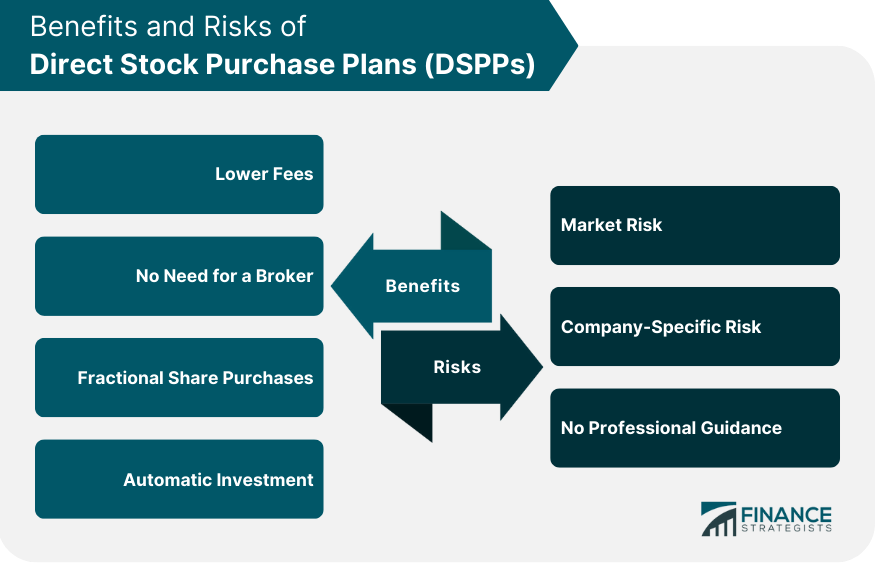

A Direct Stock Purchase Plan is a program offered by a publicly traded company that allows investors to purchase shares of the company's stock directly from the company, without going through a broker. DSPPs can be a convenient and cost-effective way for individual investors to invest in the stock of companies they believe in and support. The purpose of DSPPs is to make it easier and more affordable for individual investors to purchase shares of a company's stock. By eliminating the need for a broker, DSPPs can reduce fees and charges associated with traditional brokerage accounts, making it more accessible for small investors to invest in the stock market. DSPPs work by allowing investors to purchase shares of a company's stock directly from the company. Investors can typically enroll in a DSPP by meeting certain eligibility requirements and completing an enrollment form provided by the company offering the plan. Once enrolled, investors can purchase shares either at the current market price or at a discount, depending on the plan. Some DSPPs also offer dividend reinvestment, fractional share purchases, and other investment options. Some DSPPs require participants to be at least 18 years old, while others may allow minors to participate with the consent of a parent or guardian. This requirement helps to ensure that participants are legally able to enter into investment contracts and make their own investment decisions. Some DSPPs may only be available to residents of certain countries or regions. This guarantees that the plan is compliant with local laws and regulations, and that the company is able to effectively manage the plan for its participants. Some DSPPs require participants to already own at least one share of the company's stock before enrolling in the plan. This requirement confirms that participants have a vested interest in the success of the company and are more likely to be long-term investors. Some DSPPs may impose a maximum investment limit per participant. This limit helps to ensure that the plan is accessible to a wide range of investors and that no one participant has an unfair advantage over others. Some DSPPs may only be available to current employees of the company or its subsidiaries. This requirement verifies that the plan is being offered to individuals who are intimately familiar with the company's operations and financials. The most common investment option for DSPPs is purchasing company stock. Investors can typically purchase shares either at the current market price or at a discount, depending on the plan. Many DSPPs allow investors to reinvest their dividends to purchase additional shares of the company stock. This can be a good way to build up a larger position in the stock over time. Some DSPPs allow investors to purchase fractional shares of company stock, which can be useful for investors who want to invest a smaller amount of money or who want to diversify their portfolio across multiple companies. Some DSPPs offer mutual funds as an investment option, which can provide investors with exposure to a broader range of stocks and diversify their portfolio. It's important to note that the investment options available for DSPPs may vary from one plan to another, and investors should carefully review the investment options provided by the plan before enrolling. One of the primary benefits of investing in a DSPP is the lower fees associated with the plan. By eliminating the need for a broker, DSPPs can reduce fees and charges associated with traditional brokerage accounts, making it more accessible for small investors to invest in the stock market. With a DSPP, investors can purchase shares of a company's stock directly from the company, without the need for a broker. This can be beneficial for investors who want to avoid brokerage fees or who prefer to have more control over their investments. Some DSPPs allow investors to purchase fractional shares of company stock, which can be useful for investors who want to invest a smaller amount of money or who want to diversify their portfolio across multiple companies. Fractional share purchases can also help investors to build up a larger position in a company's stock over time. Many DSPPs offer automatic investment options, which can make it easier for investors to build their portfolios over time. With automatic investment, investors can set up regular contributions to their DSPP accounts, which are then used to purchase additional shares of the company's stock or other investment options. Like all investments in the stock market, DSPPs come with market risk. The value of the company's stock can fluctuate based on a variety of factors, including market conditions, industry trends, and company-specific factors. As a result, investors should be prepared for the possibility of losing money on their investment. Investing in a DSPP also comes with company-specific risk. The success of the investment will be tied directly to the performance of the company's stock. If the company performs poorly or experiences financial difficulties, the value of the investor's shares may decline or become worthless. Unlike traditional brokerage accounts, DSPPs do not typically offer professional guidance or advice. Investors are responsible for making their own investment decisions and should be comfortable with the risks associated with investing in the stock market. Direct Stock Purchase Plans can be a useful investment option for individual investors looking to invest in the stock of companies they believe in and support. SPPs offer several benefits, including lower fees, no need for a broker, fractional share purchases, and automatic investment. However, investors should also be aware of the risks associated with DSPPs, including market risk, company-specific risk, and lack of professional guidance. It's important for investors to carefully review the eligibility requirements, investment options, benefits, and risks associated with each DSPP before enrolling. By understanding the potential benefits and risks of DSPPs, investors can make informed decisions about whether these plans are a good fit for their investment goals and risk tolerance.Definition of Direct Stock Purchase Plans (DSPPs)

Eligibility Requirements for Direct Stock Purchase Plans

Minimum Age Requirement

Residency Requirement

Share Ownership Requirement

Maximum Investment Limit

Employment Requirement

Investment Options for Direct Stock Purchase Plans (DSPPs)

Company Stock

Dividend Reinvestment

Fractional Shares

Mutual Funds

Benefits of DSPPs

Lower Fees

No Need for a Broker

Fractional Share Purchases

Automatic Investment

Risks of DSPPs

Market Risk

Company-Specific Risk

No Professional Guidance

Bottom Line

Direct stock purchase plans (DSPPs) FAQs

A Direct Stock Purchase Plan (DSPP) is a program offered by publicly traded companies that allows investors to purchase shares of the company's stock directly from the company, without going through a broker.

To enroll in a DSPP, investors typically need to meet certain eligibility requirements and complete an enrollment form provided by the company offering the plan. The enrollment form typically requires personal and investment information, such as name, address, social security number, and investment amount.

Some of the benefits of investing in a DSPP include lower fees, no need for a broker, fractional share purchases, and automatic investment. DSPPs can also be a good way to invest in companies you believe in and support.

Like all investments, DSPPs come with risks, such as market risk, company-specific risk, and lack of professional guidance. Additionally, some DSPPs may have fees or charges associated with them that can impact investment returns.

Yes, shares purchased through a DSPP can typically be sold through a brokerage account or through the company's transfer agent. However, investors should check with the company offering the DSPP to understand any restrictions or fees associated with selling shares.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.