Banking plays a fundamental role in personal finance management, from providing a safe space to secure your money, facilitating transactions, to helping you plan for the future. Bank accounts serve as a crucial hub for these financial activities, influencing our ability to effectively manage our finances. However, circumstances might arise where bank accounts get closed - either due to inactivity, negative balances, bank-initiated closures, or even a personal choice. When this happens, understanding how to navigate the process of reopening your account becomes paramount. Banking institutions also offer various products and services tailored to the diverse needs of their customers, ensuring they cater to both short-term and long-term financial goals. One of the most common reasons for account closure is inactivity. Banks maintain their operations costs by levying charges and earnings on the account holder's activity. If an account remains dormant for an extended period, banks may choose to close it, with the duration of inactivity leading to closure varying from one bank to another. Another common reason for account closure is maintaining a negative balance or regularly overdrawing the account. Banks consider such accounts as liabilities. If the account holder continues to withdraw more than their account balance, the bank may close the account to prevent further losses. Banks have the right to terminate accounts that violate their policies. Such policies could include the prohibition of fraudulent activity, suspicious transactions hinting at money laundering, or consistent non-compliance with the bank's terms and conditions. Understanding these rules and regulations can help prevent such unexpected closures. There might also be instances where you, the account holder, may choose to close your account. Perhaps you were dissatisfied with the bank's service or found a better financial product elsewhere. However, needs change over time, and you may now wish to reopen the account. Knowing why your account was closed will guide the reopening process. Different issues might require unique approaches, but the following steps generally apply in most cases. Banks operate based on a set of terms and conditions. These policies govern account management, including guidelines for closures and possible reopenings. Your first step should be to review these terms, which can usually be found on the bank's official website or in the original agreement you signed during account creation. The next step involves reaching out to your bank's customer service. These representatives have the most accurate and up-to-date information regarding the bank's policies and procedures. When you contact them, clearly express your desire to reopen your account, and be sure to ask any questions you may have. Each bank has a unique policy on reopening closed accounts. While some might allow it under certain conditions or within a specific timeframe, others may prohibit it altogether. Understanding your bank's specific policy will provide clarity on how to proceed. If your bank allows account reopening, you will likely need to provide some form of documentation. Banks typically require proof of identification, residency, and possibly your source of income. Knowing what's needed upfront can expedite the reopening process. Before your bank reopens your account, you'll need to address any outstanding issues that led to its closure. Ignoring these issues could lead to future closures or, worse, a rejection of your reopening request. If your account closure resulted from a negative balance or an unpaid overdraft, you would need to clear these before your account can be reopened. This repayment might also include additional fees or penalties depending on your bank's policies. If your account was closed due to inactivity, you should present a plan to ensure regular account activity. This plan might involve committing to making regular deposits or using the account for day-to-day transactions. If your account was closed due to a violation of the bank's policies, providing assurance that such violations will not recur is essential. This may require demonstrating a clear understanding of the bank's rules and outlining how you plan to adhere to them in the future. Once you've addressed any outstanding issues, you can proceed to the formal steps necessary to reopen your account. The bank will likely require you to fill out forms to process your account reopening. These forms often require details about your personal information, employment, and more. It's crucial to fill these forms accurately and thoroughly to avoid any processing delays. After you've submitted the necessary forms and documents, the bank will need to verify the information. The length of this process varies by bank but expect it to take anywhere from a few days to a couple of weeks. Some banks require you to deposit a minimum balance as part of the reopening process. If your bank has such a policy, make sure to deposit the required amount once your reopening request has been approved. Unfortunately, not all banks allow closed accounts to be reopened. If this is the case, you still have alternatives. Firstly, it's crucial to understand why your bank does not allow account reopenings. Having this understanding can inform your next steps and help avoid future account closures. Even if your bank doesn't allow you to reopen a closed account, you might still be able to open a new account with them. Inquire about this possibility, and if it's an option, you can follow the regular account opening process. If opening a new account with your previous bank isn't feasible, consider other banks. There are numerous banking institutions with diverse offerings and policies. With some research, you can find one that aligns with your needs and financial habits. After your bank account is reopened (or a new one is opened), it's essential to keep it active and in good standing to avoid future closures. To keep your account active, make sure to perform transactions regularly. These could include depositing your salary, making withdrawals, transferring funds, paying bills, or using your debit card for everyday purchases. A practical approach to maintaining regular account activity is setting up direct deposits for your paycheck or automatic bill payments. This not only ensures consistent transactions but also eliminates the need to remember to conduct them manually. It's also crucial to regularly monitor your account balance and transaction history. This will help you avoid overdrawing your account and maintain a healthy financial record. Many banks offer online and mobile banking platforms, which makes tracking your finances convenient and straightforward. Bank accounts serve as pivotal tools for managing our financial endeavors, from everyday transactions to long-term savings. However, circumstances such as inactivity, policy violations, or even personal choices can lead to account closures. When faced with the need to reopen a closed account, understanding the bank's specific terms and procedures is vital. Initiating contact with customer service, addressing outstanding balances, and being proactive in providing necessary documentation can streamline the process. On the other hand, if reopening isn't feasible, options like opening a new account with the same or another institution are viable alternatives. Once an account is reactivated, maintaining regular transactions, setting up direct deposits, and diligently monitoring balances will help ensure its continued good standing. In navigating the complexities of the banking world, knowledge and proactive management are your allies. If you seek comprehensive banking solutions, don't hesitate to explore available services to elevate your financial journey.Overview of Banking

Understanding Why an Account Gets Closed

Account Inactivity

Negative Balances and Overdrafts

Policy Violations

Voluntary Closures

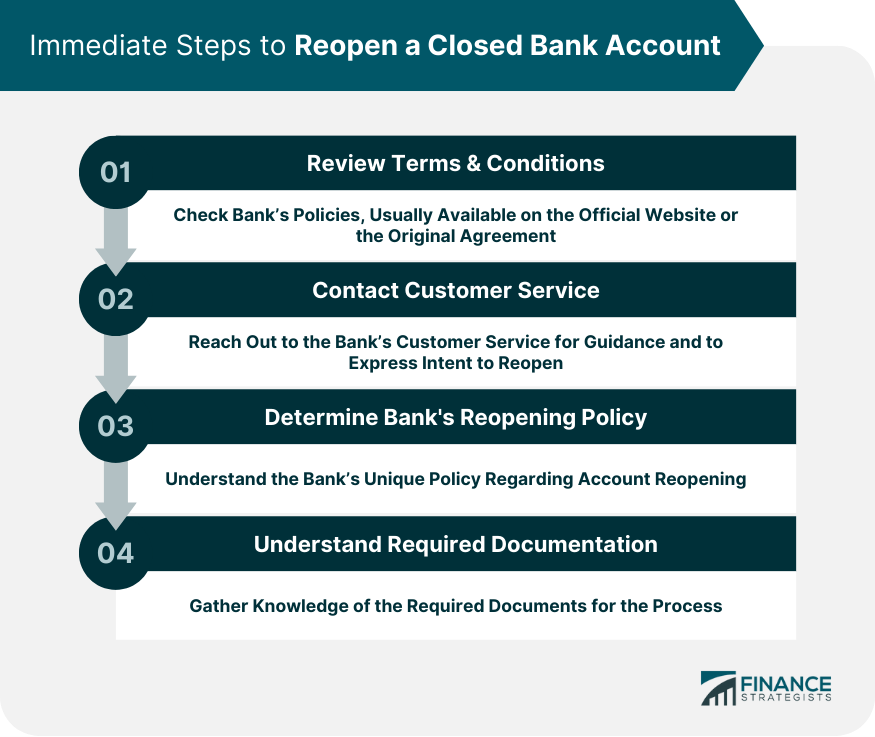

Immediate Steps to Reopen a Closed Bank Account

Review Terms & Conditions

Contact Customer Service

Determine Bank's Reopening Policy

Understand Required Documentation

Addressing Outstanding Balance Issues

Clear Up Outstanding Debts or Overdrafts

Establish a Plan to Avoid Account Inactivity

Ensure Policy Adherence

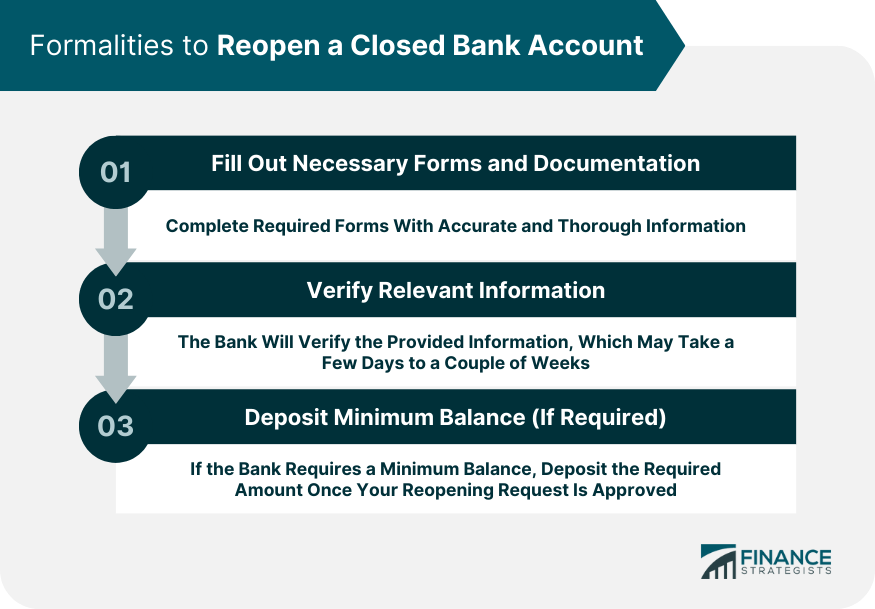

Formalities to Reopen a Closed Bank Account

Fill Out Necessary Forms and Documentation

Verify Relevant Information

Deposit the Minimum Balance (If Required)

What to Do If Your Bank Doesn't Allow Reopening a Closed Account

Understanding the Bank's Policy

Exploring the Options of Opening a New Account With the Same Bank

Exploring Options With Other Banks

How to Keep a Bank Account Active

Regular Transactions to Maintain Account Activity

Set Up Direct Deposits or Automatic Bill Payments

Keep Track of Account Balance to Avoid Overdrafts

Bottom Line

Step-By-Step Guide to Reopening a Closed Bank Account FAQs

Your account could have been closed due to inactivity, negative balances, bank-initiated closures for policy violations, or voluntary closure by you.

Start by reviewing your bank's terms and conditions, then contact their customer service to express your intent to reopen the account and gather information about their reopening policy and required documentation.

Address any issues that led to the closure, such as clearing outstanding debts or overdrafts, establishing a plan for account activity, and ensuring future policy adherence.

You'll need to fill out necessary forms, await the verification process, and potentially deposit a minimum balance if required by your bank.

If reopening isn't an option, you can explore opening a new account with the same bank or look for alternatives at other banking institutions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.