Custodial fees refer to charges assessed by financial institutions for managing and safeguarding clients' assets. These fees cover the operational expenses incurred by the custodian while providing their services. Custodial fees enable financial institutions to maintain the necessary infrastructure and resources for asset management. They ensure the safekeeping of clients' assets while adhering to regulatory requirements and industry standards. Custodial fees are typically applied in situations such as retirement accounts, brokerage accounts, and trust accounts. They help cover the costs of recordkeeping, reporting, and other administrative tasks associated with managing these accounts. Banks and credit unions offer custodial services for various types of accounts, including savings, checking, and certificates of deposit. They are regulated by federal and state authorities and provide a secure environment for holding clients' assets. Brokerage firms provide custodial services for clients' securities and investment accounts. They facilitate buying and selling of securities, manage transactions, and offer additional services like research and investment advice. Trust companies specialize in managing trusts and estate assets on behalf of clients. They offer services such as estate planning, asset management, and tax planning, ensuring the proper administration of trust assets. Registered investment advisors (RIAs) provide investment management and financial planning services. They act as fiduciaries, making investment decisions on behalf of their clients and often use third-party custodians to hold clients' assets. Retirement plan custodians manage retirement accounts like IRAs and 401(k)s. They ensure compliance with tax laws and regulations, provide recordkeeping services, and handle the administration of these accounts. The size of an account can impact custodial fees, with larger accounts often incurring lower fees on a percentage basis. This is due to economies of scale and the reduced relative cost of managing large accounts. Different account types, such as retirement accounts, taxable brokerage accounts, or trust accounts, may have different fee structures. Each account type may require varying levels of service, which can impact fees. The range of services provided by a custodian, such as investment advice, research, and reporting, can influence fees. More comprehensive services generally come with higher fees. Custodial fees can vary depending on the types of investment products held in an account. Some investments, like mutual funds or alternative investments, may have higher fees due to their complexity or additional administrative requirements. Custodians may use different fee structures, such as fixed, tiered, or percentage-based fees. These structures can impact the overall cost of custodial services and should be carefully considered when comparing providers. To evaluate custodial fees, investors should compare fees among different providers, considering factors like account size, services provided, and fee structures. This will help determine the most cost-effective option for their needs. Hidden fees and additional charges can add to the overall cost of custodial services. Investors should thoroughly review fee schedules and account agreements to understand all potential costs associated with their accounts. Fee transparency is crucial for investors to make informed decisions about custodial services. Clear and easily accessible information about fees allows investors to compare providers accurately and choose the best option for their needs. When comparing custodial fees, weighing the costs against the benefits and services provided is essential. A higher fee may be justified if it comes with superior services or investment options that align with the investor's objectives. Investors can potentially reduce custodial fees by shopping around and comparing providers. By evaluating various options, they may identify more cost-effective solutions that still meet their needs. In some cases, investors may be able to negotiate lower fees with their custodians. This is particularly relevant for high-net-worth individuals or those with large account balances. Consolidating multiple accounts with a single custodian can often lead to reduced fees. This is due to economies of scale and the potential for more favorable fee structures with larger account balances. Some custodians may offer special promotions or discounts to attract new clients or incentivize existing clients to increase their account balances. Investors should be on the lookout for such opportunities to reduce their custodial fees. Custodial fees can significantly impact long-term investment returns. Even seemingly small fees can compound over time, reducing the overall growth of an investor's portfolio. Monitoring and controlling investment costs, including custodial fees, is crucial for optimizing investment performance. By actively managing fees, investors can help maximize their returns and achieve their financial goals. Investors should balance the costs of custodial services with the quality of service and investment options provided. While minimizing fees is essential, it should not come at the expense of receiving valuable services or access to suitable investments. Custodial fees are subject to regulatory oversight and consumer protection laws. Regulatory bodies like the SEC and FINRA enforce rules and standards to ensure fee transparency and fair practices in the financial services industry. Custodians are required to disclose their fees and provide documentation, such as account agreements and fee schedules. This ensures that investors have the necessary information to make informed decisions about custodial services. Financial advisors play a crucial role in helping clients understand and manage custodial fees. They can guide clients through fee structures, negotiate on their behalf, and recommend strategies to minimize fees while still meeting investment objectives. Understanding custodial fees is essential for investors, as these fees can significantly impact long-term investment returns. By comprehending the various factors that influence fees, investors can make more informed decisions about their custodial services. Custodial fees can have a substantial effect on investment outcomes. High fees can erode returns over time, making it crucial for investors to monitor and manage these costs to maximize their investment performance. Performing due diligence and making informed decisions about custodial services are vital for investors seeking to optimize their portfolios. By comparing providers, evaluating fee structures, and balancing costs with the quality of service and investment options, investors can better achieve their financial goals. To further navigate the complexities of custodial fees and make well-informed decisions, consider consulting with a financial advisor. A knowledgeable professional can provide personalized guidance and strategies to help minimize fees while ensuring access to suitable investment options and services. Don't hesitate to contact a trusted financial advisor to make the most of your investments and secure your financial future.What Are Custodial Fees?

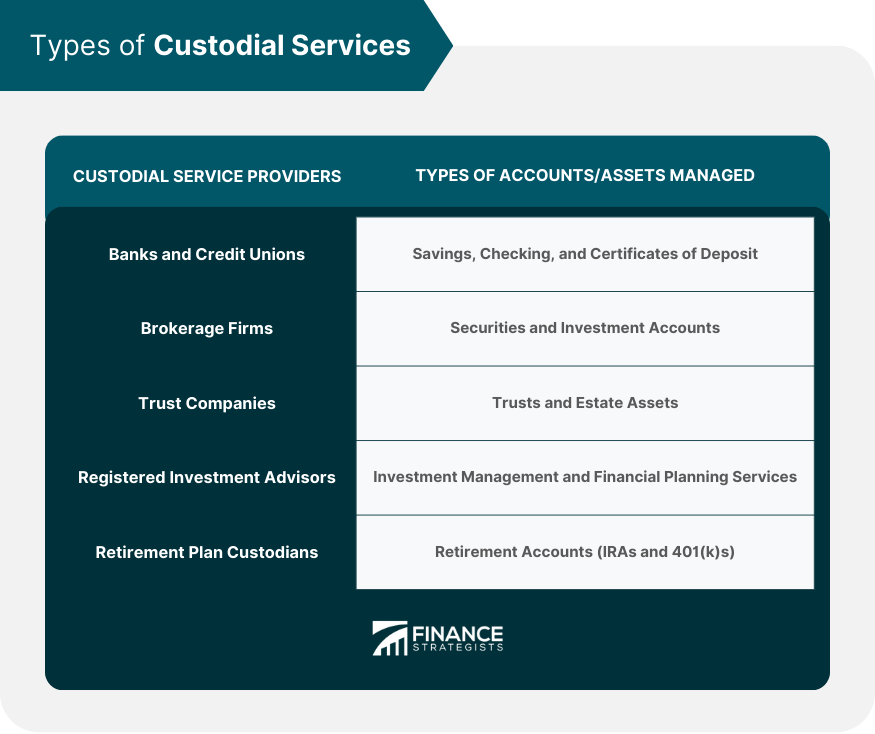

Types of Custodial Services

Banks and Credit Unions

Brokerage Firms

Trust Companies

Registered Investment Advisors

Retirement Plan Custodians

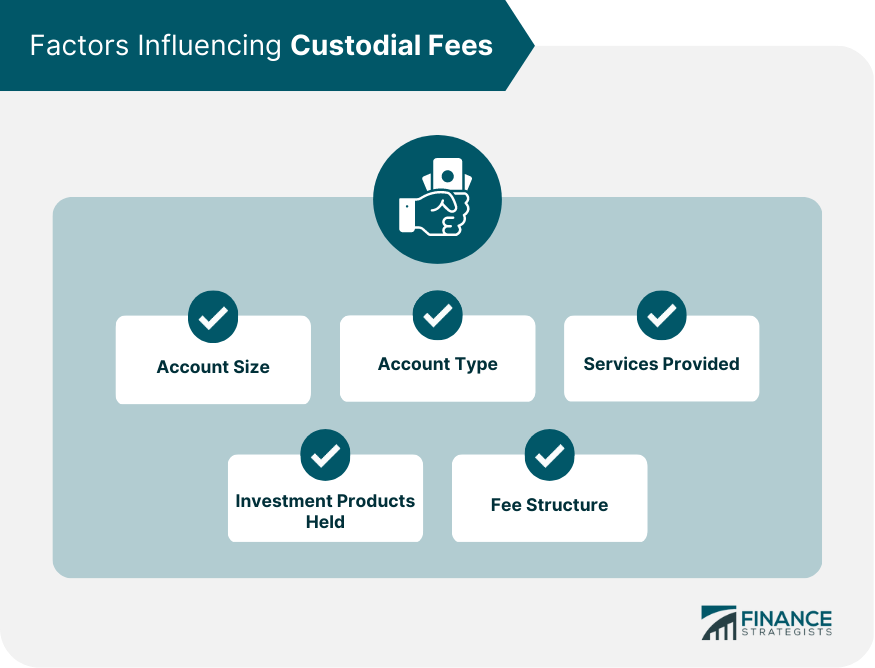

Factors Influencing Custodial Fees

Account Size

Account Type

Services Provided

Investment Products Held

Fee Structure (Fixed, Tiered, or Percentage-Based)

Comparing Custodial Fees

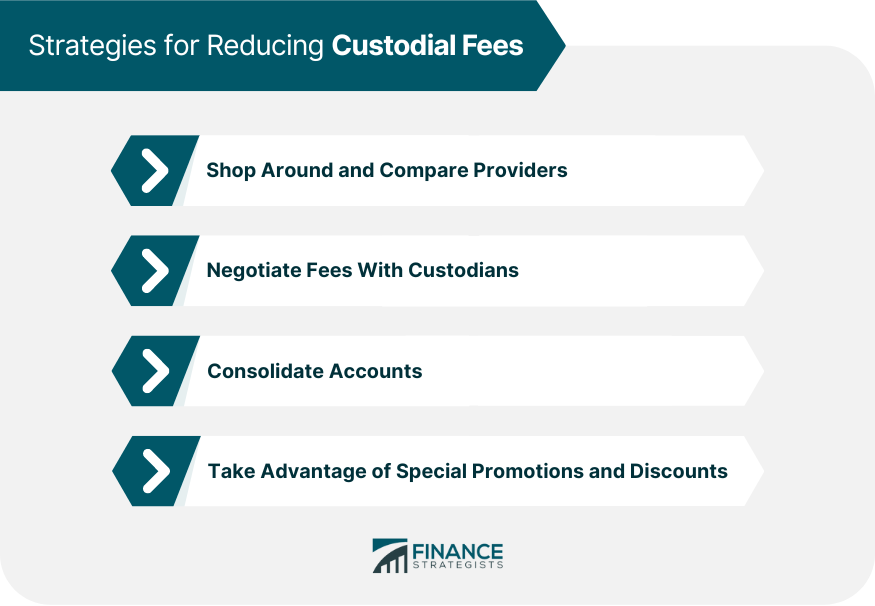

Strategies for Reducing Custodial Fees

Shopping Around and Comparing Providers

Negotiating Fees with Custodians

Consolidating Accounts

Taking Advantage of Special Promotions and Discounts

Impact of Custodial Fees on Investment Performance

Regulation and Disclosure of Custodial Fees

Regulatory Oversight and Consumer Protection

Required Fee Disclosures and Documentation

Role of Financial Advisors in Explaining and Managing Fees

Final Thoughts

Custodial Fees FAQs

Custodial fees refer to charges assessed by financial institutions for managing and safeguarding clients' assets, covering operational expenses associated with managing accounts.

Custodial services are provided by banks and credit unions for savings, checking, and certificates of deposit, brokerage firms for securities and investment accounts, trust companies for trusts and estate assets, registered investment advisors for investment management and financial planning services, and retirement plan custodians for retirement accounts.

The factors influencing custodial fees include account size, account type, services provided, investment products held, and fee structure (fixed, tiered, or percentage-based).

Investors can reduce custodial fees by shopping around and comparing providers, negotiating fees with custodians, consolidating accounts, and taking advantage of special promotions and discounts.

Custodial fees can significantly impact long-term investment returns, so monitoring and controlling investment costs is crucial for optimizing investment performance. It is important to balance the costs of custodial services with the quality of service and investment options provided.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.