The Annual Equivalent Rate (AER) is a metric used in the financial industry to express the annual interest rate on savings, investments, and loans. It is designed to provide a standardized comparison for the annual rate of return, taking into account the compounding effect of interest. The AER serves as a valuable tool for both consumers and financial institutions, allowing them to compare and evaluate different financial products with ease. By understanding the AER, individuals can make more informed decisions when selecting financial products that best suit their needs. The AER plays a crucial role in the banking industry, as it provides a clear and uniform method for expressing interest rates. This enables banks and other financial institutions to market their products transparently and helps potential customers make better-informed choices. Moreover, the AER allows financial institutions to adhere to regulatory standards by displaying interest rates in a consistent manner. This fosters a competitive and fair marketplace, benefiting both consumers and banks alike. One of the primary purposes of the AER is to standardize the way interest rates are presented across various financial products. This allows consumers to compare different offerings easily and quickly, which promotes a competitive financial landscape. Furthermore, standardizing interest rates helps to ensure that financial institutions present their offerings in a transparent and consistent manner. Another key purpose of the AER is to facilitate the comparison of different financial products, such as savings accounts, certificates of deposit, and loans. With the AER, consumers can readily assess the annual rate of return on various products, making it easier for them to choose the most suitable option. This level of comparison empowers consumers to make more informed decisions when selecting financial products, ultimately leading to better financial outcomes. By providing a standardized metric for interest rates, the AER enables consumers to make well-informed decisions about their finances. By understanding the AER, individuals can assess the true cost or benefit of a particular financial product, helping them to make sound choices that align with their financial goals. This ultimately enhances their financial planning and budgeting capabilities, resulting in more effective money management. The AER and APR (Annual Percentage Rate) are two commonly used metrics in the financial industry, but they serve different purposes. The AER is primarily concerned with representing the annual interest rate on savings and investments, accounting for the compounding effect of interest. In contrast, the APR is used to express the total cost of borrowing, including both interest and fees. While both AER and APR are important metrics, they should not be confused, as they convey different information about financial products. Understanding the distinctions between these two metrics is essential for making well-informed financial decisions. As mentioned earlier, the AER is best suited for comparing savings and investment products, as it takes into account the compounding effect of interest. On the other hand, the APR is more appropriate for comparing loan and credit products, as it includes both interest and fees, providing a more comprehensive picture of the total cost of borrowing. By using the correct metric for the appropriate financial product, consumers can ensure that they are making accurate comparisons and, ultimately, choosing the best options for their financial needs. The AER is essential for consumers because it promotes transparency in the financial marketplace. With a standardized metric for interest rates, consumers can easily understand and compare different financial products, ensuring that they have the necessary information to make informed decisions. This level of transparency is crucial for fostering a competitive and fair financial landscape, empowering consumers to select the most suitable financial products for their needs. The AER is a valuable tool for consumers, as it helps them determine the true return on investment for various financial products. By taking into account the compounding effect of interest, the AER provides a more accurate representation of the annual rate of return, allowing individuals to make well-informed choices that align with their financial goals. Moreover, understanding the AER enables consumers to assess the impact of interest rates on their investments and savings over time, enhancing their financial planning and budgeting capabilities. The AER offers several advantages for banks and financial institutions, one of which is the marketing and advertising benefits. By using the AER to express interest rates, banks can present their products in a transparent and easily understandable manner, making them more appealing to potential customers. This can lead to increased customer acquisition and retention. Another advantage of the AER for banks and financial institutions is its ability to attract and retain customers. By offering competitive interest rates and presenting them clearly through the AER, banks can demonstrate their commitment to providing value and transparency to their customers. This can foster customer loyalty and encourage long-term relationships, ultimately benefiting both the bank and its customers. Using the AER also helps banks and financial institutions comply with regulatory standards, as it ensures that interest rates are presented in a consistent and transparent manner. This not only fosters a fair and competitive marketplace but also helps banks maintain a positive reputation and avoid potential regulatory issues. While the AER is a valuable metric for comparing interest rates, it does have some limitations. One such limitation is that certain fees and charges may be excluded from the AER calculation. This means that the AER may not always provide a comprehensive picture of the total cost or benefit of a financial product, potentially leading to inaccurate comparisons. Another limitation of the AER is that it does not account for the impact of fees and charges on the overall return on investment. While the AER is useful for comparing interest rates, it may not fully capture the true cost or benefit of a financial product when additional fees and charges are involved. This means that consumers may need to consider other factors, such as fees and charges, alongside the AER when making financial decisions. The AER calculation is based on certain assumptions, such as the length of the investment period and the frequency of interest payments. These assumptions may not always accurately reflect the specific circumstances of an individual's investment, which could result in an inaccurate representation of the actual return on investment. As a result, consumers should be aware of the assumptions used in the AER calculation and consider them when making financial decisions. The AER is commonly used to express interest rates for savings accounts, allowing consumers to compare different accounts and choose the one that offers the best return on investment. By understanding the AER, individuals can select a savings account that aligns with their financial goals and maximizes their potential earnings. Certificates of deposit (CDs) are another financial product where the AER is used to express interest rates. With the AER, consumers can easily compare CDs of varying terms and interest rates, enabling them to make informed decisions when investing their money. Although the APR is more commonly used for loans and mortgages, the AER can also be applied in some cases, particularly when comparing interest rates for loans without additional fees or charges. By using the AER, consumers can evaluate the annual rate of return on various loan products, helping them choose the most cost-effective option for their specific financial situation. The Annual Equivalent Rate (AER) is an essential metric in the financial industry, providing a standardized method for expressing annual interest rates on savings, investments, and loans. By taking into account the compounding effect of interest, the AER offers a more accurate representation of the annual rate of return. The primary purpose of the AER is to standardize interest rates, facilitate comparisons between different financial products, and promote informed decision-making among consumers. The AER offers numerous advantages for both consumers and financial institutions, including promoting transparency, attracting and retaining customers, and ensuring compliance with regulatory standards. However, there are limitations to the AER, such as exclusions from the calculation, the impact of fees and charges, and the assumptions made during the calculation process. The Annual Equivalent Rate (AER) is a valuable metric for assessing the annual interest rates on various financial products. Despite its limitations, the AER provides a useful tool for consumers and financial institutions alike, promoting transparency, informed decision-making, and a competitive financial landscape.What Is the Annual Equivalent Rate (AER)?

Purpose of the Annual Equivalent Rate

Standardizing Interest Rates

Comparing Different Financial Products

Facilitating Informed Decision-Making

AER vs APR (Annual Percentage Rate)

Differentiating AER and APR

When to Use AER and APR

Importance of the Annual Equivalent Rate for Consumers

Ensuring Transparency

Determining the True Return on Investment

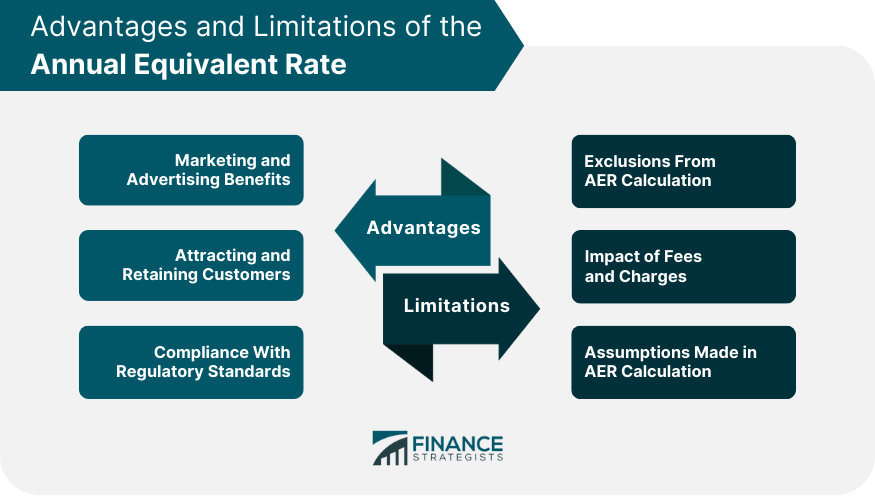

Advantages of AER for Banks and Financial Institutions

Marketing and Advertising Benefits

Attracting and Retaining Customers

Compliance With Regulatory Standards

Limitations of the Annual Equivalent Rate

Exclusions From AER Calculation

Impact of Fees and Charges

Assumptions Made in AER Calculation

Examples of the Annual Equivalent Rate in Practice

Savings Accounts

Certificates of Deposit

Loans and Mortgages

Conclusion

Annual Equivalent Rate (AER) FAQs

The primary purpose of the AER is to provide a standardized method for expressing annual interest rates on savings, investments, and loans, allowing consumers to easily compare different financial products and make informed decisions.

The AER is primarily used to express the annual interest rate on savings and investments, accounting for the compounding effect of interest. In contrast, the APR is used to express the total cost of borrowing, including both interest and fees.

The AER is important for consumers because it promotes transparency in the financial marketplace, allowing them to easily compare different financial products and make informed decisions. The AER also helps consumers determine the true return on investment for various financial products, enhancing their financial planning and budgeting capabilities.

Limitations of the AER include exclusions from the calculation, the impact of fees and charges, and the assumptions made during the calculation process. These factors can result in an inaccurate representation of the actual return on investment for some financial products.

Consumers should use the AER when comparing savings and investment products, as it takes into account the compounding effect of interest. In contrast, the APR is more appropriate for comparing loan and credit products, as it includes both interest and fees, providing a more comprehensive picture of the total cost of borrowing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.