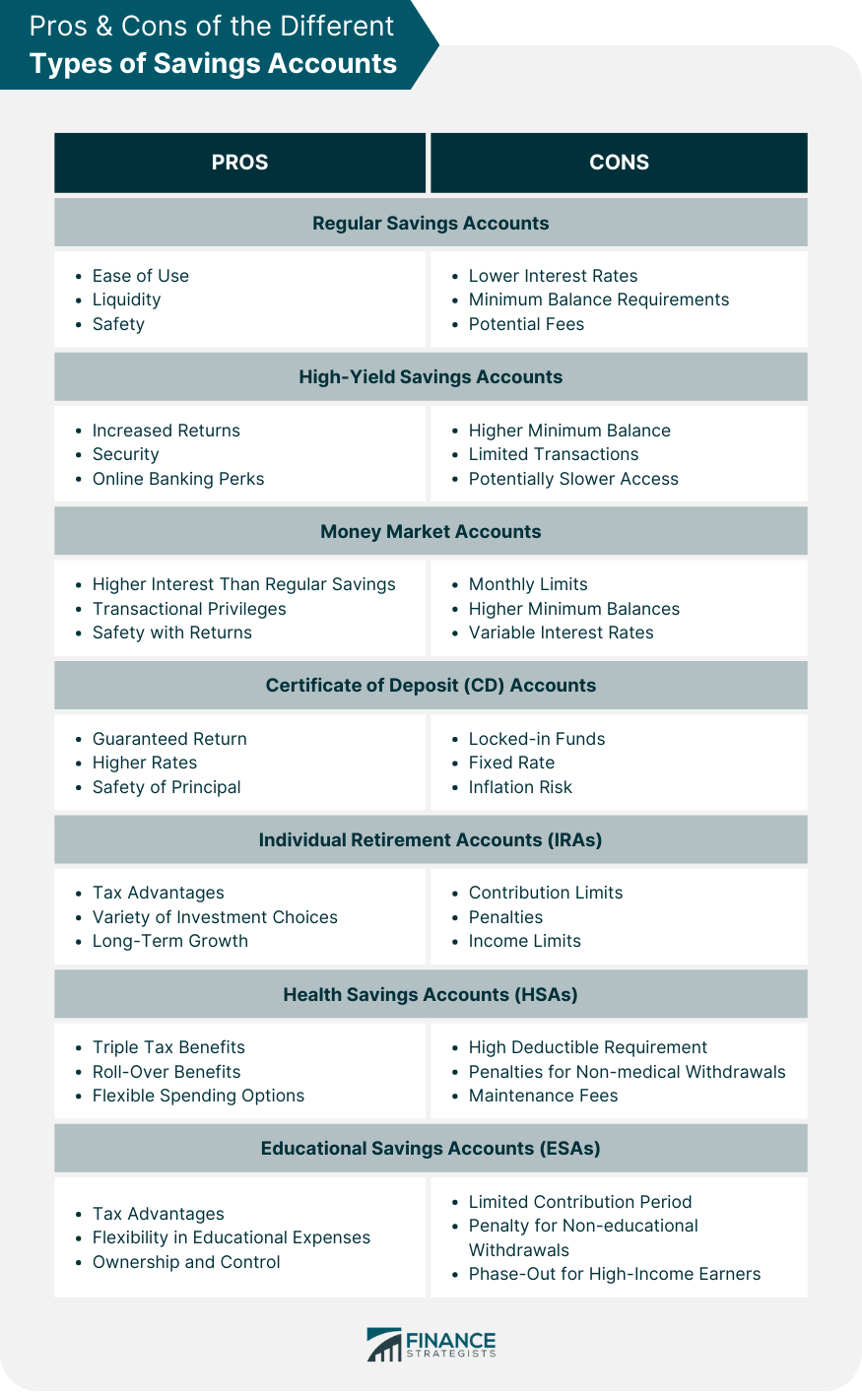

A savings account is a financial product offered by banks and credit unions that allows individuals to deposit and store their money while earning interest on the balance. It serves as a safe and secure place to keep funds, separate from the primary checking account used for day-to-day transactions. These accounts are characterized by their low risk and high liquidity, making them an attractive option for individuals looking to preserve their money and earn a modest return. It also acts as a buffer against unforeseen expenses, providing a readily available source of funds without the need to resort to borrowing or incurring debt. Moreover, savings accounts are insured by regulatory bodies like the Federal Deposit Insurance Corporation (FDIC) and offer a level of protection for account holders' money, reassuring them that their deposits are safeguarded against potential bank failures. These accounts are the most common type and serve as a fundamental tool for building savings. They often require a low minimum deposit and come with relatively simple terms and conditions. Regular Savings Accounts typically offer a modest interest rate, making them suitable for short-term savings goals or as a starter account for those just beginning their savings journey. Pros Ease of Use: The processes to set up and manage these accounts are typically straightforward, with banks offering considerable guidance along the way. Liquidity: Offers high accessibility to funds, allowing account holders to withdraw their money whenever they deem necessary, ensuring individuals can access their funds in case of emergencies. Safety: Insured up to a particular limit by bodies such as the FDIC, ensuring money is protected even if the bank faces financial challenges. Cons Lower Interest Rates: Regular savings accounts generally offer relatively low interest. Over time, especially in inflationary periods, the real value of money stored in these accounts may not grow as one might hope. Minimum Balance Requirements: Several banks institute a mandate whereby account holders must maintain a certain minimum balance in their regular savings accounts. Potential Fees: These could range from withdrawal fees after exceeding a certain number of transactions to charges for using out-of-network ATMs. Such hidden fees, if not monitored, can slowly but surely diminish the account's overall value. These accounts are ideal for individuals looking to maximize their savings growth potential. While they often require higher minimum balances and may have more stringent terms, the increased interest earnings can make a significant difference in long-term savings goals. Pros Increased Returns: High-Yield Savings Accounts facilitate quicker growth of savings. This boost is especially beneficial in combating inflationary pressures, ensuring that one's savings aren't just stagnant but actively expanding. Security: The foundation of these accounts lies in safety with the assurance of being FDIC-insured up to a predefined limit. This insurance brings peace of mind, knowing that even in the face of bank insolvencies, one's savings are shielded. Online Banking Perks: Account holders often benefit from innovative digital tools that might include superior online interfaces, budgeting tools, and alerts, all aimed at enhancing the user experience and financial management capabilities. Cons Higher Minimum Balance: Some banks stipulate the maintenance of a sizable minimum balance. This requirement might make these accounts less accessible for individuals not willing or able to lock away significant sums. Limited Transactions: Accounts might impose restrictions on the number of allowed monthly withdrawals or transfers. Exceeding this number can lead to fees, negating some of the interest advantages of the account. Potentially Slower Access: Given that many of these accounts are offered by online-only banks, there might be a slight delay when transferring funds to and from a traditional brick-and-mortar institution. MMA combines features of both savings and checking accounts, offering higher interest rates than standard savings accounts and check-writing capabilities. They are known for their competitive interest rates and may require a higher minimum balance to open and maintain the account. Money market accounts are suitable for individuals seeking a balance between accessibility and higher returns on their savings. Pros Higher Interest Than Regular Savings: They offer users the opportunity to grow their funds more aggressively than standard savings, offering a sweet middle ground between regular and high-yield accounts. Transactional Privileges: The allowance of check-writing functions and, in some cases, the provision of debit cards make them more versatile, thereby bridging the gap between a savings reservoir and an operational account. Safety With Returns: Along with the convenience and better returns, MMAs are typically FDIC-insured, combining the safety of a savings account with the perks of a checking account. Cons Monthly Limits: Federal regulations often dictate a cap on the number of monthly transactions for MMAs. Beyond this limit, account holders might either face transaction refusal or, in some cases, incur fees. Higher Minimum Balances: Many financial institutions mandate a heftier minimum balance compared to regular savings accounts. Falling short of this balance might lead to reduced interest rates or the imposition of monthly fees. Variable Interest Rates: The interest rates for MMAs can be variable. As these rates fluctuate, there might be periods where the returns on MMAs drop, making them less lucrative compared to other fixed-rate financial tools. CD accounts are time-based deposits that offer fixed interest rates over a predetermined period, known as the CD term. These accounts require customers to lock in their money for a specified duration, which can range from a few months to several years. In exchange for this commitment, CD accounts typically provide higher interest rates than regular savings accounts. They are well-suited for individuals with long-term savings goals and a willingness to forgo immediate access to their funds. Pros Guaranteed Return: The essence of a CD lies in its predictability. Once you've secured your funds in it, the agreed-upon interest rate remains unaltered throughout the tenure. Higher Rates: The promise of a better interest rate, especially with longer-term CDs, is a compelling reason for many savers to choose this pathway over regular savings. Safety of Principal: CDs, like many other bank products, typically enjoy the protective umbrella of FDIC insurance. This means that while your money is growing, it's also shielded from bank-related adversities. Cons Locked-in Funds: If you need to take your money out early, you might have to pay a penalty. This can be tough if you suddenly need your money for an emergency. Fixed Rate: A CD gives you a set interest rate. This means if other bank rates go up, you're stuck with the rate you have. So, if interest rates rise elsewhere, you might feel like you're missing out on earning more. Inflation Risk: With longer-term CDs, there's an inherent risk of inflation outpacing the interest rate. This means that while the nominal value of your savings grows, the real purchasing power might diminish. IRAs are specialized savings accounts designed to help individuals save for retirement. They offer tax advantages, allowing account holders to potentially reduce their taxable income while saving for the future. There are different types of IRAs, including Traditional IRAs, Roth IRAs, and SEP IRAs, each with unique tax implications and eligibility criteria. Pros Tax Advantages: Contributions can be tax-deductible, and earnings can grow tax-free, depending on the IRA type. Variety of Investment Choices: IRAs allow diversification by investing in stocks, bonds, mutual funds, and more. Long-Term Growth: Over time, the money you put in an IRA can grow a lot because of compound interest. Cons Contribution Limits: There are annual limits to how much can be contributed. Penalties: Withdrawing funds before a certain age can lead to penalties and tax implications. Income Limits: Eligibility for certain IRA contributions is subject to annual income restrictions. Depending on your modified adjusted gross income (MAGI), you may be limited in, or excluded from, making contributions to particular types of IRAs. HSAs are tax-advantaged savings accounts available to individuals enrolled in high-deductible health insurance plans. It allows account holders to set aside pre-tax money to cover qualified medical expenses. The funds in an HSA can be invested and grow tax-free, making it an attractive option for individuals looking to save for medical expenses in a tax-efficient manner. Pros Triple Tax Benefits: HSAs are unique in providing three layers of tax benefits. Contributions reduce taxable income, any growth or earnings within the account are tax-free, and withdrawals for medical expenses are also not taxed. Roll-Over Benefits: If you don't spend what you've saved during the year, your money will carry over to the next year, allowing for long-term savings for future medical needs. Flexible Spending Options: Not only can you use your HSA for immediate medical expenses, but after the age of 65, you can use the funds for any purpose. Cons High Deductible Requirement: Only available to those with high deductible health plans. Penalties for Non-medical Withdrawals: Withdrawing funds for non-qualified expenses can lead to taxes and penalties. Maintenance Fees: Some HSAs might have monthly maintenance fees or other charges, which can eat into your savings if not carefully monitored. It's essential to read the terms and conditions and select a provider wisely. ESAs, also known as Coverdell Education Savings Accounts, are specialized accounts designed to help parents and guardians save for a child's education expenses. Educational Savings Accounts offer tax advantages similar to IRAs, allowing tax-free growth of funds when used for qualified educational expenses. These accounts provide a valuable tool for families planning for their children's future educational needs. Pros Tax Advantages: Contributions made to an ESA are not tax-deductible, but the earnings on the account grow tax-free. Additionally, withdrawals from the ESA are tax-free if used for qualified education expenses, which can include tuition, fees, books, supplies, and certain educational technology expenses. Flexibility in Educational Expenses: ESAs can be used for both primary and secondary education expenses. This means that funds saved in an ESA can be utilized for private elementary and secondary school expenses, including tuition, tutoring, and other educational needs. Ownership and Control: The designated beneficiary of the account is typically the student for whom the funds are intended. However, if the designated beneficiary does not use all the funds or decides not to pursue higher education, the account holder has the flexibility to change the beneficiary to another eligible family member. Cons Limited Contribution Period: Once the beneficiary turns 18, no further contributions are allowed, which may restrict the potential for additional savings in later years. Penalty for Non-educational Withdrawals: If funds from an ESA are withdrawn for non-qualified expenses, such as non-educational purposes, they may be subject to both income tax and a 10% penalty on the earnings portion. Phase-Out for High-Income Earners: For contributors with higher incomes, the ability to make ESA contributions gradually phases out, making the account less accessible to those with substantial earnings. Selecting the right savings account is essential for optimizing savings growth and meeting specific financial objectives. Here are key factors to consider when choosing a savings account: Start by evaluating your financial goals and objectives. Determine whether you are saving for short-term goals, such as a vacation or an emergency fund, or for long-term goals like retirement or a child's education. Understanding your objectives will help you identify the most suitable savings account type. Interest rates directly impact the growth of your savings over time. Compare the interest rates offered by different savings accounts, taking note of any tiered structures or promotional rates. Additionally, be aware of any fees associated with the account, such as maintenance fees or transaction charges, which can affect your overall savings earnings. Assess how often you expect to access your funds. Some accounts may have withdrawal restrictions, while others offer more flexibility. If you anticipate needing immediate access to your savings, consider an account with easy withdrawal options, such as a regular savings account or a money market account. Look beyond interest rates and fees and consider other features offered by the savings account. Some accounts may offer mobile banking, budgeting tools, or ATM fee reimbursements, enhancing the overall banking experience. Choose an account that aligns with your banking preferences and lifestyle. Savings accounts serve as secure financial products allowing individuals to deposit and earn interest on their money. They offer low risk and act as a buffer against unforeseen expenses. The various savings account types cater to different needs. Regular savings accounts are versatile starters; high-yield accounts maximize growth, money market accounts balance accessibility, and CDs offer guaranteed returns with locked-in funds. ESAs have tax advantages for education but limited contributions. IRAs offer retirement tax benefits with investment options, while HSAs provide triple tax benefits for medical expenses but require high-deductible health plans. Choosing the right savings account depends on assessing financial goals, comparing interest rates and fees, considering accessibility, and evaluating additional account features. Selecting the most suitable savings account empowers individuals to build a stronger financial future while meeting their unique financial objectives.What Is a Savings Account?

Types of Savings Accounts

Regular Savings Accounts

High-Yield Savings Accounts

Money Market Accounts

Certificate of Deposit (CD) Accounts

Individual Retirement Accounts (IRAs)

Health Savings Accounts (HSAs)

Educational Savings Accounts (ESAs)

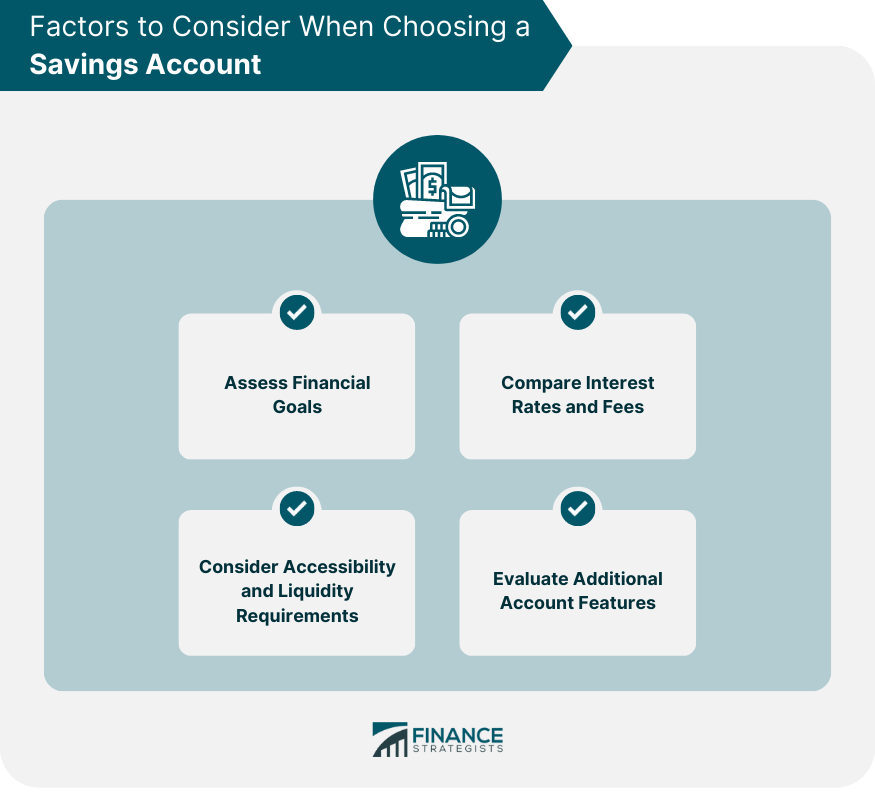

Choosing the Right Savings Account For Your Needs

Assess Financial Goals

Compare Interest Rates and Fees

Consider Accessibility and Liquidity Requirements

Evaluate Additional Account Features

Conclusion

Types of Savings Accounts FAQs

There are various types of savings accounts, including regular savings accounts, high-yield savings accounts, money market accounts, certificate of deposit (CD) accounts, individual retirement accounts (IRAs), health savings accounts (HSAs), and educational savings accounts (ESAs).

A regular savings account is a basic account offered by banks and credit unions, suitable for building savings with easy access to funds and a modest interest rate.

High-yield savings accounts offer higher interest rates than regular savings accounts, providing a greater potential for savings growth, but may have higher minimum balance requirements.

Money market accounts are a hybrid between savings and checking accounts, offering competitive interest rates and check-writing capabilities, ideal for those seeking liquidity with better returns.

CD accounts offer fixed interest rates over a specified term, providing guaranteed returns, but the funds are locked in for the duration of the CD, ranging from months to years.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.