Hot money refers to funds that flow rapidly between financial markets in search of the highest short-term interest rates or returns. These funds are typically speculative in nature and are often characterized by their short investment horizon and high liquidity. Hot money is important in the banking industry because it can significantly impact a country's financial stability, exchange rates, and overall economic performance. While hot money can provide much-needed capital inflows and investment opportunities, it also carries risks due to its volatile and unpredictable nature. One of the main characteristics of hot money is its rapid movement across financial markets. Investors who engage in hot money transactions are constantly searching for the best short-term returns, leading them to quickly shift their funds between different markets, countries, or investment instruments. Hot money is highly liquid, meaning it can be easily converted into cash or other assets without losing its value. This high level of liquidity allows investors to quickly enter or exit investment positions, which further contributes to the rapid movement of hot money across markets. Hot money transactions typically have a short-term investment horizon, with investors seeking quick profits rather than long-term capital appreciation. This short-term focus contributes to the volatility of hot money flows, as investors are more likely to move their funds in response to temporary market fluctuations. Institutional investors, such as pension funds, insurance companies, and mutual funds, are common sources of hot money. These large investors often have significant financial resources at their disposal and engage in hot money transactions to maximize their short-term returns. Hedge funds, which are investment funds that use advanced investment strategies to generate high returns, are another significant source of hot money. Hedge funds often employ leverage and engage in speculative activities, making them more likely to pursue hot money opportunities. Foreign investors can also contribute to hot money flows by moving their funds between countries in search of higher interest rates or better investment opportunities. These investors may be attracted by favorable economic conditions, government policies, or other factors that create short-term profit potential. Hot money can contribute to economic instability, as rapid capital inflows and outflows can lead to fluctuations in interest rates, inflation, and economic growth. These fluctuations can create uncertainty and make it more difficult for businesses and consumers to plan for the future. The rapid movement of hot money across borders can lead to significant exchange rate volatility. As investors move their funds between countries, demand for different currencies can fluctuate, causing exchange rates to rise or fall. This volatility can create challenges for businesses engaged in international trade, as well as for central banks seeking to maintain stable exchange rates. Hot money flows can also cause disruptions in financial markets, as large-scale investment activities can lead to price distortions, market bubbles, or even crashes. These disruptions can have significant consequences for both investors and the broader economy. One way that governments and central banks can attempt to control hot money flows is by implementing capital controls. These measures may include restrictions on foreign exchange transactions, limits on capital inflows or outflows, or taxes on certain types of transactions. Monetary policy measures, such as changes to interest rates or reserve requirements, can also be used to influence hot money flows. By adjusting these policy tools, central banks can make their country's financial markets less attractive to hot money investors, thereby reducing the potential impact of these flows on their economies. In some cases, governments and financial regulators may impose reporting requirements on financial institutions and investors engaged in hot money transactions. These requirements can help authorities monitor and track hot money flows, allowing them to identify potential risks and take appropriate action if necessary. One of the main benefits of hot money is that it can provide increased liquidity to financial markets. This additional liquidity can facilitate smoother trading and investment activities, potentially leading to more efficient allocation of capital and resources. Hot money flows can also create investment opportunities for domestic and foreign investors. As hot money enters a country's financial markets, it can lead to higher asset prices and increased demand for certain investment instruments. This can provide opportunities for investors to profit from these market movements. For countries that are experiencing economic difficulties or struggling to attract foreign investment, hot money can provide much-needed capital inflows. These inflows can help support economic growth, finance infrastructure projects, or stabilize a country's financial system. One of the primary risks associated with hot money is that it can increase a country's vulnerability to external economic shocks. As hot money flows are often driven by short-term factors, they can quickly reverse in response to changes in global financial conditions or investor sentiment. This can leave countries exposed to sudden capital outflows, potentially leading to financial instability or economic crises. The rapid movement of hot money across markets can also create opportunities for market manipulation. Unscrupulous investors or financial institutions may use hot money flows to artificially inflate or deflate asset prices, leading to market distortions and potential losses for other investors. As mentioned earlier, hot money flows can be highly volatile and prone to sudden reversals. These rapid capital outflows can create significant challenges for countries and financial markets, as they can lead to sharp declines in asset prices, reduced liquidity, and even financial crises. Hot money is a term used to describe the rapid flow of funds between financial markets in search of the highest short-term returns. These flows are characterized by their high liquidity, short-term investment horizon, and rapid movement across markets and countries. Hot money carries both benefits and risks for the banking industry and the broader economy. While it can provide increased liquidity, investment opportunities, and capital inflows, it can also contribute to economic instability, exchange rate volatility, and financial market disruptions. Understanding the nature of hot money and its potential impacts is crucial for policymakers, regulators, and investors alike. By being aware of the benefits and risks associated with hot money, these stakeholders can make more informed decisions and implement appropriate measures to manage its potential consequences. Hot money is a double-edged sword in the world of banking and finance. While it can provide much-needed capital and investment opportunities, it can also create significant challenges for countries and financial markets.What Is Hot Money?

Characteristics of Hot Money

Rapid Movement

High Liquidity

Short-Term Investment Horizon

Sources of Hot Money

Institutional Investors

Hedge Funds

Foreign Investors

Impact of Hot Money on Banking

Economic Instability

Exchange Rate Volatility

Financial Market Disruptions

Regulations and Controls on Hot Money

Capital Controls

Monetary Policy Measures

Reporting Requirements

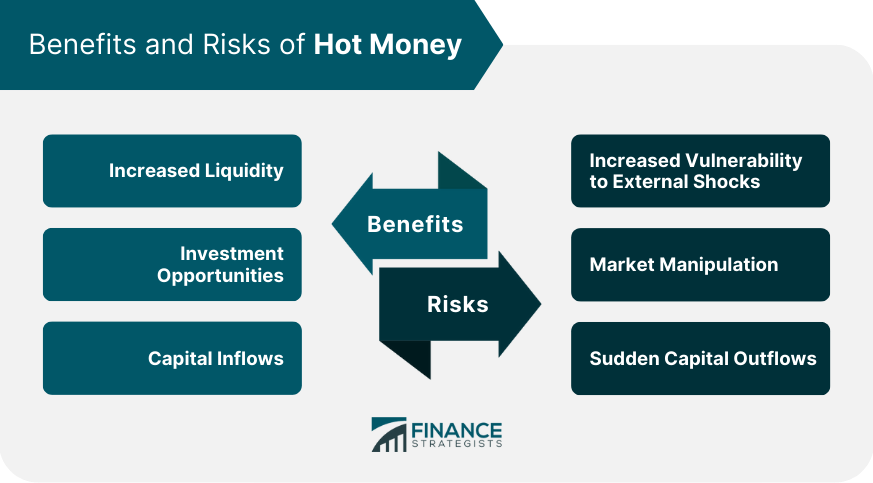

Benefits of Hot Money

Increased Liquidity

Investment Opportunities

Capital Inflows

Risks of Hot Money

Increased Vulnerability to External Shocks

Market Manipulation

Sudden Capital Outflows

Final Thoughts

Hot Money FAQs

Hot money refers to funds that flow rapidly between financial markets in search of the highest short-term interest rates or returns.

Institutional investors, hedge funds, and foreign investors are common sources of hot money.

Hot money can contribute to economic instability, exchange rate volatility, and financial market disruptions.

Capital controls, monetary policy measures, and reporting requirements are some methods used by governments and central banks to regulate and control hot money flows.

Benefits of hot money include increased liquidity, investment opportunities, and capital inflows. Risks associated with hot money are increased vulnerability to external shocks, market manipulation, and sudden capital outflows.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.