Joint bank accounts for unmarried couples are shared financial resources to which both partners have equal access and responsibility. These accounts can be used for a variety of purposes, such as consolidating bills, managing shared expenses, or saving for mutual goals. Setting up a joint account involves both partners agreeing on the account's usage and rules. The purpose of such accounts is to simplify the financial aspect of a relationship, providing a transparent platform for managing finances together. However, equal authority requires mutual trust and communication, as both partners can make deposits, withdrawals, or changes without the other's consent. Therefore, while this financial tool fosters monetary collaboration in a relationship, it also necessitates clear, open discussions about financial expectations and responsibilities. To set up a joint bank account, unmarried couples should first undertake comprehensive research to select the appropriate bank or financial institution. They must carefully evaluate aspects such as associated fees, the quality of customer service provided, and the efficiency of online banking facilities. The correct choice depends on the couple's unique needs and preferences. In the process of opening a joint account, both partners are typically required to provide certain identification and personal documents. Depending on the financial institution's policies, they may also need to furnish evidence of their relationship or shared living situation. It's essential to understand and comply with these legal necessities to ensure the smooth establishment of the joint account. For effective management of the joint account, couples should establish transparent rules regarding expenditures and contributions toward savings. Additionally, the account statements should be reviewed jointly on a regular basis. This encourages open communication about finances and helps avoid misunderstandings or disputes. In the context of a joint bank account, both parties share equal liability for any debts or financial obligations tied to the account, regardless of who is responsible for incurring them. Thus, both partners should be fully aware of their mutual responsibilities and risks associated with the account to prevent potential disagreements or financial difficulties in the future. Joint bank accounts can carry tax implications, particularly concerning gift taxes. Therefore, understanding how these tax laws apply to their financial situation is imperative for couples. Additionally, it's vital to know how assets from a joint account are divided or transferred in the event of a partner's death, ensuring that wealth is distributed as per the couple's wishes. Unlike married couples, unmarried partners may not have the benefit of certain legal protections during disputes over finances. This discrepancy underscores the importance of mutual understanding and comprehensive legal documentation to protect both parties. Unmarried couples should thoroughly discuss and agree on the terms of the joint account to avoid potential conflicts. Streamlined Financial Management for Shared Expenses: No more two separate rent transfers or calculating split grocery bills. With a joint account, financial obligations become a collective effort, simplifying everyday transactions. Enhanced Trust and Transparency in the Relationship: Shared financial spaces can cultivate trust. When both parties can view and access finances openly, it fosters a transparent relationship dynamic. Achieving Mutual Financial Goals: From saving for a dream vacation to purchasing a shared asset, a joint bank account allows couples to set, track, and achieve mutual financial milestones. Preparation for Emergencies or Unexpected Expenses: Emergencies are unpredictable. With combined resources, coping with unexpected financial challenges becomes relatively easier. Easier Estate Planning and Fund Accessibility: In the unfortunate event of a partner's demise, a joint account can prevent potential access issues to the deceased partner's funds. Possibility of Disagreements Over Spending Habits: Differing views on expenditures can lead to conflicts. Regular, open communication becomes vital to align financial priorities. Challenges During Relationship Changes or Breakup: Navigating the division of a joint account post-breakup can be emotionally and logistically challenging, adding stress to an already tense situation. Risk of Overdrawing the Account: Two people accessing and drawing funds means double the activity, increasing the potential for financial missteps. Vulnerability to Financial Abuse or Misuse: Joint accounts, while symbols of trust, can, unfortunately, become platforms for financial manipulation in cases where one party acts unscrupulously. Creating a joint account is a financial and emotional commitment. Discussing and understanding each other's spending habits, savings goals, and boundaries can ensure a smoother journey. Regular financial check-ins, creating a shared budget, or even attending financial counseling can keep communication lines open and prevent misunderstandings. When disagreements arise, it's essential to address them head-on, ensuring that both parties feel heard and understood. This approach solidifies trust and mutual respect. Separate Accounts With Shared Responsibilities: This method ensures financial autonomy while still sharing household or mutual responsibilities, offering a balanced approach. Combination of Individual and Joint Accounts for Different Purposes: Some couples opt for this, keeping personal expenses separate but pooling resources for shared financial objectives. Utilize Financial Apps and Tools for Joint Budgeting Without Merging Accounts: Modern technology offers tools that allow couples to budget together without necessarily merging their financial worlds, fostering collaboration. A joint bank account can offer numerous benefits for unmarried couples, from streamlining financial management to fostering trust and transparency. However, opening such an account is not without its challenges and considerations. Both partners bear equal responsibility and liability, necessitating clear communication and a shared understanding of financial habits, goals, and boundaries. Additionally, the potential tax implications, consequences on estate transfers, and the absence of certain legal protections compared to married couples necessitate careful consideration. Alternatives to fully joint accounts can be a viable option for couples seeking a balance between financial autonomy and collaboration. Regardless of the chosen path, ongoing dialogue about money matters, handling disagreements with respect, and building mutual financial trust is crucial for maintaining a healthy relationship and a well-managed joint bank account. Remember, the right choice depends on the couple's unique needs, preferences, and financial situation.What Are Joint Bank Accounts for Unmarried Couples?

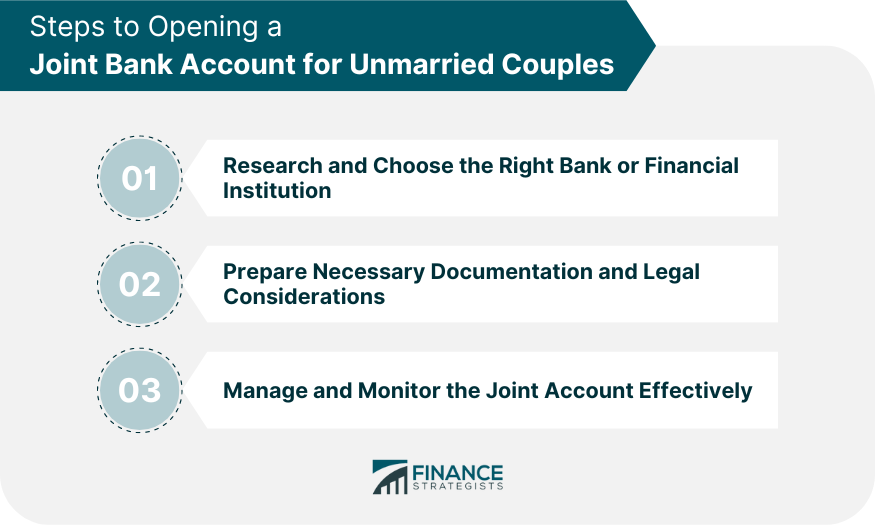

Steps to Opening a Joint Bank Account for Unmarried Couples

Research and Choose the Right Bank or Financial Institution

Prepare Necessary Documentation and Legal Considerations

Manage and Monitor the Joint Account Effectively

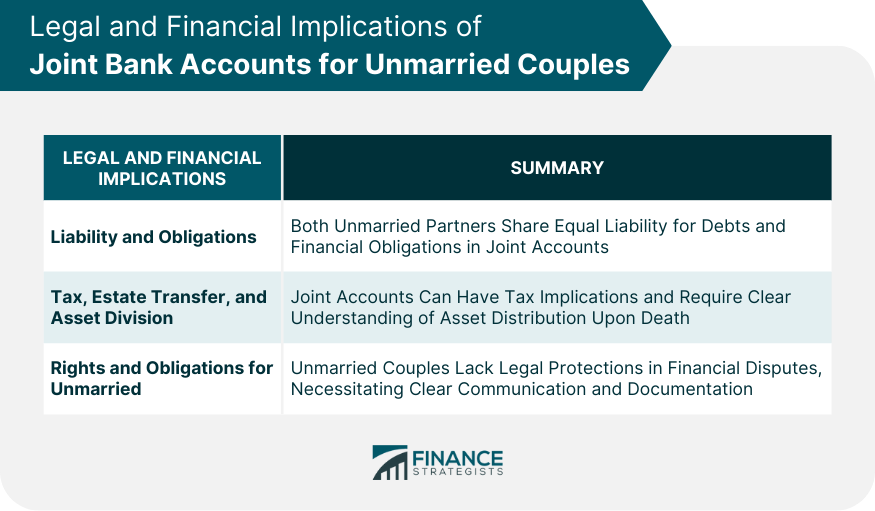

Legal and Financial Implications of Joint Bank Accounts for Unmarried Couples

Consequences of Liability and Obligations on Each Partner

Impact on Tax, Estate Transfer, and Division of Assets

Differences in Rights and Obligations for Unmarried Couples Compared to Married Ones

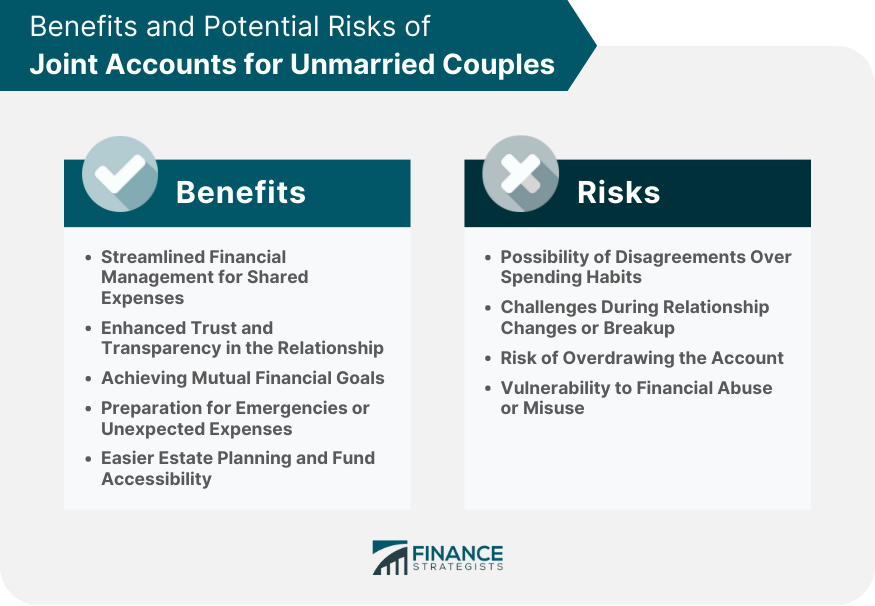

Benefits of Joint Accounts for Unmarried Couples

Potential Risks and Considerations of Joint Accounts for Unmarried Couples

Navigating Trust and Communication for Joint Accounts of Unmarried Couples

Financial Habits, Goals, and Boundaries

Strategies to Maintain Open Dialogue About Money Matters

Handling Disagreements and Building Financial Trust

Alternatives to Fully Joint Accounts

Bottom Line

Joint Bank Account For Unmarried Couple FAQs

A joint bank account is a single financial account operated by two or more individuals, facilitating ease of access to funds for all parties involved.

A joint account can streamline financial management for shared expenses, enhance trust and transparency in the relationship, assist in achieving mutual financial goals, prepare for emergencies, and simplify estate planning.

Yes, potential risks include disagreements over spending habits, challenges during relationship changes or breakups, the risk of overdrawing the account, and vulnerability to financial abuse or misuse.

Unmarried couples should be aware of liability concerns for each partner, tax implications, potential effects on estate transfers, and differences in rights and obligations compared to married couples.

Yes, couples can maintain separate accounts with shared responsibilities, use a combination of individual and joint accounts for different purposes, or employ financial apps and tools for joint budgeting without merging their accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.