Allotment refers to the process of allocating shares or other financial instruments to investors during various types of issuances, such as Initial Public Offerings (IPOs), private placements, and rights issues. The allotment process helps determine the number of shares each investor receives based on their application and the total number of shares available for issuance. Allotment plays a critical role in finance as it ensures a fair and transparent distribution of shares among investors. It also helps companies raise capital efficiently by allocating shares to investors who value them the most. Moreover, allotment procedures help maintain an orderly and well-functioning securities market, which in turn fosters investor confidence and encourages investments. The key players involved in the allotment process include the issuing company, investment banks, underwriters, stock exchanges, and regulatory authorities. These entities work together to ensure that the allotment process complies with the legal and regulatory requirements and is conducted in a transparent and efficient manner. Pro-rata allotment refers to allocating shares to investors in proportion to their respective applications. In this method, each investor receives a percentage of shares based on the total number of applied shares and the total shares available for allotment. Pro-rata allotment is commonly used in IPOs and rights issues to ensure a fair distribution of shares among investors. Preferential allotment involves the allocation of shares to a select group of investors, typically at a preferential price. This allotment type is often used to raise capital from strategic investors, such as venture capitalists, private equity firms, or other institutional investors. Companies may opt for preferential allotment to raise funds quickly, secure long-term investors, or negotiate better terms. Private allotment refers to issuing shares to a small group of private investors, usually through a private placement. This method does not offer shares to the general public, and the transaction is conducted privately between the company and the investors. Private allotment allows companies to raise capital without the regulatory requirements and costs associated with public offerings. QIP allotment is a fundraising method listed companies use to issue shares, convertible securities, or other financial instruments to qualified institutional buyers (QIBs). This allotment type allows companies to raise capital quickly without needing a public offering. QIPs are subject to regulatory guidelines and require the approval of existing shareholders. ESOP allotment allows employees to purchase company shares at a predetermined price. These options typically vest over time and can be exercised by employees to acquire shares. ESOP allotment incentivizes employees to remain with the company and contribute to its growth, aligning their interests with those of shareholders. The IPO allotment process begins with investors submitting applications to purchase shares through a registered broker or an online platform. Investors must provide personal and financial information and specify the number of shares they wish to apply for. During the subscription period, investors can submit their applications to participate in the IPO. The period typically lasts a few days, after which the total share demand is assessed, and the allotment process begins. The basis of allotment is a method used to determine the allocation of shares among investors. This process considers the total number of shares applied for, the total shares available for allotment, and investor categories such as retail, institutional, and non-institutional investors. The basis of allotment aims to ensure a fair and transparent distribution of shares among all applicants. Once the allotment process is complete, the issuing company, lead managers, and stock exchanges announce the allotment results. Investors can check their allotment status through the registrar's website or their broker's platform. Following the announcement, shares are credited to investors' demat accounts, and the company gets listed on the stock exchange. Private placements involve the sale of securities to a small group of private investors. The allotment process in private placements is negotiated between the company and the investors, with terms such as pricing, number of shares, and lock-up period being mutually agreed upon. In a rights issue, existing shareholders are offered the right to purchase additional shares in proportion to their current shareholding. The allotment process for rights issues follows the pro-rata principle, ensuring that all eligible shareholders have an equal opportunity to participate in the capital-raising exercise. Block trades involve the sale of a large block of shares between institutional investors outside the regular stock exchange trading system. The allotment process in block trades is negotiated directly between the buyer and the seller. The transaction is executed through an intermediary such as an investment bank or a broker. Companies or investors seeking to acquire a controlling stake in a listed company offer open offers. In an open offer, the acquirer publicly offers existing shareholders to purchase their shares at a specified price. The allotment process in open offers involves accepting applications from shareholders and allocating shares to the acquirer based on the acceptance received. The demand and supply of shares play a crucial role in the allotment process. When the demand for shares exceeds the supply, the allotment process may result in oversubscription, leading to a pro-rata allocation of shares among investors. Conversely, when the supply of shares exceeds demand, the allotment process may result in under subscription, with shares being allocated to all applicants without any proration. The allotment process may influence investor categories, such as retail, institutional, and non-institutional investors. Companies and regulators may reserve a specific percentage of shares for each investor category, ensuring a balanced distribution of shares among different investor types. Regulatory requirements, such as minimum and maximum investment limits and the reservation of shares for specific investor categories, can impact the allotment process. These requirements are designed to promote fair and transparent allotment practices and protect the interests of investors. In certain cases, companies can determine the allotment process. For example, in preferential allotments, companies can decide the terms of the issuance and the allocation of shares among selected investors. SEBI, the market regulator in India, provides guidelines for the allotment process in various types of issuances, such as IPOs, QIPs, and rights issues. These guidelines aim to ensure transparency, fairness, and efficiency in the allotment process. The Companies Act governs the allotment process for companies in India, including share capital provisions, securities issuance, and shareholder rights. The Act outlines the legal framework for the allotment process, ensuring compliance with statutory requirements. Listing agreements between companies and stock exchanges outline the terms and conditions for listing securities, including the allotment process. These agreements help ensure that the allotment process complies with the rules and regulations of the stock exchange and promotes a well-functioning securities market. Stock exchange regulations provide guidelines for listing, trading, and allotting securities. These regulations are designed to maintain a fair and orderly market, protect investor interests, and facilitate efficient capital raising by companies. Oversubscription occurs when the demand for shares in an issuance exceeds the total number of shares available for allotment. In such cases, shares are allotted pro-rata, which may result in investors receiving fewer shares than they applied for, impacting their investment strategy and expected returns. Allocation bias refers to the unequal distribution of shares among different investor categories or the preferential treatment of certain investors during the allotment process. Such biases can undermine the fairness and transparency of the allotment process, discouraging investments and harming market confidence. Market volatility can impact the allotment process by affecting investor demand and the pricing of shares. Fluctuations in market conditions may lead to changes in investor sentiment, impacting the subscription levels and the success of the allotment process. Regulation changes, such as revisions to allotment guidelines or listing requirements, can impact the allotment process and create uncertainty for companies and investors. Regulatory changes may require companies to adjust their allotment strategies or delay their capital-raising plans, affecting their ability to meet funding needs. Shareholders who are allotted shares in a company have various rights, including the right to receive dividends, attend shareholder meetings, and vote on company matters. These rights help ensure that shareholders can participate in decision-making and share in the company's growth and success. Shareholders also have certain obligations, such as complying with disclosure requirements, adhering to lock-up periods, and fulfilling other regulatory and contractual obligations. By meeting these obligations, shareholders help maintain a well-functioning securities market and protect their own interests and those of other investors. Companies must communicate regularly with their shareholders, providing updates on financial performance, business developments, and other relevant information. Effective shareholder communication helps maintain investor confidence and fosters long-term relationships between companies and their shareholders. Shareholders can attend and vote at shareholder meetings, either in person or through proxies. By participating in these meetings, shareholders can influence company decisions and ensure that their interests are represented in the decision-making process. Allotting shares can lead to the dilution of ownership for existing shareholders. As new shares are issued, existing shareholders' ownership decreases, which may impact their control over the company and their share of future profits. The allotment of shares can affect a company's market capitalization, which is the total value of its outstanding shares. As new shares are issued and sold, the company's market capitalization may increase, reflecting the additional capital raised and the market's perception of the company's growth prospects. Allotting shares can impact a company's financial ratios, such as earnings per share (EPS), price-to-earnings (P/E), and debt-to-equity ratios. Investors use these ratios to assess the company's financial performance and valuation, and changes in these ratios may influence investor sentiment and the company's share price. The allotment of shares can directly impact the company's share price, as the increased supply of shares in the market may affect the demand and pricing dynamics. Depending on the market's perception of the company's prospects and the success of the allotment process, the share price may rise or fall following the allotment of new shares. Allotment is a critical process in finance where shares or financial instruments are allocated to investors during issuances such as Initial Public Offerings (IPOs), private placements, and rights issues. This process ensures fair and transparent distribution of shares, helps raise capital efficiently, and fosters a well-functioning securities market, encouraging investments. The process involves key players like the issuing company, investment banks, underwriters, stock exchanges, and regulatory authorities to comply with legal and regulatory standards. Types of allotment include Pro-rata, Preferential, Private, Qualified Institutional Placement (QIP), and Employee Stock Option Plan (ESOP). Each type serves unique purposes, ranging from a proportional allocation of shares to quick capital raising or employee motivation. The allotment process is affected by factors such as demand and supply of shares, investor category, regulatory requirements, and the company's discretion. Allotment practices adhere to the legal and regulatory frameworks laid out by bodies like the Securities and Exchange Board of India (SEBI) and abide by specific company Acts and stock exchange regulations.What Is Allotment?

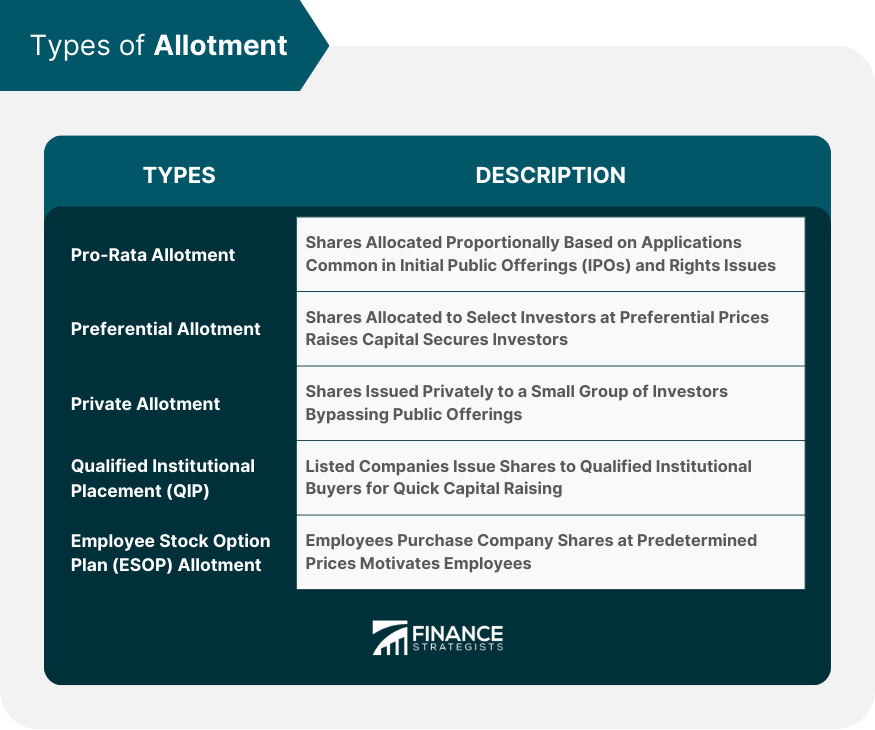

Types of Allotment

Pro-Rata Allotment

Preferential Allotment

Private Allotment

Qualified Institutional Placement (QIP) Allotment

Employee Stock Option Plan (ESOP) Allotment

Allotment Process

Initial Public Offering (IPO) Allotment

IPO Application

Subscription Period

Basis of Allotment

Allotment Announcement

Allotment in Secondary Market Transactions

Private Placements

Rights Issues

Block Trades

Open Offers

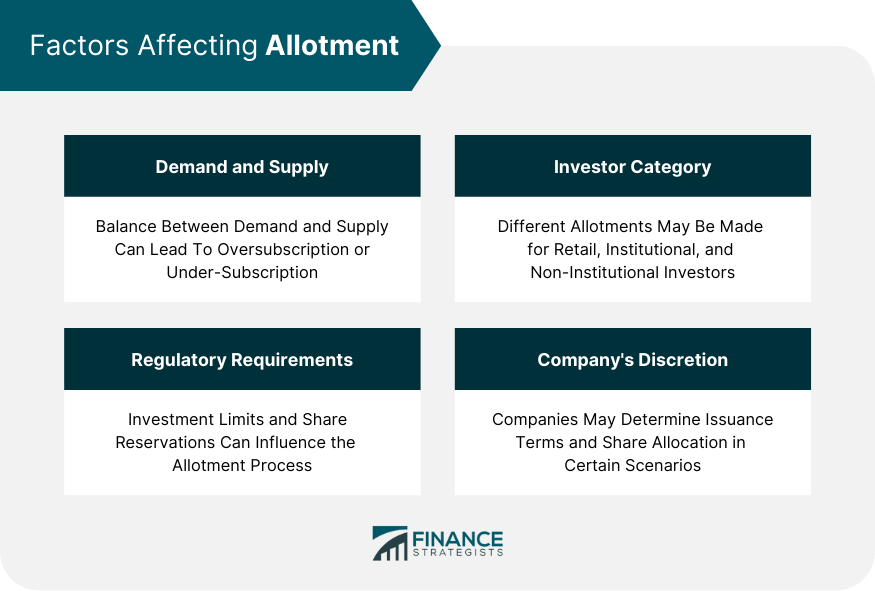

Factors Affecting Allotment

Demand and Supply

Investor Category

Regulatory Requirements

Company's Discretion

Legal and Regulatory Framework for Allotment

Securities and Exchange Board of India (SEBI) Guidelines

Companies Act

Listing Agreements

Stock Exchange Regulations

Risks and Challenges in Allotment

Oversubscription

Allocation Bias

Market Volatility

Regulatory Changes

Rights and Obligations of Allottees

Rights of Shareholders

Obligations of Shareholders

Shareholder Communication

Shareholder Meetings and Voting

Impact of Allotment on Company Valuation

Dilution of Ownership

Changes in Market Capitalization

Impact on Financial Ratios

Effect on Share Price

Conclusion

Allotment FAQs

Allotment in finance refers to the process of allocating shares or securities to investors during an Initial Public Offering (IPO) or secondary market transaction.

There are various types of allotment, including pro-rata, preferential, private, Qualified Institutional Placement (QIP), and Employee Stock Option Plan (ESOP) allotment.

The IPO allotment process involves submitting an application, a subscription period where investors express their interest, a basis of allotment determined by various factors, and the allotment announcement of shares to successful applicants.

Several factors can influence allotments, such as the demand and supply of shares, investor category, regulatory requirements, and the company's discretion in determining the allotment ratio.

Allotment can affect company valuation, including dilution of ownership, changes in market capitalization, alterations in financial ratios, and potential impacts on the share price.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.