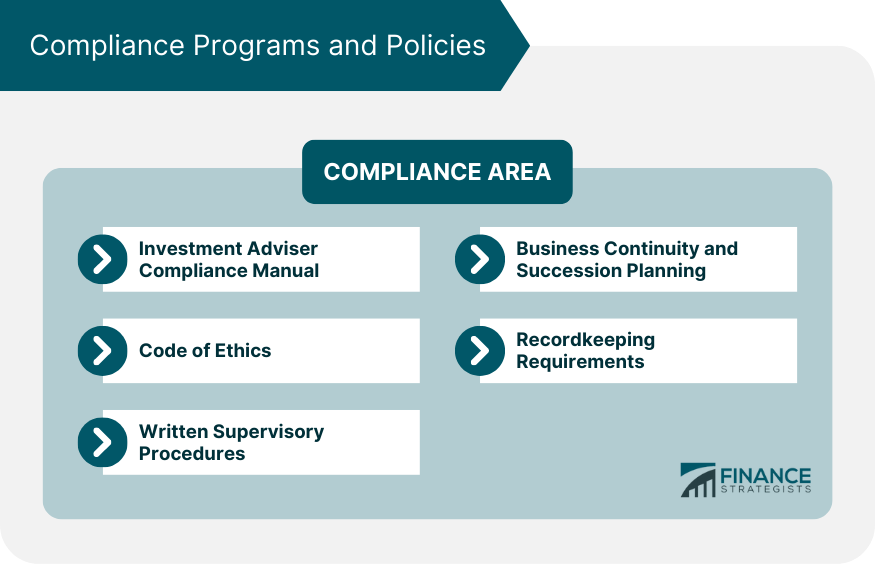

Compliance Programs and Policies

Investment Adviser Compliance Manual

Code of Ethics

Written Supervisory Procedures

Business Continuity and Succession Planning

Recordkeeping Requirements

Fiduciary Duties and Responsibilities

Duty of Care

Duty of Loyalty

Conflict of Interest Disclosures

Best Execution Obligation

Client Communications and Reporting

Conclusion

Investment Adviser Registration FAQs

Investment advisers with assets under management (AUM) above a certain threshold, depending on the jurisdiction, must register with the Securities and Exchange Commission (SEC) or state securities regulators.

The Form ADV serves as both the registration form and a comprehensive disclosure document for investment advisers. It provides information about the adviser's business, ownership, clients, affiliations, services, fees, investment strategies, and potential conflicts of interest.

Yes, there are various exemptions and exceptions from registration, such as those for private fund advisers, venture capital fund advisers, foreign private advisers, intra-state advisers, and others. Investment advisers should consult the applicable rules and regulations to determine if they qualify for an exemption or exception.

Investment advisers have a fiduciary duty to act in the best interests of their clients, which includes providing advice that is based on a thorough and reasonable analysis of relevant information and is consistent with the client's investment objectives and risk tolerance. Advisers must also place the interests of their clients above their own and avoid conflicts of interest.

Investment advisers are subject to periodic examinations by the SEC or state securities regulators and must conduct regular risk assessments to identify potential areas of concern. Advisers must also remain current with all required regulatory filings and disclosures and may be subject to enforcement actions or sanctions if they violate securities laws or regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.