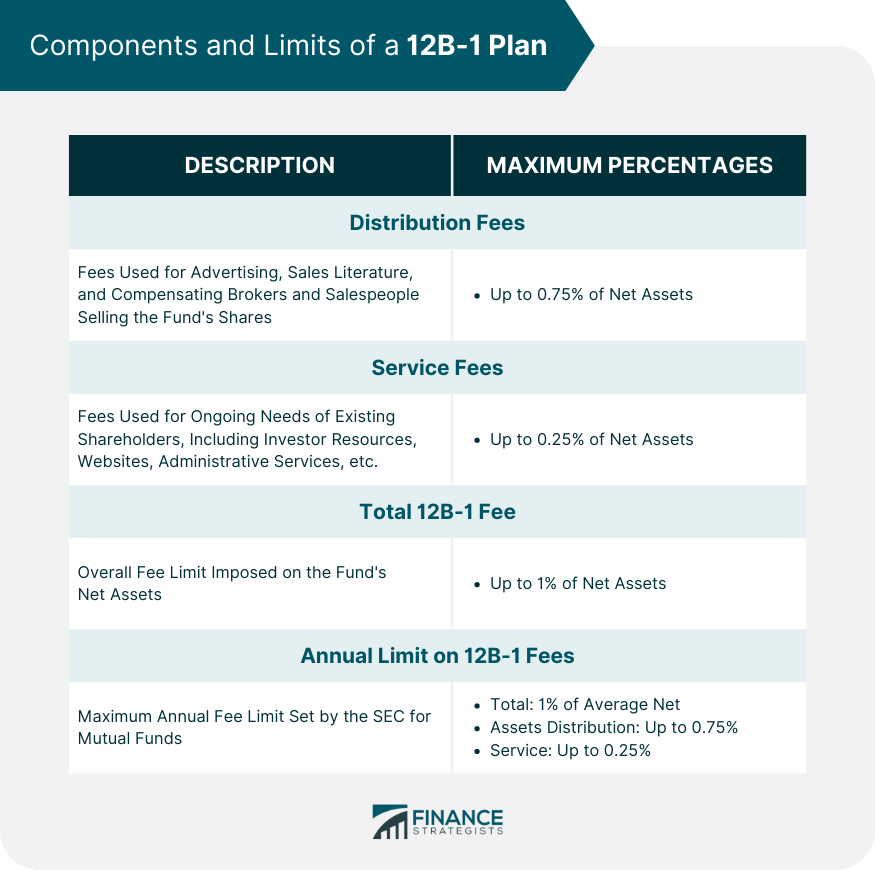

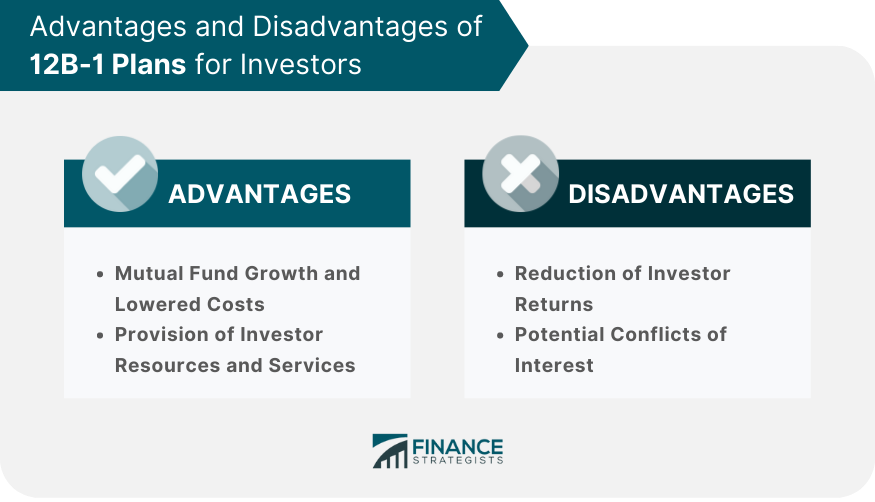

The 12B-1 plan, named after Rule 12b-1 of the Investment Company Act of 1940, refers to a fee charged by mutual funds and ETFs to their shareholders. This fee covers marketing, distribution, and servicing expenses. It was introduced by the SEC in the 1980s to help funds attract more investors and spread costs over a larger asset base. The 12B-1 fee supports fund advertising, promotion, and sales, as well as services like record-keeping and customer support. However, the fee has faced criticism and scrutiny over transparency and potential conflicts of interest. The terms "12B-1 plan" and "12B-1 fees" are often used interchangeably. The 12B-1 plan refers to the structure and framework that allows mutual funds or ETFs to charge fees to shareholders, while the 12B-1 fees specifically refer to the fees themselves that are charged by these funds. A 12B-1 fee is an annual charge deducted from a mutual fund's assets. This fee is often expressed as a percentage of the fund's net assets, and it's charged directly to the fund, not to the investor. However, as it reduces the fund's net asset value, it indirectly affects the returns that investors receive. The 12B-1 fee is part of the total expense ratio of a mutual fund, which also includes management fees and other operational costs. The fund uses the 12B-1 fee to cover distribution costs (like advertising, broker compensation, and printing of prospectuses) and service fees (like customer assistance and account maintenance). There are two main types of 12B-1 fees: distribution fees and service fees. The distribution fee is used for the marketing and selling of fund shares, including advertising costs, broker compensation, and printing and mailing prospectuses. The service fee is used for ongoing services to shareholders, such as maintaining customer service lines or offering advice on the fund. Distribution fees are a significant part of the 12B-1 plan. These fees help mutual funds attract more investors through advertising and sales literature. They also compensate brokers and other salespeople who sell the fund's shares. The rationale behind these fees is that by increasing the fund's assets, they can lower the expense ratio for all shareholders. Service fees, another component of the 12B-1 plan, cater to the ongoing needs of existing shareholders. These fees fund investor hotlines, websites, and other resources that provide fund information. They also support administrative services like processing transactions and maintaining account records. The total 12B-1 fee is usually capped at 1% per year of the fund's net assets. Out of this, a maximum of 0.75% can be used for distribution fees, while the remaining 0.25% can be allocated for shareholder service fees. However, the actual percentages can vary widely depending on the fund's strategy and the discretion of the fund managers. The SEC has set a limit on the 12B-1 fee that mutual funds can charge. The total annual fee cannot exceed 1% of the fund's average net assets, and the portion used for distribution cannot exceed 0.75%. The remaining 0.25% is allocated for service fees. One of the main advantages of 12B-1 fees is their role in promoting mutual fund growth. By covering marketing and distribution costs, these fees allow funds to attract more investors. As the fund's asset base expands, the fixed costs are spread over a larger pool of assets, potentially lowering the overall costs for all shareholders. The service fee portion of a 12B-1 plan goes towards providing investors with resources and services. This includes account maintenance, customer support, and shareholder communications. These services can enhance an investor's experience and understanding of the fund, adding value to their investment journey. On the downside, 12B-1 fees can significantly reduce an investor's returns over the long term. Even though these fees may seem small in terms of percentage, they can compound over time and take a substantial bite out of your overall investment returns. The longer your investment horizon, the greater the impact of these fees on your returns. Critics argue that 12B-1 fees can create conflicts of interest, as they can incentivize brokers to recommend funds that pay higher commissions. This is because a portion of the 12B-1 fee goes towards compensating brokers and advisors for selling fund shares and providing ongoing services. As such, a broker might be tempted to recommend a fund with a higher 12B-1 fee, even if it's not the best fit for the investor's financial goals. This conflict of interest can potentially lead to unsuitable investment recommendations. The 12B-1 plan, named after Rule 12b-1 of the Investment Company Act of 1940, is a fee charged by mutual funds and ETFs to their shareholders. It covers marketing, distribution, and servicing expenses, aiming to attract more investors and spread costs over a larger asset base. The 12B-1 plan consists of distribution fees, which cover advertising and compensating brokers, and service fees, which cater to existing shareholders' needs. The total fee is usually capped at 1% of the fund's net assets, with a maximum of 0.75% for distribution fees and 0.25% for service fees. Advantages of 12B-1 plans include promoting mutual fund growth and providing investor resources and services. However, they can also reduce investor returns over the long term and create conflicts of interest for brokers recommending funds. Investors should carefully consider the advantages and disadvantages of 12B-1 plans when making investment decisions, taking into account their individual financial goals and risk tolerance.What Is the 12B-1 Plan?

Understanding the 12B-1 Plan

Explanation of 12B-1 Fees

How 12B-1 Plans are Used in Mutual Funds

Different Types of 12B-1 Fees

Structure of a 12B-1 Plan

Distribution (or Marketing) Fees

Service (or Shareholder) Fees

Breakdown of Typical 12B-1 Fee Percentages

Annual Limit on 12B-1 Fees

Advantages of 12B-1 Plans for Investors

Mutual Fund Growth and Lowered Costs

Provision of Investor Resources and Services

Disadvantages of 12B-1 Plans

Reduction of Investor Returns

Potential Conflicts of Interest

Final Thoughts

12B-1 Plan FAQs

A 12B-1 plan is a fee charged by mutual funds or exchange-traded funds (ETFs) to cover marketing, distribution, and service costs. Named after Rule 12b-1 of the Investment Company Act of 1940, this fee is intended to help the funds attract more investors and provide ongoing services to shareholders.

A 12B-1 fee is deducted from a fund's assets, reducing its overall net asset value. While the fee doesn't directly come out of your pocket, it indirectly affects your returns as it lowers the fund's overall performance. Over time, even a small 12B-1 fee can compound and significantly erode your investment returns.

A 12B-1 plan typically includes two types of fees: distribution fees and service fees. Distribution fees cover the cost of marketing and selling fund shares, while service fees are used for ongoing services to shareholders, such as customer support and account maintenance.

Yes, 12B-1 plans have been a source of controversy. Critics argue that these fees erode investor returns, add to the overall cost of investing, and can potentially create conflicts of interest. This has led to calls for more transparency and even regulatory reforms.

Given the ongoing criticism and regulatory scrutiny, the use of 12B-1 fees may change in the future. Some industry experts predict more transparency in how these fees are disclosed and used, while others foresee a possible reduction or even elimination of these fees. However, as of now, 12B-1 plans remain a common feature of many mutual funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.