Financial abuse is a form of mistreatment that involves controlling, exploiting, or manipulating another person's finances for personal gain. This type of abuse can occur within various relationships, such as between family members, intimate partners, or caregivers and the elderly. It often goes unnoticed, as it can be subtle and difficult to recognize. Financial abuse is a prevalent issue that affects countless individuals worldwide. It is particularly common among the elderly, individuals with disabilities, and those in vulnerable situations. Due to the hidden nature of financial abuse, its true extent is challenging to measure, and many cases go unreported. Financial abuse can manifest in various ways, ranging from theft and fraud to coercion and manipulation. Understanding the different forms of financial abuse is crucial to identifying and addressing it effectively. Theft and fraud are common forms of financial abuse that involve stealing money, property, or personal information. Examples include forging checks, stealing credit cards, or accessing bank accounts without authorization. These actions can result in significant financial losses for the victim. Exploitation involves taking advantage of someone's trust, vulnerability, or dependency for financial gain. This can include manipulating a person into signing over property, coercing them into making financial decisions against their best interests, or misusing their funds for personal expenses. Coercion and manipulation involve using threats, deception, or pressure to force someone to take specific financial actions. This may include intimidating a person into providing money, restricting access to financial resources, or controlling their financial decisions to maintain power and control. Misusing property or assets involves the unauthorized or inappropriate use of someone's belongings for personal benefit. This can include selling or disposing of assets without consent, using property as collateral for loans, or mismanaging funds intended for the victim's care and well-being. Control is a common warning sign of financial abuse, as abusers often seek to dominate their victim's financial decisions. This may include closely monitoring spending, limiting access to funds, or dictating how money is spent. Isolation is another red flag for financial abuse, as it can make it easier for the abuser to exert control over the victim's finances. This may involve restricting contact with friends or family, limiting access to financial information, or preventing the victim from seeking professional advice. Manipulation is a key component of financial abuse and can manifest as emotional or psychological tactics used to coerce the victim into making financial decisions against their best interests. This may include guilt-tripping, deceit, or making false promises. Intimidation is a powerful tool used by abusers to maintain control over their victims' finances. This can involve threats, verbal aggression, or physical violence to force compliance with financial demands or decisions. Certain demographics, such as older adults and women, are at a higher risk of experiencing financial abuse. This may be due to factors such as increased dependency, cognitive decline, or societal power imbalances. Marital status can also impact the likelihood of experiencing financial abuse. Individuals in relationships with a history of domestic violence or manipulation may be at a greater risk of financial abuse. Individuals with disabilities or those who rely on others for care and support may be more vulnerable to financial abuse. Dependency on caregivers or loved ones can make it challenging to recognize and address financial exploitation. Individuals experiencing financial hardships, such as unemployment or mounting debt, may be more susceptible to financial abuse. Abusers may exploit the victim's vulnerability by offering financial assistance or support, only to later manipulate or control the individual's finances. The emotional consequences of financial abuse can be severe, leading to feelings of betrayal, humiliation, and loss of trust. Victims may experience anxiety, depression, or a sense of helplessness as they struggle to regain control of their finances and rebuild their lives. Financial abuse can result in significant monetary losses, debt, or ruined credit. These financial setbacks can make it difficult for victims to recover and may impact their ability to secure housing, employment, or access to credit in the future. In some cases, financial abuse may lead to legal consequences for both the victim and the abuser. The victim may face legal disputes related to the unauthorized use of their assets or property, while the abuser may face criminal charges or civil lawsuits for their actions. The stress and emotional toll of financial abuse can have serious implications for an individual's physical and mental health. Victims may experience sleep disturbances, worsening of chronic conditions, or develop new health issues as a result of the ongoing stress and anxiety. Educating individuals about financial abuse and its warning signs is crucial for prevention and early intervention. Awareness campaigns, workshops, and educational resources can help people recognize the signs of financial abuse and take action to protect themselves and their loved ones. Promoting sound financial management practices can empower individuals to take control of their finances and reduce their vulnerability to abuse. This may include budgeting, monitoring accounts, and understanding financial rights and responsibilities. Connecting individuals with support networks and resources is essential for addressing financial abuse. This may involve counseling, support groups, or financial planning services to help victims regain control of their finances and rebuild their lives. Legal protection and intervention measures, such as restraining orders or fraud investigations, can help stop financial abuse and hold abusers accountable. Ensuring that victims have access to legal resources and support is crucial for addressing financial abuse and promoting justice. Financial abuse is a prevalent form of mistreatment that involves controlling, exploiting, or manipulating someone's finances for personal gain. It can happen within various relationships, including family members, intimate partners, and caregivers of the elderly, and it often goes unnoticed. The different types of financial abuse include theft and fraud, exploitation, coercion and manipulation, and misuse of property or assets. Warning signs of financial abuse include control, isolation, manipulation, and intimidation. Certain risk factors increase the likelihood of financial abuse, such as age, gender, marital status, disability, dependence, and financial vulnerability. Financial abuse can have severe consequences, including emotional, financial, legal, and health consequences. Prevention and intervention strategies include education and awareness, financial management, support and resources, and legal protection and intervention. It is essential to recognize the signs of financial abuse and take action to protect oneself or loved ones from its damaging effects..What Is Financial Abuse?

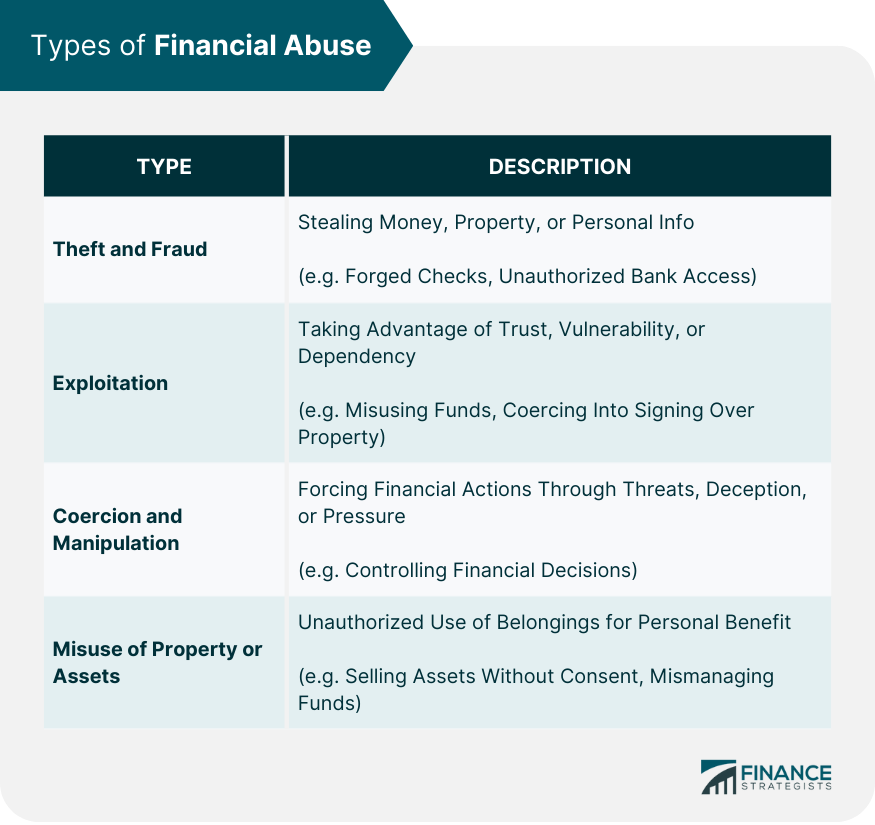

Types of Financial Abuse

Theft and Fraud

Exploitation

Coercion and Manipulation

Misuse of Property or Assets

Warning Signs of Financial Abuse

Signs of Control

Signs of Isolation

Signs of Manipulation

Signs of Intimidation

Risk Factors for Financial Abuse

Age and Gender

Marital Status

Disability and Dependence

Financial Vulnerability

Consequences of Financial Abuse

Emotional Consequences

Financial Consequences

Legal Consequences

Health Consequences

Prevention and Intervention of Financial Abuse

Education and Awareness

Financial Management

Support and Resources

Legal Protection and Intervention

Final Thoughts

Financial Abuse FAQs

Financial abuse refers to a situation where an individual misuses or withholds another person's financial resources without their consent, leading to harm or loss to the victim.

Warning signs of financial abuse may include a sudden change in financial situation, unexplained withdrawals or transfers, lack of control over finances, forced or coerced financial transactions, and isolation from family or friends.

Individuals who are older, have disabilities, or are in a dependent relationship are most vulnerable to financial abuse. However, financial abuse can happen to anyone regardless of their age or gender.

The consequences of financial abuse can be severe and may include emotional distress, financial instability, legal issues, and even physical harm in some cases.

Financial abuse can be prevented through education, awareness, and intervention. It is important to have open communication and a clear understanding of financial arrangements. If financial abuse is suspected, seeking help from support groups, legal resources, or law enforcement can be helpful in addressing the issue.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.