Underwriting spread represents the difference between the amount paid by the underwriter to the issuer and the price at which the underwriter sells the securities to the public. This figure is a primary source of income for underwriting firms and an essential part of the security issuance process. The underwriting spread reflects the compensation earned by the underwriter for taking on the risk and work associated with issuing new securities. It comprises the cost of underwriting the issuance, managing the offering, and for assuming the risk of buying the securities from the issuer and selling them to investors. In the realm of wealth management, the underwriting spread holds great significance. It directly affects the cost of raising capital for the issuer, as it represents a cost that the issuing entity incurs during the process of issuing new securities. Conversely, for investors, the underwriting spread can impact the initial pricing and subsequent performance of the securities. A high underwriting spread may signal the underwriter's perceived risk with the security, influencing its market reception. The primary offering price refers to the initial price at which new securities are offered to the public. This price, set by the underwriter, is carefully determined based on a variety of factors including the issuer's financial health, market conditions, and investor demand. The primary offering price is a crucial element in calculating the underwriting spread. The difference between the price at which the underwriter buys the securities from the issuer and the primary offering price forms part of the underwriting spread. The issuer's proceeds are the funds that the issuing company receives from the sale of the securities. These proceeds are calculated by multiplying the number of securities issued by the price paid by the underwriter. This component forms part of the underwriting spread equation. The underwriter’s profit is fundamentally the difference between the issuer’s proceeds and what the underwriter receives from selling these securities to the public. The underwriter's discount or commission represents the underwriter's fees for their services and the risk they undertake. This is the key part of the underwriting spread that the underwriter earns as income. It's essential to consider that the underwriter's discount isn't a flat fee but usually a percentage of the primary offering price. The percentage varies based on factors such as the size and complexity of the offering and market conditions. Gross spread is the total income that an underwriter earns from an offering, expressed as a percentage of the offering’s gross proceeds. This is the most comprehensive view of an underwriting spread and includes all forms of underwriting income. For instance, if an underwriter purchases securities from an issuer for $950,000 and sells those securities for $1,000,000, the gross spread would be $50,000, or 5% of the gross proceeds. Net spread, on the other hand, is a more precise measure. It represents the underwriter's income after deducting all expenses associated with the offering. It includes costs such as legal fees, marketing costs, and administrative expenses. For example, in the case above, if the underwriter incurred $10,000 in expenses related to the offering, the net spread would be $40,000, or 4% of the gross proceeds. The creditworthiness of the issuer plays a significant role in determining the underwriting spread. Underwriters consider the issuer's financial health, debt level, and payment history to evaluate risk. If the issuer's creditworthiness is low, the perceived risk is high. Consequently, underwriters may require a higher underwriting spread to compensate for the increased risk. A high-creditworthiness issuer might result in a lower underwriting spread. Market conditions, like the overall health of the economy, interest rates, and investor sentiment, also impact the underwriting spread. In a bullish market or a stable economy, the risk of securities not being bought by the public is low, resulting in a lower underwriting spread. However, during bearish market conditions or economic downturns, the risk increases, leading to a higher underwriting spread. Similarly, high investor demand for a particular type of security can reduce the underwriting spread. The complexity of the security offering significantly influences the underwriting spread. More complex offerings require additional work in terms of documentation, regulation compliance, and investor education, justifying a higher underwriting spread. For instance, the issuance of sophisticated securities like collateralized debt obligations (CDOs) or asset-backed securities (ABS) would typically have a higher underwriting spread compared to more straightforward securities like common shares. The reputation of the underwriter can influence the underwriting spread. Highly reputed underwriters with a track record of successful offerings may charge a premium for their services, resulting in a higher underwriting spread. On the flip side, underwriters with less experience or reputation may charge a lower spread to attract business. Thus, the choice of underwriter can affect the cost of issuing securities for the issuer and the pricing for investors. The underwriting spread primarily serves as compensation for underwriting services. It allows underwriting firms to generate income for the services they provide, including risk assessment, market analysis, and sales efforts. This compensation is necessary to incentivize underwriting firms to continue providing these services, which are critical for the functioning of the financial markets and for companies seeking to raise capital. The underwriting spread can also impact investor returns. It is part of the initial cost of a security, and investors will need the security’s price to appreciate beyond this cost to make a profit. Therefore, a higher underwriting spread could potentially lower investor returns, especially in the short term. Investors and wealth managers must consider the underwriting spread when calculating potential returns on an investment. Benchmarking underwriting spreads, comparing them across different offerings, sectors, and time periods, can provide useful insights. It can help identify market trends, assess the reasonableness of the spread for a given offering, and provide a tool for negotiation for both issuers and investors. By monitoring these benchmarks, wealth managers can make informed decisions about where to invest and negotiate better terms for their clients. One of the primary criticisms of underwriting spreads is the lack of transparency. There is often limited information available to the public about the factors influencing the spread, how it is calculated, and how it is distributed among the syndicate members. This lack of transparency can make it difficult for issuers and investors to assess whether the spread is reasonable and fair, potentially leading to overpricing or underpricing of securities. Another challenge related to underwriting spreads is the potential for conflicts of interest. Since underwriters stand to earn more from a higher underwriting spread, they might be tempted to set the spread higher than necessary. While regulations and competitive forces usually keep this in check, there is still a potential for conflicts of interest, which could undermine the fairness of the security offering process. Critics of the underwriting spread model have suggested alternative methods of compensation that could potentially address some of its challenges. For instance, some suggest a flat fee model, where underwriters are paid a predetermined amount regardless of the offering size or complexity. This could reduce the potential for conflicts of interest and make costs more predictable for issuers. Increasing disclosure and transparency can help address some of the challenges associated with underwriting spreads. By making information about the calculation and distribution of the spread publicly available, underwriters can demonstrate fairness and reduce potential suspicions. This could also help issuers and investors better understand the costs associated with the offering and make more informed decisions. Adopting a competitive bidding process for underwriting services can also help manage underwriting spreads. This process encourages underwriters to offer the most favorable terms to win the underwriting deal, potentially resulting in a lower spread. Moreover, it introduces an element of market competition, which can drive efficiency and fairness in the underwriting process. For issuers, conducting thorough due diligence when selecting underwriters is crucial. This involves assessing the underwriter's experience, reputation, and track record with similar offerings. By carefully selecting underwriters, issuers can help ensure they receive high-quality services and a fair underwriting spread. The underwriting spread is a fundamental concept in the financial world, central to the process of issuing new securities. It serves as compensation for the underwriter, balancing the risks and work associated with the security issuance process. A range of factors influence the underwriting spread, including the issuer's creditworthiness, market conditions, the complexity of the offering, and the underwriter's reputation. Best practices for underwriting spread involve thorough market research, transparent communication about the underwriter's discount, and accurate expense accounting for calculating the net spread. The underwriting spread impacts the costs of capital for issuers and can influence investor returns. Wealth managers can also use benchmarking of underwriting spreads as a tool for decision-making and negotiation.What Is an Underwriting Spread?

Importance of Underwriting Spread in Wealth Management

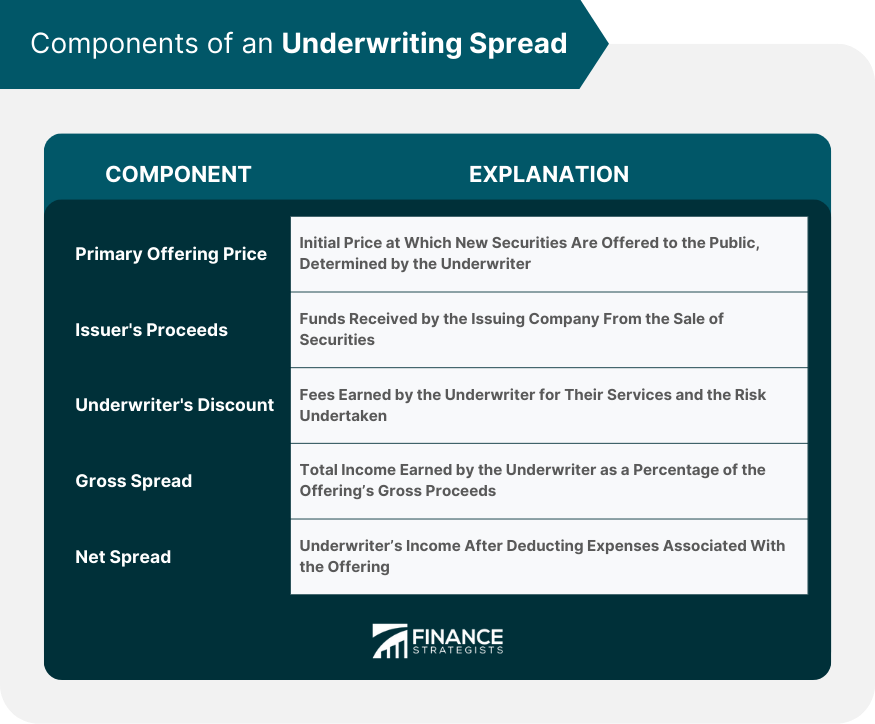

Underwriting Spread Components

Primary Offering Price

Issuer's Proceeds

Underwriter's Discount or Commission

Gross Spread

Net Spread

Factors Influencing Underwriting Spreads

Issuer's Creditworthiness

Market Conditions

Complexity of the Offering

Underwriter's Reputation

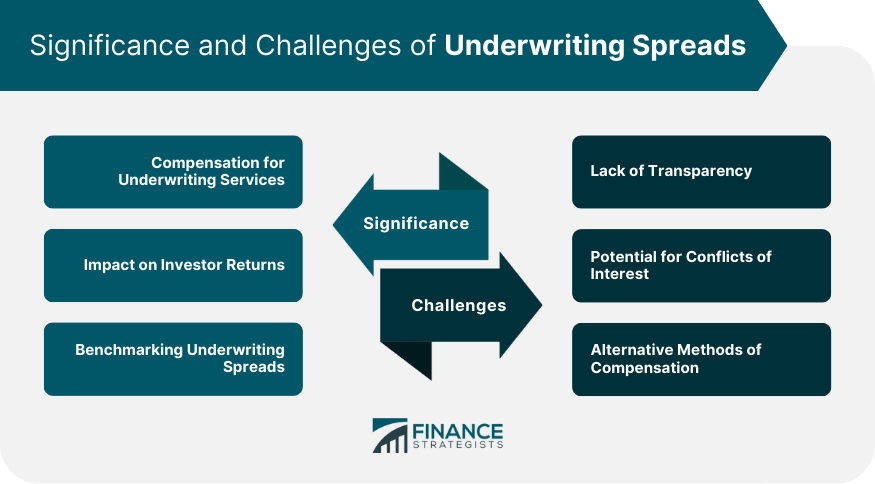

Significance of Underwriting Spreads

Compensation for Underwriting Services

Impact on Investor Returns

Benchmarking Underwriting Spreads

Challenges and Criticisms of Underwriting Spreads

Lack of Transparency

Potential for Conflicts of Interest

Alternative Methods of Compensation

Best Practices for Managing Underwriting Spreads

Disclosure and Transparency

Competitive Bidding Process

Due Diligence in Selecting Underwriters

Conclusion

Underwriting Spread FAQs

Underwriting spread refers to the difference between the amount paid by the underwriter to the issuer and the price at which the underwriter sells the securities to the public. It serves as the primary compensation for underwriters.

Several factors influence underwriting spread, including the issuer's creditworthiness, market conditions, the complexity of the offering, and the underwriter's reputation.

In wealth management, the underwriting spread impacts the cost of raising capital for issuers and can influence investor returns. Also, benchmarking underwriting spreads can help wealth managers make informed investment decisions.

Some of the main criticisms of underwriting spread include lack of transparency, potential for conflicts of interest, and the possibility of overpricing or underpricing securities.

Best practices for managing underwriting spread include increasing disclosure and transparency, adopting a competitive bidding process for underwriting services, and conducting thorough due diligence when selecting underwriters.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.