A joint bank account is a shared account used by two or more individuals, not limited to married couples, but can include business partners, siblings, or close friends. It functions like an individual bank account, but its unique feature is joint ownership. All parties named have equal authority and access to the funds, making it a flexible tool for managing shared finances, but it also requires trust, transparency, and communication. This type of account simplifies mutual financial responsibilities, facilitating collective management of transactions such as bill payments, deposits, and transfers. As a result, a joint account can ease the complexity often associated with handling separate accounts for shared expenses. This type of joint account is commonly used among married couples or close relatives. In a JTWROS arrangement, all co-owners have equal rights to the account's assets and are granted the entirety of the account's contents upon the death of another account holder. This means that if one of the joint tenants dies, the remaining assets in the account automatically pass on to the surviving tenant(s) without the need for probate. However, it's essential for all parties to understand that any member can make transactions without consent from others. TIC is another form of joint ownership but with some distinct differences from JTWROS. In this arrangement, each co-owner can have a different ownership stake, specified as a percentage. Unlike JTWROS, when one tenant dies, their share doesn't automatically go to the surviving tenants. Instead, it goes to their heirs or as indicated in their will. This setup allows more flexibility in determining the distribution of assets but requires clear documentation and understanding of each party's share. Banks typically ask for identification documents from all parties involved. This can include social security numbers, proof of address, and more. It's crucial to ensure all documentation is accurate and up-to-date to avoid any potential hitches during the setup process. Depending on the bank, the co-owners might choose to have equal or unequal ownership, reflecting their contributions to the account. This flexibility can cater to the unique dynamics of the relationship, allowing for a setup that mirrors their financial involvement. Every account holder can deposit or withdraw money, regardless of who added the funds. This flexibility, while convenient, also demands that all parties exercise financial responsibility to prevent potential overdrafts or disputes. All parties are generally responsible for any fees, including overdrafts. If one party overspends, both might bear the consequences. It’s essential to keep a buffer in the account or set up overdraft protection to avoid such situations. Any account holder can typically close the account. However, all parties should ideally agree to it. Closing an account unilaterally can strain the relationship and might lead to financial complications. To add or remove someone, most banks require the account to be closed and reopened. It's essential to discuss and plan such changes in advance, ensuring smooth transitions without disruptions to financial activities. All named parties have equal rights, meaning they can make unilateral decisions regarding the account. This power comes with the responsibility to act in the best interests of all involved. Every account holder can review transactions and balances at any time. This transparency ensures that all parties are continually informed and can address any concerns immediately. If suspicious activity occurs, any account holder can raise the concern with the bank. It's recommended to regularly review statements to quickly detect and address unauthorized transactions. For added security, co-owners can set up alerts for transactions, ensuring all are in the loop. These notifications can act as a first line of defense against potential fraudulent activities or overspending. In a JTWROS account, the surviving member assumes total control upon one's death. This automatic transition ensures that financial processes aren't hampered during challenging times. For other joint accounts, the deceased's portion might go to their estate, unless specified otherwise. Having a clear will or testament can simplify this process and prevent legal complications. Banks can impose restrictions or close accounts if they suspect fraudulent activity. Account holders should be aware of the bank's terms and conditions to avoid unexpected account limitations. Account holders' rights can be curtailed by legal judgments, such as garnishments. It’s essential to stay informed about potential legal claims that might affect the joint account. Openly discussing finances can fortify trust in any relationship, be it personal or professional. Joint accounts serve as a tangible manifestation of this trust, as they involve shared financial responsibility. Both parties can simultaneously monitor their finances, avoiding misunderstandings. This continuous oversight can lead to more informed financial decisions and faster resolution of discrepancies. Joint accounts can simplify the process of handling shared expenses like rent, utilities, or groceries. By pooling resources, co-owners can potentially enjoy better financial efficiency and coordination. Setting up savings goals, like vacations or home purchases, becomes more systematic. With mutual contributions, reaching these goals can be faster and more collaborative. In many places, joint accounts can bypass the lengthy probate process, offering swift fund access after one's death. This benefit can be particularly advantageous, ensuring that the surviving party isn’t financially hamstrung during an already difficult period. The right of survivorship ensures that assets are transferred smoothly without legal entanglements. This clear pathway provides peace of mind to account holders, knowing their intentions will be honored. Joint accounts can lead to disagreements if one party is fiscally reckless or overly conservative. Regular financial discussions can help preempt such disputes, ensuring all parties remain on the same page. One party's spending habits could lead to overdraft fees that both have to cover. Setting up alerts or having regular check-ins can mitigate such risks. Every purchase or expenditure is visible to all account holders, leading to potential judgment or disagreements. While transparency is a virtue, it's essential to strike a balance to maintain personal autonomy. One might feel the need to explain personal purchases, leading to potential friction. Setting boundaries about what requires discussion can help preserve individual freedom within the joint framework. Separating finances after a breakup or business fallout can be messy. Ideally, having a prior agreement on how to handle such a scenario can ease the process. If the account incurs debt, both parties could be held responsible, regardless of who spent the money. It underscores the importance of mutual trust and fiscal responsibility when managing a joint account. Before opening a joint account, it's essential to discuss financial habits, aspirations, and goals. It ensures alignment in financial practices. Understanding each other's financial habits can prevent potential conflicts down the line. To avoid misunderstandings, it's helpful to set rules regarding spending limits, savings goals, and even the types of allowable transactions. These guidelines can serve as a roadmap, helping navigate the intricacies of shared financial management. Regularly reviewing the account and discussing financial matters ensures that all parties remain aligned and aware of their joint financial standing. These check-ins can be a platform for recalibrating goals, addressing concerns, or celebrating financial milestones. A joint bank account offers a practical solution for individuals who wish to manage shared finances, be it couples, business partners, or close friends. Like any financial tool, it comes with its unique set of benefits and drawbacks. Its principal advantage lies in simplifying mutual financial responsibilities, promoting transparency, and streamlining the handling of shared expenses. However, this ease comes with the responsibility of open communication, understanding, and trust. The potential for disputes, loss of financial privacy, and complications during separations mean individuals should proceed with caution. Before taking the plunge, it's imperative to assess individual financial habits and goals, establish ground rules for account usage, and commit to regular communication. By addressing these considerations, parties can harness the potential of a joint account while minimizing its inherent risks. If you're contemplating a joint bank account, consider seeking professional banking services to guide you through the process.What Is a Joint Bank Account?

Different Types of Joint Accounts

Joint Tenants With Right of Survivorship (JTWROS)

Tenants in Common (TIC)

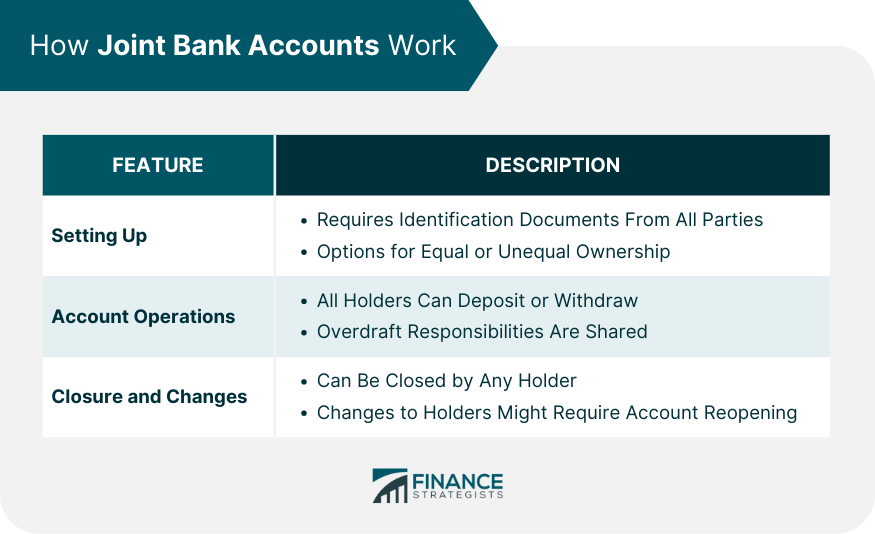

How Joint Bank Accounts Work

Setting up the Account

Requirements

Equal or Unequal Ownership Options

Account Operations

Deposit and Withdrawal Rights

Overdrafts and Responsibilities

Closure and Changes

Process for Closing

Modifying Joint Account Holders

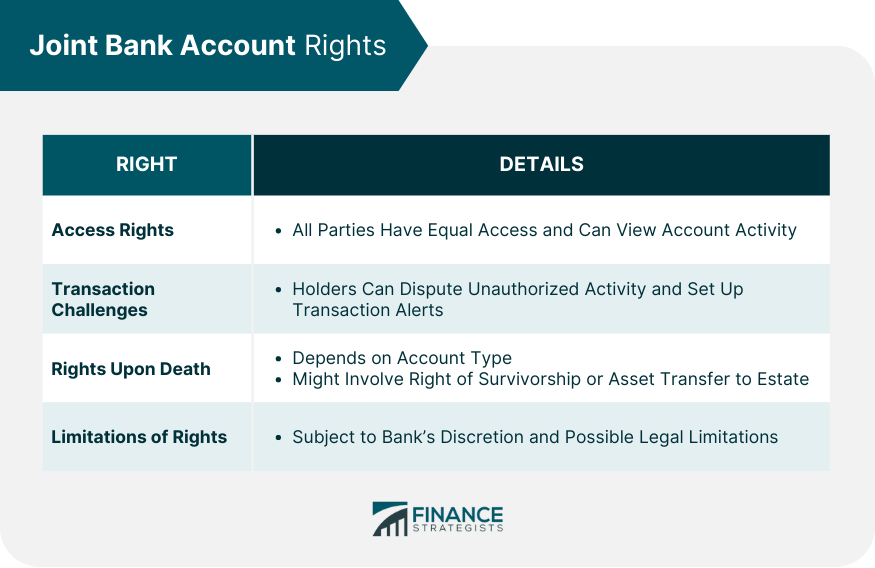

Joint Bank Account Rights

Access Rights

Equal Rights for All Account Holders

Right to View Account Activity

Right to Challenge Transactions

Disputing Unauthorized Activity

Setting up Alerts and Controls

Rights Upon the Death of an Account Holder

Right of Survivorship

Transfer of Account Ownership

Limitations of Rights

Bank's Discretionary Powers

Legal and Contractual Limitations

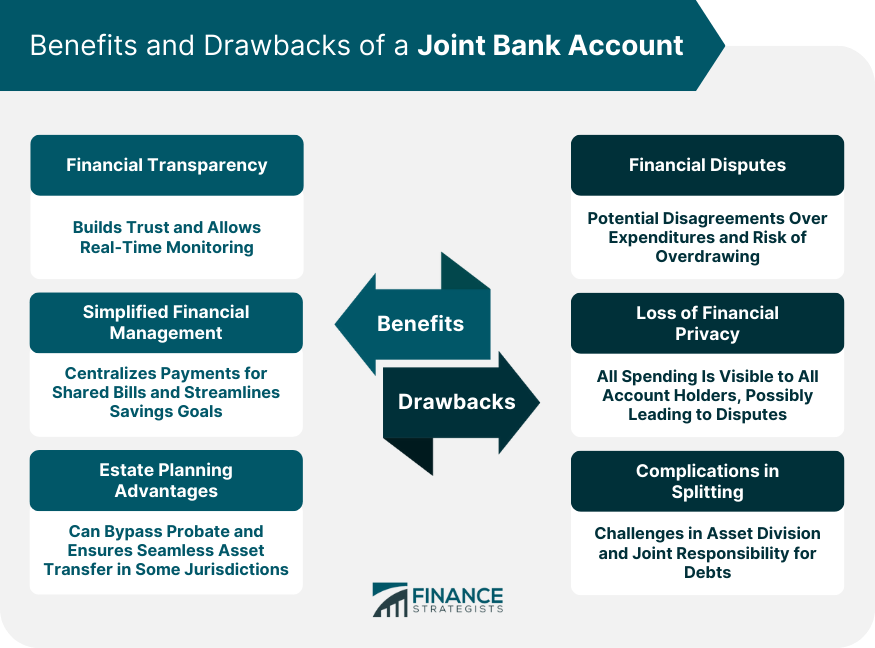

Benefits of a Joint Bank Account

Financial Transparency Between Account Holders

Trust Building

Real-Time Monitoring

Simplified Financial Management

Unified Payments for Shared Bills

Streamlined Savings Goals

Estate Planning Advantages

Avoiding Probate in Certain Jurisdictions

Seamless Asset Transfer

Drawbacks of a Joint Bank Account

Financial Disputes

Disagreements Over Expenditures

Risk of Overdrawing

Loss of Financial Privacy

Exposure of Spending Habits

Potential Intrusion in Personal Purchases

Complications in Splitting or Separation

Asset Division

Responsibility for Debts

Considerations Before Opening a Joint Bank Account

Assessment of Financial Habits and Goals

Setting Ground Rules for Usage

Importance of Regular Communication and Review

Final Thoughts

Joint Bank Account FAQs

A joint bank account is a shared account between two or more individuals, allowing them mutual access to manage and use the funds.

It operates like a regular account but gives all named parties equal authority over the funds, from deposits to withdrawals.

It fosters financial transparency, simplifies the management of shared expenses, and offers advantages in estate planning.

There can be financial disputes, loss of privacy, and complications in case of splitting or separation.

Yes, all named parties have equal access rights, can challenge transactions, and have specific rights upon the death of an account holder.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.