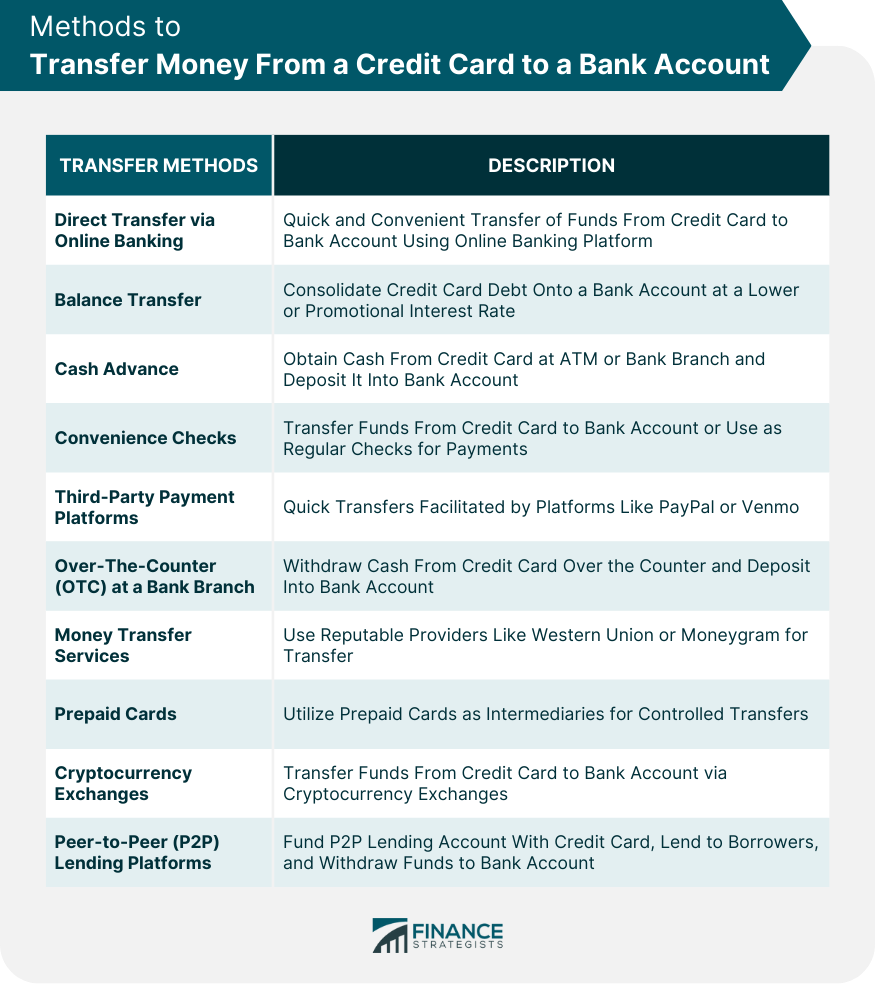

Yes, it is generally possible to transfer money from a credit card to a bank account through various methods. Some of the common ways include direct transfers via online banking, balance transfers, cash advances, convenience checks, and using third-party payment platforms like PayPal or Venmo. These methods offer varying degrees of convenience and may come with associated fees and interest rates. It's essential for individuals to review their credit card issuer's terms and conditions, understand associated fees, and consider the purpose of the transfer before proceeding. While transferring money from a credit card to a bank account can be a helpful financial tool, responsible financial management and careful evaluation of alternative options are essential to avoid unnecessary costs and potential debt accumulation. It is often possible to transfer money from a credit card to a bank account, but the process and availability may vary depending on the credit card issuer and the specific transfer method chosen. There are several ways through which this can be done: A balance transfer presents an effective solution for credit cardholders to consolidate their outstanding credit card debt onto a bank account, often at a lower or promotional interest rate. This process typically involves logging into the online banking account, selecting the option to transfer funds, and specifying the credit card as the funding source and the bank account as the recipient. A balance transfer presents an effective solution for credit cardholders to consolidate their outstanding credit card debt onto a bank account, often at a lower or promotional interest rate. To apply, check if the credit card issuer allows transfers to a bank account. Provide bank details during the application, and if approved, the debt moves to the designated account. Credit cardholders can obtain a cash advance from their credit card at an ATM or a bank branch, subsequently depositing the withdrawn cash into their bank account. To initiate a cash advance, find a compatible ATM or bank branch, insert the credit card, and withdraw the desired amount. Alternatively, request a cash advance from a teller. Deposit the cash into the bank account using a deposit machine or the bank teller's assistance. Convenience checks, also known as credit card checks, allow credit cardholders to transfer funds from their credit card to a bank account or use them as regular checks for payments. To use a convenience check, receive them from the credit card issuer via mail or promotion. Fill out the check with the recipient's details, amount, and necessary information. Deposit the check into the bank account using a teller or ATM, or mail it to the bank for processing. Third-party payment platforms offer a simple process to transfer money from a credit card to a bank account. Create an account on platforms like PayPal or Venmo, and provide personal and financial information. Link the credit card to the platform, and initiate the transfer to the bank account by specifying the amount and recipient details. Confirm the transfer and the platform will process it. The funds should be available in the bank account within a few business days. In select cases, certain banks permit credit cardholders to withdraw cash over the counter at a bank branch and deposit it into their bank accounts. To initiate the transaction, visit a local bank branch where you have an account, and inform the teller of your intention for a cash advance or credit card to bank account transfer. The teller will verify your identity, process the request, withdraw the desired amount from the credit card, and deposit it into your linked bank account. First, the individual needs to choose a reputable money transfer service provider, such as Western Union or MoneyGram. Next, they must visit the physical location of the chosen service provider or access their website or mobile app. To initiate the transfer, they will be required to provide their credit card information, including the card number and security code, as well as the recipient bank account details, such as the account number and routing number. After confirming the transaction and paying any applicable fees, the money transfer service will process the transfer. First, the individual needs to obtain a prepaid card, either by purchasing one from a retail store or receiving one as a gift or incentive. After acquiring the prepaid card, they should register it online or through the issuer's mobile app, providing necessary personal information and linking it to their credit card. Once the registration is complete, they can load funds onto the prepaid card using their credit card as the funding source. After the funds are loaded, they can then proceed to transfer the desired amount from the prepaid card to their linked bank account. To use cryptocurrency exchanges, register on a reputable platform accepting credit card funding. Verify your identity, link your card, and add funds to your exchange account. Convert cryptocurrency to fiat currency and initiate a withdrawal to your linked bank account with the desired amount. The fiat currency will be transferred within a few business days, subject to exchange processing times and recipient bank policies. First, register on the P2P platform, provide personal info, and undergo identity verification. Once the account is set up, fund the P2P lending account using a credit card. After the funds are added, explore lending opportunities and invest in borrowers. Depending on the platform's policies, borrowers may withdraw funds to their linked bank accounts, and lenders receive repayments in their P2P accounts. To transfer received funds to their bank account, navigate to the withdrawal section, and specify the amount and recipient's bank account. The platform will process the transfer, and funds should be available within a few business days. Transferring money from a credit card to a bank account can be a valuable financial tool, but it's essential to approach the process with caution and consideration of several factors. Let's explore the key considerations that individuals should keep in mind: Credit card companies and financial institutions may impose various fees for different transfer methods. These fees can significantly impact the overall cost of the transfer, so it's crucial to be aware of them upfront. For example, direct transfers via online banking or third-party payment platforms may have transaction fees, while cash advances often come with cash advance fees and ATM withdrawal charges. Similarly, balance transfers might incur balance transfer fees, which can offset potential interest savings. Different credit card companies may have varying policies regarding the transfer of funds to a bank account. Some issuers may impose limits on the amount that can be transferred, while others may not allow certain types of transfers at all. Reading the fine print and contacting the credit card issuer for clarification can prevent misunderstandings and ensure a smooth transfer process. The urgency of the transfer plays a significant role in the choice of the method. While some transfers can be completed swiftly, others may take several business days to process. Before transferring funds from a credit card, individuals must consider their credit limit and available credit. Initiating a transfer that exceeds the available credit limit can lead to declined transactions, additional fees, and potential negative impacts on credit scores. Transferring money from a credit card to a bank account can have implications for one's credit score. It mainly affects the credit utilization ratio, which is the percentage of available credit being used. High credit utilization can negatively impact credit scores, potentially leading to a decrease in the score. One of the most critical aspects of any credit card-to-bank account transfer is having a well-defined repayment plan. Credit card debts should be repaid promptly to avoid accumulating high-interest charges and falling into a cycle of debt. Creating a budget and establishing a repayment schedule ensures that the transferred funds are repaid on time and responsibly. Avoiding late payments is crucial to maintaining a positive credit history. A critical aspect of deciding to transfer money from a credit card to a bank account is to determine whether the situation constitutes an emergency or not. In non-emergency situations, it may be necessary to consider other financial options, like loans or alternative methods of obtaining funds, to prevent incurring unnecessary fees and interest charges. Transferring money from a credit card to a bank account is indeed possible through various methods, each with its own set of advantages and considerations. Direct transfers via online banking offer convenience and speed, while balance transfers can be useful for debt consolidation. However, caution should be exercised with cash advances and convenience checks due to their higher fees and potential impact on credit scores. Third-party payment platforms provide quick transfers, but users must be aware of associated fees. Over-the-counter transactions at bank branches offer an alternative, but their availability may vary. Money transfer services, prepaid cards, cryptocurrency exchanges, and peer-to-peer lending platforms are additional facilitators for transferring money from a credit card to a bank account. Responsible financial planning is essential for making informed decisions regarding credit card to bank account transfers.Can You Transfer Money From a Credit Card to Your Bank Account?

How to Transfer Money From a Credit Card to a Bank Account

Direct Transfer via Online Banking

Balance Transfer

Cash Advance

Convenience Checks

Third-Party Payment Platforms

Over-the-Counter (OTC) at a Bank Branch

Money Transfer Services

Prepaid Cards

Cryptocurrency Exchanges

Peer-to-Peer (P2P) Lending Platforms

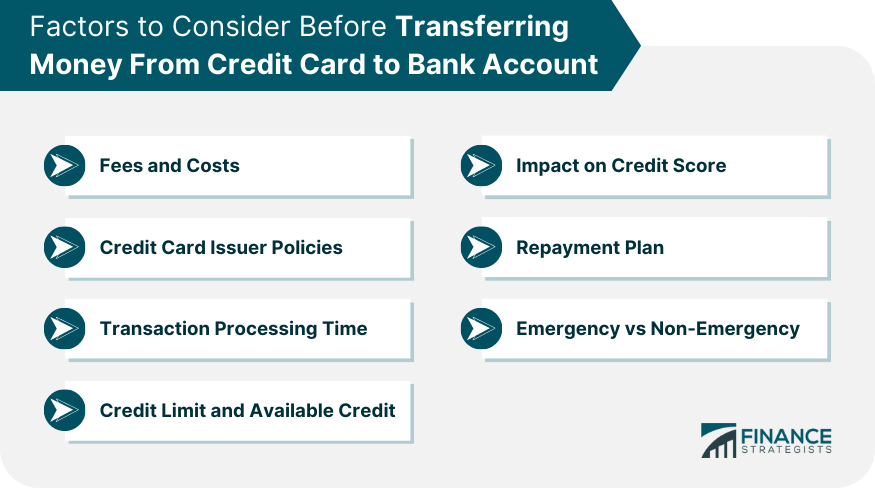

Factors to Consider Before Transferring

Fees and Costs

Credit Card Issuer Policies

Transaction Processing Time

Credit Limit and Available Credit

Impact on Credit Score

Repayment Plan

Emergency vs Non-Emergency

Conclusion

Transfer Money From Credit Card to Bank Account FAQs

Yes, it is possible to transfer money from your credit card to your bank account using various methods.

You can transfer money through direct transfers via online banking, balance transfers, cash advances, third-party payment platforms, and more.

Yes, different transfer methods may have associated fees, so it's essential to be aware of these costs before initiating the transfer.

Transferring money may impact your credit score, particularly with cash advances. It's crucial to consider this aspect and manage your credit responsibly.

Before transferring, consider fees, credit card issuer policies, processing time, credit limit, impact on credit score, and whether the transfer is necessary for your financial situation. Responsible planning is crucial for successful transfers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.