A Totten trust is a type of revocable trust that is created by placing funds into a bank account that is in the name of the account holder and a named beneficiary. The account holder maintains control of the funds during their lifetime, but upon their death, the funds are transferred directly to the named beneficiary. Have quesions about Totten Trusts? Click here.

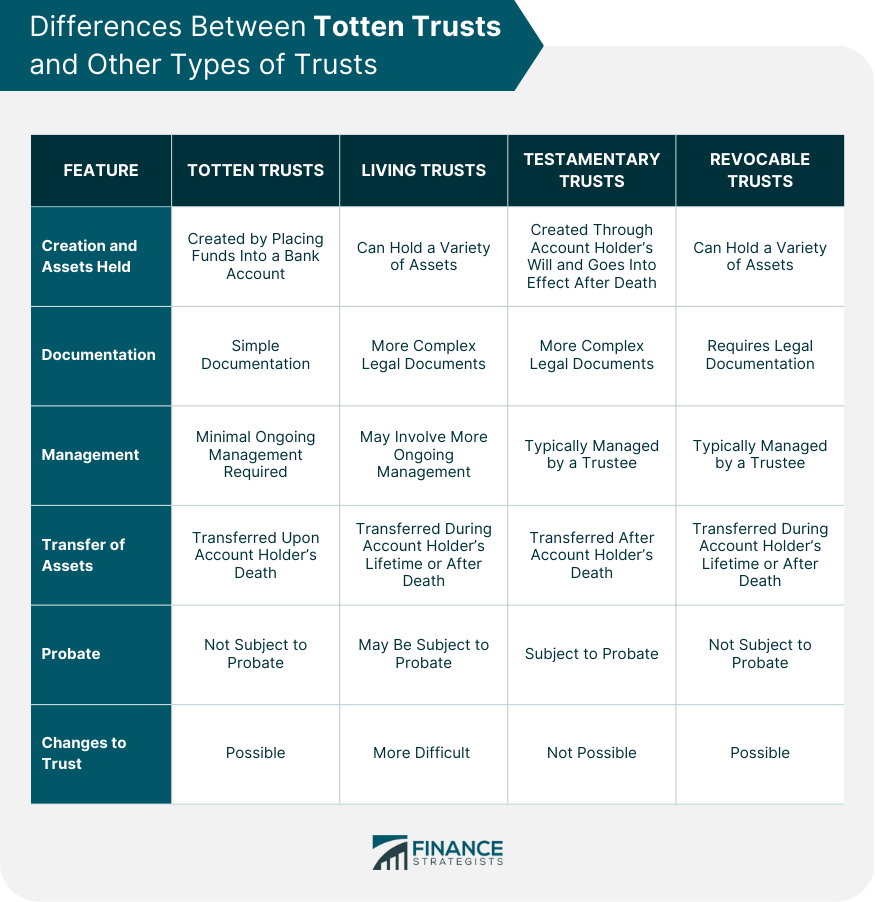

The purpose of a Totten trust is to provide a simple and straightforward way to transfer assets to a named beneficiary after the account holder passes away. It is often used as part of an overall estate plan to ensure that a specific asset, such as a bank account or investment account, is passed down to a particular individual. One of the main benefits of a Totten trust is that it can be set up quickly and easily, without the need for complex legal documents or a lengthy probate process. The funds in a Totten trust are not subject to probate, they can be transferred to the named beneficiary more quickly and efficiently than other types of assets. Here is the guide to setting up a totten trust: To set up a Totten trust, the account holder must be at least 18 years old and have a valid Social Security number. The account must also be set up as a payable-on-death (POD) account, which allows the funds to be transferred to the named beneficiary upon the account holder's death. To open a Totten trust account, the account holder should visit their bank and inform them that they wish to set up a POD account. The account holder will need to provide the name and contact information of the named beneficiary. When naming a beneficiary for a Totten trust, the account holder should carefully consider who they want to receive the funds from after their death. The named beneficiary can be changed at any time during the account holder's lifetime, but it is important to ensure that the account is always properly updated with the most current beneficiary information. Managing a Totten trust can be a straightforward process, as the account holder retains control of the funds in the account during their lifetime. Here are some key considerations for managing a Totten trust: During the account holder's lifetime, they retain control of the funds in the Totten trust account and can access them as needed. The named beneficiary does not have any rights to the funds until the account holder passes away. However, it is important to keep in mind that the funds in the account are typically included in the account holder's taxable estate, so it may be necessary to consult with a tax professional to minimize tax liabilities. The account holder can make changes to the named beneficiary at any time during their lifetime simply by updating the information with their bank or financial institution. Additionally, the account holder can close the account and withdraw the funds without penalty. Totten trusts are typically not subject to income taxes, but the account holder should consult with a tax professional to ensure they are in compliance with any applicable tax laws. The funds in the account may be subject to IRS estate taxes upon the account holder's death, so it is important to keep this in mind when planning and managing a Totten trust. However, it is important to keep in mind that managing a Totten trust is not only about retaining control of the funds in the account but also understanding the tax implications of setting up the trust. While Totten trusts are generally not subject to income taxes, the funds in the account may be subject to estate taxes upon the account holder's death. Totten trusts can serve a variety of important purposes in estate planning, including simplifying the transfer of assets to a named beneficiary, avoiding probate, and providing for specific beneficiaries. Totten trusts can be a simple and straightforward way to ensure that a specific asset, such as a bank account, is passed down to a particular individual. By designating a beneficiary, the account holder can ensure that the funds in the account will be transferred to the intended recipient without the need for a complex legal process or a court's involvement. Totten trusts are not subject to probate, which means that the funds can be transferred to the named beneficiary more quickly and efficiently than other types of assets. This can save both time and money for the beneficiary and the account holder's estate. Totten trusts can be a useful tool for providing for a beneficiary who may have specific needs, such as a minor child or a person with disabilities. By designating a beneficiary, the account holder can ensure that the funds in the account are used for the intended purpose and are not subject to the claims of creditors. It is important to understand the differences between Totten trusts and other types of trusts, as each type of trust has its own unique features and advantages. A Totten trust is a type of revocable trust that is created by placing funds into a bank account, while a living trust is a more comprehensive estate planning tool that can be used to hold a variety of assets, including real estate, investments, and personal property. Living trusts also typically require more complex legal documents and may involve more ongoing management than Totten trusts. A Totten trust is a type of trust that is created during the account holder's lifetime, while a testamentary trust is created through the account holder's will and goes into effect after their death. Testamentary trusts may be subject to probate and typically involve more complex legal documents than Totten trusts. Totten trusts are a type of revocable trust, which means that the account holder can make changes to the trust or revoke it entirely during their lifetime. Revocable trusts can be used to hold a variety of assets, including bank accounts, real estate, and personal property. The table below further illustrates the difference between Totten trusts and other types of trusts. Totten trusts can be a useful tool for simplifying estate planning, avoiding probate, and providing for beneficiaries. They are easy to set up and manage and can be a good option for individuals who want a simple way to ensure that their assets are distributed according to their wishes. Setting up a Totten trust has its basic requirements. You will need to open a trust account with a bank or financial institution and then name a beneficiary. It is important to understand the differences between Totten trusts and other types of trusts, as each type of trust has its own unique features and advantages. They differ in the creation, management, transfer, probate requirements, and making changes. Individuals who are interested in setting up a Totten trust should consult with an estate planning attorney to ensure that the trust is created properly and in compliance with applicable laws.What Is a Totten Trust?

Purpose of Totten Trusts

Benefits of Totten Trusts

Setting up a Totten Trust

Requirements for Creating a Totten Trust

How to Open a Totten Trust Account

Naming a Beneficiary for a Totten Trust

Managing a Totten Trust

Accessing Funds in a Totten Trust

Making Changes to a Totten Trust

Taxes and Totten Trusts

Common Uses for Totten Trusts

Simplifying Estate Planning

Avoiding Probate

Providing for Beneficiaries

Differences Between Totten Trusts and Other Types of Trusts

Totten Trusts vs Living Trusts

Totten Trusts vs Testamentary Trusts

Totten Trusts vs Revocable Trusts

Final Thoughts

Totten Trust FAQs

A Totten trust is a type of revocable trust that is created by placing funds into a bank account that is in the name of the account holder and a named beneficiary. It differs from other types of trusts, such as living trusts or testamentary trusts, in that it is a simpler and more straightforward way to transfer assets to a named beneficiary.

To set up a Totten trust, you must be at least 18 years old and have a valid Social Security number. The account must also be set up as a payable-on-death (POD) account, which allows the funds to be transferred to the named beneficiary upon the account holder's death. To open a Totten Trust account, visit your bank or financial institution and inform them that you wish to set up a POD account.

One of the main benefits of a Totten trust is that it can be set up quickly and easily, without the need for complex legal documents or a lengthy probate process. Additionally, because the funds in a Totten trust are not subject to probate, they can be transferred to the named beneficiary more quickly and efficiently than other types of assets.

Yes, the named beneficiary of a Totten trust can be changed at any time during the account holder's lifetime simply by updating the information with the bank or financial institution where the account is held.

Totten trusts are typically not subject to income taxes, but the account holder should consult with a tax professional to ensure they are in compliance with any applicable tax laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.