The "Hard-To-Borrow List" refers to a collection of securities that are difficult to secure for short-selling transactions due to their limited availability in the market. This scarcity could be due to various factors, including high market demand, low float, or regulatory restrictions. The primary purpose of this list is to signal the ease or difficulty of borrowing a particular security for short selling, helping investors and brokers gauge potential borrowing costs and availability. The Hard-To-Borrow List holds significant importance in financial markets as it influences investment strategies, particularly in short selling. Understanding this list enables investors to make informed decisions, manage risk, and potentially avoid higher costs or losses associated with short-selling these securities. In essence, it is a vital tool for navigating the complexities of short selling in financial markets. To grasp why some securities end up on the Hard-To-Borrow List, it's crucial to understand the factors at play. Think of securities as goods in a store. If there's a limited supply of a specific item, it becomes harder for customers to find it. Similarly, if a security is in short supply on the market, it's likely to land on the Hard-To-Borrow List. This scarcity can happen when a security has a low number of shares available (low float) or when a lot of investors want to buy the stock (high demand). In the stock market, if many traders want to short-sell a particular security, the demand to borrow that security increases. As demand increases and it becomes tougher to find available shares, the security becomes "hard to borrow" and ends up on the list. Sometimes, external factors like regulatory restrictions also influence which securities appear on the Hard-To-Borrow List. Suppose a company is under investigation or has recently released significant news, like earnings reports. In that case, it might be temporarily harder to borrow its shares, placing it on the Hard-To-Borrow List. Understanding the Hard-To-Borrow List is vital for investors, as it can significantly shape their investment strategies and potential returns. Securities on the Hard-To-Borrow List are scarce, they're often more expensive to borrow. This higher cost can eat into the profits of short sellers, making their trading strategy less profitable. The more expensive it is to borrow a security, the fewer shares a short seller might afford to borrow. This limitation could hinder their ability to make a profit, as their trading activity is restricted by these higher costs. Having connections often help in life, and it's no different in trading. Maintaining a strong relationship with a broker-dealer can sometimes provide access to hard-to-borrow securities. Just like a well-connected friend who can get rare concert tickets, broker-dealers can often source these scarce securities from their networks. The Hard-To-Borrow List not only influences individual investors but also has a notable impact on the broader market dynamics. When securities are on the Hard-To-Borrow List, their limited availability can make buying and selling them more difficult and time-consuming, impacting the market's overall liquidity. When an item is scarce, its demand often increases, leading to a price hike. Similarly, the limited availability of securities on the Hard-To-Borrow List can result in increased demand, driving up their prices. This price fluctuation can affect both individual security and broader market trends. Securities on the Hard-To-Borrow List can contribute to market volatility due to a phenomenon called a short squeeze. A short squeeze happens when short sellers, who have borrowed and sold a security expecting its price to fall, are forced to buy back the securities to cover their short positions when prices rise instead. This buying can further drive up prices and increase market volatility. Regulatory guidelines are crucial in overseeing the Hard-To-Borrow List and ensuring the trading process remains fair and transparent. The SEC is a federal agency that monitors the Hard-To-Borrow List to ensure market participants adhere to its rules. The SEC's goal is to prevent any form of market manipulation that could upset the balance and fairness of trading. Regulation SHO is a specific rule set by the SEC concerning short-selling practices. It outlines the necessary steps and conditions related to trading hard-to-borrow and fail-to-deliver securities. Its aim is to ensure a level playing field in the market for all investors. Disregarding these regulations can result in serious repercussions. Traders who don't follow the SEC rules may face hefty fines, sanctions, or even a ban from trading. Therefore, understanding and complying with these rules is vital for any trader to operate successfully within the bounds of the law. Navigating the landscape of hard-to-borrow securities can be tricky, but there are strategies investors can employ to manage these situations. One way to handle hard-to-borrow securities is to think outside the box and use alternative strategies. For instance, investors can buy put options, which give them the right to sell a security at a certain price in the future. Alternatively, they could invest in inverse ETFs, which are designed to increase in value when a particular market or index declines. Both these strategies can help investors profit from a potential drop in a security's price without needing to borrow the security itself. Another strategy is to use financial instruments known as derivatives. These include options, futures, and swaps, which derive their value from an underlying security. By using derivatives, investors can mimic short-selling strategies without actually borrowing the security. This way, they can avoid the risks and costs associated with hard-to-borrow securities while still potentially profiting from a decrease in the security's price. The Hard-To-Borrow List is a fundamental tool in financial markets, signaling the availability and borrowing cost of securities for short selling. Factors influencing this list range from the availability of shares and market demand to regulatory restrictions. This list has implications for both individual investors, impacting borrowing costs and short-selling strategies, and the broader market dynamics, affecting liquidity, price trends, and volatility. Broker-dealer relationships can often alleviate the difficulty of accessing such securities. The SEC ensures regulatory compliance related to this list under Regulation SHO, with non-compliance attracting consequences. Investors can employ alternative strategies, such as put options, inverse ETFs, and derivatives, to navigate and potentially profit from the hard-to-borrow securities landscape without directly borrowing these securities. Understanding the Hard-To-Borrow List and these associated strategies is crucial for effective risk management and informed decision-making in the complex world of financial trading.What Is a Hard-To-Borrow List?

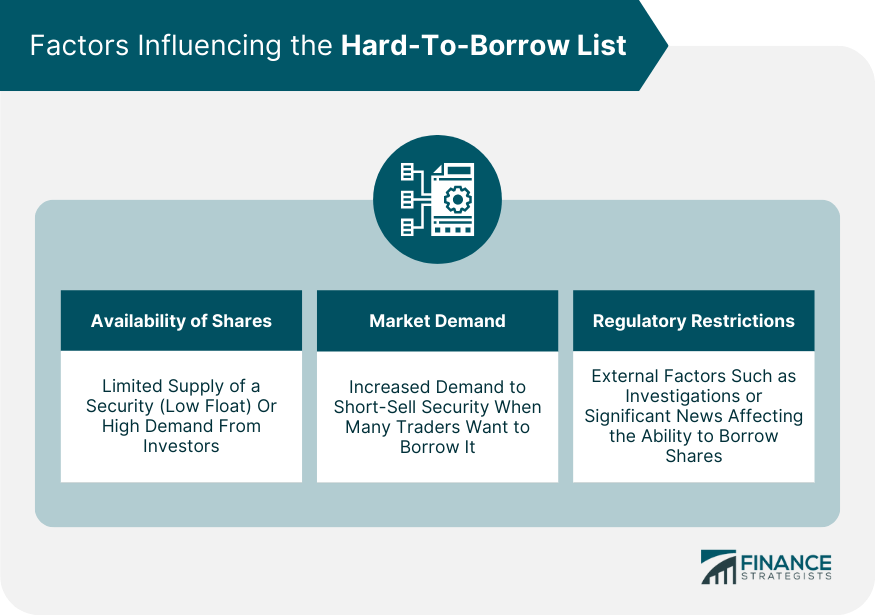

Factors That Influence the Hard-To-Borrow List

Availability of Shares

Market Demand

Regulatory Restrictions

How the Hard-To-Borrow List Affects Investors

Borrowing Costs and Profitability

Limitations for Short Sellers

Role of Broker-Dealer Relationships

How the Hard-To-Borrow List Impacts the Market

Market Liquidity and Transaction Ease

Security Price and Market Trends

Market Volatility and Short Squeezes

Hard-To-Borrow List Regulatory Aspects

Role of the Securities and Exchange Commission (SEC)

Regulation SHO

Consequences of Regulatory Non-Compliance

How to Deal With Hard-To-Borrow Securities

Alternative Strategies: Put Options and Inverse ETFs

Power of Derivatives: Options, Futures, and Swaps

Final Thoughts

Hard-To-Borrow List FAQs

The Hard-To-Borrow List refers to a collection of securities that are difficult to secure for short-selling transactions due to their limited availability in the market.

Factors that influence the Hard-To-Borrow List include the availability of shares, market demand, and regulatory restrictions.

The Hard-To-Borrow List affects investors by increasing borrowing costs, limiting short-selling opportunities, and influencing investment strategies and potential returns.

The Hard-To-Borrow List impacts the market by affecting liquidity, security prices, market trends, and contributing to market volatility, particularly through short squeezes.

Investors can employ alternative strategies like using put options, inverse ETFs, or derivatives to manage hard-to-borrow securities without directly borrowing them. These strategies can help investors profit from potential price drops.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.