Penny stocks are shares of small, often lesser-known companies that trade for less than $5 per share. Their low price makes them accessible to all types of investors, but they are also associated with high volatility and risk due to limited financial reporting, lack of liquidity, and susceptibility to market manipulation. The primary purpose of trading penny stocks is the potential for high returns; their low prices can lead to significant profits if the company experiences growth. However, due to their inherent risks, they require careful research, strategic planning, and effective risk management. The future of penny stocks is continuously influenced by technological advancements, emerging market trends, and global economic factors. Despite the risks, with the right approach, penny stocks can provide a unique investment opportunity. Penny stocks are unique for several reasons. Understanding these characteristics can help investors make informed decisions. By definition, penny stocks are low-priced securities. This makes them accessible to all types of investors. It's a common misconception that these stocks are cheap, but it's essential to remember that low cost doesn't necessarily mean high value. Penny stocks are infamous for their volatility. Prices can skyrocket or plummet in a matter of hours. The potential for high returns often lures investors, but it's important to understand the risks associated with these high rewards. Unlike larger corporations, penny stock companies don't always have a lot of information available for investors. This lack of transparency can make it challenging to make informed decisions. Due to their lower trading volumes, penny stocks often lack liquidity. This can make it difficult for investors to sell their stocks when they want to exit the market. Due to their low prices and market caps, penny stocks are often susceptible to market manipulation. Pump and dump schemes, for instance, are unfortunately common in this sector of the market. Given the risks and potential for manipulation associated with penny stocks, regulatory bodies like the Securities and Exchange Commission (SEC) closely monitor this sector. The SEC plays a crucial role in regulating penny stocks to protect investors. The agency enforces laws and regulations that mandate transparency and fair practices in the penny stock market. This act was a significant step in regulating penny stocks. It provided enhanced protections for investors and mandated brokers to disclose specific information about penny stocks to potential investors. Current regulations continue to govern penny stock trading. Compliance with these rules ensures that traders and companies uphold the integrity of the market. The risks of fraud and manipulation are unfortunately high with penny stocks. Investors must be wary of these risks and make informed decisions to protect their investments. Begin by researching various penny stocks. Look at the company's financial statements, industry position, and any news or reports related to the company. Thorough research helps identify potential investment opportunities and assess the company's prospects. Understanding a company's fundamentals is crucial. This includes its earnings, debt, revenue, and other financial indicators. Analyzing these factors can provide insights into the company's financial health and potential for growth. Once you've chosen a penny stock to invest in, the next step is to make the purchase. This is usually done through a broker or online exchange. Select a reputable broker or exchange that offers access to penny stocks and has a user-friendly trading platform. Just like any other investment, it's important to diversify your portfolio when investing in penny stocks. Don't put all your eggs in one basket. Consider allocating funds across different sectors or industries to spread the risk and increase the potential for returns. Swing trading involves buying stocks and holding them for a few days to weeks. It's based on technical analysis and the principle of 'buy low, sell high.' Day trading involves buying and selling stocks within the same day. It's a more active form of trading that requires a significant amount of time and attention. Position trading involves holding a stock for a longer period, typically months or even years. It's based on long-term trends and company fundamentals. Scalping is a high-frequency trading strategy that aims to make small profits on large volumes of trades. It's a short-term strategy that requires fast decision-making. Many penny stock companies do not provide regular financial reports, making it difficult for investors to assess the company's financial health. Penny stocks are notoriously volatile. This can result in significant gains but also significant losses. Penny stocks are often associated with scams and fraudulent schemes, such as pump and dump schemes. Investors must be vigilant to protect their investments. Due to their low trading volumes, penny stocks may lack liquidity. This can make it difficult to sell the stocks when desired. Conducting thorough due diligence and research is crucial. It can help investors identify red flags and make informed decisions. One way to limit risk is to limit the size of the investment. This way, if the investment does not perform as expected, the loss is manageable. This can protect investors from significant losses. This strategy involves setting a predetermined price at which the stock will be sold if the price falls to that level. Regularly taking profits can also help mitigate risks. It can ensure that even if the price of the stock falls, the investor has already made some profit. Penny stocks are shares of small, often lesser-known companies that trade for less than $5 per share. Their low price makes them accessible to all types of investors, but they are also associated with high volatility and risk due to limited financial reporting, lack of liquidity, and susceptibility to market manipulation. The primary purpose of trading penny stocks is the potential for high returns; their low prices can lead to significant profits if the company experiences growth. Due to their inherent risks, they require careful research, strategic planning, and effective risk management. Despite the risks, with the right approach, penny stocks can provide a unique investment opportunity.What Are Penny Stocks?

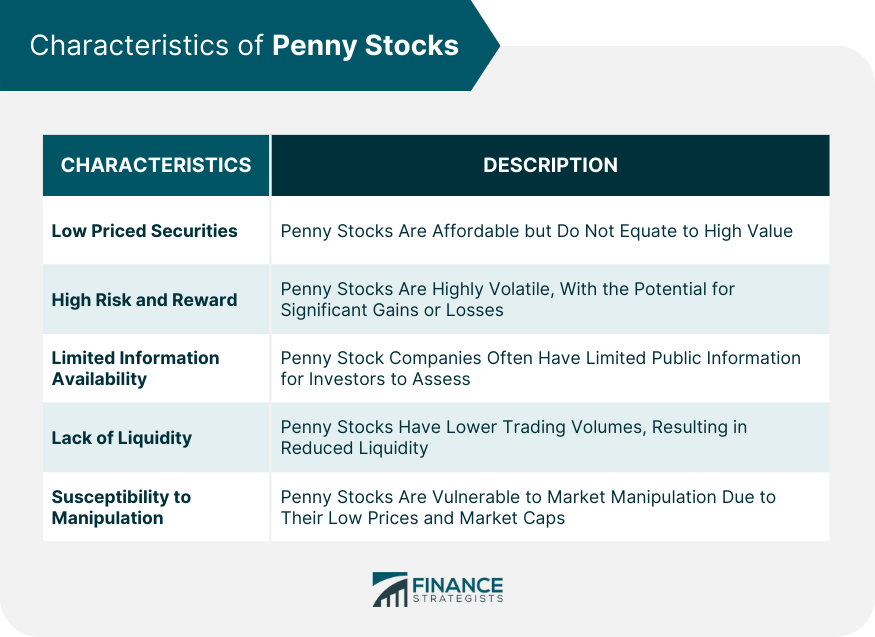

Characteristics of Penny Stocks

Low Priced Securities

High Risk and Reward

Limited Information Availability

Lack of Liquidity

Susceptibility to Manipulation

Regulatory Environment for Penny Stocks

Role of the Securities and Exchange Commission

Penny Stock Reform Act of 1990

Current Regulations and Laws

Risks of Fraud and Manipulation

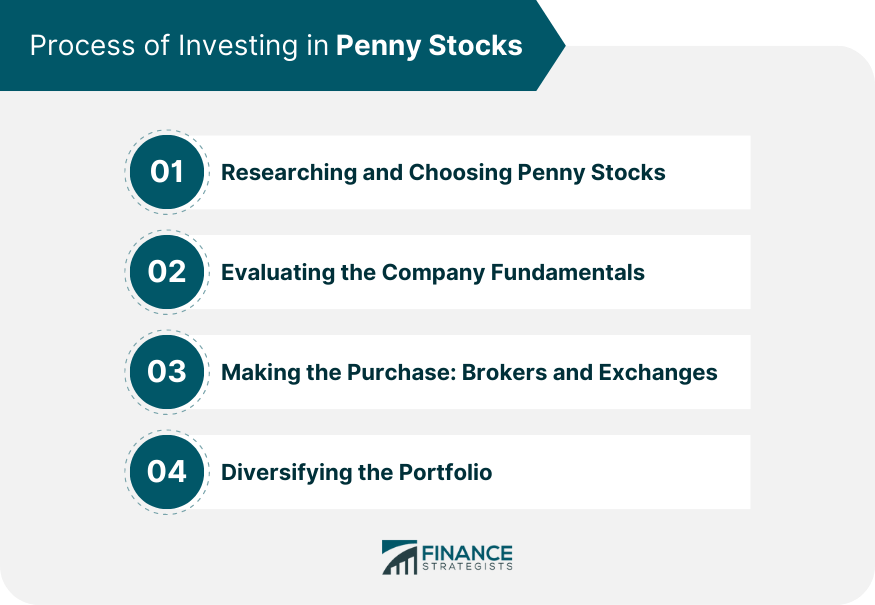

How to Invest in Penny Stocks

Researching and Choosing Penny Stocks

Evaluating the Company Fundamentals

Making the Purchase: Brokers and Exchanges

Diversifying the Portfolio

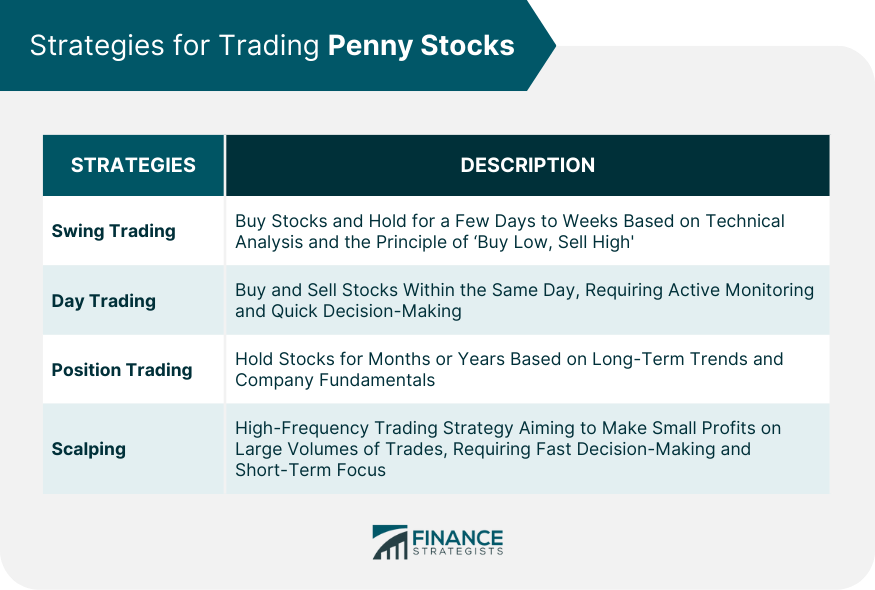

Strategies for Trading Penny Stocks

Swing Trading

Day Trading

Position Trading

Scalping

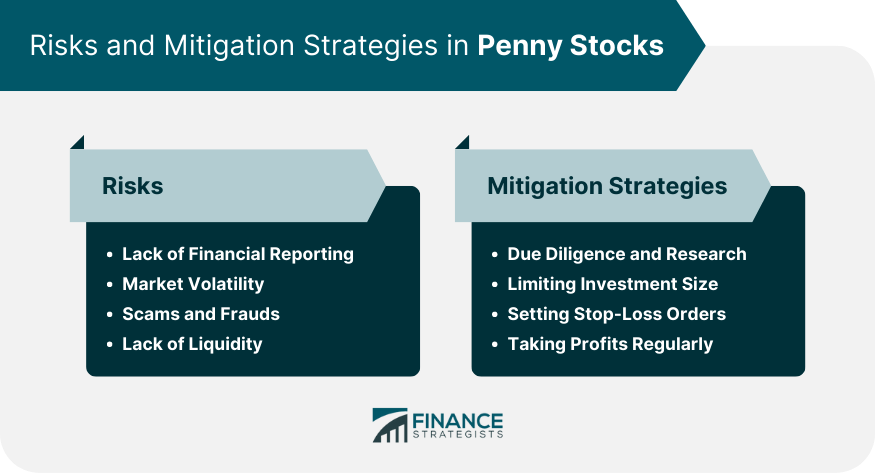

Risks Associated With Penny Stocks

Lack of Financial Reporting

Market Volatility

Scams and Frauds

Lack of Liquidity

Mitigating Risks in Penny Stock Trading

Due Diligence and Research

Limiting Investment Size

Setting Stop-Loss Orders

Taking Profits Regularly

Conclusion

Penny Stocks FAQs

Penny stocks are shares of small companies that typically trade for less than $5 per share. Due to their low price, they're accessible to many investors but also come with high volatility and risk.

The primary risks of trading penny stocks include market volatility, lack of financial reporting, lack of liquidity, and susceptibility to scams and fraudulent schemes. Despite the potential for high returns, these risks make penny stock investment a high-risk venture.

Risks can be mitigated by conducting thorough due diligence and research, limiting the size of your investment, setting stop-loss orders, and regularly taking profits. These strategies can help protect your investment and limit potential losses.

Successful strategies for trading penny stocks include swing trading, day trading, position trading, and scalping. Each strategy has its own benefits and drawbacks, so it's important to choose a strategy that aligns with your investment goals and risk tolerance.

The future of penny stocks looks promising, with emerging trends in FinTech and blockchain technologies potentially impacting the market. Technological advancements could make trading more efficient, and global economic factors will continue to influence the penny stocks market. However, the high risks associated with penny stocks will likely persist, so careful research and risk management will remain crucial.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.