A Lock-Up Agreement is a legally binding contract that prevents company insiders - such as early investors, employees, and owners - from selling their shares for a specified period. This period, typically ranging from 90 to 180 days, is often implemented following major corporate events like an Initial Public Offering (IPO), merger, or acquisition. The primary purpose of a lock-up agreement is to help stabilize the market by preventing an immediate flood of shares, which could lead to volatility and potentially decrease the stock price. Lock-up agreements are of great importance in maintaining investor confidence, ensuring stock price stability, and demonstrating the long-term commitment of major stakeholders. Understanding these agreements is crucial for both investors and companies, as they can significantly impact a company's stock price dynamics and market perception. A lock-up agreement involves two primary parties - the insiders of the company, who could be the owners, employees, or early investors, and the underwriters who facilitate the process of the IPO or the acquiring firm in a merger or acquisition. The agreement stipulates specific terms, such as the duration of the lock-up period, usually ranging from 90 to 180 days but can extend up to a year or more. It also outlines conditions under which the lock-up may be waived or terminated. In the context of IPOs, the lock-up agreement seeks to prevent the flooding of the market with a company's shares immediately post-IPO. It helps maintain the stock price and control its volatility, providing the company with a more stable start on the public market. During mergers and acquisitions, lock-up agreements can serve to demonstrate the seriousness and commitment of the acquiring party. It restricts the acquirer from selling their acquired shares immediately, thus ensuring stability post-merger. In venture capital funding scenarios, the lock-up agreement ensures that the venture capitalists do not sell their shares immediately after the company goes public, thereby protecting the company's stock price. Lock-up agreements ensure that the company's stock price is not subject to the whims of insiders who might be tempted to sell off their shares immediately post-IPO. It serves to instill confidence in other investors and establishes a period of relative price stability. For M&A, lock-up agreements can serve as a sign of commitment from the acquiring firm, reassuring other stakeholders about the long-term intentions of the new ownership. This provides an element of stability during the typically turbulent post-merger period. In the world of venture capital, lock-up agreements can help maintain a stable environment for newly public companies, thus attracting other investors and allowing the company to establish itself in the public market. During the lock-up period, insiders are unable to sell their shares, often leading to lower trading volume and potentially higher stock price, as the supply of shares available for trading is lower. Once the lock-up period ends, there is typically an increase in trading volume as insiders begin to sell their shares. This increased supply can sometimes lead to a decrease in the company's stock price. In the United States, the Securities and Exchange Commission (SEC) oversees lock-up agreements and requires companies to disclose their existence and terms in their registration statements for IPOs. While lock-up agreements are legal, they may occasionally be the subject of legal disputes, often centered around whether the lock-up terms were adequately disclosed or if they were breached by the insiders. Critics of lock-up agreements argue that they allow for market manipulation, as insiders and underwriters can control the supply of shares, thus affecting the stock price. Lock-up agreements can potentially disadvantage minority shareholders. As insiders are prevented from selling their shares, minority shareholders might be left in a vulnerable position if the stock price drops. Lock-up agreements are evolving with the changing financial landscape. There is a trend toward longer lock-up periods to ensure more extended market stability, especially for high-profile IPOs. Regulatory bodies worldwide are scrutinizing lock-up agreements more closely, and changes in regulations could be on the horizon. This may include stricter disclosure requirements or limits on the length and terms of lock-up agreements. Lock-up agreements are crucial legal contracts that maintain stock price stability after significant corporate events such as IPOs, mergers, or acquisitions. These agreements prevent company insiders from selling their shares for a defined period, reducing market volatility and reinforcing investor confidence. Essential elements of these agreements include the duration of the lock-up period and conditions for potential termination. They serve different functions in various contexts, like IPOs, M&As, and venture capital funding. While they provide stability, critics argue that lock-up agreements allow potential market manipulation and disadvantage minority shareholders. With evolving financial landscapes, lock-up agreements are seeing trends towards longer periods, and regulatory bodies globally are considering changes in associated regulations.What Is a Lock-Up Agreement?

Structure of a Lock-Up Agreement

Parties Involved

Key Terms and Provisions

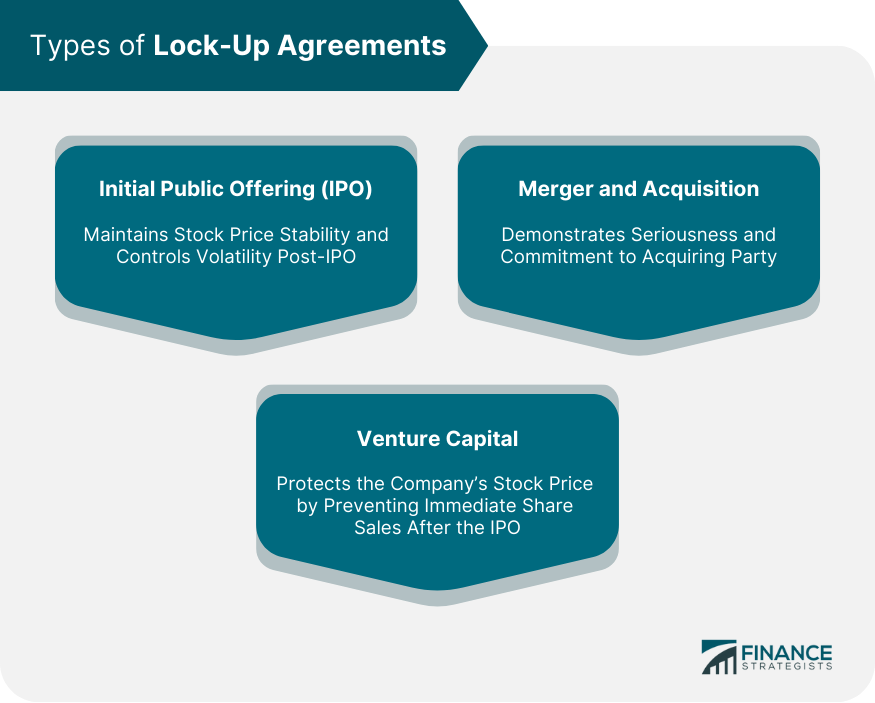

Types of Lock-Up Agreements

Initial Public Offering

Merger and Acquisition

Venture Capital

Importance of Lock-Up Agreements

In Initial Public Offerings

In Mergers and Acquisitions

In Venture Capital Funding

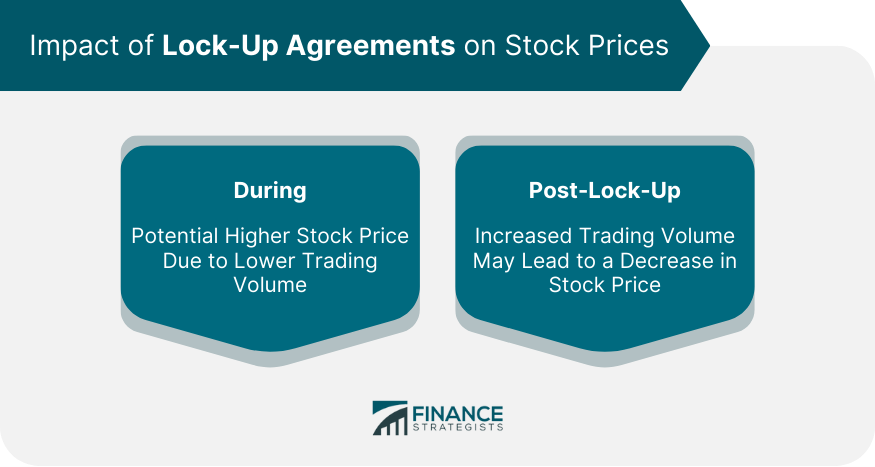

Impact of Lock-Up Agreements on Stock Prices

During the Lock-Up Period

Post-Lock-Up Period

Legal and Regulatory Aspects of Lock-Up Agreements

SEC Regulations

Legal Considerations and Disputes

Controversies and Criticisms of Lock-Up Agreements

Market Manipulation Accusations

Impact on Minority Shareholders

Future of Lock-Up Agreements

Trends in Use and Terms of Lock-Up Agreements

Potential Changes in Regulations

Final Thoughts

Lock-Up Agreement FAQs

A lock-up agreement is a contractual provision that prevents insiders of a company, such as employees or early investors, from selling their shares for a specific period, typically following an IPO, a merger, or an acquisition. It is designed to prevent market instability that might be caused by a sudden influx of shares.

Lock-Up Agreements play a crucial role during IPOs by preventing insiders from selling their shares immediately after the company goes public. This helps maintain the stock price, control its volatility, and provides a stable start in the public market.

During the lock-up period, the inability of insiders to sell their shares often leads to a lower trading volume and potentially a higher stock price due to the reduced supply of shares. Once the lock-up period ends, there is typically an increase in trading volume as insiders start selling, which may decrease the company's stock price.

Critics of lock-up agreements argue that they can potentially enable market manipulation, as insiders and underwriters have control over the supply of shares, which could affect the stock price. Furthermore, lock-up agreements may disadvantage minority shareholders, who may be left vulnerable if the stock price drops.

Lock-up agreements are likely to continue evolving with the changing financial landscape. Trends indicate a possible shift towards longer lock-up periods for more extended market stability. Also, changes in regulations, including stricter disclosure requirements or limitations on the terms of lock-up agreements, could be on the horizon.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.