Market capitalization, or market cap, is the combined value of a company's outstanding stock. It is an estimate of the total value of a company. A related metric called enterprise value is more useful than market cap in many cases. Enterprise value takes the market cap, then adds the debt on the balance sheet and subtracts the cash. While market cap is widely used and provides a straightforward measure of a company's market value, enterprise value offers a more nuanced perspective, especially in scenarios involving corporate transactions. It can reveal discrepancies between companies with similar market caps but varying debt levels, highlighting potential risks and opportunities. However, it's important to note that both market cap and enterprise value have their limitations and should be used in conjunction with other financial metrics for a comprehensive evaluation of a company's valuation. Market capitalization, often referred to as market cap, represents the total market value of a company's outstanding shares of stock. It is computed by multiplying the company's current share price by its total number of outstanding shares. This figure provides a snapshot of a company's size and is frequently used by investors to classify companies into different size tiers, namely small-cap, mid-cap, and large-cap. Market capitalization serves as a crucial metric in the world of investing. It allows investors and analysts to make comparisons between companies, sectors, and industries on a like-for-like basis. Besides, it offers an insight into the perception of a company's future prospects and risk profile. A company with a higher market cap is often seen as more stable and less risky compared to one with a lower market cap. Enterprise Value (EV) is a comprehensive measure of a company's total value. Unlike market capitalization, which only considers equity value, EV takes into account the entire economic value of a company—equity plus debt, minus cash, and cash equivalents. Simply put, enterprise value provides a much more detailed view of a company's worth as it encompasses all sources of capital, including debt. The importance of enterprise value arises from its comprehensive nature. By considering both equity and debt capital, it offers a more holistic view of a company's worth. This makes it a preferred metric, especially during mergers, acquisitions, and buyouts where a buyer needs to fully assess a company's value, including its outstanding debt and cash reserves. Both market capitalization and enterprise value are widely used metrics in the valuation of companies. They serve as important measures for investors, analysts, and stakeholders to assess the worth of a company in the market. These metrics are commonly utilized to compare companies within the same industry or sector, providing valuable insights for investment decision making. Both market capitalization and enterprise value incorporate the current stock price of a company in their calculations. The stock price is a fundamental component in determining market capitalization as it directly influences the company's market value. Similarly, the stock price plays a crucial role in calculating enterprise value as it impacts the equity value portion of the calculation. Thus, the stock price serves as a key factor in both metrics. Market capitalization and enterprise value provide indications of a company's size and prominence in the market. A higher market capitalization and enterprise value generally suggest a larger company with a significant market presence. These metrics are often used by investors and market participants as a measure of a company's perceived value and its standing within the industry. By considering both market capitalization and enterprise value, stakeholders can gain insights into the relative size and market perception of companies for various investment and strategic considerations. The primary difference between market capitalization and enterprise value lies in their components. Market capitalization solely considers equity value—the total value of all outstanding shares of a company's stock. On the other hand, enterprise value goes a step further. It includes not just the equity value, but also the market value of debt and cash reserves. This inclusive approach gives enterprise value a broader perspective on the company's worth. When it comes to interpretation and applicability, market capitalization and enterprise value serve different purposes. Market capitalization is commonly used to classify companies based on their size or for comparative analysis within a specific industry. It reflects the equity market's view of a company's worth. In contrast, enterprise value is typically used during business valuation, mergers, and acquisitions, as it provides a complete picture of a company's total value. It reflects the cost of acquiring a company in its entirety. One key difference between market capitalization and enterprise value is their calculation methodology. Market capitalization is determined by multiplying the stock price by the number of outstanding shares, focusing solely on equity value. In contrast, enterprise value considers equity value along with debt and cash reserves. This comprehensive approach provides a more accurate assessment of a company's total worth and is particularly useful in business valuation and acquisitions. The choice between using market capitalization or enterprise value largely depends on the purpose and context of the analysis. For basic comparisons or classifications based on size, market capitalization may be sufficient. However, for in-depth business valuation, especially during acquisitions, enterprise value becomes a more appropriate and informative metric due to its comprehensive approach to company valuation. Another factor to consider when choosing the right metric is the financial structure of the company. For companies with a significant amount of debt or cash reserves, enterprise value would offer a more accurate picture of the company's total value. Conversely, for companies with little to no debt and minor cash reserves, market capitalization might provide a reasonably accurate valuation. The nature of the industry and its norms also play a role in the choice of metric. Certain industries might favor one metric over the other. For example, in industries where companies typically carry a lot of debt, such as utilities or telecoms, enterprise value might be the preferred metric for comparative analysis. On the contrary, in industries where companies have less debt, market capitalization could be a more widely used measure. For companies with a lot of debt or a lot of cash, enterprise value is much more useful than the market cap, and better reflects the "true price" of the company. If someone were to buy the company outright, the acquirer would have to take on the debt but could pocket the cash. This affects the total amount of money paid. Market capitalization is used as a convenient metric to estimate the total value of a company. It is an estimate of how much it would cost to buy a company by purchasing all of the outstanding shares on the open market. However, companies that are purchased outright via a takeover usually require a premium to be paid above the current market price. This is due to the fact that an acquisition often gives the purchasing company a competitive advantage. Both market capitalization and enterprise value are key financial metrics used to assess a company's worth, albeit from different perspectives. Market capitalization represents the market's perception of a company's equity value, while enterprise value offers a more comprehensive look, factoring in debt, cash, and cash equivalents. Both market capitalization and enterprise value are important financial metrics used to assess a company's worth. They provide insights into a company's value and are commonly used in investment analysis. The similarity between the two is that they serve as measures of a company's value. However, the difference lies in the factors they consider. Market capitalization focuses solely on equity value, while enterprise value incorporates debt and cash reserves, providing a more comprehensive view of a company's worth. The choice between the two hinges on the context of analysis, the company's financial structure, and industry norms. Understanding the nuances of both metrics empowers investors and analysts to make well-informed decisions and comparisons.Market Cap and Enterprise Value

What Is Market Capitalization?

What Is Enterprise Value?

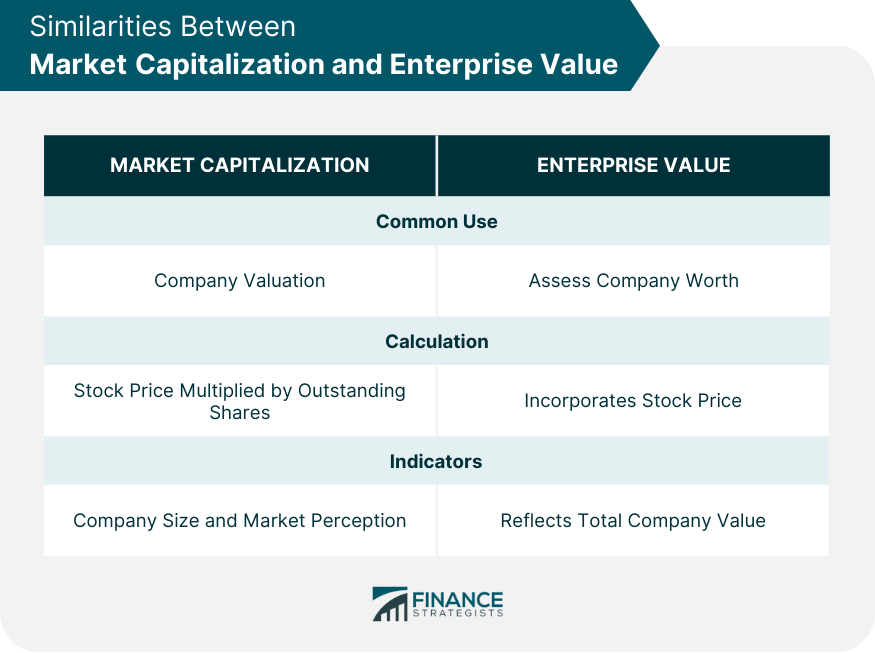

Similarities Between Market Capitalization and Enterprise Value

Common Use in Company Valuation

Incorporation of Stock Price in Calculation

Indicators of Company Size and Market Perception

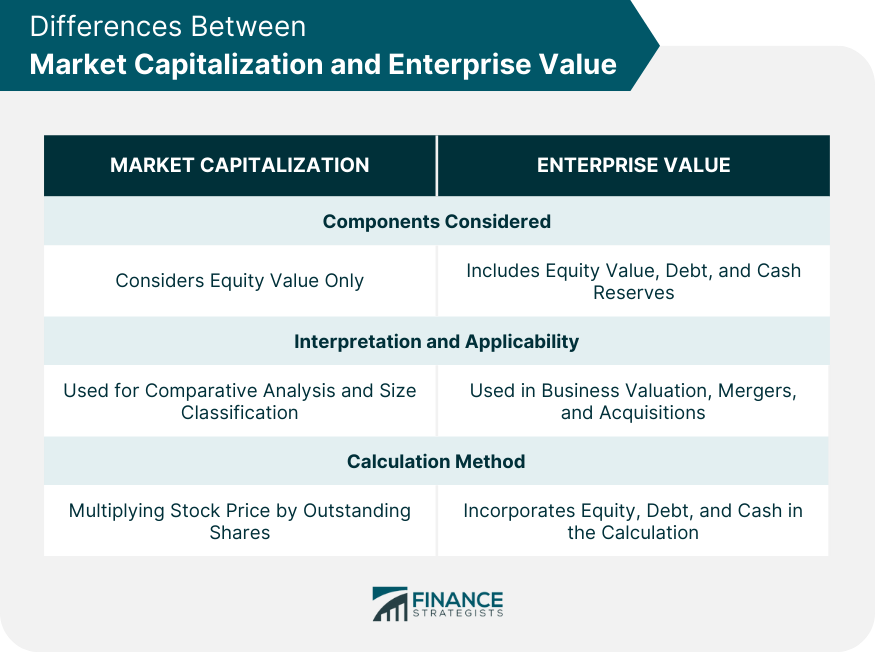

Differences Between Market Capitalization and Enterprise Value

Components Considered

Interpretation and Applicability

Calculation Method

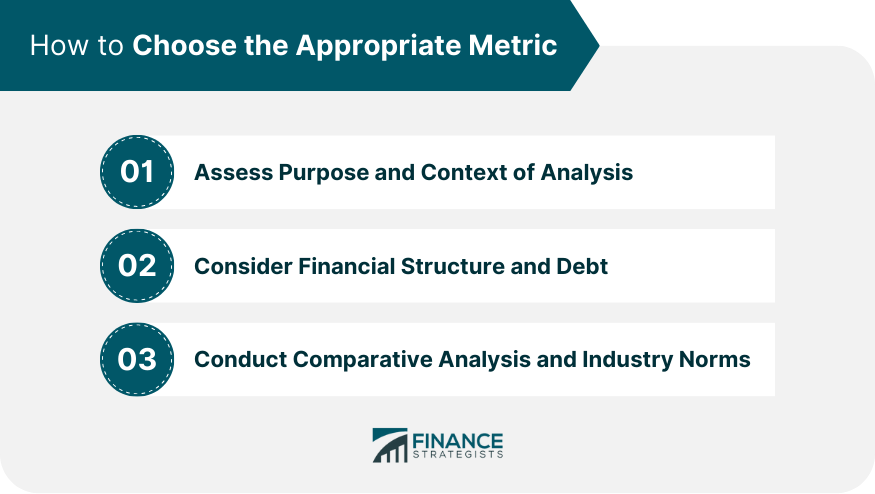

How to Choose the Appropriate Metric

Assess Purpose and Context of Analysis

Consider Financial Structure and Debt

Conduct Comparative Analysis and Industry Norms

How Does Enterprise Value Affect Decision Making

How Investors May Take Advantage

Conclusion

Market Capitalization vs Enterprise Value FAQs

Market capitalization is a measure of the dollar value of all outstanding shares of a company, while enterprise value takes into account equity as well as debt. In simple terms, market capitalization evaluates the equity portion only, while enterprise value considers both debt and equity.

Market capitalization is commonly used when comparing companies within the same industry, as it provides a quick snapshot of which company has the highest value based on its stocks alone. Enterprise value should be used when comparing similar companies across industries, or assessing acquisitions, as it takes into account both debt and equity.

No, market capitalization only includes the dollar value of all outstanding shares of a company, which does not include any debt obligations.

Enterprise value includes both the equity portion (market capitalization) as well as the debt obligations of a company.

The formula for calculating Enterprise Value is EV = Market Capitalization + Total Debt - Cash and Equivalents. This takes into account both the equity portion (market capitalization) and any debt obligations while subtracting any cash and equivalents.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.