No, not all wills go into probate. Whether a will must go through probate depends on various factors, such as the type and value of the deceased's assets, how those assets were owned, and the specific laws of the state. Assets held jointly with rights of survivorship, assets held in a trust, or assets with named beneficiaries like life insurance policies or retirement accounts often bypass probate. Furthermore, many states have simplified probate or exempted small estates from the formal probate process. Thus, while many will do go through probate, it is not a universal requirement, and certain estate planning tools can be used to avoid it. A will and probate are key elements of estate planning with an intertwined relationship. A will is a legal document where a person, known as the testator, outlines how their assets should be distributed upon their death. It includes details about beneficiaries and the division of assets and may also designate an executor to carry out these instructions. Probate, on the other hand, is the legal process that takes place after a person's death. It involves authenticating the deceased's will, appointing an executor if none is named, settling the deceased's debts, and distributing the remaining assets as the will directs. If there's no will, state laws guide the distribution of assets. In essence, a will provides the roadmap for the probate process, detailing the deceased's wishes for their estate. The probate process, in turn, ensures these wishes are legally adhered to and effectively carried out. 1. Locate and Review the Will: The original will must be found and reviewed for instructions and appointment of the executor. 2. File a Petition: File a petition in the probate court in the county where the deceased resided to validate the will and initiate the probate process. 3. Notify Heirs and Creditors: Notify heirs, beneficiaries, and creditors about the probate proceedings. This gives them an opportunity to make claims against the estate or contest the will. 4. Inventory Assets: The executor needs to locate, inventory, and appraise the deceased's assets. This includes all real and personal property, bank accounts, investments, and other assets. 5. Pay Debts and Taxes: Before the assets can be distributed, the deceased's debts must be paid off. This includes any taxes owed. 6. Distribute Assets: Once debts and taxes have been cleared, the remaining assets are distributed according to the will's instructions. 7. Close the Estate: Once all debts, taxes, and distributions have been made, the executor can petition the court to close the estate. This completes the probate process. Avoiding probate can save time, money, and privacy. Probate can be lengthy and costly, and all probate records are public. Therefore, avoiding probate can keep the details of a person's estate private. Creating a trust, such as a revocable living trust, allows assets to be transferred outside of probate. When a trust is set up, the property is technically owned by the trust, so it does not form part of the individual's estate when they die. Properties owned jointly with the right of survivorship are automatically passed to the surviving owner, avoiding probate. Accounts such as bank accounts or retirement accounts often have payable-on-death (POD) designations. The account automatically transfers to the named beneficiary upon the owner's death, bypassing probate. Assets that are given away before death do not form part of the estate, hence avoiding probate. 1. Time-Saving: Probate can be a lengthy process. Avoiding it speeds up asset distribution. 2. Cost-Effective: Probate involves court, attorney, and executor fees. Bypassing it can save these expenses. 3. Privacy: Probate is a public process. Avoiding it helps keep estate matters private. 1. Upfront Costs: Tools to avoid probate, like setting up trusts, can require substantial initial costs. 2. Complexity: Avoiding probate often involves complex legal processes requiring professional assistance. 3. Potential Disputes: Tools like joint ownership might lead to disputes among co-owners. 4. Tax Implications: Some methods, like gifting, can lead to tax liabilities. The role of an executor is of crucial importance in probate proceedings. Typically, the testator designates an executor within the will itself. However, in scenarios where an executor is not named or is unable to fulfill the duties, the court steps in to assign an administrator. This substitute functions much like an executor, ensuring the will's instructions are carried out effectively. Executors or administrators bear a weighty responsibility as they handle various tasks. These include identifying, securing, and valuing the deceased's assets, settling outstanding debts and taxes, filing necessary tax returns, and ultimately, dispersing the assets as per the directives in the will. They're also responsible for providing a detailed account of their actions to the court, which serves as a check on their management of the estate. The task of administering a will isn't without its hurdles. Executors and administrators may confront a host of challenges, such as tracking down all of the deceased's assets and debts or managing disagreements among beneficiaries. To address these potential difficulties, having a well-drafted will with explicit instructions is key. Additionally, seeking advice from legal and financial experts can be instrumental in navigating the complexities of the probate process. Probate laws provide a legal framework for the administration and settlement of estates. They set forth procedures for the validation of wills, the appointment of executors or administrators, managing creditors' claims, distributing assets to beneficiaries, and resolving any arising disputes in the probate process. Within the United States, the application of probate laws varies significantly from one state to another. Certain states have embraced the Uniform Probate Code (UPC), which aims to standardize and simplify the probate process. However, other states have maintained their unique probate laws and procedures, which could potentially lead to more intricate and diverse probate proceedings. Globally, the nuances of probate laws and procedures vary significantly. For instance, in the United Kingdom, the probate process is known as the 'grant of probate.' In contrast, in Australia, it's referred to as the 'grant of representation.' These differences are largely influenced by the distinct legal systems and cultural norms present within each country. The relationship between wills and probate is a complex yet vital aspect of estate management. Not all wills necessitate probate, as it hinges on various factors such as asset types, ownership forms, and jurisdictional laws. The probate process, although time-consuming and public, ensures that a deceased person's estate is properly managed and distributed according to their wishes. Nonetheless, numerous legal strategies, including trusts and joint ownership, can circumvent this process for reasons of privacy, time efficiency, and cost-effectiveness. Executors and administrators play a pivotal role in this landscape, overseeing the fulfillment of the deceased's will despite potential challenges. Importantly, probate laws vary widely across states and countries, further underscoring the necessity of understanding these nuances in estate planning. Ultimately, professional advice is paramount to navigate these complexities and ensure a smooth transition of one's legacy.Do All Wills Go Into Probate?

Will and Probate Relationship Overview

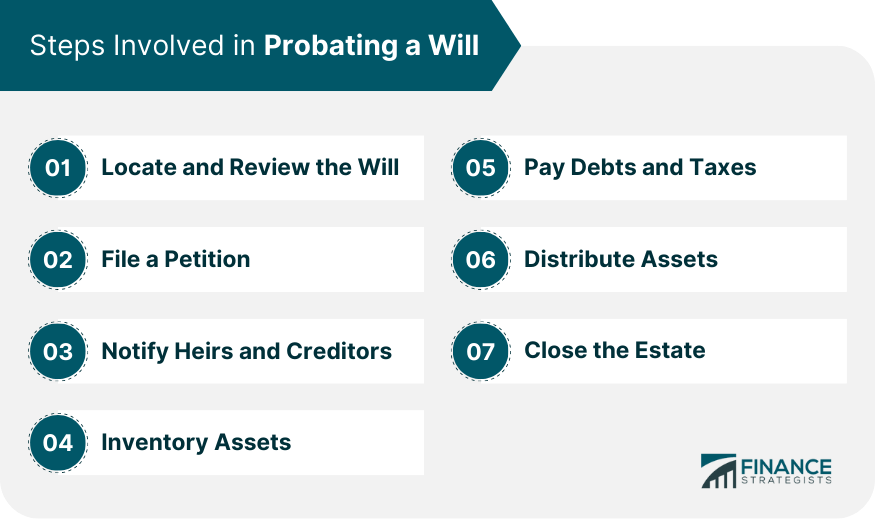

Steps Involved in Probating a Will

Avoiding Probate

Reasons to Avoid Probate

Legal Instruments That Can Avoid Probate

Trusts

Joint Ownership

Payable-On-Death Designations

Gift

Pros and Cons of Avoiding Probate

Pros

Cons

Significance of Executors and Administrators in the Probate Process

Process of Appointing Executors and Administrators

Essential Duties and Responsibilities of Executors and Administrators

Navigating Challenges and Identifying Solutions in Probate Administration

Understanding Probate Laws and Their Variations

General Overview of Probate Laws

Variations in Probate Laws Across the US States

Probate Laws Differences by Country

Conclusion

Do All Wills Go Into Probate? FAQs

No, not all wills have to go through probate. Whether a will goes through probate depends on factors such as the type and value of assets, ownership forms, and state laws.

There are several methods to avoid probate, including creating a trust, holding assets jointly with the right of survivorship, designating payable-on-death beneficiaries, and gifting assets before death.

Avoiding probate can save time and money, maintain privacy, and expedite the distribution of assets to beneficiaries.

Executors and administrators are responsible for tasks such as identifying and valuing assets, settling debts and taxes, filing tax returns, and distributing assets according to the will's instructions.

Yes, probate laws vary across states within the United States and differ significantly between countries. Some states have adopted standardized probate codes, while others have their own unique laws and procedures. International differences in probate laws are influenced by distinct legal systems and cultural norms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.